Viva.com and Alipay+ extend strategic partnership

Hey Payments fanatic,

The retail experience for international tourists in 24 European markets will be enhanced with the collaborationç between Viva.com and Alipay+.

European merchants will now be able to accept direct payments from 15 e-wallets.

This partnership will enable global tourists, primarily from Asia, to make secure and convenient payments at European businesses using their preferred e-wallets. With support from over 15 e-wallets and banking partners, visitors can also enjoy exclusive merchant promotions through Alipay+.

Viva.com now enables merchants across various sectors—such as travel agencies, retail stores, hotels, restaurants, and taxis—to accept over 40 payment methods, including Alipay+.

Viva.com’s Tap on Any Device technology transforms any device—be it mobile, desktop, smart interactive, or self-checkout—into a payment terminal, capable of accepting contactless, chip & PIN, and QR code payments. This technology enhances the checkout experience by supporting various payment journeys, allowing transactions to be completed anywhere, and reducing queues and wait times.

This collaboration kicks off in time for the upcoming wave of inbound tourism to Europe for ‘Golden Week’ in October.

And now with more payments news...

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

🇬🇧 Club L London partners with Checkout.com to Accelerate International Expansion on Shopify Platform. Club L London has chosen Checkout.com as its primary payment provider, taking advantage of Checkout. com’s robust pre-built Shopify checkout solution and leading payments performance capabilities.

🇱🇺 Mangopay, a leading provider of modular payment infrastructure for platforms, has appointed FinTech leader Sergi Herrero as CEO, succeeding Romain Mazeries, who is stepping down but will remain on the board. Herrero, previously Meta’s Global Director for Payments and Commerce Partnerships, has also held senior roles at Square, BNP Paribas, and VEON.

🇺🇸 Why ORNG’s founder pivoted from college food ordering to real-time money transfer. After six years running Phood, a payments app to use dining dollars globally, Alex Parmley pivoted the company to ORNG. This newly named startup partners with banks, FinTechs, and large businesses for quick and easy payments.

🇦🇪 Xpence, Paymob join forces at 24 FinTech to reshape digital payment landscape. The partnership will enhance digital payments for SMEs across the GCC. Xpence will integrate Paymob’s advanced payment technology into its platform, enabling seamless online and in-person card payments for SMEs throughout the region.

🇬🇧 CEO of Lanistar exits amid report of winding-up petition. Jeremy Baber, CEO of UK-based payment provider Lanistar, has left the FinTech amidst a report of the company facing a winding-up petition from its London landlord over unpaid rent. Read on

🇬🇧 OKTO Unleashes Next-Gen Pay-Ins and Payouts on its way to SBC Summit. In this interview, OKTO’s CCO Simon Dorsen shares insights on the company’s priorities, the latest advancements in their product suite, and what attendees can expect at the upcoming SBC Summit in Lisbon. Read full interview

🇺🇸 CloudPay partners with Workday. The new offering is expected to deliver an optimised, end-to-end global payroll experience, which will ensure that customers will have the possibility to benefit from secure, integrated, and efficient solutions.

🇺🇸 Mastercard CFO Sachin Mehra, diagnosed with cancer, will continue working. Mehra will undergo treatment for non-Hodgkin lymphoma while remaining actively involved in the company's daily operations. Mastercard announced Monday that Mehra’s blood cancer was detected early and is highly localized and curable, with an “excellent” long-term prognosis. Find out more

🇮🇱 Nayax partners with Adyen to globally expand electric vehicle charging and automated self-service payments infrastructure. With this partnership, Adyen integrates Nayax’s end-to-end payment and loyalty platform into its global system. This will enable Nayax to expand into new regions, including LatAm and APAC.

🇲🇾 Hong Leong Bank adds Weixin Pay to DuitNow QR for easier payments. The bank now allows HLB DuitNow QR merchants to accept Weixin Pay (WeChat Pay), offering an additional payment option for Weixin Pay users and Chinese tourists in Malaysia.

GOLDEN NUGGET

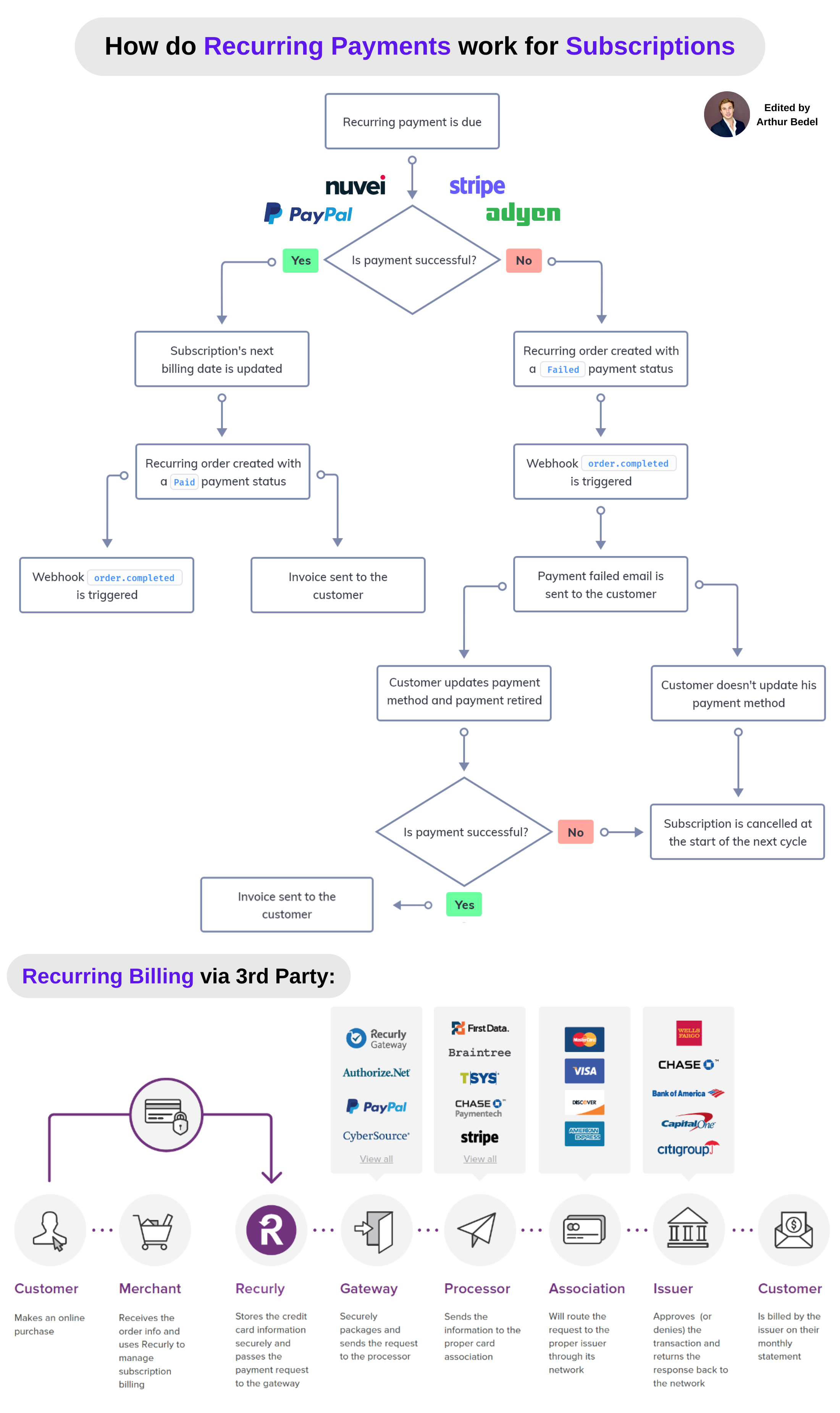

Recurring payments may appear to be simple but in reality are quite complex - let's take a look:

1️⃣ A consumer subscribed or purchased to a service, on regular frequency. First off, the amount may not always be the exact same which may cause billing problems.

2️⃣ Recurring Payment is now due.

3️⃣.1️⃣ Payment Successful

🔸Subscription's next billing date is updated

🔸Recurring order is created with a paid payment status

🔸The invoice is sent to the customer

3️⃣.2️⃣ Payment Unsuccessful

4️⃣ Recurring Order created with a Failed Payment Status

5️⃣ Payment failed e-mail is sent to the customer

6️⃣.1️⃣ Customer updates payment method and payment retried successfully

🔸Same completion process as above

6️⃣.2️⃣ Customer doesn't update his payment method or Payment is declined

🔸Subscription is cancelled at the start of next cycle

—

In order to provide Recurring Billing service, Payment Service Providers are one option, 3rs Party Recurring Platforms are another👇

🔸In this example, Recurly is utilizing its subscription and billing engine to store the card information securely and pass the payment request to the Payment Service Provider.

—

Now this complex process, especially when using a credit or debit card, can be simplified using Account Updater Services:

This payment solution provided by some Acquirers - Nuvei and Worldpay - and 3rd Party providers - Recurly and Zuora - updates the card in file for the consumer automatically (token). It enables the card on file to always be the current one creating a much more seamless experience for the consumer!

Recurring payments are mostly completed using cards but Alternative Payment Methods are and will continue to also disrupt this payment model

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()