Visa Enhances Consumer Protection with Smarter Bank Transfer Payments

Hey Payments Fanatic!

Visa is set to revolutionize bank transfers with its upcoming Visa A2A payments service, launching in the UK in early 2025. This innovative service promises to bring modernity and security to the age-old method of paying via bank transfers, giving consumers unprecedented control over their transactions.

Visa A2A will enhance the payment experience with advanced features such as biometric security, streamlined dispute resolution, and flexible payment management. By modernizing the traditional direct debit system, Visa aims to address long-standing issues in bill payments and subscriptions, which have remained largely unchanged for decades.

With over £3.7 trillion processed through A2A payments in the UK last year, Visa's new service could transform how consumers manage their finances and interact with businesses. The initiative will also offer benefits to businesses, including real-time settlements and improved cash flow management.

As Visa brings its extensive payment expertise to this new venture, it’s poised to set a new standard for digital transactions and enhance the overall payment ecosystem.

Cheers,

Stay Ahead in FinTech! Subscribe to my FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

PAYMENTS NEWS

🇺🇸 Yuno announced a new partnership with Kount, an Equifax Company, a leader in trust and safety technology. The collaboration combines Yuno’s innovative payment orchestration capabilities with Kount’s advanced solutions for fraud detection, identity verification, chargeback management and regulatory compliance.

🇺🇸 PayPal is launching 𝗣𝗮𝘆𝗣𝗮𝗹 𝗘𝘃𝗲𝗿𝘆𝘄𝗵𝗲𝗿𝗲, a rewards program for consumers on the PayPal Debit Mastercard. The program includes stackable cash-back offers and personalized ways to manage spending. It enables PayPal Debit cardholders to receive 5% cash back on up to $1,000 in selected category spend per month.

🇨🇳 Alibaba's Taobao and Tmall to accept WeChat Pay. The introduction of WeChat Pay on these platforms is expected to roll out later in September 2024. The decision reflects Alibaba’s efforts to revitalise growth in its domestic ecommerce business.

Iata and Amadeus offer payments option to bypass card-processing costs. Airline association Iata and Amadeus payments platform Outpayce have announced they are partnering to enable airlines to accept account-to-account payments or bank transfers direct from customers.

🇮🇹 Satispay connects with Stripe. Through this collaboration, selected Italian online merchants using Stripe will be able to accept payments with Satispay and will join the already growing community of more than 350.000 retailers that are powering their day-to-day sales operations with Satispay.

Mastercard partners with Mercuryo to launch a euro-denominated crypto debit card, enabling users to spend crypto from self-custodial wallets at over 100 million merchants. Mastercard's collaboration introduces a euro-denominated debit card enabling users to spend cryptocurrencies like Bitcoin from self-custodial wallets.

🇩🇪 CTS EVENTIM adds Tink’s user-friendly Pay by Bank service to its checkout options. With minimal data entry and fewer redirects, this account-to-account payment offering provides a secure and streamlined experience – allowing merchants to differentiate themselves from the competition.

🇺🇸 Affirm to Profit Soon From Buy Now, Pay Later. Lower interest rates and growing volume will be tailwinds. Affirm has been able to adjust its pricing to merchants and consumers to levels that have accommodated higher transaction costs. Read on

🇨🇳 Ant Group sees 300% rise in international users adopting mobile payment in China in 2024. This surge has created significant business opportunities for local merchants. The number of Chinese merchants regularly servicing overseas travelers through the company’s mobile payment solutions have tripled during the same period.

🇺🇸 Banked selected to support Visa A2A launch, an open system to boost consumer protection with smarter bank transfer payments. Banked will use Visa's A2A platform to facilitate variable recurring payments (VRP), enabling automatic transfers from payer to merchant for seamless one-click or scheduled payments.

🚨 Three former Wirecard executives (including Wirecard boss Markus Braun) found personally liable for €140m. Former Wirecard boss Markus Braun and two other executives have been ordered to pay €140mn plus interest in damages to the defunct payment group’s administrator over violations of professional duties. Click here to learn more

🇮🇪 Global digital payments platform CleverCards announces FinTech veteran Ray Brash as new Chief Operating Officer. This key hire comes on the back of CleverCards’ recent €8 million funding round, marking another significant milestone in the company’s ambitious growth and expansion strategy.

🇵🇱 Poland’s BLIK payment system looks to expand abroad with Revolut. Blik, the payment system that has taken Poland by storm, is reportedly working on making its instant payment services available to Revolut’s banking clients in Poland and subsequently roll out its service internationally with the help of the U.K.-based financial platform. Continue reading

🇺🇸 Ryan Breslow’s $450M Bolt deal said to involve a restraining order now. Breslow’s plan to get himself reinstalled as CEO of FinTech company Bolt has apparently stalled. According to Forbes, Breslow sent an email to shareholders thanking them for signing off on the deal. Find out more

GOLDEN NUGGET

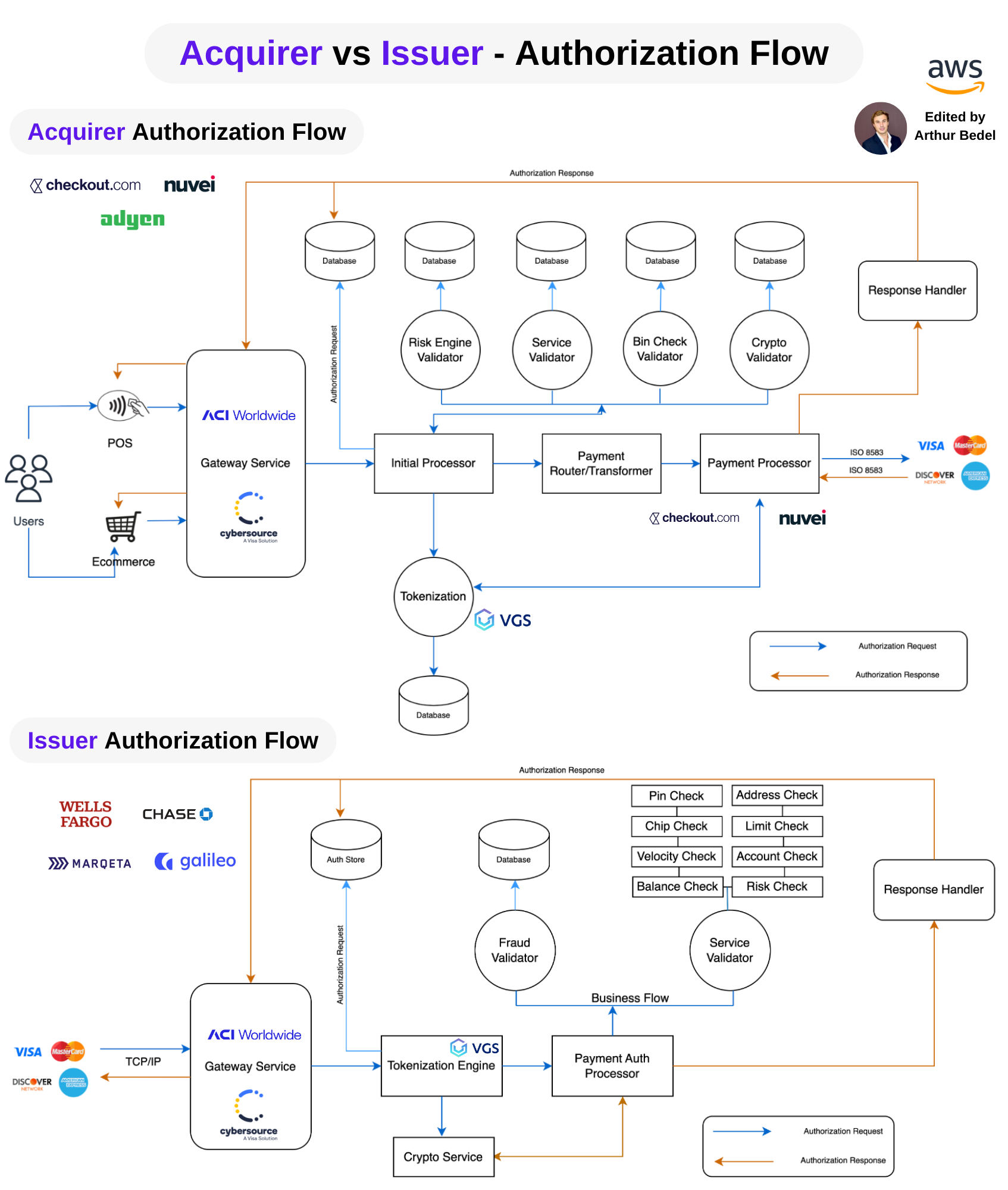

𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫 𝐯𝐬 𝐈𝐬𝐬𝐮𝐞𝐫 - 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐅𝐥𝐨𝐰𝐬 𝐢𝐧 𝐚 𝐜𝐚𝐫𝐝 𝐭𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧👇

In general, credit card transactions are processed in 3 steps:

1️⃣ 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 - check funds availability with the issuing bank to ensure the funds exist in the cardholder's account

2️⃣ 𝐂𝐥𝐞𝐚𝐫𝐢𝐧𝐠 - bundle transactions sent to the issuing bank for reconciliation

3️⃣ 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 - actual movement of funds to the merchant's bank account

𝐌𝐚𝐢𝐧 𝐩𝐥𝐚𝐲𝐞𝐫𝐬 𝐢𝐧 𝐚 𝐜𝐫𝐞𝐝𝐢𝐭 𝐜𝐚𝐫𝐝 𝐭𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧:

🔸 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲 - facilitates a payment transaction with the transfer of information between a payment portal (website, mobile etc.) & the payment processor or acquirer

🔸 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐨𝐫 - processes credit and debit card transactions on behalf of merchants connecting all of the players in the credit card lifecycle

🔸 𝐓𝐨𝐤𝐞𝐧 𝐕𝐚𝐮𝐥𝐭 - secures & stores sensitive payments data (PCI) and generate a randomly generated token used in the transaction to protect the card details.

🔸 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫 - establishes and manages a merchant's account to accept and process card transactions. Acquirers pass transaction requests and authentication data between merchants and card networks

🔸 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐬 - connects customers, merchants, issuing banks and acquiring banks. They act as governing bodies of payment processing. (Visa, Mastercard)

🔸 𝐈𝐬𝐬𝐮𝐞𝐫 - creates & provides the credit card to the cardholder. They connect consumers to the financial system and facilitate the funding of transactions to businesses (Marqeta, Chase)

Let's take a look at the different Authorization Flows 👇

𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠

A user presents their card to a merchant, a PSP or Tokenization Provider (VGS) tokenizes the card details at checkout so that the card credentials are not stored by the merchant (descoping PCI). The card details are then tokenized, sent to the gateway to route them to a PSP.

The PSP performs various checks such as card bin check, fraud scoring, etc, and determines which card network to route to. The transaction is converted to the right message format based on ISO20022 or ISO8583 before sending to the card network.

𝐈𝐬𝐬𝐮𝐞𝐫 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠

The card network receives the message from the acquirer, detokenizes the payment transaction and runs additional checks.

The card network then sends the message to the relevant issuing bank to run a bunch of validations, including pin check, address check, chip check, limit check, balance check, etc.

After the checks, it responds back with an approval or decline, which is sent to the card network & then routes back to the acquirer

Source: Amazon Web Services (AWS)

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()