Wero Payment Service Launches in Belgium

Hey Payments Fanatic!

Wero officially launches in Belgium this week, marking a bold move by 16 European banks to challenge PayPal, Mastercard, and Visa.

The rollout is particularly interesting as it signals the beginning of the end for Payconiq in Belgium. Following European Payments Initiative's strategic acquisition of Payconiq International and iDEAL last year, Wero is now integrated into major Belgian banks' apps including Belfius, BNP Paribas Fortis, Fintro, Hello Bank!, ING, KBC, and CBC.

Customers can use the Wero digital wallet to instantly send and receive money from friends and family by scanning or generating QR codes.

The timing couldn't be more strategic. As European Payments Initiative CEO Martina Weimert emphasizes, controlling payments in Europe is crucial. This "designed by and for Europeans" solution represents a significant step toward payment sovereignty.

While Payconiq and Wero will coexist temporarily, the full transition timeline will be announced in 2025. It's a careful balance between innovation and maintaining continuity for users.

I highly recommend reading this earlier piece I published about Wero and its bold plans.

Scroll down for more interesting Payments industry news updates and I'll be back in your inbox tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

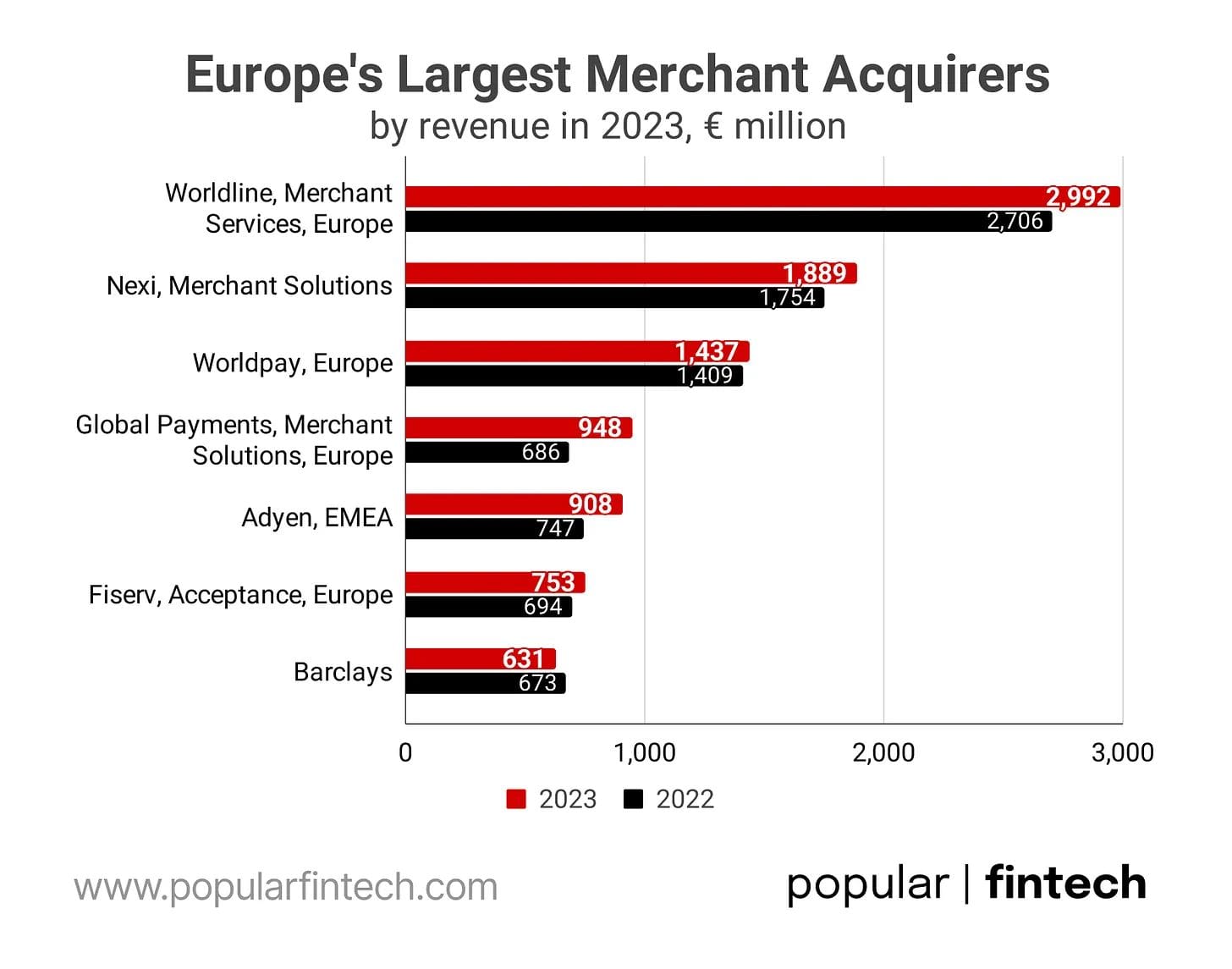

Europe's Largest Merchant Acquirers by Revenue👇

The Key Takeways:

PAYMENTS NEWS

🇸🇬 Thunes fortifies Global Compliance with appointment of Peter Cohen as Chief Compliance Officer. Peter will play a key role in advancing Thunes’ commitment to world-class compliance standards, reporting to General Counsel Ruwan De Soyza as part of the Legal & Compliance Function.

🇿🇼 Zimswitch taps ACI Worldwide to protect Zimbabweans from payment fraud. Through this implementation, Zimswitch aims to enhance the security of Zimbabwe's digital payment infrastructure, providing stronger protection for both financial institutions and consumers.

🇬🇧 Solidgate AI Dispute Representment. The Solidgate AI Dispute Representment module connects to various acquiring banks and payment methods via its payment orchestration engine, streamlining the process. Click here to learn more

🇺🇸 Revolutionizing Global Workforce Management with the EOR Model, by PayQuicker. The Employer of Record (EOR) model has emerged as a game-changer, offering businesses a streamlined approach to global expansion and talent acquisition. Explore the full article for further insights.

🇩🇪 Airwallex partners with Moss to enhance and streamline global payments. Airwallex’s solutions enable Moss customers to top up their wallets, transfer funds, and use currency conversion for better exchange rates. This enhanced functionality helps Moss support businesses across nine European markets.

🇮🇳 Payment solutions provider PeLocal secures $2m seed funding. The new funds aim to expand the platform and enhance strategies for large-scale projects. The company targets 10 million monthly transactions on WhatsApp within the next year.

🇬🇧 Guavapay partners with American Express to expand merchant payment acceptance options. MyGuava Business merchants can now accept AmEx via online gateways and POS terminals in the UK and Europe, expanding Guavapay’s reach and helping businesses access high-spending customers while improving payment experiences.

🇺🇸 Worldpay partners with Mastercard to introduce Virtual Card Programme for travel agents. Through the Mastercard Wholesale Programme, Worldpay provides virtual cards to travel agents, enhancing payment efficiency, flexibility, and benefits for agents and suppliers across the UK and Europe.

🇸🇦 EdfaPay Raises USD 5M to Power FinTech Expansion Across MENA. The funding underscores rising demand for FinTech solutions in the region’s SME and startup ecosystem, while EdfaPay’s growth fosters competition, boosts FinTech adoption, and supports economic transformation efforts.

🇦🇺 Westpac to boost business banking. Westpac aims to recruit 200 additional business bankers over the next three years to enhance support for Australia’s rapidly growing SME sectors. The initiative could boost its business banker team by up to 40% by the end of 2027.

🇸🇪 Sweden's Riksbank presents case for modernisation of retail payments infrastructure. The Riksbank’s view is that the future infrastructure will have to comply with European standards, be ready to accept retail payments instantly or on schedule, and facilitate the entry of new actors using new technologies.

🇺🇸 Visa, Mastercard warn of ‘Unintended Consequences’ from CCCA at senate hearing. The Senate Judiciary Committee discussed the Credit Card Competition Act (CCCA), which would require large banks to offer merchants alternatives to Visa and Mastercard. More on that here

GOLDEN NUGGET

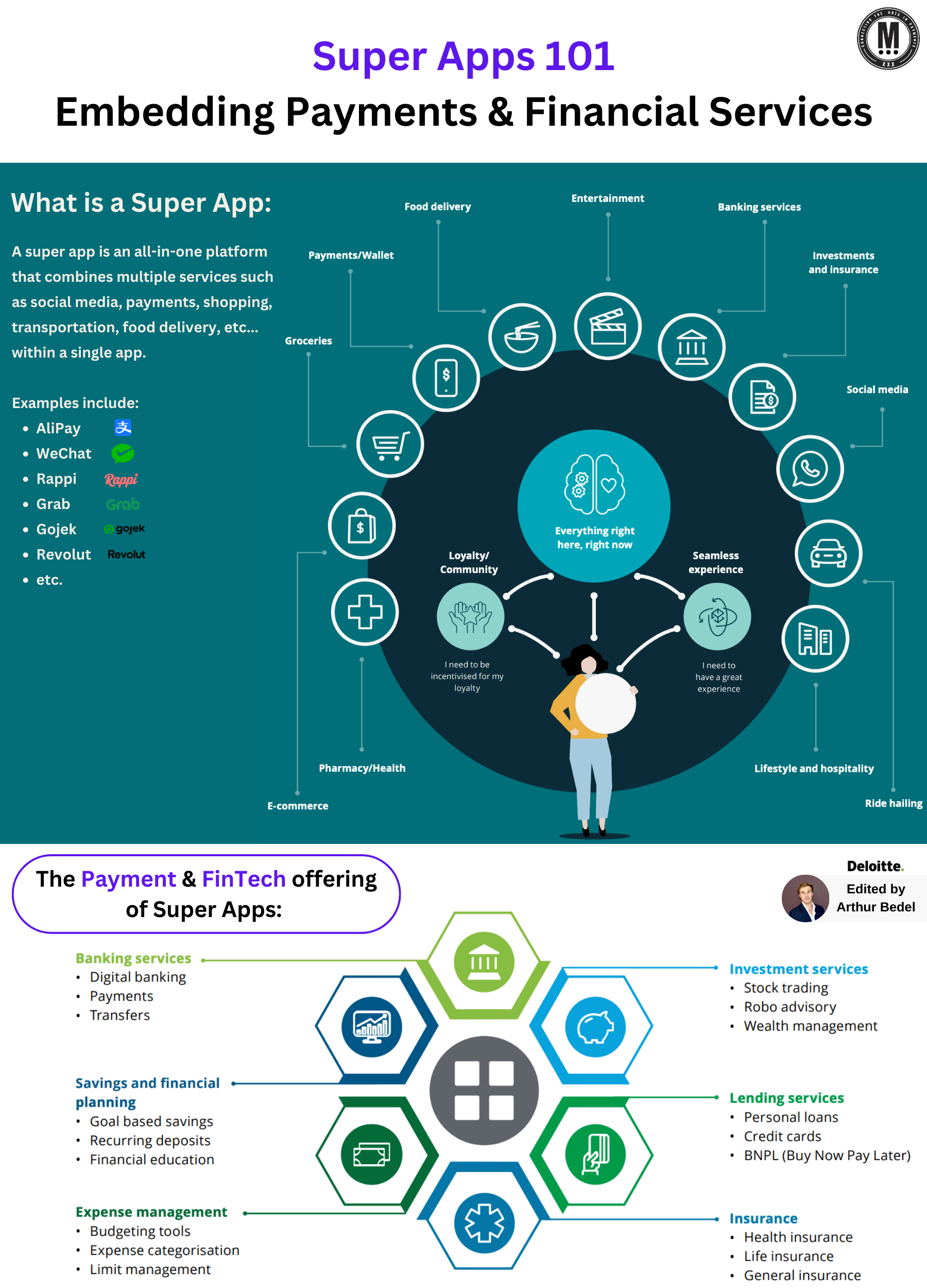

𝐒𝐮𝐩𝐞𝐫 𝐀𝐩𝐩𝐬 101 — Transforming the digital experience with an all-in-one ecosystem embedding Payments & FinTech👇

In today's fast-paced digital landscape, consumers want convenience, simplicity, and an integrated experience — that's where Super Apps come in.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐒𝐮𝐩𝐞𝐫 𝐀𝐩𝐩?

A Super App is an all-in-one platform that offers a suite of services, including social media, payments, shopping, transportation, food delivery, and more, within a single application. Think of it as the Swiss army knife of digital services

𝐏𝐨𝐩𝐮𝐥𝐚𝐫 𝐒𝐮𝐩𝐞𝐫 𝐀𝐩𝐩𝐬:

► Alipay and Wechat in China

► Grab in Southeast Asia

► Revolut in Europe

etc...

𝐄𝐦𝐛𝐞𝐝𝐝𝐢𝐧𝐠 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 & 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬

Super Apps seamlessly embed financial services to create a holistic user experience. Imagine paying for groceries, booking a ride, or even managing investments without leaving the app. Here's how:

► 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐬𝐞𝐫𝐯𝐢𝐜𝐞𝐬: Digital banking, payments, and transfers

► 𝐒𝐚𝐯𝐢𝐧𝐠𝐬 & 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐏𝐥𝐚𝐧𝐧𝐢𝐧𝐠: Goal-based savings, recurring deposits, and financial education

► 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬: Access to loans, credit, and BNPL options

► 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞: Health, life, and general insurance

𝐒𝐮𝐩𝐞𝐫 𝐀𝐩𝐩𝐬 𝐱 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — Driving Engagement and Monetization

Payments are more than just a transaction method for Super Apps—they're the lifeblood of a connected, data-driven ecosystem:

► 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦 𝐀𝐧𝐜𝐡𝐨𝐫: Payments anchor users within a suite of interconnected services, enabling them to seamlessly pay for services (one-stop shop)

► 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐈𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧: Super Apps act as financial gateways for unbanked populations, offering digital wallets and peer-to-peer transfers.

► 𝐏𝐞𝐫𝐬𝐨𝐧𝐚𝐥𝐢𝐳𝐞𝐝 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐏𝐫𝐨𝐝𝐮𝐜𝐭𝐬: Using transaction data, Super Apps can tailor offerings like micro-loans or budgeting advice based on spending habits.

► 𝐂𝐫𝐨𝐬𝐬-𝐒𝐞𝐥𝐥𝐢𝐧𝐠 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬: Payments enable cross-selling across services. For example, a ride-hailing user might get a discount on nearby restaurants, increasing "lifetime value" and reducing churn.

► 𝐑𝐞𝐯𝐞𝐧𝐮𝐞 𝐆𝐞𝐧𝐞𝐫𝐚𝐭𝐢𝐨𝐧: Super Apps generate revenue from transaction fees, interest on loans, and subscription-based financial features. These diversified revenue streams contribute to long-term profitability.

► 𝐔𝐬𝐞𝐫 𝐋𝐨𝐲𝐚𝐥𝐭𝐲 𝐭𝐡𝐫𝐨𝐮𝐠𝐡 𝐑𝐞𝐰𝐚𝐫𝐝𝐬: Many Super Apps reward users for transactions, offering points or cashback to encourage repeat usage. This not only enhances user retention but also amplifies the app's network effect.

In the end, Super Apps aren't just reshaping the digital experience — they're building digital ecosystems where users can live, work, and play.

Source: Deloitte

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()