Visa Expands Cross-Border QR Payments in Asia Pacific

Hey Payment Fanatic!

Today, Visa announced its collaboration with top QR payment providers across the Asia Pacific, letting consumers use their favorite digital wallets to scan and pay via QR codes—even when traveling abroad. This pilot program kicks off in Singapore and will soon roll out across the region, promising a smoother, more unified experience for cross-border payments.

Using Visa’s global network, users of payment apps like Lakala in China, Touch 'n Go in Malaysia, FOMO Pay in Singapore, and others in Taiwan and Vietnam can now simply scan a Visa-enabled QR code and pay securely, just as they would at home.

This breakthrough was made possible through Visa’s partnership with payments tech company Juspay, integrating QR payment capabilities seamlessly across borders. "Consumers accustomed to QR payments at home can now enjoy the same seamless and secure experience abroad," said T.R. Ramachandran, Visa’s SVP for Products and Solutions, Asia Pacific. Visa's vision is clear: consistent, convenient payments—anywhere.

The impact is substantial for both consumers and merchants. Small businesses can now reach more international customers and streamline their processes, while consumers benefit from the growing popularity of QR payments, which, as Visa’s recent study shows, is Southeast Asia’s second most popular payment method.

Seems like a great week for Asian Pacific countries and the Payments industry, enjoy more updates I listed for you below and I'll be back in your inbox tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

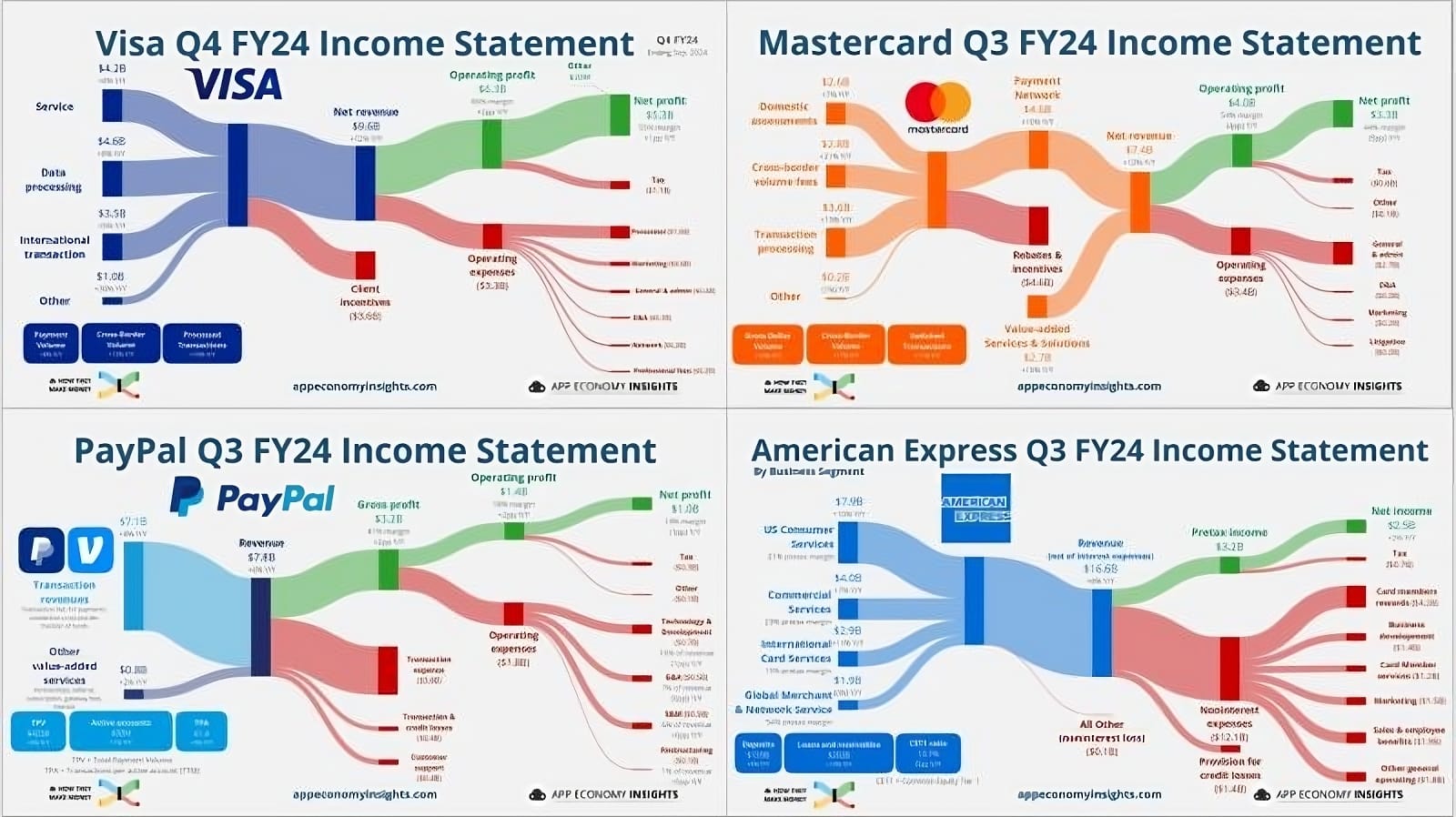

The latest Payments Giants Earnings Reports by App Economy Insights👇

All Income Statements at glance:

PAYMENTS NEWS

🇬🇧 Thunes and GCash launch innovative, cross-border digital wallet top-up solution. This ground-breaking initiative enables GCash users to top up their wallet balances directly within the app using funds from their U.K. and European bank accounts.

🇺🇸 Sure and Checkout. com partner to improve payments for digital insurance. By partnering with Checkout. com, Sure optimizes authorization rates, strengthens fraud prevention, and increases customer retention with hands-on, performance-focused support.

🇬🇧 British FinTech firm Wise posts 55% jump in profit on expanding market share. Revenues at the money transfer platform climbed 19% year-over-year for the period, to £591.9 million, the company reported Wednesday. Continue reading

🇸🇬 Mastercard goes OTP-free in APAC for faster, safer online transactions. Combining tokenization, Click to Pay, and biometric passkeys, it enables secure, on-device facial or fingerprint scans for seamless online checkout, the same way consumers unlock their phones every day.

🇦🇪 Mastercard joins Buna, the Arab Regional Payment System. The collaboration combines Mastercard Move’s money transfer capabilities and extensive network with Buna’s cross-border payment system to enable seamless payments into and out of the MENA region.

🇧🇷 B89 and PagBrasil join forces to expand Pix in Latin America. This collaboration enables B89 to offer Pix International to merchants in Panama, Colombia, Peru, Bolivia, Paraguay, Venezuela, and Ecuador, allowing Brazilian citizens to pay in reais at a fixed exchange rate.

🇸🇬 Tencent partners with Visa to bring Palm Payment to Singapore. The service will first be rolled out in Singapore, where Visa cardholders from participating banks, including DBS, OCBC, and UOB, will be part of the pilot program. Read more

🇬🇧 ConnexPay integrates with Shift4 to streamline payment solutions. This partnership will empower online travel agencies (OTAs) and hospitality businesses in the UK and Europe by integrating ConnexPay’s payment issuance solutions with Shift4’s payment processing infrastructure.

🇸🇬 Nium and Partior to offer real-time multi-currency payments. This partnership makes Nium the first FinTech payment service provider to join the Partior network, and supports Nium’s recent strategy of connecting more networks to its real-time payments infrastructure.

🇬🇧 Accept Cards introduces cash processing tech for SMEs. The UK payments broker has launched Accept Cash, an innovative cash payments solution to meet SME demand for instant, affordable cash deposits that support cash flow stability. Link here

🇵🇰 Dlocal and inDrive enhance driver payments in Pakistan. The partnership facilitates seamless and immediate wallet top-ups for drivers. This comes as a large portion of Pakistan’s population remains unbanked.

🇬🇧 Finseta enhances payment security with launch of Confirmation of Payee service powered by tell.money. This service will ensure that payments are directed to the intended recipients promptly and with enhanced security measures to ensure the accuracy of transactions.

🇳🇬 MTN Nigeria to obtain two additional payment licences for MoMo PSB. MTN Nigeria has applied for Payment Service Solutions Provider (PSSP) and Payment Terminal Service Provider (PTSP) licences for its FinTech subsidiary MoMo PSB, reflecting its growing focus on digital payments in the country.

🇨🇭 Bluecode introduces contactless NFC payments alongside existing barcode and QR code technology. This will enable users of Bluecode partners, such as issuing banks, to make secure, contactless payments simply by tapping their smartphones at payment terminals.

GOLDEN NUGGET

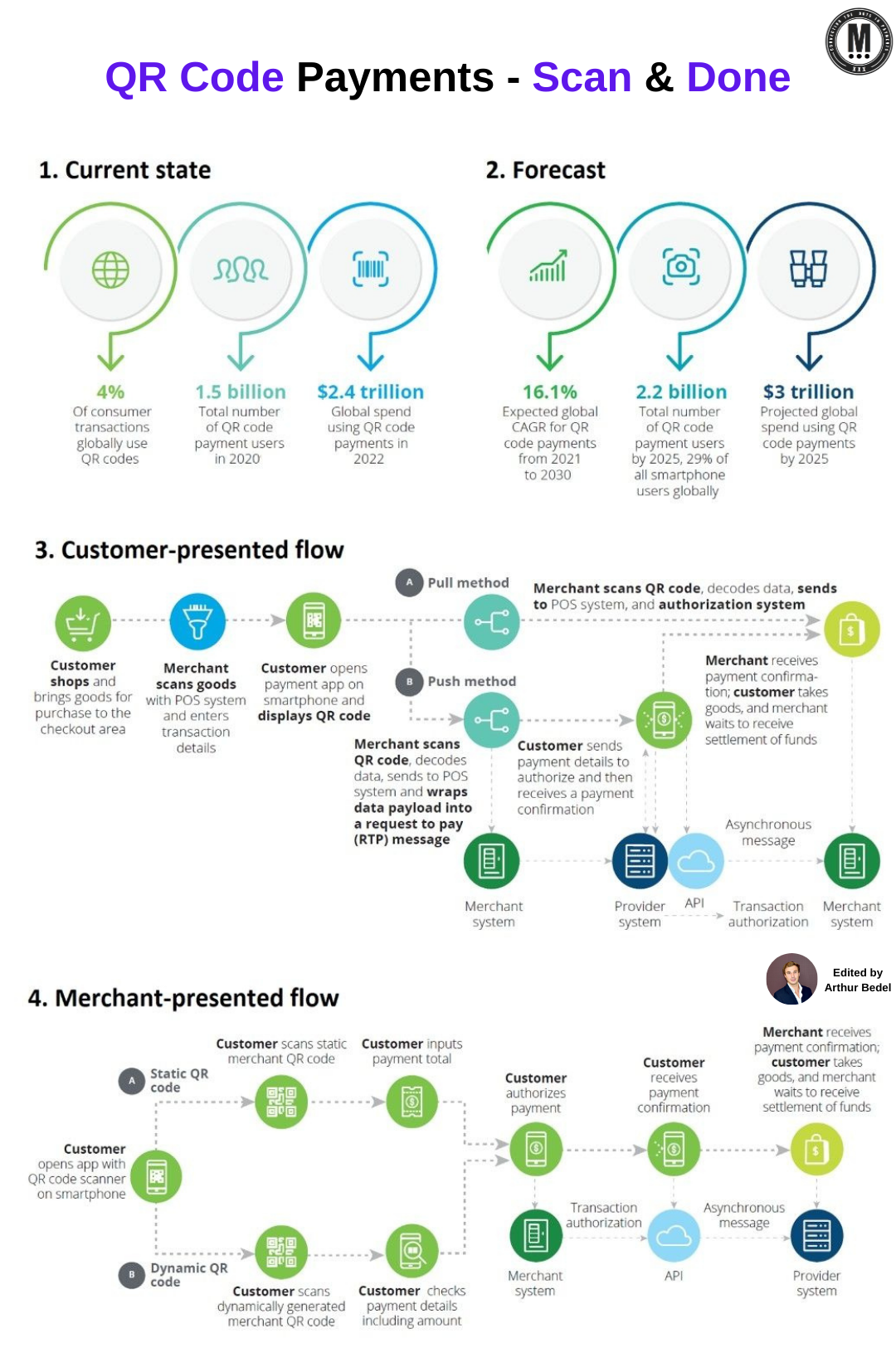

𝐐𝐮𝐢𝐜𝐤 𝐑𝐞𝐬𝐩𝐨𝐧𝐬𝐞 (𝐐𝐑) codes appear everywhere, from Restaurant menus to Super Bowl advertising. These square-shaped black & white codes are taking on payments by storm 👇

As companies and consumers have grown increasingly comfortable with QR codes, more companies are adopting them for payments. Influenced by COVID19, contactless payments rapidly gained popularity over traditional payment methods, a trend likely to continue over the next five years. Today, 4% of consumer transactions globally use QR codes, and that number is expected to increase at a 16.1% CAGR by 2030.

Originally, invented in 1994 by Denso Wave in Japan, they were initially used for production, tracking and shipping in the auto industry. Today, some of the largest companies have incorporated that technology for various purposes:

🔸 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 - Venmo, WeChat Pay, Alipay

🔸 𝐑𝐞𝐭𝐮𝐫𝐧𝐬 - Kohl's and other retailers

🔸 𝐋𝐨𝐲𝐚𝐥𝐭𝐲 - McDonald's, Starbucks, LVMH

🔸 𝐌𝐚𝐫𝐤𝐞𝐭𝐢𝐧𝐠 - Coinbase, Taco Bell, National Basketball Association (NBA)

Asia-Pacific (APAC), especially China, is empowering the usage of QR codes for payment purposes due to the rise of mobile wallets - WeChat Pay & Alipay - and other SuperApps (closely followed by Africa!).

This technology, usable across all channels, is a creative, inexpensive and efficient way to bypass card rails and old POS hardware and resource-heavy integrations. Today QR codes account for more than 90% of mobile payments in China. From commerce to entertainment and beyond everything in China can be paid for using QR codes.

3 𝐤𝐞𝐲 𝐟𝐞𝐚𝐭𝐮𝐫𝐞𝐬 of QR code payments benefit customers and merchants alike:

► Contactless payment experience: Using a digital payment option eliminates the need for cards or money to change hands.

► Faster payment, service, and settlements: Digital transactions enable immediate payment, convenience, accurate records, and prompt settlement between financial institutions.

► Affordable and accessible functionality: Lower setup and transaction costs help merchants pass savings along to consumers.

𝐍𝐨𝐭𝐞 -- Currently, merchants have two choices to consider when implementing

QR payments:

► 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫-𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐞𝐝 𝐜𝐨𝐝𝐞: The customer presents a QR code for the merchant to scan. Merchants can choose to build their own app for a customer-presented method or choose to accept third-party apps, such as Zelle, Venmo, or PayPal.

► 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭-𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐞𝐝 𝐜𝐨𝐝𝐞: The merchant's POS system produces a QR code for the customer to scan with a mobile device. In most cases, the customer manually inputs their payment details. A unique code is generated for each transaction.

QR codes are here, growing globally. Don't overlook that technology, it might as well be the key to your processing issues.

Source: Deloitte

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()