Zepz Secures $267M in Funding Backed by Accel, TCV, and World Bank

Hey Payment Fanatic!

Zepz, formerly WorldRemit, has just raised a cool $267 million from big names like Accel, TCV, and Leapfrog to fuel its growth in Africa and beyond. The World Bank’s IFC also pledged $20 million to the mix.

Though Zepz didn’t reveal its latest valuation, it was last pegged at $5 billion in 2021 after acquiring Sendwave. But tough times hit, leading to layoffs in 2023.

Despite parking IPO plans, Accel partner Harry Nelis is optimistic, saying FinTech funding is “back for the big players.” With more people switching to online transfers, Zepz sees huge potential to grow and acquire smaller firms.

Founded in 2010 by Somali entrepreneur Ismail Ahmed, Zepz hit unicorn status and turned profitable in 2022. CEO Mark Lenhard noted that remittances spike during crises, and Zepz is ready to meet that demand.

It’s official—FinTech funding is heating up again. Stay tuned!

Scroll down for more interesting Payments industry news updates and I'll be back in your inbox tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

PAYMENTS NEWS

🇮🇳 Visa and CARD91 partner to streamline Forex Card issuance. This collaboration brings together Visa’s digital payments network and CARD91’s issuance platform-as-a-service solutions to improve the issuance experience for both cardholders and issuers, the companies said in a press release.

🇦🇪 American Express cards now accepted on Telr’s merchant network. This agreement will enable American Express Card Members to use their cards at thousands of Telr’s merchants online, growing the number of locations at which they can use their Card.

Orabank teams up with Network International for digital payment leap. The partnership marks a key milestone in Orabank's digital transformation, enhancing the banking experience and competitiveness in Francophone markets through Network International's innovative payment solutions, boosting consumer trust and convenience.

🇸🇬 FOMO Pay partners Visa to expand digital payments acceptance for Small Medium Enterprises in Singapore. Through this collaboration, FOMO Pay will integrate Visa's QR into the SGQR network, enabling cardholders to scan the QR code and pay with their Visa cards.

🇬🇧 Ebury said to start London IPO investor talks. The Santander-backed firm is exploring potential investors for a London IPO, with Goldman Sachs and Bank of America advising on the process. If it moves forward, the IPO could take place in the first half of next year.

🇷🇴 BLIK payment system gets central bank’s authorization to operate in Romania. The decision will enable the development of this system in local currency (RON) and open it to Romanian payment service providers. As a first step, the operator plans to focus on the development of payments in the e-commerce channel.

🇩🇰 Facit Bank taps Neonomics to streamline invoice payments. With Neonomics’s open banking Checkout, Facit Bank customers can now make direct payments from their bank and schedule invoice payments in advance through Pay Date, reducing late payments and fees while enhancing convenience and security.

🇲🇽 Paysend launches ‘Paysend Libre’ in Mexico powered by Mastercard Move bringing financial inclusion to millions. The launch integrates Mastercard's acceptance network with Paysend's capabilities in digital remittance transfers between Latin America and the USA. Learn more

GOLDEN NUGGET

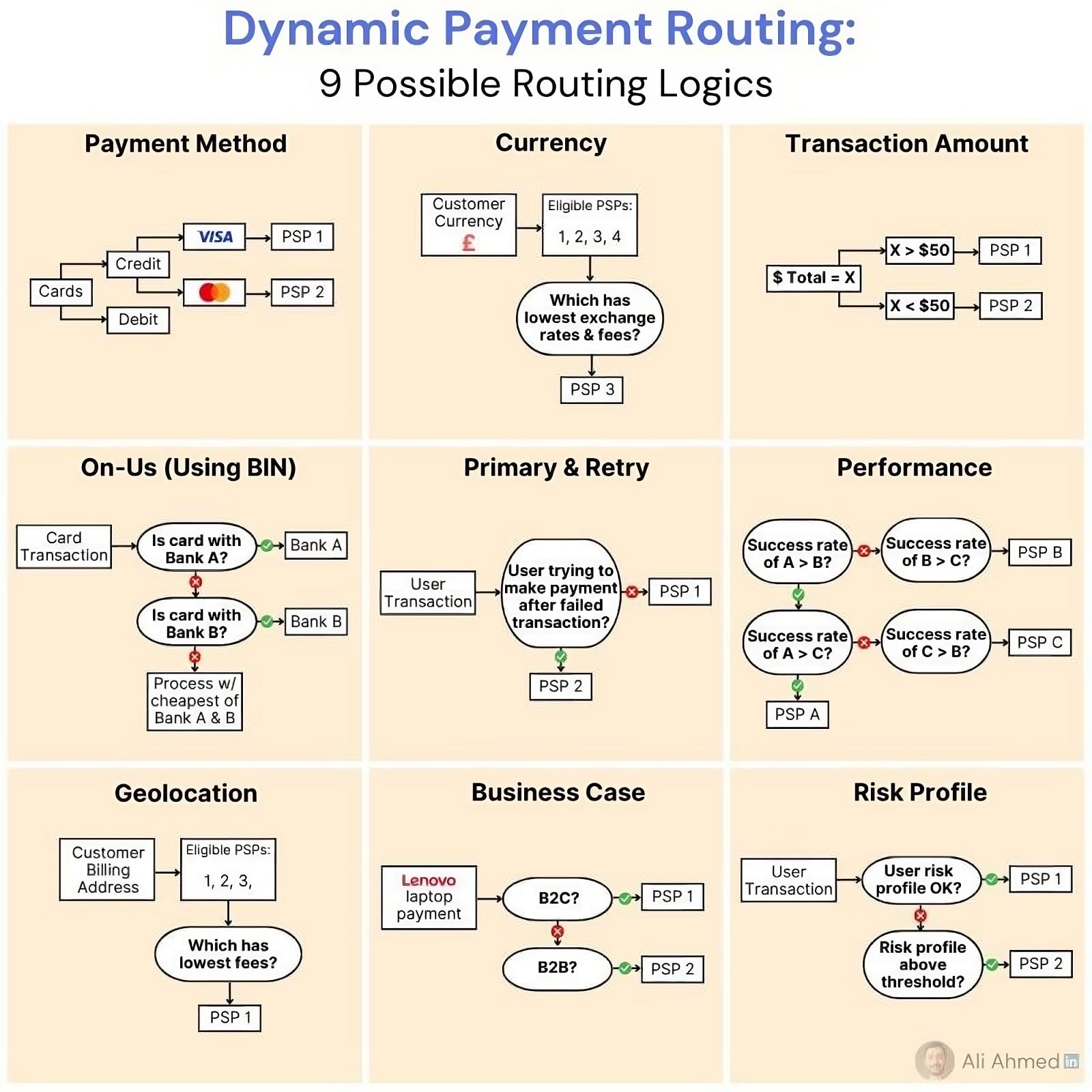

What is Payment Routing?

Let’s break it down:

Payment routing is apart of the Payment process for merchants working with multiple PSPs.

The idea is that, based on a set of rules decided by the merchant, transactions will take the most efficient path to the right PSP.

There are 2 types of routing, static & dynamic.

1️⃣ Static Routing: Static routing is when a merchant delivers transactions to a PSP through a route they manually configured. The path of the transaction is set in stone & can't "intelligently" make the right decision.

2️⃣ Dynamic Routing: Dynamic payment routing is able to adjust the path of the transaction in real-time, based on current conditions. It's sometimes called "smart" or "intelligent" routing since it can make decisions based on logical rules, rather than a set path.

What are the benefits of dynamic routing?

► Resilience - Transactions can be rerouted if a path or node in the network goes down.

► Scalability - As payments become more complex, dynamic routing allows merchants to remove the burden of taking on more transactions than normal. Companies that are growing internationally (like Dollar Shave Club) benefit.

► Cost Effectiveness - Dynamic routing ensures that the lowest costly route is picked, meaning transaction fees are always lower on average.

► Load Balancing - To prevent congestion, or simply to fulfill volume metrics, dynamic routing can more evenly distribute transaction traffic across its existing network. Some high-risk merchant providers (like PaymentCloud) benefit here.

► User Experience - Faster transaction times, lower fees on average, & reduced likelihood of failed transactions mean that consumers don't experience friction, while merchants optimize revenue.

Should merchants build a dynamic payment routing system in-house, or use a provider? This question comes up a lot.

Long-term, an in-house dynamic routing system makes it hard to remain efficient & scalable.

Each new alternative payment method can take 2-4 weeks to integrate, each payment method or rail can have different fees, & issue handling takes longer.

By using a provider, like ACI Worldwide for example, adding new payment methods to routing is like turning on a light switch, there's only one fee for all payment methods & provider rails, and issue handling can be taken care of in minutes.

Source: Ali Ahmed

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()