Visa Brings Apple Pay to Egypt 🇪🇬 for Seamless Digital Payments

Hey Payments Fanatic!

Visa has launched Apple Pay in Egypt, bringing digital payment capabilities to Egyptian customers across multiple platforms. The service enables contactless payments in stores through iPhone or Apple Watch, secured by Face ID, Touch ID, or device passcode along with a one-time dynamic security code.

Malak El Baba, Vice President and Visa's Country Manager for Egypt, described the launch as "a significant milestone" in bringing payment innovations to new markets. The service will be accepted at grocery stores, pharmacies, taxis, restaurants, retail outlets, and other locations throughout Egypt.

Beyond in-store payments, Apple Pay offers online and in-app purchasing capabilities for iPhone, iPad, and Mac users, eliminating the need to create accounts or repeatedly enter personal information for services like food delivery, online shopping, transportation, and parking.

Enjoy more Payments industry updates I listed for you below and I'll be back in you inbox tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

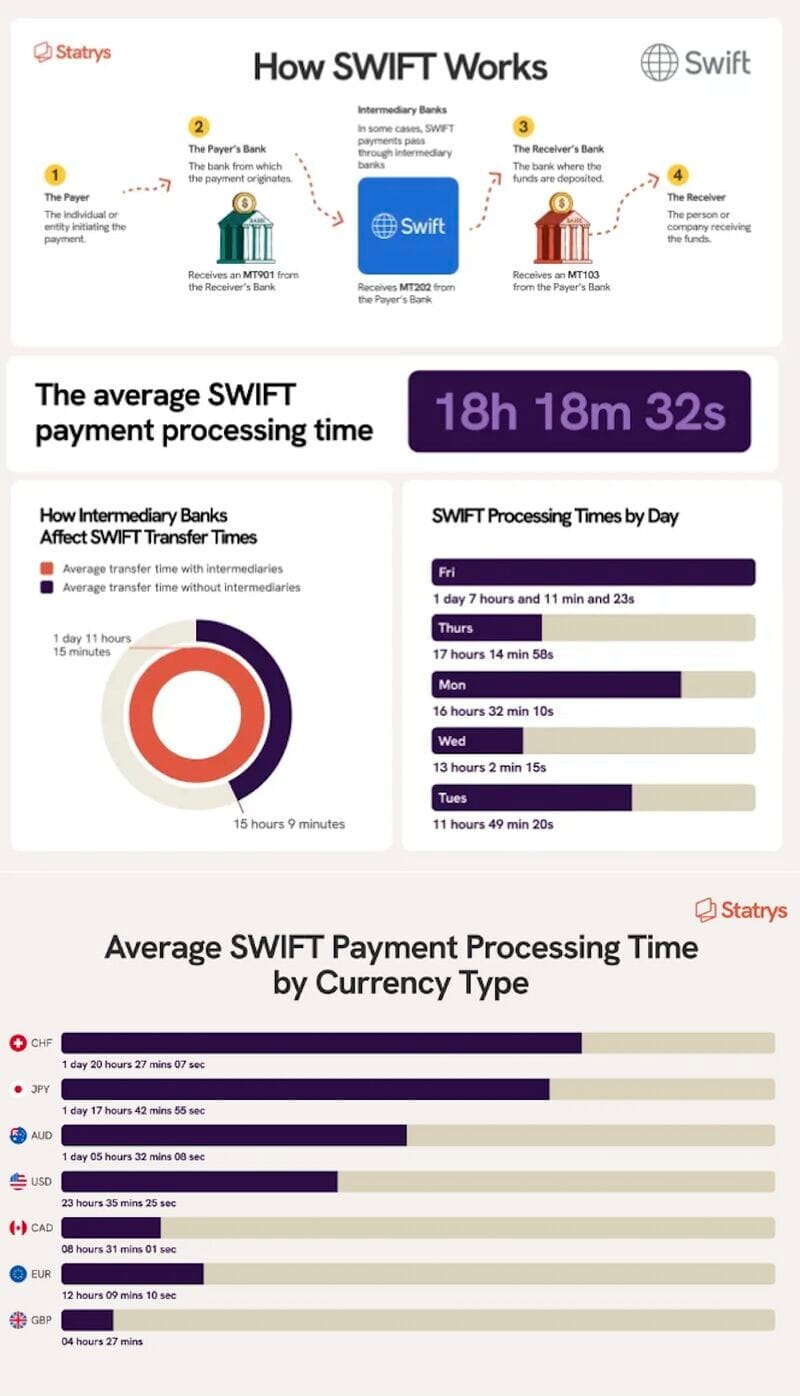

What is a 𝗦𝗪𝗜𝗙𝗧 𝗣𝗮𝘆𝗺𝗲𝗻𝘁? And how long do SWIFT Payments take?

PAYMENTS NEWS

🇫🇷 Mollie is introducing Alma, a buy now, pay later leader in France and Belgium. Alma enables businesses to offer their customers a flexible, seamless payment solution while ensuring secure cash flow and maintaining brand integrity. Find out more

🇪🇬 MoneyHash banks $5.2M. The pre-Series A comes around a year after its last funding, when it announced a $4.5 million seed round in February 2024. In total, MoneyHash has raised over $12 million since Nader Abdelrazik and Mustafa Eid launched the Egyptian FinTech in early 2021

🌍 Worldline teams up with Wix to scale commerce and payment solutions. Through this collaboration, Wix merges its platform to create and manage an online presence and commerce tools with Worldline’s integrated payment acceptance enabled by localised acquiring features to equip merchants with an all-in-one solution.

🇺🇸 Stripe accidentally sent an image of a duck when notifying some employees they were getting laid off. The company laid off 300 staff, equivalent to about 3.5% of its workforce. Those roles were primarily in product, engineering, and operations. The firm also sent impacted staff an incorrect date for the date of termination in an email.

🌎 Depay and Satoshi Tango launch QR code to facilitate cryptocurrency transactions in Latin America. This collaboration introduces a system where consumers in Argentina, Brazil, Colombia, and Peru can now use QR codes to make payments in retail outlets, significantly advancing the adoption of cryptocurrency in the region.

🇪🇨 PayMon raises $600K pre-seed round led by Magma Partners. PayMon will use the funds to expand operations in Mexico and Ecuador and add additional payment solutions, including digitizing payments to suppliers and ticket purchases for events, as well as handling payments related to students.

🇺🇸 Tech Industry sues CFPB over ‘chilling’ effect on digital wallets. The suit focused on the rule which was finalized last November and took effect last month, through which the CFPB has sought to regulate companies tied to payments of more than 50 million transactions on an annual basis.

🇮🇹 Qomodo raises $13.9M to expand BNPL for Italy’s main-street retailers. Qomodo claims to now serve 2,500 physical merchants. The idea is to let small businesses improve their cash flow and increase revenue with a BNPL solution that lets consumers make flexible, interest-free installments on items purchased in-store.

🇵🇭 Philippines’ GCash builds up business beyond payments before IPO. “We’re looking to expand further our lending business and investing platforms that will support our AI work,” GCash President and CEO Martha Sazon said. GCash is in discussions with banks for the potential public offering that will depend on market conditions.

🇬🇧 Gala Technology launches SOTpay Connect to streamline payment processes. The platform is a comprehensive payment gateway that caters to a variety of channels, including open banking, direct debits, omni-channel transactions, and even social media-based payments via text, email, or WhatsApp.

🇨🇦 MuchBetter partners with Peoples Group to expand services into Canada . MuchBetter’s latest move aims to bring stylish, cutting-edge wearable tech and to disrupt established industries and product lines. This is part of its rapid growth and expansion plans.

🇵🇰 Mastercard collaborates with Foodpanda to fuel the growth of Pakistan’s digital economy. The partnership introduces initiatives designed to encourage the use of digital payment methods over cash on delivery. Mastercard will drive awareness and usage of secure, rewarding payment options for millions of consumers across the country.

🌍 Visa strikes multi-year relationship with Disney Europe. The alliance with Disney will bring exciting opportunities for Visa’s customers in the region, including unique benefits and offers across Disney's products and services, access to pre-sales and priority bookings, and invitations to tailor-made events and experiences.

🇫🇷 myPOS acquires Toporder. myPOS says the acquisition will enable the company to expand its presence in the French “retail, food and beverage sectors by providing integrated payment and cash register solutions tailored to streamline operations, improve efficiency and drive growth”.

🇧🇷 Appmax, a FinTech specializing in payment solutions for e-commerce and digital businesses, has received authorization from the Central Bank of Brazil (BC) to operate as a regulated Payment Institution (PI). With its own license, the company hopes to hook new customer profiles.

GOLDEN NUGGET

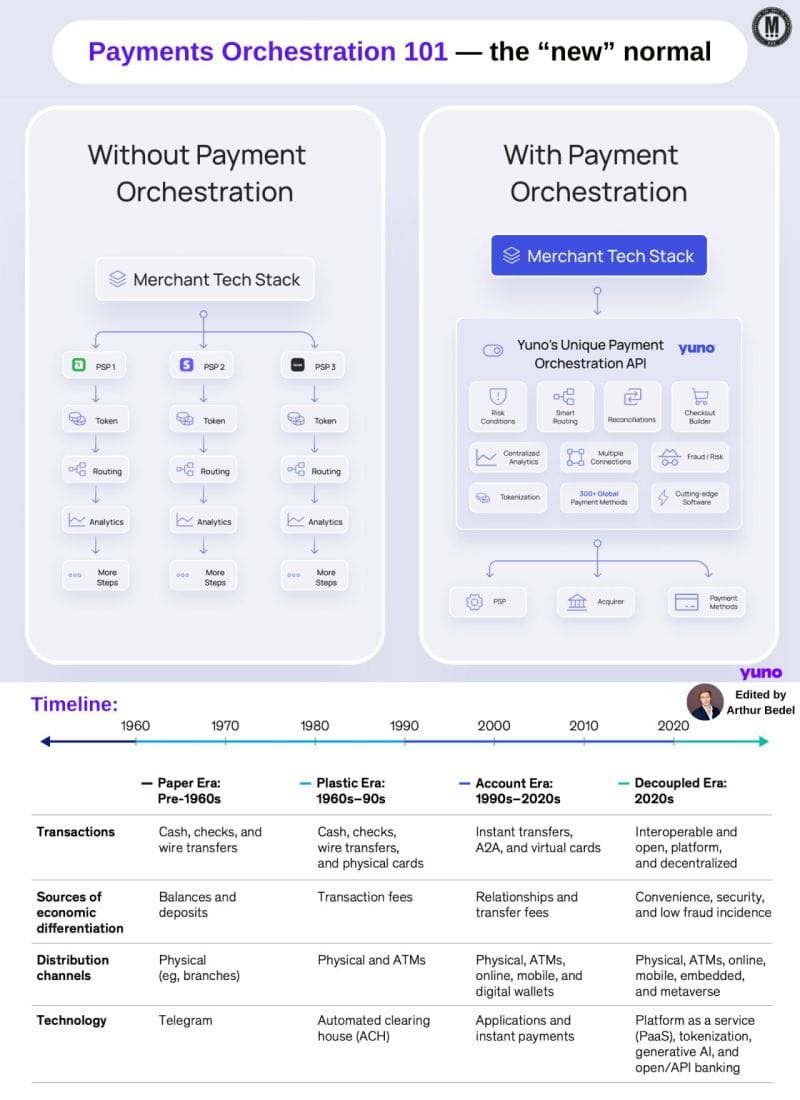

Payments Orchestration 101 - The "new normal" by Arthur Bedel 💳 ♻️

Let’s dive in:

The payments landscape has undergone a profound evolution. What began as simple barter systems over 5,000 years ago has now evolved into an intricate digital ecosystem that enables seamless, secure, and real-time global transactions.

The buzzword "𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧" is one of the key drivers transforming the payments industry, a flexible approach to managing payments.

Unlike traditional systems that operate in silos, payments orchestration integrates multiple Payment methods, Gateways, & Processors into a single, centralized platform, optimizing transaction routing & dealing with cross-border complexity.

𝐖𝐡𝐲 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐌𝐚𝐭𝐭𝐞𝐫𝐬:

𝐂𝐨𝐬𝐭 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲: Businesses no longer need to rely on a single payment provider. Instead, they can optimize costs by routing transactions through the most cost-effective channels.

𝐑𝐞𝐬𝐢𝐥𝐢𝐞𝐧𝐜𝐞: If one payment gateway fails, orchestration ensures that transactions are seamlessly rerouted, reducing downtime and enhancing reliability.

𝐒𝐜𝐚𝐥𝐚𝐛𝐢𝐥𝐢𝐭𝐲: With orchestration, businesses can easily adapt to changing market demands, incorporating new payment methods as they emerge.

A fundamental shift, moving from static, rigid systems to dynamic, intelligent networks that adapt to customer needs in real time.

𝐓𝐡𝐞 𝐑𝐨𝐥𝐞 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐄𝐧𝐚𝐛𝐥𝐢𝐧𝐠 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧:

Tokenization is another critical innovation driving this evolution. By replacing sensitive payment information with unique tokens, it enhances security while enabling orchestration to function seamlessly across multiple channels.

This transactional data can be passed to all providers in a seamless way enabling a unified experience across providers, also providing companies with the ability to:

► Optimize their payment strategy

► Create better customer profile for marketing and partnership purposes

► Enhance their fraud strategy across providers

𝐊𝐞𝐲 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐫𝐞𝐚𝐬 𝐒𝐡𝐚𝐩𝐢𝐧𝐠 𝐭𝐡𝐞 𝐅𝐮𝐭𝐮𝐫𝐞:

𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Real-time payments (RTP) with PIX in Brazil and UPI in India.

𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Biometrics are becoming mainstream, offering more secure, personalized payment experiences, impacting the definition of card-present and card-non present transactions.

𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠: Open Banking is enabling a better and faster access to financial services and will continue to do so.

The future of payments is already taking shape — and it’s one where flexibility, security, and seamlessness will define success.

I highly recommend reading the complete #fintechreport by Yuno for more interesting info on this topic.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()