Wise Business Launches Free Invoicing Tool for SMBs

Hey, Payments Fanatic!

Wise has introduced a new invoicing feature, now available within the Wise Business account. This free service streamlines the process of creating invoices, managing payments, and tracking finances, all in one place.

Now Wise Business customers can:

- Create and issue professional, well-formatted invoices – which can be automatically issued via email.

- Automatically reconcile payments without hassle, with invoices seamlessly integrated into the Wise Business account.

- Track an invoice’s status to see what’s paid or overdue.

- Issue invoices in multiple currencies – including GBP, USD and EUR – and receive payments free of inflated exchange rates and hidden fees.

- Attach payment methods, allowing clients to pay quick and securely – a “Pay with Wise” option provides the cheapest, fastest experience for users whose customers also use Wise.

Following a successful beta phase and a full launch in September, the new invoicing tool has already enabled businesses to process over £14 million in invoices, improving the speed and efficiency of their payment experience.

Have you tried it? What do you think about this new feature? Tell me more in the comments.

PS. I'm heading to Barcelona for Checkout's Thrive event and the first FinTech Running Club run, joined by my colleague from Connecting the Dots in Payments, Arthur Bedel. Don't miss the chance to meet both of us—see you there!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

𝗟𝗲𝘁'𝘀 𝗱𝗶𝘃𝗲 𝗶𝗻:

PAYMENTS NEWS

Ecommpay underlines ESG credentials at industry events.

Ecommpay, the inclusive global payments platform has underlined its commitment to ESG with the commissioning of a new exhibition stand that reflects its sustainability goals.

Ecommpay launched a new brand identity in September 2024, demonstrating its focus on accessibility, inclusivity and sustainability. As part of the brand refresh, a new exhibition stand was commissioned for use across industry events over the coming years.

Already featured at Seamless and eCommerce Expo, the stand was designed and produced by Pie Factory, a member of 1% for the Planet 2024. It has been created from a lightweight modular frame system moulded from infinitely recyclable aluminium.

Miranda McLean, Chief Marketing Officer at Ecommpay commented: “Ecommpay is wholly committed to delivering inclusive and sustainable payment solutions and it is crucial that we ‘walk the talk’ in every aspect of our operations, including our presence at industry events. The partnership with Pie Factory means that we are having as low an impact on the environment as possible in our event activity.

🇬🇧 McLaren Racing enters payments fast lane with Airwallex partnership. With Airwallex’s platform, McLaren now manages payments through a batch system, using a customised approval process. This has reduced the time required for payment runs to under an hour, saving the finance team half a day of work each month.

🇸🇪 Avarda partners with Checkout.com to boost payment performance and further global expansion. The new agreement will enhance Avarda's payment performance by improving the checkout experience for card payments, simplifying the process, boosting customer loyalty, and reducing friction, which ultimately decreases cart abandonment.

🇸🇬 Singapore orders Qoo10 to suspend payment services under the Payment Services Act 2019 (PS Act) effective immediately. This directive follows numerous customer complaints about delayed payments to merchants on Qoo10’s e-commerce platform.

🇸🇬 Alchemy Pay launches Google Pay integration for crypto payments. The firm has updated its Virtual Card to integrate with Google Pay, enabling seamless crypto payments for everyday transactions. This update marks another step in Alchemy Pay's mission to offer innovative financial solutions for crypto users.

🇬🇧 DailyPay announces international expansion into the United Kingdom. Beginning this fall, DailyPay will have an EWA offering available in the United Kingdom, marking the company's first foray outside the U.S. More here

🇬🇧 Global FinTech Wise and Swift to expand cross-border payments options. This will enable their customers to benefit from the speed and convenience of Wise, and the breadth of Swift “without needing to implement any major changes to their systems.”

GOLDEN NUGGET

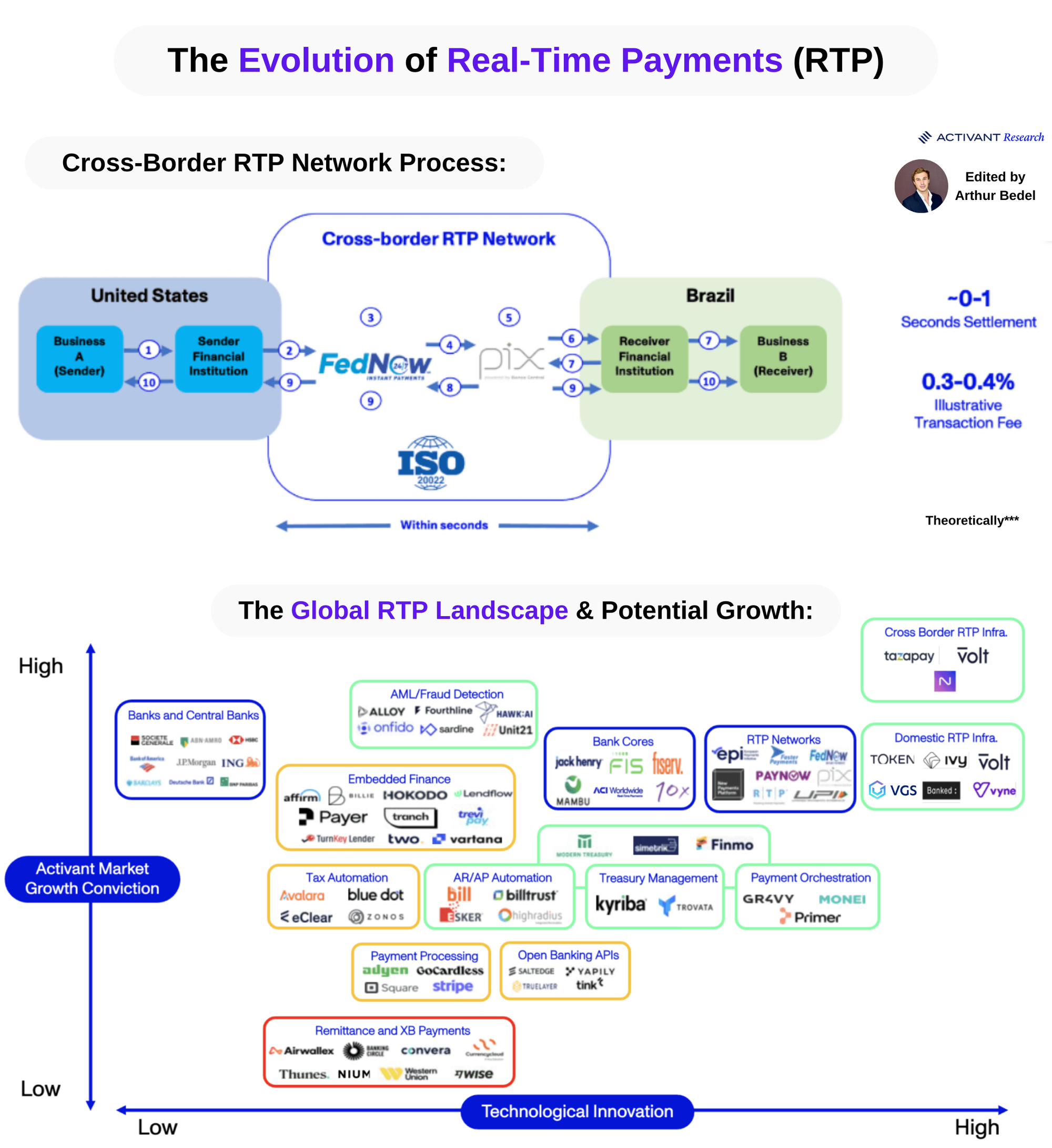

The Evolution of Real Time Payments (RTP), it's time Local went Global with new Cross-Border processes.

The Global Payments Market:

The global payments market has been experiencing significant growth, reaching $2.2 trillion in revenues in 2022, an all-time high with an 11% increase from the previous year.

B2B transactions made up 97% of the ~$156 trillion in cross-border payment flows in 2023, took 2-5 days to settle at an average cost of 6.2%. In Brazil and India, Real Time Payments (RTP) has decreased settlement times to seconds and costs by 50-90%.

When one considers that domestic payments cost anywhere between 30bp and 300bp depending on the payment rails used (ACH or card), and international payments costs (excluding foreign exchange fees) range from 65bp to 450bp, there is a significant profit pool to be disrupted 🤯.

Real Time Payments (RTP):

Real-time payments are account-to-account (A2A) financial transactions that are initiated, cleared, and settled usually within seconds. These transactions run on RTP networks designed by central and commercial banks to offer faster and cheaper payment solutions, bypassing traditional payment infrastructure like cash, checks, ACH, wire transfers, and cards.

Benefits of Real-Time Payments:

🔸 Lower Costs

🔸 Increased Security

🔸 Reduced Fraud Risk

🔸 Greater Financial Visibility

🔸 Improved Cash Flow Management

🔸 Value-Added Services

How Real-Time Payments (RTP) Work in a Cross-Border Transaction (i.e. U.S. -> Brazil) 👇

1️⃣ Company A initiates a payment, sending a message to its Financial Institution via its banking app or online banking platform.

2️⃣ The sender's FI submits a payment message to the FedNow service (ISO20022 messaging format).

3️⃣ FedNow validates the message, verifying it meets the required format specifications.

4️⃣ FedNow sends the payment message to the PIX network.

5️⃣ PIX validates the message, verifying it meets the required format specifications.

6️⃣ PIX sends the contents of the message to the receiver's FI to seek confirmation that it intends to accept the message.

7️⃣ The receiver's FI sends a positive response to PIX, confirming that it intends to accept the payment.

8️⃣ PIX sends the same correspondence to FedNow.

9️⃣ FedNow and PIX will debit and credit the designated master accounts of the sender's and receiver's FI.

🔟 Outside of the FedNow/PIX services the receiver's FI credits the receiver's account and sender's FI debits the sender's account.

Real-time payments are set to revolutionize both domestic and cross-border transactions. By providing faster, cheaper, and more secure payment options, RTP networks offer significant advantages over traditional payment methods 🚀.

Source: Activant Capital

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()