Yuno Continues to Expand U.S. Presence

Hey Payments Fanatic!

Yuno, a global leader in payment orchestration, announced the appointment of Jonathan Summerton as the new Senior Vice President of Enterprise Commerce. This strategic hire marks a pivotal moment in Yuno's aggressive expansion within the United States market.

Jonathan Summerton will be working under the guidance of Carol Grunberg, Yuno's Chief Business Officer. Together, they aim to enhance Yuno's mission of transforming global cross-border commerce.

Currently, Yuno's payment solutions are utilized in over 80 countries, and this new leadership addition will further solidify their presence and capabilities in this domain.

Yuno is rapidly setting a benchmark in the industry with its cutting-edge, efficient payment infrastructure. The platform empowers businesses to broaden their global reach, cut operational costs, and significantly improve transaction approval rates.

Summerton, with a robust background in payments and financial services from his previous roles at Transfast (a Mastercard company), Thunes, and Northwestern Mutual, brings invaluable experience to Yuno. His expertise is expected to strengthen Yuno’s enterprise relationships and drive the company’s growth in the U.S. market.

This strategic expansion is bolstered by Yuno’s recent $25 million Series A funding round, which included investment from industry heavyweights like DST Global Partners, Andreessen Horowitz, and Tiger Global.

These resources will propel Yuno's ambitious growth plans not only in the United States but also across Asia, Africa, and Europe.

Enjoy more Payments industry updates I listed for you below and I'll be back in your inbox tomorrow!

Cheers,

SPONSORED CONTENT

INSIGHTS

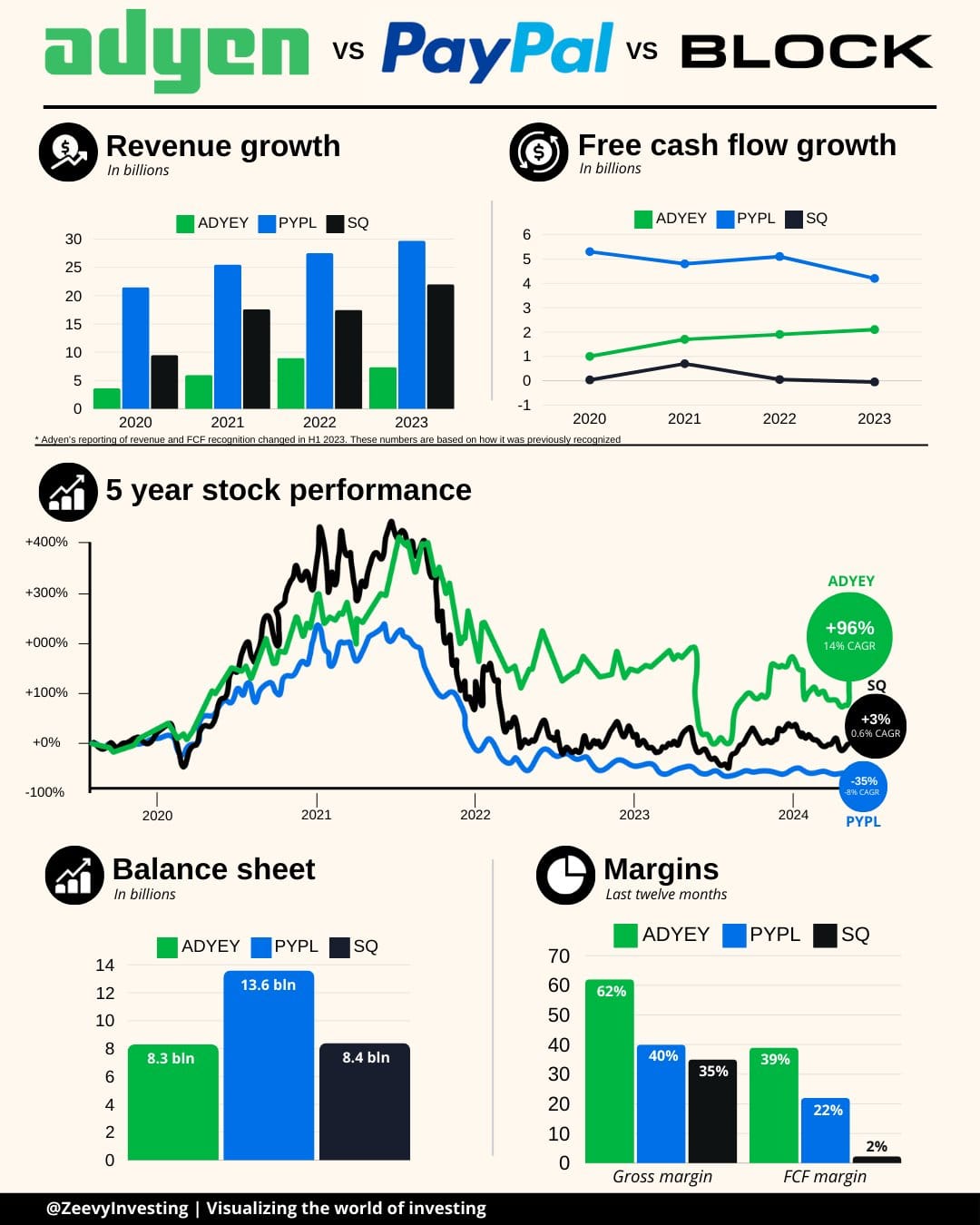

A comparison:

PAYMENTS NEWS

🇨🇦 Nuvei & FinTech360 launch Cashier solution for the forex B2B industry. By integrating Nuvei’s capabilities into its infrastructure, FinTech360 enhances its service offerings, making them more attractive to potential forex clients. Read more

🇲🇩 OTP Bank has successfully implemented MIA Instant Payments, aiming to accelerate the process of digital transformation and its overall development. The MIA platform represents an important step in the overall modernisation and development of the payment system in the region of Moldova.

🇮🇳 HDFC Bank partners with Zeta to offer Credit Line on UPI. The partnership will empower HDFC Bank to launch innovative credit products on NPCI’s CLOU scheme, which allows banks to connect pre-approved credit lines directly to the UPI user base.

🇦🇺 New security feature for businesses to save millions in scams. In a move to help reduce scam losses and make Australia a harder place for scammers to operate, Westpac is extending its payee verification solution to institutional and government clients.

🇺🇸 Shift4 to acquire Givex Corp., global provider of gift card, loyalty & Point-of-Sale solutions. The acquisition will add 130,000+ locations across more than 100 countries to Shift4’s customer base. The Arrangement Agreement is subject to customary closing conditions and the transaction is expected to be completed in Q4 2024.

🇺🇸 Paze, an online checkout experience by banks, is now available in the US. It's a direct competitor to other online checkout experiences like Stripe Link, Shop Pay, etc. Just like Early Warning Services, banks have joined forces to provide a direct checkout experience competing with all the big players. Paze will allow businesses to accept payments without a credit card number on file.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()