Yuno Enables Secure Checkout with Mastercard

Hey Payments Fanatic!

Global payment orchestrator Yuno is rolling out Mastercard's Click to Pay at checkout to all its clients across 40 markets worldwide.

This integration aims to tackle the growing challenge of cart abandonment in e-commerce, which reached 70.19% globally in 2023 according to Statista, resulting in an estimated $260 billion in recoverable losses across the US and EU. The solution becomes particularly crucial as fraud rates are seven times higher online than in stores, with criminals exploiting exposed card numbers.

Yuno's single-click Click to Pay integration is especially crucial for businesses expanding into new markets, where brand recognition can be a challenge.

The solution enables merchants to offer a globally recognized payment solution that eliminates friction at checkout almost anywhere in the world while ensuring purchases can be made securely and quickly with just a few clicks. Juan Pablo Ortega, Co-Founder and CEO at Yuno, said: "Making Mastercard's Click to Pay at checkout feature easy to integrate for all of our customers supports our commitment to removing barriers to global commerce."

Yuno's clients, including Viva Aerobus, Bacu, and Habibs, have already begun taking advantage of Mastercard Click to Pay at Checkout via Yuno, helping them deliver a secure and convenient user experience for their customers across the globe.

Through this implementation, customers won't need to manually enter their card information, as all payment, shipping, and billing data will be securely stored by Mastercard for greater convenience.

Scroll down for more interesting Payments industry news updates and I'll be back in your inbox tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

📊 Payments are eating the world…

Check out this great report by J.P. Morgan👇

PAYMENTS NEWS

🇵🇭 GCash launches UK/EU Bank Cash In feature for seamless remittance to the Philippines. The introduction of the new feature is aimed at addressing the challenges faced by the estimated two million Filipinos living in the UK and Europe in sending remittances back home, as per FF News.

🇦🇪 Telr partners with Samsung to launch Samsung Pay in the UAE. This collaboration integrates Samsung Pay into Telr’s comprehensive suite of payment solutions, marking a significant leap forward in the country’s e-commerce capabilities.

🇪🇬 Geidea to launch its SoftPos service in Egypt. This expansion aligns with Geidea’s strategy to drive digital transformation in the MENA region, offering merchants and consumers an advanced, secure, and seamless payment experience.

🇬🇧 Worldpay brings faster refunds to the UK. The faster refund service enables most UK shoppers using Mastercard or Visa to receive near-instant refunds for online returns at participating retailers like HMV. This will drive better rates of retention and cost efficiency through reduced queries related to refunds.

🇫🇷 Spendesk officially launches its own Payment Institution: Spendesk Financial Services. With Spendesk Financial Services, Spendesk now has end-to-end control over its payment services infrastructure. This strategic initiative represents a significant milestone in the evolution of its platform.

🇫🇷 Société Générale goes live on CLS’s cross currency swaps service. The CCS service can be used seamlessly in conjunction with post-trade processing platform MarkitWire to integrate CCS flows into CLSSettlement, allowing participants to benefit from multilateral netting against all FX transactions.

🇱🇹 Request Finance expands with Pay.so Lithuania acquisition. The acquisition enhances Request Finance's Fiat-to-Crypto and Crypto-to-Fiat transaction capabilities (USD 100 to USD 100M) while adding direct payments, multi-payee billing, and employee payments to streamline financial operations for businesses.

GOLDEN NUGGET

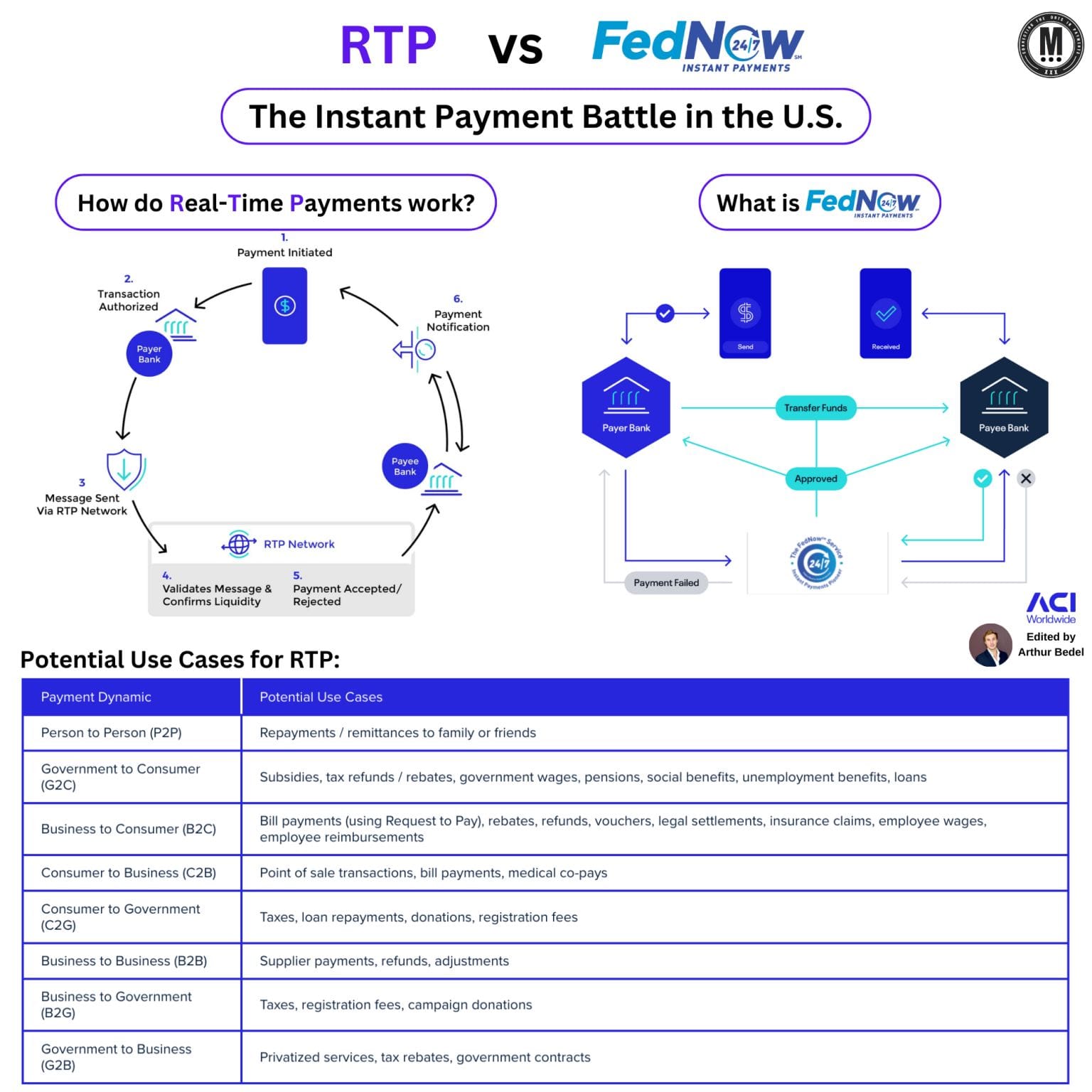

𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 (𝐑𝐓𝐏) vs. 𝐅𝐞𝐝𝐍𝐨𝐰 — Understanding the Instant Payment Revolution in the U.S.

The U.S. payments landscape is undergoing a massive transformation with the introduction of 𝐑𝐞𝐚𝐥-𝐓𝐢𝐦𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 (RTP) and 𝐅𝐞𝐝𝐍𝐨𝐰 — two powerful systems enabling near-instantaneous transfers. Both networks are designed to bring speed, security, and efficiency to payments, but they differ in their infrastructure, features, and purpose.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐑𝐓𝐏?

Real-Time Payments (RTP) is the first private instant payment network in the U.S., launched by The Clearing House in 2017. RTP operates as a 24/7/365 network.

𝐊𝐞𝐲 𝐚𝐭𝐭𝐫𝐢𝐛𝐮𝐭𝐞𝐬:

► Operated by The Clearing House, a private-sector entity.

► Offers end-to-end settlement, ensuring immediate transfer of funds.

► Includes Request for Payment (RfP), allowing businesses to send payment requests to customers

► Supports advanced capabilities like detailed remittance information for transaction transparency

► Validates liquidity before processing payments to ensure funds availability

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐅𝐞𝐝𝐍𝐨𝐰?

FedNow, launched by the 𝐅𝐞𝐝𝐞𝐫𝐚𝐥 𝐑𝐞𝐬𝐞𝐫𝐯𝐞 in 2023, is the public sector's solution to instant payments. It aims to create an inclusive and accessible platform for financial institutions of all sizes.

𝐊𝐞𝐲 𝐚𝐭𝐭𝐫𝐢𝐛𝐮𝐭𝐞𝐬:

► Operated by the Federal Reserve, ensuring public accessibility.

► Designed to provide nationwide access to real-time payments, including for smaller banks and credit unions.

► Sends instant notifications to both senders and recipients

► Focuses on financial inclusion by simplifying onboarding for smaller FIs

𝐏𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥 𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬 𝐟𝐨𝐫 𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬:

► 𝐏𝐞𝐫𝐬𝐨𝐧 𝐭𝐨 𝐏𝐞𝐫𝐬𝐨𝐧 (P2P): Sending remittances to friends and family instantly

► 𝐆𝐨𝐯𝐞𝐫𝐧𝐦𝐞𝐧𝐭 𝐭𝐨 𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫 (G2C): Distributing subsidies, tax refunds, pensions, or unemployment benefits

► 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐭𝐨 𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫 (B2C): Disbursing refunds, legal settlements, insurance claims, or payroll

► 𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫 𝐭𝐨 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 (C2B): Paying medical co-pays, utility bills, or retail purchases in real-time

► 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐭𝐨 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 (B2B): Processing supplier payments, invoice adjustments, and refunds

► 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐭𝐨 𝐆𝐨𝐯𝐞𝐫𝐧𝐦𝐞𝐧𝐭 (B2G): Submitting taxes, registration fees, or campaign donations.

𝐓𝐡𝐞 𝐁𝐢𝐠𝐠𝐞𝐫 𝐏𝐢𝐜𝐭𝐮𝐫𝐞:

RTP and FedNow are not competitors — they are collaborators in advancing the payments ecosystem. Together, they:

► Accelerate Payment Modernization

► Enhance Financial Inclusion

► Drive Innovation

Instant Payments, alternative to traditional card payments, are growing globally. It will take time but they are here to stay.

Source: ACI Worldwide

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()