Visa Blocks 85% More Fraud This Cyber Monday with AI

Hey Payments Fanatic!

Visa's fraud prevention technology is proving its worth this holiday season, with the payment giant blocking nearly 85% more suspected fraudulent transactions globally during Cyber Monday compared to last year. The surge in fraud attempts was significant, with suspicious activity increasing by 200% worldwide over the holiday weekend.

The company's US$11 billion investment in technology over the past five years seems to be paying off. Their newest solution leverages generative AI to prevent account takeovers across shopping platforms, building on their track record of blocking US$40 billion worth of suspected fraudulent transactions globally last year.

Diego Paul Fabara, Chief Risk and Client Services Officer at Visa puts it well: "Although crooks are using AI more and more, so are we. And that's paying off. As we saw during the kickoff to the holiday shopping season, Visa continues to thwart more attempts at fraud from these bad actors, continuing our mission to be the safest way to pay and be paid for everyone, everywhere."

Read more global Payments industry updates below👇 and I'll be back tomorrow!

Cheers,

SPONSORED CONTENT

INSIGHTS

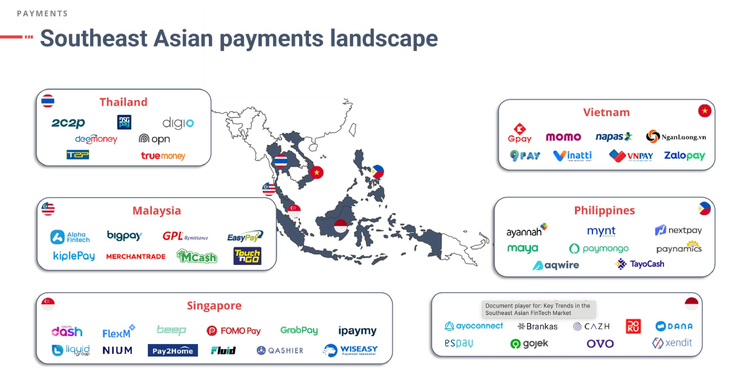

📊 Explore the driving factors and Key Trends in the Southeast Asian FinTech market in this great #fintechreport by Royal Park Partners 👇

PAYMENTS NEWS

🇺🇸 Damon O'Donnell appointed Director of People & Business Operations at Aeropay. Damon brings a strong background in recruiting and operations, having previously held Chief of Staff roles at prominent companies such as Pinterest and Moët Hennessy.

🇺🇸 Remote launches stablecoin payouts. The stablecoin payouts payments feature enhances Remote’s platform, giving companies a single-dashboard solution to manage all their talent. This new capability is now available to US-based customers, offering companies a secure and near-instant way to pay global contractors.

🇮🇳 India’s MobiKwik surges 82% in market debut. The Indian FinTech’s $69 million IPO comes amid fierce competition from larger rivals, and it pushes MobiKwik’s market value to $464 million, well above its initial target of $250 million. Read More

🇹🇷 Mastercard partners with Dgpays. This collaboration enables the companies to co-develop advanced payment technologies and loyalty solutions. The initiative will focus on optimising access to digital payments, ensuring secure and practical solutions that build trust among consumers and businesses alike.

🇺🇾 Uruguay payments provider DLocal explores sale. DLocal is exploring options including a potential sale. It is also working with Morgan Stanley to gauge takeover interest from potential acquirers. Read more

🇨🇦 Affirm and Adyen expand partnership. The partnership makes Affirm the first Buy Now, Pay Later (BNPL) provider to support Adyen for Platforms, an end-to-end payment solution for platform businesses, and brings more payment options to Adyen merchants in Canada.

🇺🇸 Aptia adopts HSBC's Pre-Validation API for payments. This strategic move reinforces Aptia’s commitment to offering its customers the most secure, efficient, and seamless payment processes. By integrating this advanced technology into its operations, Aptia is raising the bar for security and trust in pension fund administration.

🇺🇸 Leap Financial secures $3.5M investment to fuel AI-driven innovation in cross-border payments. Leap’s mission is to dismantle outdated systems, allowing financial and non-financial institutions to participate in money flows efficiently and at a reduced cost.

🇦🇺 ANZ Bank eyes buyback of payments unit. Merchant acquiring, a low-margin, tech-intensive sector, was positioned as a strategic partnership to support ANZ's small and institutional clients. This potential buyback signals a shift in ANZ’s approach to the payments market.

🇺🇸 US watchdog warns credit card issuers not to devalue rewards. The CFPB emphasized that unfair, deceptive, or abusive practices such as altering rewards through hidden terms or technical issues could lead to penalties. This move underscores the agency’s commitment to safeguarding cardholders' rights.

GOLDEN NUGGET

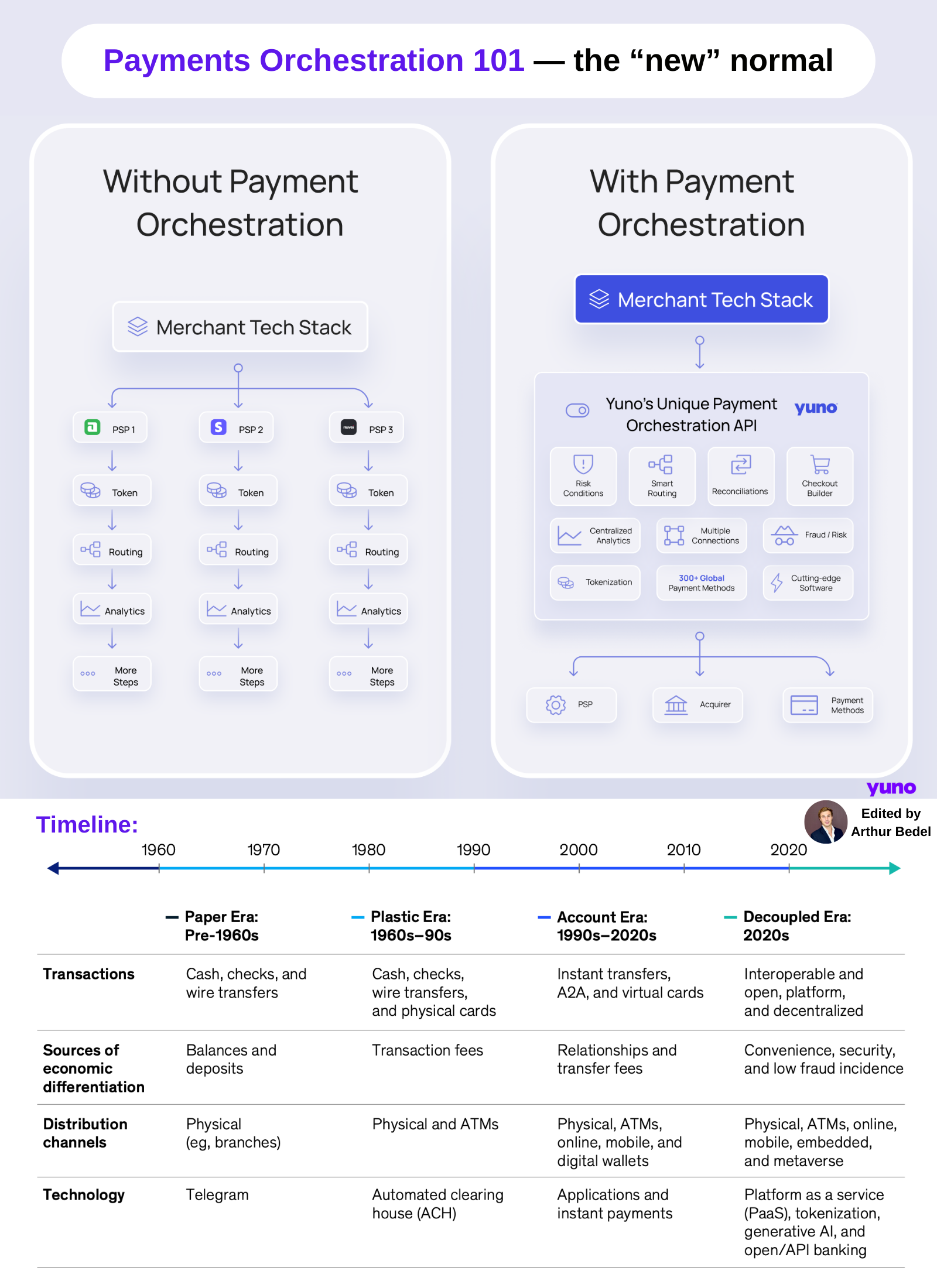

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 x 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 — 𝐬𝐡𝐚𝐩𝐢𝐧𝐠 𝐭𝐡𝐞 𝐟𝐮𝐭𝐮𝐫𝐞 of 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 together 👇

The payments landscape has undergone a profound evolution. What began as simple barter systems over 5,000 years ago has now evolved into an intricate digital ecosystem that enables seamless, secure, and real-time global transactions.

The buzzword "𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧" is one of the key drivers transforming the payments industry, a flexible approach to managing payments. Unlike traditional systems that operate in silos, payments orchestration integrates multiple hashtag#paymentmethods, hashtag#gateways, and hashtag#processors into a single, centralized platform, optimizing transaction routing, dealing with cross-border complexity, expected to exceed $15B by 2026.

𝐖𝐡𝐲 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐌𝐚𝐭𝐭𝐞𝐫𝐬:

𝐂𝐨𝐬𝐭 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲: Businesses no longer need to rely on a single payment provider. Instead, they can optimize costs by routing transactions through the most cost-effective channels.

𝐑𝐞𝐬𝐢𝐥𝐢𝐞𝐧𝐜𝐞: If one payment gateway fails, orchestration ensures that transactions are seamlessly rerouted, reducing downtime and enhancing reliability.

𝐒𝐜𝐚𝐥𝐚𝐛𝐢𝐥𝐢𝐭𝐲: With orchestration, businesses can easily adapt to changing market demands, incorporating new payment methods as they emerge.

A fundamental shift, moving from static, rigid systems to dynamic, intelligent networks that adapt to customer needs in real time.

𝐓𝐡𝐞 𝐑𝐨𝐥𝐞 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐄𝐧𝐚𝐛𝐥𝐢𝐧𝐠 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧:

Tokenization is another critical innovation driving this evolution. By replacing sensitive payment information with unique tokens, it enhances security while enabling orchestration to function seamlessly across multiple channels. This transactional data can be passed to all providers in a seamless way enabling a unified experience across providers, also providing companies with the ability to:

► Optimize their payment strategy

► Create better customer profile for marketing and partnership purposes

► Enhance their fraud strategy across providers

𝐊𝐞𝐲 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐫𝐞𝐚𝐬 𝐒𝐡𝐚𝐩𝐢𝐧𝐠 𝐭𝐡𝐞 𝐅𝐮𝐭𝐮𝐫𝐞:

► 𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Real-time payments (hashtag#RTP) with PIX in Brazil and UPI in India.

► 𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Biometrics are becoming mainstream, offering more secure, personalized payment experiences, impacting the definition of card-present and card-non present transactions.

► 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠: Open Banking is enabling a better and faster access to financial services and will continue to do so.

The future of payments is already taking shape — and it's one where flexibility, security, and seamlessness will define success.

Source: Yuno

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()