Walmart to Launch Instant Bank Payments, Bypassing Card Networks

Hey Payment Fanatic!

Walmart is upgrading its pay-by-bank option for online shopping, offering instant transfers that bypass traditional card networks like Visa and Mastercard. Currently, payments through Walmart Pay can take up to three days to process, but the new system will provide instant transaction updates for customers and Walmart alike.

This upgrade benefits customers with low balances by avoiding pending transactions, reducing the risk of overdraft fees, says Jamie Henry, Walmart’s VP of Emerging Payments. Instant payments give users immediate control over their budgets.

As frustration with card fees grows, Walmart’s move could push more customers toward bank transfers, especially since many merchants pass card fees to consumers. Though Walmart hasn’t heavily promoted pay-by-bank, adoption has exceeded expectations, Henry noted.

Launching in 2025, the new system will run on Fiserv’s NOW Network, which integrates with real-time payment systems like The Clearing House and FedNow, aiming for widespread bank connectivity.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

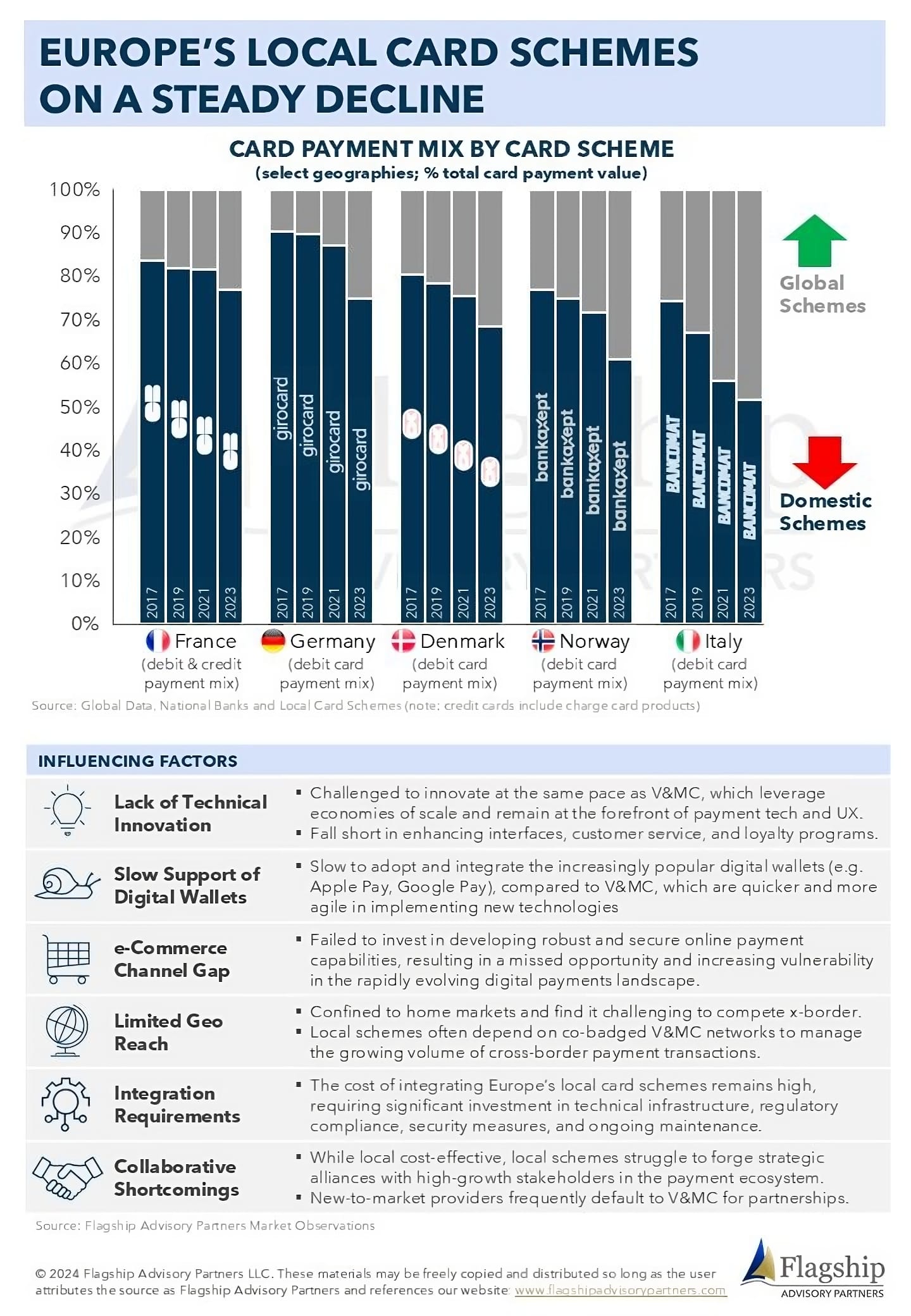

Local card schemes in Europe are rapidly losing ground to international giants Visa and Mastercard.

Here are the Key Influencing Factors👇

PAYMENTS NEWS

🇱🇹 Local Lithuania media announced that kevin. has gone bankrupt. A court official confirmed that a bankruptcy case has been opened. According to public records, the company owes €420,000 to the state social insurance alone, not to mention delays in payments to employees and partners. Find out more

🇨🇳 Paysend introduces instant cross-border payouts to China UnionPay Cards. By introducing the new capability, Paysend intends to enable businesses to utilise the reach and reliability of its Enterprise single API to conduct cross-border transactions directly to UnionPay cards issued in China.

🇦🇪 Astra Tech launches ‘Send Now Pay Later’ remittance service on BOTIM in UAE. The innovative service, which the company claimed is the first of its kind in the Middle East and North Africa (MENA) region, offers instant international money transfers with the option to defer payment.

🇳🇱 PayU has introduced Flash Pay, a biometric authentication solution for card payments. This solution combines the ease of a seamless payment experience with robust security measures, meeting both customer aspirations for convenience and banks’ stringent authentication requirements.

🇮🇳 MobiKwik's ZaakPay integrates Meta to deliver payments on WhatsApp. Users are set to be able to conduct transactions leveraging MobiKwik Wallet, ZIP, and Pocket UPI, benefiting from increased flexibility and services that can meet their unique payment preferences.

🇺🇸 Adyen offers Cinemark moviegoers more payment options. The collaboration offers moviegoers increased payment options and ease of use, per a release. Adyen is powering payments on Cinemark’s website and mobile app, along with purchases made at the chain’s box offices, lobby kiosks and concessions counters.

🇺🇸 Louisiana first US state to officially embed crypto as a payment method. Louisiana State Treasurer, John Fleming, confirmed the integration of digital currencies as a payment method this week enabling Louisiana residents to have the option to pay for state services with their crypto wallets.

🇰🇪 Safaricom and Mastercard expand payment solutions via M-PESA for 600K+ merchants in Kenya. This partnership combines M-PESA's vast merchant network with Mastercard’s global payment system to deliver seamless, secure, and scalable payment solutions, allowing merchants to reach global markets.

🇺🇸 AtoB raises $130 million to fuel transportation payments services. “These milestones will allow us to better support truckers and the small businesses they represent — the backbone of America’s economy — with tools that allow for transparency and efficiency,” said the firm’s CEO.

📈 Real-time cross-border payments FinTech Nium reports steady business growth. The company announced that its monthly payment volume grew by 3X in Oceania over the last year. This growth has been driven by increased adoption of its real-time cross-border payment solutions by financial institutions and spend management platforms.

🇨🇳 Jack Ma-backed Ant Group Co. has raised $6.5 billion in loans to refinance an offshore credit line of the same size, as it expands its global operations, according to people familiar with the matter. Continue reading

🇿🇦 Happy Pay secures USD 1.8 million in pre-seed funding. The company said that the pre-seed funding will be allocated to launching a range of new products, improving marketing efforts, and broadening Happy Pay's network of merchants. Additionally, it plans to grow its workforce strategically while prioritising expansion.

GOLDEN NUGGET

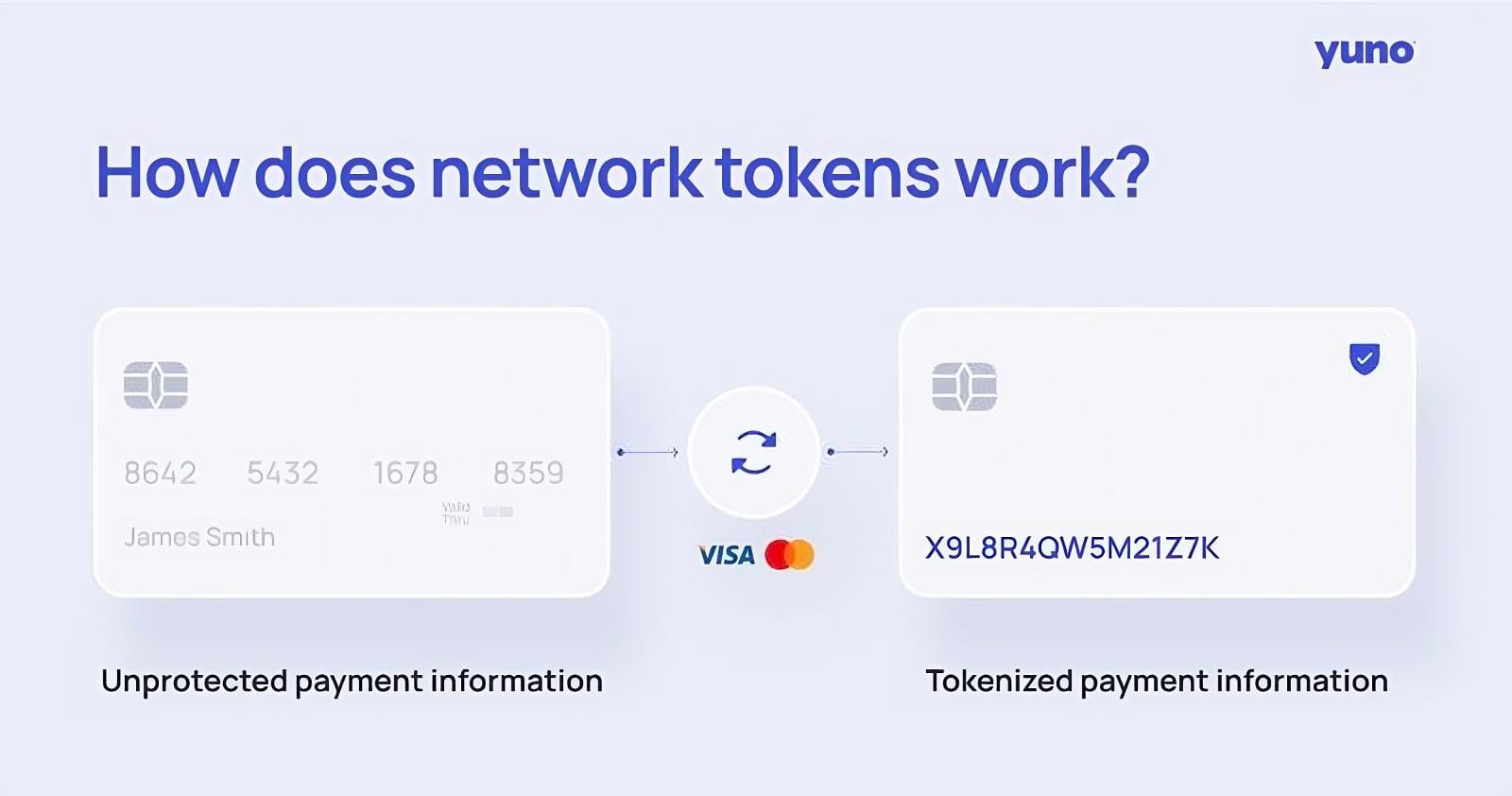

➡️ How do Network Tokens work? And why are they so fundamentally beneficial?

Let's dive in:

𝗙𝗿𝗮𝘂𝗱 𝗗𝗲𝘁𝗲𝗰𝘁𝗶𝗼𝗻

Using Network Tokens ensures that stolen data remains unusable, mitigating the impact of malware, data breaches, and phishing attacks.

This proactive approach significantly mitigates the potential impact of security breaches, safeguarding both the organization and its customers from the detrimental consequences of fraud.

Furthermore, embracing Network Tokens can lead to substantial benefits in terms of regulatory compliance, particularly in regard to PCI DSS obligations.

Since, unlike with traditional payment methods, the exposure to sensitive data is minimized.

In essence, organizations can proactively fortify their defenses against fraud while simultaneously alleviating the complexities associated with PCI compliance.

𝗥𝗲𝗱𝘂𝗰𝗲 𝗜𝗻𝘃𝗼𝗹𝘂𝗻𝘁𝗮𝗿𝘆 𝗖𝗵𝘂𝗿𝗻

Beyond bolstering security, Network Tokens are best known to mitigate payment refusals.

Payment declines range from 10% up to 30%, depending on the industry, of which around 70% can be categorized as false declines.

The ambiguity of such a high percentage has been a frustration for merchants and payment managers for decades.

While some, such as Insufficient Funds, offer a very definite reason for payment refusal, the classic Do Not Honor is most often a mix of various reasons and a handed down frustration.

Network Tokens reduce number declines that fall into these -frustrating- generic categories, with the potential to increase approval rates by over 3%, since Payment Manager will also be able to focus on addressing inefficiencies in other areas.

I highly recommend reading the deep dive article for more interesting info on this topic.

Source: Yuno

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()