Visa Direct Enables Instant Bank Transfers in Under One Minute

Hey Payments Fanatic!

Visa has just announced a major upgrade to Visa Direct - starting April 2025, funds transferred to U.S. bank accounts will be available within 1 minute or less. This enhancement reaches 99% of bank accounts in the US and over 11 billion endpoints globally, spanning cards, accounts, and digital wallets.

Jim Filice, VP, Head of Real-time Payments, Visa Direct shares: "Today, Visa Direct processes billions of real-time transactions in the US, across 50+ use cases, making it a preferred choice for consumers when receiving money from businesses or moving money between their accounts."

Adding to this, Reed Luhtanen, Executive Director and CEO, U.S. Faster Payments Council notes: "Upgrading the U.S. payment system is essential for secure, near-immediate funds availability."

By the way: don't miss out on your chance to meet me in Las Vegas in March and join the best community in FinTech!

The best FinTech event of the year is back from March 10 until March 13, and of course I'll be attending 😉

Less than one week remains to secure the best price on your ticket to Fintech Meetup 2025.

Do I see you in Vegas?

I've compiled more updates from the global Payments industry for your perusal below 👇

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

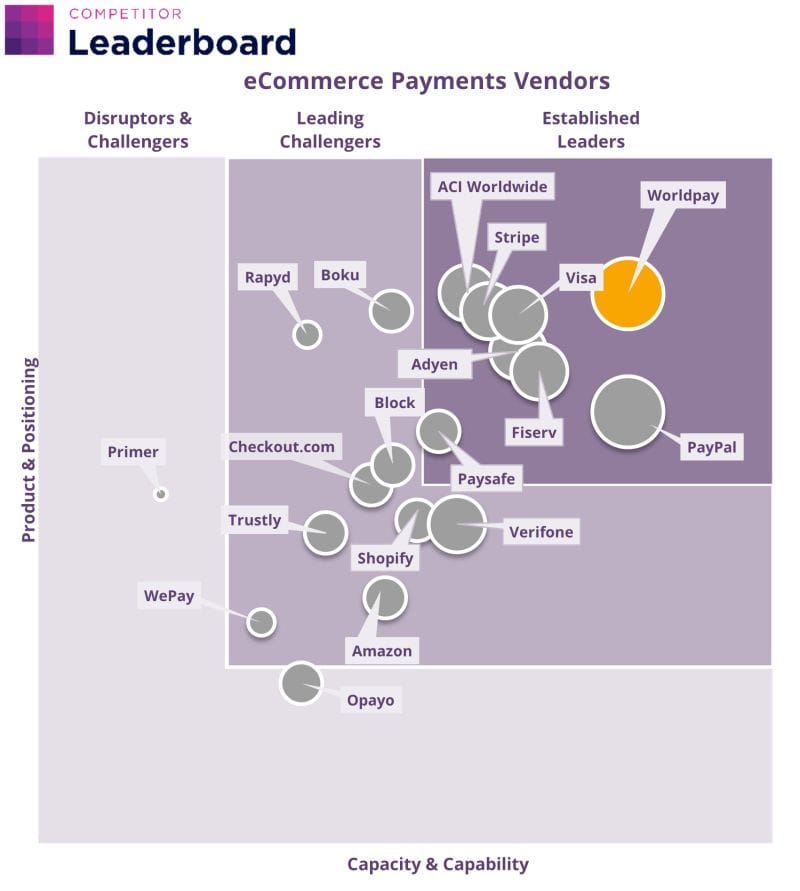

𝗲𝗖𝗼𝗺𝗺𝗲𝗿𝗰𝗲 𝗣𝗮𝘆𝗺𝗲𝗻𝘁𝘀 𝗩𝗲𝗻𝗱𝗼𝗿𝘀 𝗟𝗲𝗮𝗱𝗲𝗿𝗯𝗼𝗮𝗿𝗱 👇

Based on capacity and capability assessments, Vendors are positioned as:

PAYMENTS NEWS

➡️ Kuady strengthens Latin American footprint with Ecuador and virtual prepaid Mastercard in Argentina launch. Kuady, a leading payments service processor, has announced significant strides in its Latin American expansion, with the introduction of its digital wallet services in Ecuador and the launch of its virtual prepaid Mastercard in Argentina. These developments underscore Kuady’s commitment to driving financial inclusion and delivering innovative payment solutions across the region.

Lorenzo Pellegrino, CEO at Kuady commented: : “The expansion into Ecuador and the launch of our virtual prepaid Mastercard in Argentina mark major milestones in our journey to drive financial inclusion and innovation across Latin America. We’re empowering individuals and businesses with secure, real-time payment solutions that break down barriers to financial access, whether through our e-wallet or the flexibility of our Mastercard. These efforts reflect our dedication to fostering digital economies and creating opportunities for communities across the region and beyond." Read the full press release here

🇺🇸 Slope taps Marqeta to power BNPL Card, enabling brands and marketplaces to offer flexible loan options. By integrating with Marqeta, Slope enables its customers to make in-store purchases when needed and spread payments over time, enhancing cash flow and allowing for faster access to working capital. The Slope Card offers cost-effective, modern business capital at checkout.

🇬🇧 GoCardless and Endava partner to streamline bank payment solutions. Endava will integrate and manage GoCardless payment solutions for enterprise clients undergoing digital transformation, expediting the implementation of bank payment systems for faster access to their features.

🇭🇰 The Payment Cards Group and Black Bear Merchant Services join forces to launch a new brand 'AbbyPay'. This partnership will accelerate PCG's expansion in market share by covering 50,000 local merchants in Hong Kong and other APAC regions with multiple brands to meet diverse market demands and empower local merchants through innovative payment technology.

🇳🇱 eBay and Klarna expand tie up bringing buy now pay later service to new markets. Expanding from a launch in Germany, eBay is offering Klarna (including Pay in 3 and Pay in 30 Days) to people in the UK, Austria, France, Italy, the Netherlands and Spain, with more markets coming soon.

🇺🇸 equipifi and Synergent partner to expand Credit Union access to buy now, pay later platform. As a result of this partnership, Synergent credit unions will be able to launch their own BNPL programs through their digital banking apps, helping members split their larger purchases into flexible installment loans.

🇬🇧 Mercia exits card payments specialist in sale to US company. Shift4 has acquired Grimsby-based Card Industry Professionals, a provider of card terminals, POS, and online payment solutions to SMEs like retailers and salons. The deal marks an exit for Mercia Ventures, which backed the firm in 2022 via NPIF and MEIF funding.

🇬🇧 Ordo teams up with Eviden to launch the new payment platform. The new Open Banking solution is being piloted with the aim to facilitate direct payments between businesses and customers in real-time, providing a lower-cost alternative to direct debit and standard credit.

🇬🇧 The Payments Association calls for action to address the environmental impact of digital payments. A report by The Payments Association’s ESG Working Group shows that while digital payment emissions are small, their scale has an impact. It calls for standardizing measurement, collaboration, aligning with regulations, and tying sustainability to business goals.

🇸🇪 Swish introduces tap-to-pay feature. The new feature lets users link their payment cards directly to the app, simplifying everyday transactions for its 8.6 million users. This update is part of Swish’s efforts to adapt its services to meet changing consumer preferences and expand its functionality.

GOLDEN NUGGET

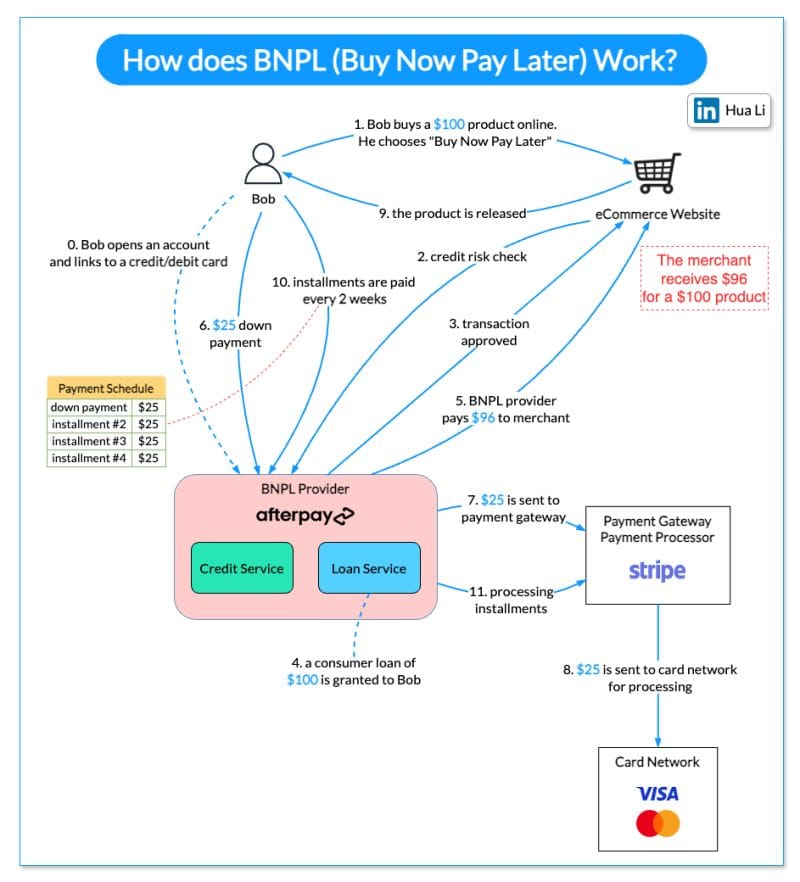

How do 𝐁𝐍𝐏𝐋 (Buy Now, Pay Later) providers like Afterpay work?

How do BNPL providers make money?

🔹 BNPL has grown dramatically in recent years. It rewrites the product payment flow for both eCommerce and POS (Point of Sale) and the BNPL provider is the 𝐩𝐫𝐢𝐦𝐚𝐫𝐲 𝐢𝐧𝐭𝐞𝐫𝐟𝐚𝐜𝐞 between the merchants and the customers.

🔹 Benefits for the merchants - The merchants who offer the BNPL payment option see a 20% increase in cart conversion and a 40% increase in the average order size.

🔹 Benefits for the customers - The customers can now acquire the product with only the down payment, and pay later with zero interests or fees.

🔹 Benefits for BNPL providers - BNPL providers can sell future installments (receivables) to a lender at a discount. For example, a series of $100 installments to be received in 6 weeks can be sold at $96. This is quite a high interest for the lenders.

The diagram below shows how the process works:

Step 0. Bob opens an account with AfterPay. This account links to an approved credit/debit card.

Step 1. Bob wants to buy a $100 product and he chooses the “Buy Now, Pay Later” payment option.

Steps 2-3. BNPL provider checks Bob’s credit score and approves the transaction.

Steps 4-5. BNPL provider grants Bob a consumer loan of $100, which is usually financed by a bank. $96 out of $100 is paid to the merchant immediately (Yes, the merchant receives less with BNPL than with credit cards!) Bob now needs to pay back the BNPL provider according to the payment schedule.

Steps 6-8. Now Bob pays the BNPL $25 down payment. The payment transaction is sent to Stripe for processing. Stripe forwards it further to the card network. Since this goes through the card network as well, an 𝐢𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐟𝐞𝐞 needs to be paid to the card network.

Step 9. The product is released and can be shipped to Bob.

Steps 10-11. Bob pays installments to the BNPL provider every 2 weeks. The installments are deducted from the credit/debit card and sent to the payment gateway for processing.

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()