VX2 Takes Off: Tom Greenwood to Head Volt.io’s New Payment Venture

Hey Payments Fanatic!

Volt.io has introduced VX2, a stablecoin settlement solution designed to integrate seamlessly with the company’s real-time payment infrastructure.

The new venture will be spearheaded by Tom Greenwood, who is transitioning from his role as Volt’s CEO to lead VX2 as its new chief executive.

In his place, Volt Co-founder Steffen Vollert will assume the role of Interim CEO.

Bringing a wealth of experience in real-time payments and a deep passion for digital assets, Greenwood will steer VX2 toward addressing complex cross-border payment challenges with the use of stablecoins like USDT and USDC.

VX2 will operate as an independent entity, with majority ownership retained by Volt. The venture is backed by Volt’s core investors, including prominent names like IVP, EQT, CommerzVentures, Augmentum FinTech, and Fuel Ventures.

Enjoy more Payments Industry news I listed for you below, and I'll be back in your inbox tomorrow for the final news update of this week!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

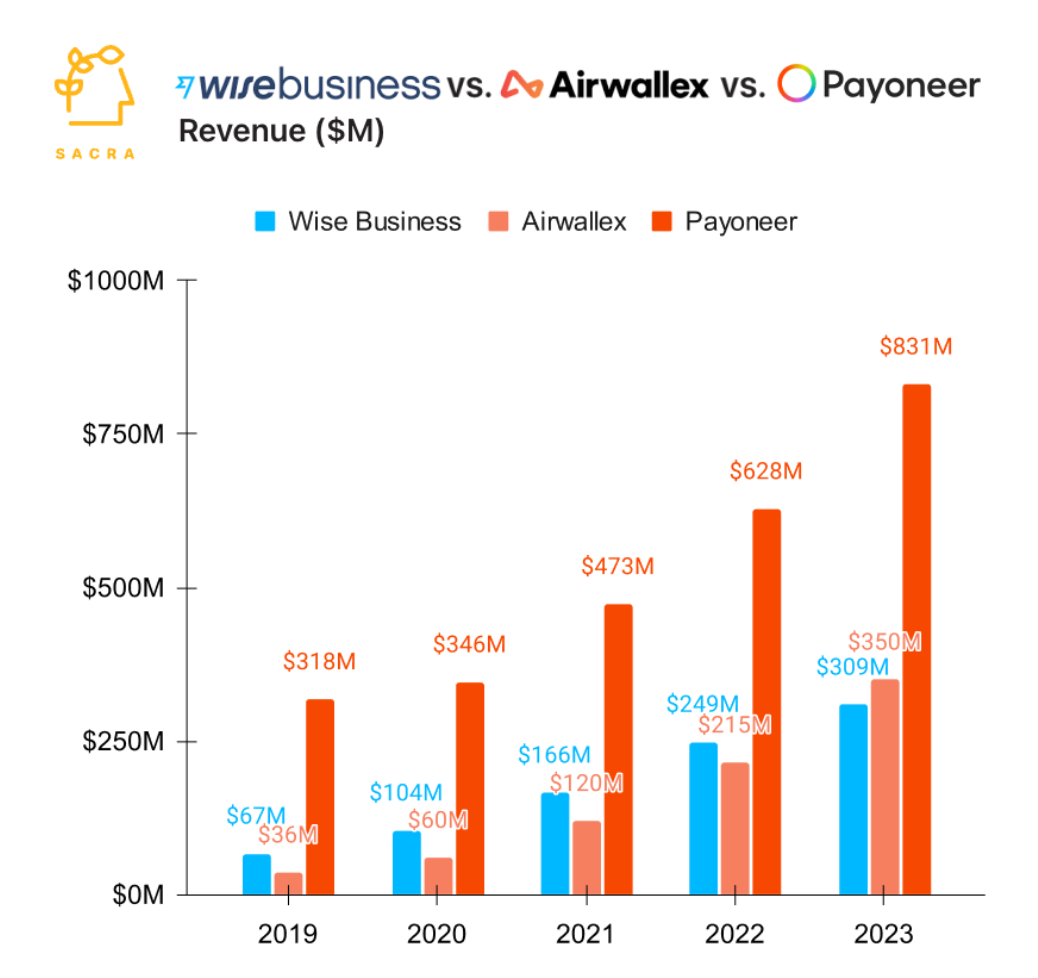

📊 Airwallex 🆚 Wise Business 🆚 Payoneer

Airwallex hit $𝟭𝟬𝟬𝗕 in annual transaction volume in 2024, up 73% (❗️) year-over-year, for a revenue run rate of $𝟱𝟬𝟬𝗠.

Now, the Aussie cross-border payments company is going global.

PAYMENTS NEWS

🇸🇦 TeleMoney, the International Remittance arm of Arab National Bank, joins Thunes’ Direct Global Network. This alliance will allow TeleMoney to send funds directly to digital wallets and facilitate seamless bank transfers across key markets in Asia and Africa. This collaboration positions Thunes as a key player in the Saudi Arabian financial ecosystem.

🇺🇸 First Citizens Bank customers can now receive instant deposits. By joining the RTP network, First Citizens enables customers to receive payments in seconds, much faster than ACH or wire transfers. This instant payment service is available 24/7.

Boost Payment Solutions empowers enterprise buyers to conveniently pay global suppliers using commercial cards with Boost 100XB. The solution was developed to simplify and streamline buyers' international transactions, allowing the use of existing U.S.-issued commercial cards to pay suppliers in over 180 countries worldwide.

🇺🇸 Silverflow and Chesapeake Bank partner to deliver advanced payment processing solutions. This collaboration aims to provide Chesapeake Bank's ISO clients with a modern, high-performance, and robust payment processing solution. Read more

🇦🇪 NymCard leverages Mastercard move to offer fast and efficient cross-border payments across 47 countries. The collaboration will enhance NymCard’s BaaS platform by using Mastercard Cross-Border Services to provide efficient international remittance experiences to various countries. Read on

🇳🇿 Finexio and Unimarket launch payment risk assessment and management tool. The new Payment Risk Score (PRS) is designed to tackle payment fraud by offering enterprises a data-driven approach to assessing risk levels across common payment methods, the companies said in a press release emailed to PYMNTS.

🇪🇺 European card transactions to fall as A2A payments take off. The number of card transactions in Europe is set to plummet by more than a third over the next three years, driven by the rise of account-to-account payments as ventures such as the EPI's new Wero wallet gain traction, claims a Capgemini report.

🇪🇬 Paymob, started by three college friends, lands another $22M and is profitable in Egypt. Paymob, which describes itself as a financial services enabler, has raised over $90 million to scale up to this point, and became profitable in the second quarter of this year, with revenues increasing sixfold since mid-2022.

🇩🇪 Mondu teams up with Stripe to deliver BNPL payments to B2B merchants. Through this integration, both companies plan to support B2B merchants and marketplaces to provide Mondu’s flexible invoice payment options directly via their existing Stripe setup, optimising the checkout experience and increasing conversion rates.

🇳🇬 Nigerian FinTech Grey partners dLocal to drive expansion into new emerging markets. Through this partnership, Grey will provide cross-border payouts to wallets and bank accounts, expanding its services into new markets such as Brazil, Indonesia, Mexico, the Philippines, and South Africa.

🇺🇸 Tech startup Ansa wants to democratize the digital wallet. The company is bringing technology pioneered by Starbucks to smaller operations, allowing them to streamline payments while reducing swipe fees. Keep reading

GOLDEN NUGGET

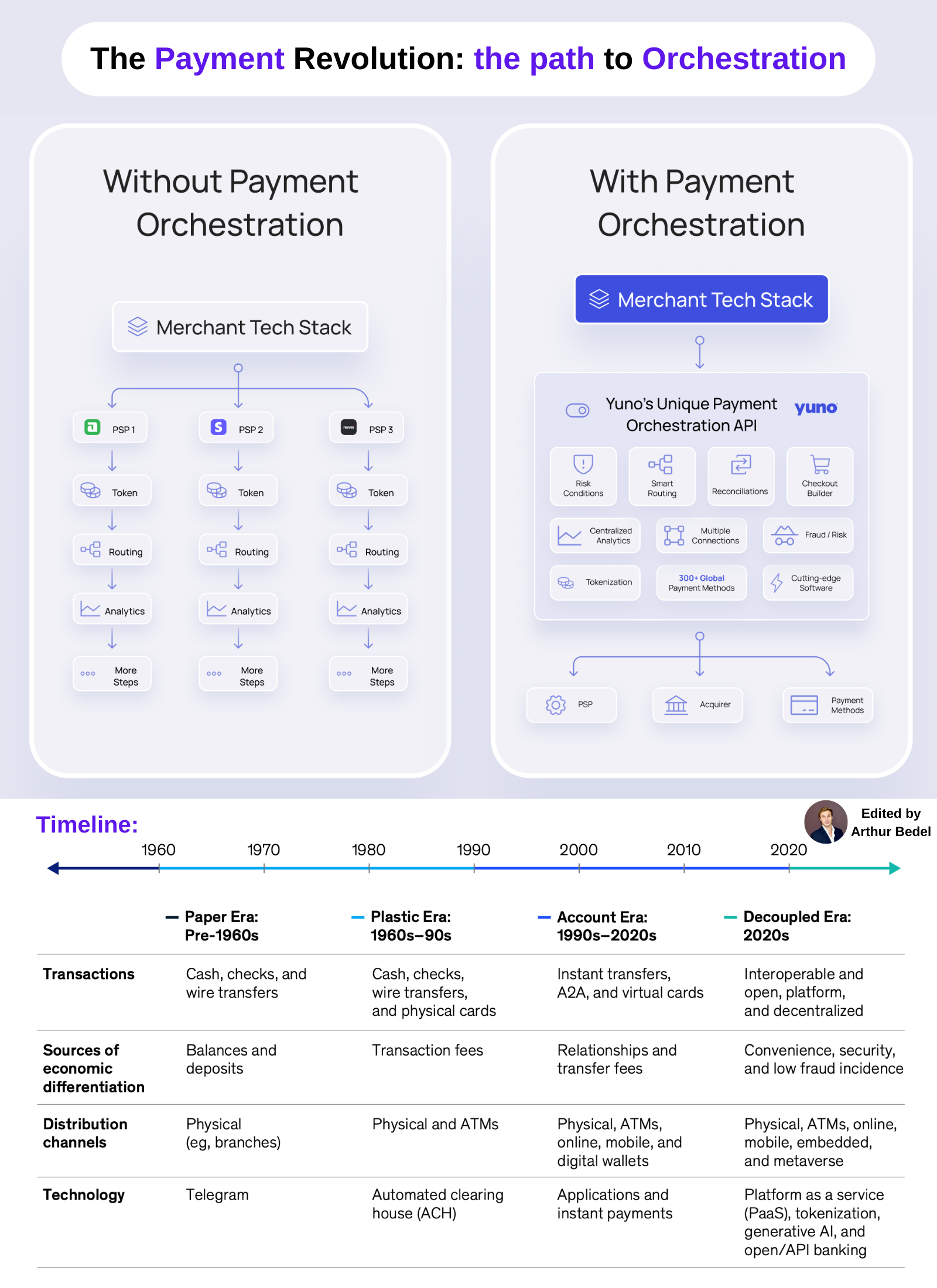

𝐓𝐡𝐞 𝐄𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐨𝐟 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: How 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 and 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐚𝐫𝐞 𝐬𝐡𝐚𝐩𝐢𝐧𝐠 𝐭𝐡𝐞 𝐟𝐮𝐭𝐮𝐫𝐞.

The payments landscape has undergone a profound evolution. What began as simple barter systems over 5,000 years ago has now evolved into an intricate digital ecosystem that enables seamless, secure, and real-time global transactions.

The buzzword "𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧" is one of the key drivers transforming the payments industry, a flexible approach to managing payments. Unlike traditional systems that operate in silos, payments orchestration integrates multiple payment methods, gateways, and processors into a single, centralized platform, optimizing transaction routing, dealing with cross-border complexity, expected to exceed $15B by 2026.

𝐖𝐡𝐲 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐌𝐚𝐭𝐭𝐞𝐫𝐬:

𝐂𝐨𝐬𝐭 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲: Businesses no longer need to rely on a single payment provider. Instead, they can optimize costs by routing transactions through the most cost-effective channels.

𝐑𝐞𝐬𝐢𝐥𝐢𝐞𝐧𝐜𝐞: If one payment gateway fails, orchestration ensures that transactions are seamlessly rerouted, reducing downtime and enhancing reliability.

𝐒𝐜𝐚𝐥𝐚𝐛𝐢𝐥𝐢𝐭𝐲: With orchestration, businesses can easily adapt to changing market demands, incorporating new payment methods as they emerge.

A fundamental shift, moving from static, rigid systems to dynamic, intelligent networks that adapt to customer needs in real time.

𝐓𝐡𝐞 𝐑𝐨𝐥𝐞 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐄𝐧𝐚𝐛𝐥𝐢𝐧𝐠 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧:

Tokenization is another critical innovation driving this evolution. By replacing sensitive payment information with unique tokens, it enhances security while enabling orchestration to function seamlessly across multiple channels. This transactional data can be passed to all providers in a seamless way enabling a unified experience across providers, also providing companies with the ability to:

🔸 Optimize their payment strategy

🔸 Create better customer profile for marketing and partnership purposes

🔸 Enhance their fraud strategy across providers

𝐊𝐞𝐲 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐫𝐞𝐚𝐬 𝐒𝐡𝐚𝐩𝐢𝐧𝐠 𝐭𝐡𝐞 𝐅𝐮𝐭𝐮𝐫𝐞:

🔸 𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Real-time payments (RTP) with PIX in Brazil and UPI in India.

🔸 𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Biometrics are becoming mainstream, offering more secure, personalized payment experiences, impacting the definition of card-present and card-non present transactions.

🔸 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠: Open Banking is enabling a better and faster access to financial services and will continue to do so.

The future of payments is already taking shape — and it's one where flexibility, security, and seamlessness will define success.

Source: Yuno's report

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()