Yuno Partners with PayPal to Enhance Payment Orchestration Capabilities

Hey Payments Fanatic!

Payment orchestration platform Yuno has announced a partnership with PayPal, enabling Yuno-powered merchants to integrate PayPal's payment solutions into their checkout experience. This collaboration allows merchants to tap into PayPal's global network while offering customers secure and flexible payment options.

Catherine Kaupert, Global Head of Partnerships of Yuno states: "We're thrilled to team up with PayPal, a well-known and trusted name in digital payment processing globally. This integration further strengthens Yuno's capabilities, allowing our merchants to tap into PayPal's extensive network and drive growth with ease."

Paola Fuentes Duclaud, Head of Partnerships for Hispanic Latam at PayPal adds: "Our affiliation with Yuno integrates our entire product portfolio, including PayPal Checkout and credit and debit card payment processing to provide cutting-edge payment solutions for both customers and businesses." The collaboration comes after Yuno's $25 million Series A round led by prominent investors including Andreessen Horowitz and Tiger Global.

Read more global Payments industry updates below 👇 and I'll be back tomorrow!

Cheers,

Explore Latin America’s FinTech growth. Join my weekly newsletter to stay informed—don’t miss a beat!

INSIGHTS

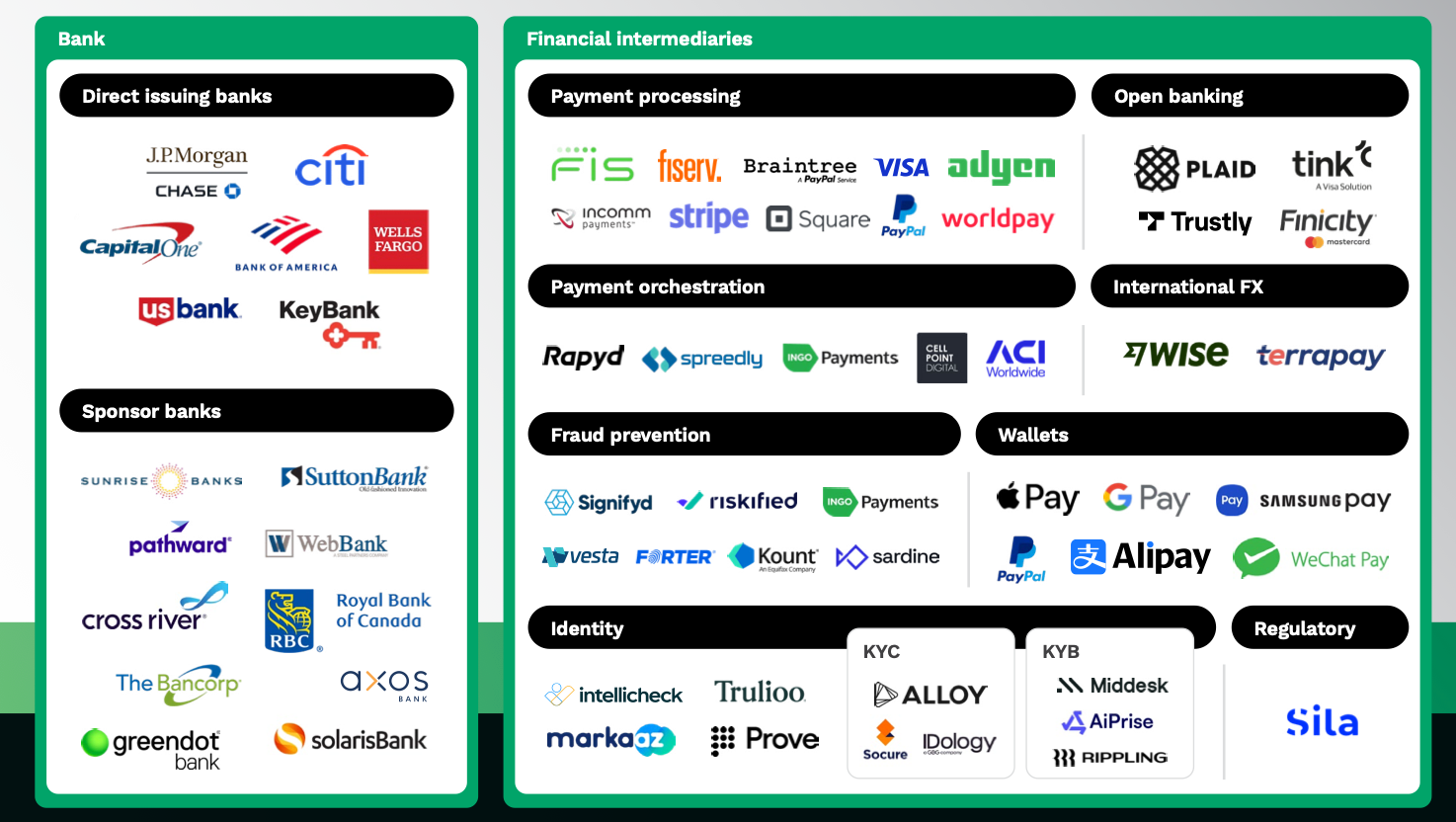

📊 "The Modern Money Mobility Ecosystem" report is a foundational report full of insights, exclusive graphics and actionable recommendations for navigating it. The following table provides a comprehensive overview of the various players in the financial technology and services ecosystem, categorized by their primary functions while acknowledging their presence in multiple areas of the ecosystem.

PAYMENTS NEWS

🇺🇸 Klarna scores global payment deal with Stripe to expand reach ahead of blockbuster U.S. IPO. The new deal improves functionality for Stripe merchants, including the ability to A/B test Klarna and measure real-time conversion rates.

🇬🇧 ClearBank partners with Airwallex. Through the integration, Airwallex customers gain access to Confirmation of Payee (CoP), a bank transfer verification system that confirms the recipient's name matches their account details before payment processing.

🇬🇧 Bank of England announces ‘Digital Pound Lab’ to test potential capabilities. The lab will function as a technology sandbox to allow experimentation of API functionality, innovative use cases for a digital pound, and potential use models for payment interface providers (PIPs) and external service interface providers (ESIPs).

🇧🇷 OKTO acquires U4C to expand Pix operations in Brazil. U4C provides payment technology solutions as an authorized Pix participant, using its integration with Brazil’s financial systems to enable instant payments directly on an app or website, without the need to open a third-party bank app or enter the recipient’s data.

🇧🇷 Bank of America’s take on Latin America’s digital payments advantage. “After many decades of the status quo in payments, Latin America is going through a major transformation,” Marcelo Moussalli, managing director and Latin America product head executive at BofA, told PYMNTS. The transformation is driven by Brazil and Mexico, which account for about two-thirds of LatAm's GDP, he said.

Thunes and Hyperwallet expand payout access for merchants across APAC. With this new alliance, Hyperwallet can help its expansive global merchant base, including some of the world's best-known ride-hailing super apps, marketplaces and social media platforms, offer customers their preferred method of access to funds.

🇺🇸 CFPB finds high Buy Now, Pay Later use among high-debt borrowers. The research revealed that more than three-fifths of BNPL borrowers held multiple simultaneous BNPL loans at some point during the year, and one-third had loans from multiple providers. Continue reading

🇺🇸 Shift4 Payments and SEC reach disclosure violation settlement. According to the SEC's order, in its annual filing and proxy statement for 2020, Shift4 failed to disclose that a sibling of an executive and director received about $1.1 million in compensation as a non-executive employee of the company.

🇺🇸 Klarna seeks to offload US ‘pay in 4’ loans. The transaction would help free up capital for loan growth needed to satisfy potential IPO investors, ahead of one of the year’s most hotly anticipated stock market listings. This option allows consumers to split purchases at retailers’ checkouts into four interest-free payments, paid every two weeks.

GOLDEN NUGGET

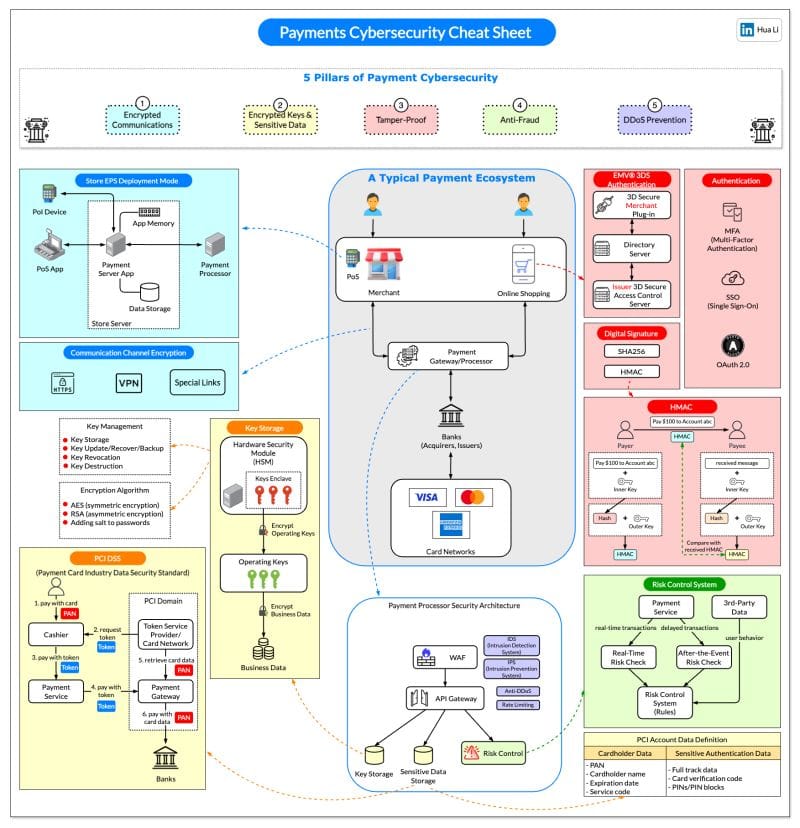

A Cheat Sheet for Payment Cybersecurity.

Payment cybersecurity is a crucial aspect of the modern financial ecosystem. The cheat sheet below outlines 5 pillars of secure payment systems with a typical payment data flow.

🔹 1. Encrypted Communication Channels

Unencrypted data transmitted over the internet can be intercepted, leading to data breaches or theft. Using protocols like HTTPS for web transactions or VPNs for internal corporate communication further reduces vulnerabilities.

🔹 2. Encrypted Keys and Sensitive Data

Use Advanced Encryption Standard (AES) for data encryption and RSA or Elliptic Curve Cryptography (ECC) for securing key exchanges. Implement Hardware Security Modules (HSMs) to securely manage and store cryptographic keys.

Data masking and Tokenization can further enhance the protection of sensitive payment information by replacing real data with dummy values.

🔹 3. Tamper-Proof

Payment systems must be resistant to tampering, both physically and digitally, to prevent fraud, data theft, or unauthorized access.

3D Secure (3DS): This is an authentication protocol designed to provide an additional layer of security in online credit card transactions, helping to prevent fraud.

MFA is a key component in making systems tamper-proof by requiring more than one authentication method.

OAuth 2.0 is an open standard for access delegation, commonly used to grant websites or applications limited access to user information without exposing passwords.

HMAC is crucial for ensuring that messages or data within a system are not tampered with. Any attempt to modify the message without knowing the secret key will result in an invalid HMAC.

🔹 4. Anti-Fraud & Risk Control

Use a combination of Multi-Factor Authentication (MFA), biometrics, and tokenization to secure user authentication.

Implement real-time monitoring and machine learning-based anomaly detection systems that track transaction patterns and flag unusual activity.

🔹 5. DDoS Prevention

Distributed Denial of Service (DDoS) attacks aim to overwhelm payment systems with massive traffic, rendering them inoperable.

Employ Web Application Firewalls (WAFs) and Intrusion Detection Systems (IDS) to detect and mitigate DDoS attacks. Cloud-based DDoS protection services, such as CDNs or services like AWS Shield, can absorb and filter malicious traffic. Rate limiting and geo-blocking are also effective strategies to prevent large volumes of unwanted traffic from overwhelming systems.

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()