Visa has officially issued more than 10 billion tokens

Hey Payments Fanatic!

Visa announced at Money 20/20 Europe a significant milestone achieved by its tokenisation technology, revealing that Visa tokens have generated more than $40 billion USD in incremental ecommerce revenue for businesses globally and saved $650 million USD in fraud in the last year.

Visa also announced it has issued more than 10 billion (!) tokens since the technology’s launch in 2014.

Over the last 10 years, Visa has further enhanced security across the payment ecosystem through tokenisation – a technology that replaces sensitive personal data with a cryptographic key that conceals sensitive payment data.

Tokenisation can be embedded into any device, making digital payments more secure while being virtually useless to scammers.

Currently, over 40% of all transactions processed by Visa in Europe use tokens , reflecting their widespread adoption and the trust consumers place in this secure payment method.

Tokenisation technology has also caused a six-basis point increase in payment approval rates globally.

Overall, tokenisation can reduce the rate of fraud by up to 60%, providing businesses with more successful transactions and offering much-needed peace of mind to consumers and merchants of all sizes.

Now that's what I call impressive.

What do you think? Let me know in the comments below👇

Cheers,

INSIGHTS

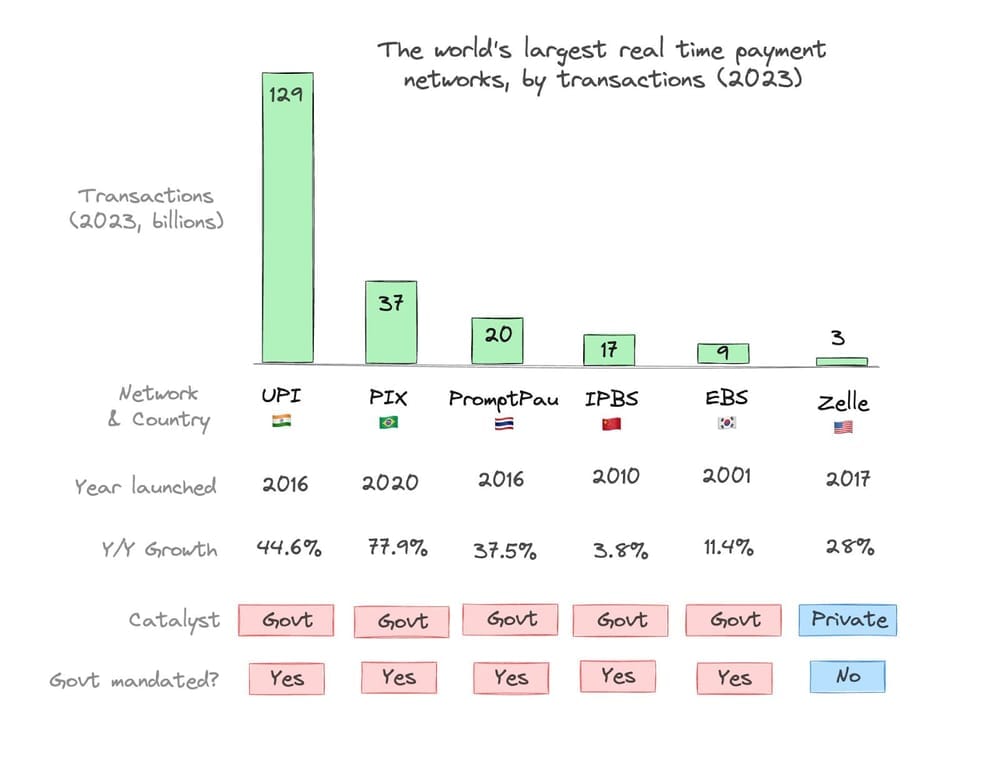

📱 The global growth of Real-Time Payments (RTP) is impressive – 266 billion transactions and 42% y/y growth in 2023. However, 80% of real-time transactions occur in a handful of countries:

PAYMENTS NEWS

🇦🇪 Network International leads launch of UAE Domestic Card Scheme ‘Jaywan’ among merchants. Jaywan aims to advance the UAE national agenda, enhance efficiency, and promote digital payments by increasing card-based transactions across all customer segments.

🇸🇪 PPRO partners with Lunar and Swish to unlock Swedish consumer market for global businesses. This collaboration will boost PPRO’s instant payment capabilities in Sweden by seamlessly integrating with Lunar’s payment infrastructure, enabling Swedish consumers to use Swish for payments at more global merchant brands.

🇺🇾 Mastercard launches Biometric Checkout Program in Uruguay. The Program allows for faster payment and shorter lines at checkout, and integrates with loyalty programs, leading to an enhanced and personalized customer experience. Read more

🇬🇧 DNA Payments launches online card acceptance of Discover® Global Network to UK merchants. This will particularly benefit businesses in the tourism, hotel, and hospitality sectors looking to grow through bookings or accepting payments for goods and services.

🇿🇦 Onafriq partners with payment tokenisation firm VGS to improve security for FinTechs in Africa and the Middle East. This cooperation is part of a long-standing relationship between the two companies, with VGS serving as Onafriq's trusted partner for Payment Card Industry (PCI) compliance and payment features.

🇪🇺 Elavon, an international payments provider, has played a significant role in advancing the adoption of cashless transactions in the Czech Republic, Slovakia, and Hungary. Elavon’s seamless integration across various merchants ensures a smooth payment process, boosting customer satisfaction and loyalty.

💳 Visa generated $40 million in USD in incremental e-commerce revenue globally, after issuing over $10 billion tokens, announced at Money 20/20 Europe. Recently unveiled Visa data tokens will give consumers more control over their data and deliver seamless AI-powered shopping experiences.

🇫🇷 Marqeta expands partnership with Lydia to power the new European digital bank Sumeria, which aims to simplify banking with its easily accessible app designed to mimic the ease of use and intuitiveness of beloved consumer brands.

🇦🇺 Breezepay secures US funding grant to expand stablecoin payments platform. The funds will be used to expand the company’s stablecoin payments gateway platform, scale up its technological infrastructure, and foster partnerships that will bring its payment solution to a wider audience.

📈 Digital Payments - A Wave of Innovation in the Nordics. Check out the complete report by Visa Consulting & Analytics. Read the complete report here

GOLDEN NUGGET

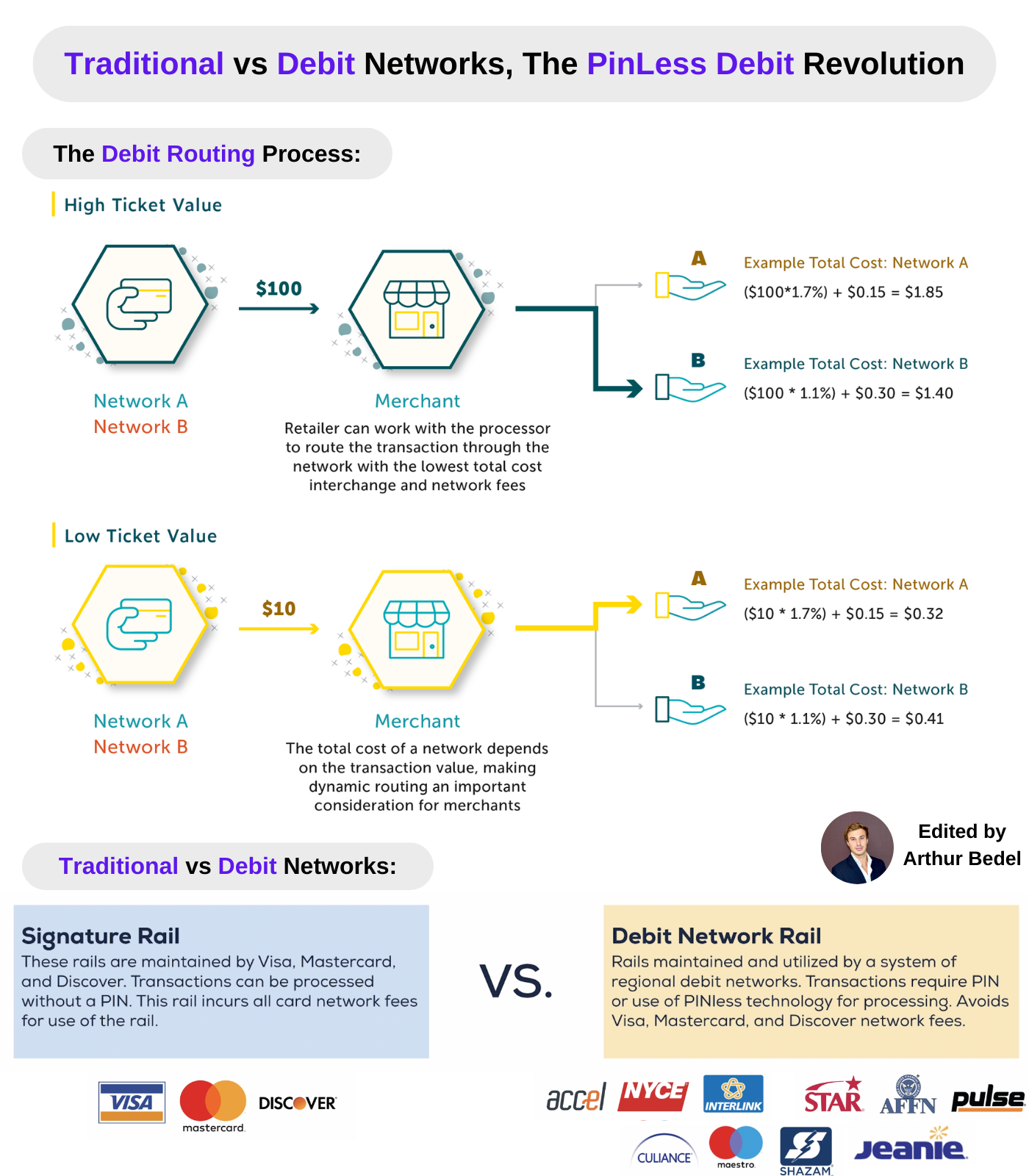

Traditional Networks (Visa & Mastercard) vs Debit Networks (Pulse, NYCE, Star) — how PinLess Debit is changing the game👇

Definition:

🔸PinLess Debit Routing is the ability to route Debit transactions to different networks without requiring a PIN entry and it's changing the game.

In 2011, the Durbin amendment was introduced by the U.S. government as a way to help merchants find relief from expensive network interchange rates. This clause enables merchants to choose the least cost network to route their transactions through, resulting in lower costs for merchants.

In fact, through domestic debit networks, costs could be 30% less with competition on interchange and low-fixed-cost network fees. CMSPI estimates significant six- or seven-figure savings are available for online U.S. merchants, so now is the time to carefully consider the payoffs and pitfalls of your debit arrangements.

The Online Debit Routing for Card-Not Present (CNP) transactions is estimated to deliver $3B in annual savings for merchants.

👉 Opportunities and Payoffs of PinLess Debit Routing:

🔸Savings — 20 to 30% of savings can be expected for an eCommerce merchant on Interchange.

🔸Business Sense — Removing the use of a PIN for a Card-Not-Present Debit Transaction provides a seamless customer experience.

🔸Early Adoption — Adoption is growing quickly. New features and providers are entering the space. Being a first mover always has potential benefits due to partnership opportunities.

🔸Routing Strategy — Visa & Mastercard have some competition coming their way. The PinLess debit networks offer cost savings opportunities that may attract large merchants focused on cost.

👉 Pitfalls and Challenges of PinLess Debit Routing:

🔸Fast-paced Industry — As new networks are adding new features and capabilities, entering into a long-term contract could be armful resulting in a non-optimized cost strategy.

🔸Inacurrate Analysis — Take into account AOV, Transaction volumes, Card profiles splits for your business and industry. An accurate analysis is needed to ensure merchants aren't being overcharged.

🔸Fraudulent Purchases — The removal of the Pin without 3DS or additional verification services can increase fraud. Creating a strategy to mitigate it is crucial.

It's crucial for merchants today to enable PinLess Debit Routing in the US to optimize their payment strategy and gain access to a real cost savings solution. Networks — Accel, NYCE, Maestro, Pulse, Star, Interlink and others — are a solution to the forever growing duopoly of Visa and Mastercard. Large merchants know it, everyone should too 🚀

Source: CMSPI, Redbridge Debt & Treasury Advisory, Christian Johnson & Alistair Matthewson.

This Golden Nugget Edition is thanks to Arthur Bedel 💳 ♻️

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn.

Comments ()