Visa Backs Mynt in €22M Funding Round

Hey Payments Fanatic!

The payments giant Visa has invested in Stockholm-based Mynt, a spend management platform tailored to SMEs. Alongside the capital injection, Visa and Mynt announced a broader reseller partnership, reinforcing a collaboration that began in 2023. With this deal, both companies aim to reach deeper into the European SME ecosystem—one API and card at a time.

Mynt’s journey started in 2018, built around the idea that spend control should be as seamless as issuing a card. In just 12 months, the company quadrupled its client base—from 3,000 to 12,000—while reaching month-on-month profitability in September. Its tools already integrate with popular accounting systems across the Nordics, and the platform is expanding its reach into banks, ERPs, and even fuel card providers.

The investment is part of a €22 million Series B round, bringing Mynt’s total funding above €50 million. The company is now valued at €175 million. While numbers offer one part of the story, the real narrative might lie in the dual-channel strategy: Mynt becomes a Visa reseller, and Visa, in turn, distributes Mynt’s SaaS offering.

Philip Konopik, regional managing director, Visa Nordics & Baltics, says: “We are thrilled to invest in Mynt as they continue to grow following several years of joint value-creating collaboration. Another great example of Nordic fintech innovation where Visa is deepening collaboration with Mynt, where our combined capabilities will enable our clients and partners to bring market leading propositions and services to Small and Medium sized Businesses across Europe.”

Read more global Payments industry updates below 👇 and I'll be back on Monday!

Cheers,

INSIGHTS

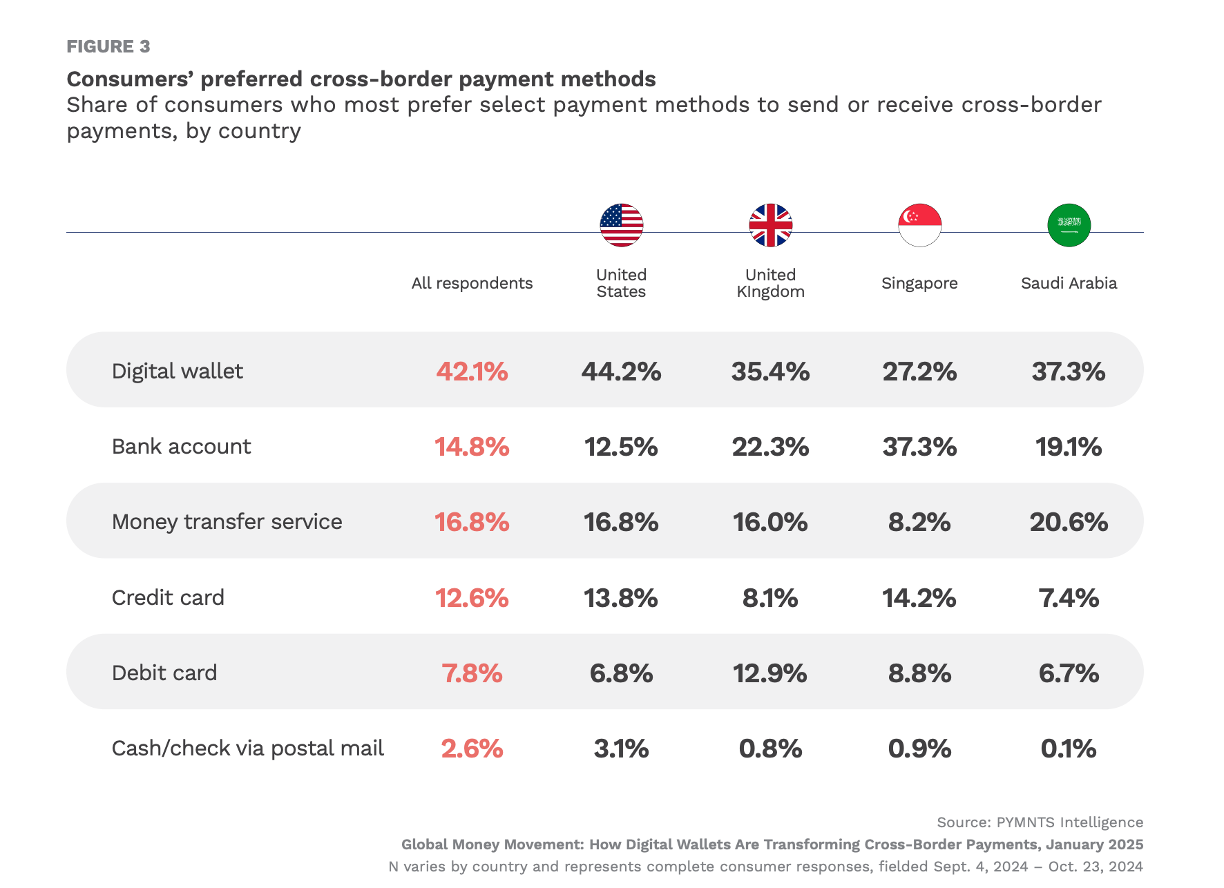

📊 42% of consumers prefer digital wallets for cross-border payments.

PAYMENTS NEWS

🇺🇸 Inside ACI Worldwide’s 2025 growth strategy. The company is eyeing international opportunities coupled with increasing adoption of real-time and commercial payments to grow operations in 2025. The $5.2 billion global payments firm this year developed a hub called ACI Connetic that routes payments in the most efficient way to complete the transaction, Tom Warsop, Chief Executive, said in an interview.

🇮🇹 Ecommpay streamlines Italian market entry for e-commerce merchants. The company is providing access to the most popular local and global payment methods in the region. In addition to acquiring and credit card payments, seamless integration is available with popular payment methods, Satispay, MyBank, and BANCOMAT Pay.

🇦🇪 Checkout.com gears up to become the first global digital PSP to launch card issuing in the UAE. The company aims to roll out domestic card issuance in the region in 2026, pending regulatory approval. This will enable businesses to launch branded cards, whether physical or virtual, power customer rewards, streamline expenses, and simplify business-to-business payouts.

🇺🇸 Cash App owner Block pays $𝟰𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 fine to New York over compliance failures. Block will pay a $40 million civil fine and hire an independent monitor to settle charges by New York's financial services regulator that it failed to adequately police and stop money laundering on its Cash App mobile payment service.

🇬🇧 Damisa secures £2.25 million pre-seed to build the fastest and most secure stable-coin payment experience to date. The funds will enable Damisa to accelerate its go-to-market strategy, scale its operational infrastructure, obtain the necessary licenses, and advance technological capabilities ahead of its public launch.

🇺🇸 Klarna Plus marks first year in the US, signaling growing momentum in subscription services. Klarna Plus represents a key pillar in delivering enhanced value and deepening consumer adoption beyond the brand’s day-to-day services. In the last year, customers have saved a total of $5 million in discounts and fees.

🇨🇳 Payoneer completes acquisition of licensed PSP based in China, Easylink Payment Co., Ltd. “We serve a diverse range of companies in China, allowing them to grow their business globally,” says John Caplan, CEO of Payoneer. Keep reading

🌍 Instapay partners Mastercard to revolutionise remittances for migrant workers. This partnership allows the over three million migrant workers residing in Malaysia, hailing predominantly from Indonesia, Nepal, Bangladesh, India, and the Philippines, to remit funds to their home countries in local currencies in near real-time.

🇨🇳 X Pay and STOREBERRY form a strategic alliance to revolutionize local e-commerce payments and drive sustainable growth. Through seamless integration with STOREBERRY's ecosystem, X Pay tailored a smooth payment experience to meet the rapidly evolving demands of the market.

🇮🇳 PayPal India VP-HR Jayanthi Vaidyanathan steps down after a 17-year tenure. She joined PayPal in 2008 as the HR Head for India, tasked with establishing and scaling the India operations from the ground up. Read more

🇬🇧 Curve Pay takes on tech giants with alternative to Apple Pay. The company is also advocating for regulatory intervention to address Apple's fees for third-party access to NFC payment technology in the UK, aligning with the European Commission's push for increased competition in mobile payments.

🇬🇧 Wise expands India presence to hire hundreds across functions. The company is setting up a technology and operations hub in Hyderabad, which will serve as a full-stack centre for product, engineering and servicing teams. It is also introducing a new feature that allows SMBs and freelancers to receive overseas payments in foreign currencies.

🌍 Weavr integrates B4B Payments, boosting European payment flexibility. B4B Payments allows Weavr to strengthen its position within its current markets, allows the company to expand into key European markets outside the Eurozone, and validates a model for expansion that can follow the customer beyond Europe.

🇱🇻 Nets and BluOr Bank enter issuing and processing agreement to allow the latter to utilise its payment card issuing services and improve the customer banking experience. Through this move, Nets is set to process the bank’s customers' card transactions, with plans to deliver increased security when conducting transactions and withdrawing funds.

GOLDEN NUGGET

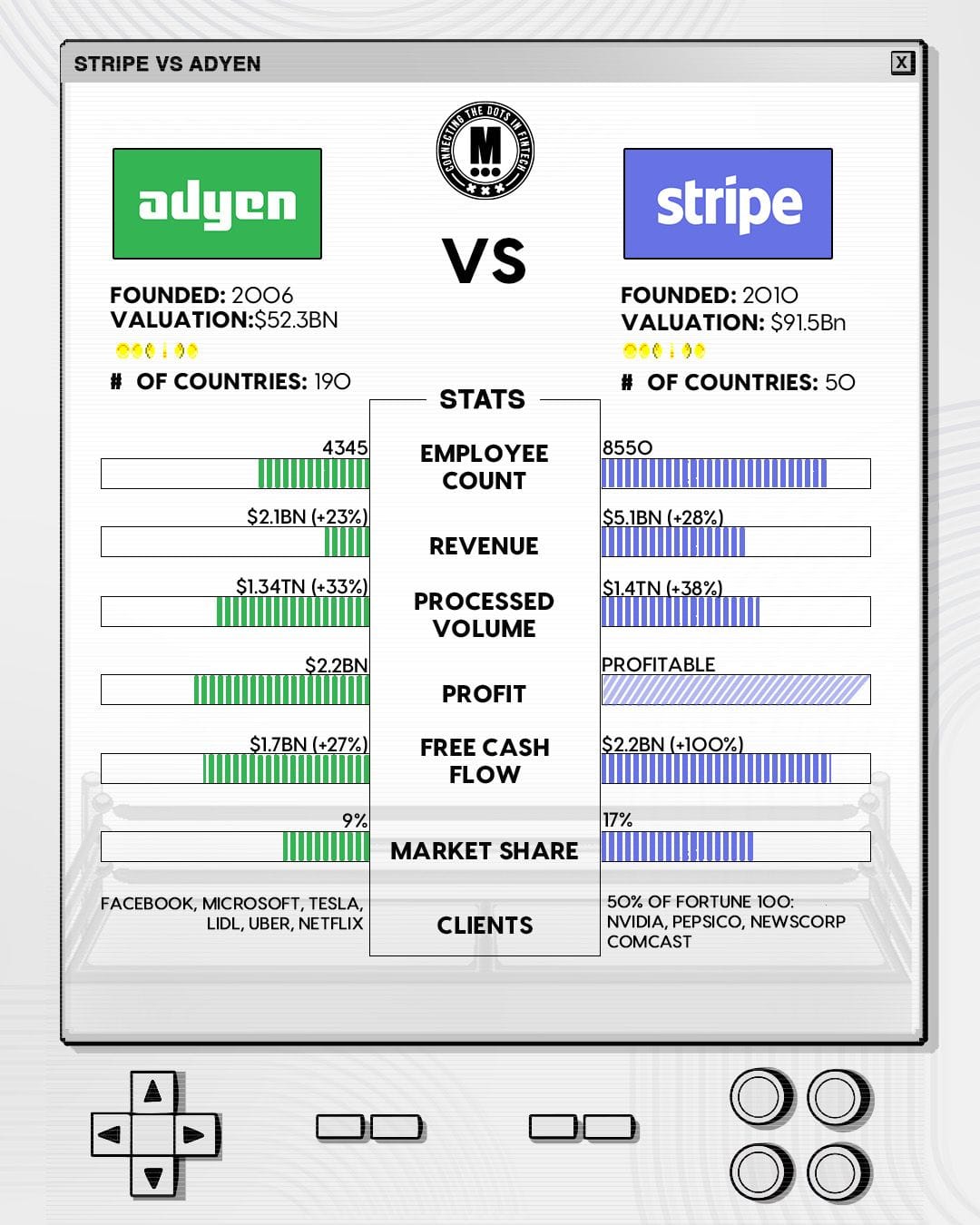

Here is a comparison of Key Stats and the latest (2024) Financial Reports:

𝗞𝗲𝘆 𝗦𝘁𝗮𝘁𝘀👇

𝗔𝗱𝘆𝗲𝗻

• Founded: 2006

• Valuation: $52.3B

• Countries Operated In: 190

• Employees: 4,345

• Revenue: $2.1B (+23% YoY)

• Processed Volume: $1.34T (+33% YoY)

• Profit: €925.2 million

• Free Cash Flow: $1.7B (+27% YoY)

• Market Share: 9%

• Clients: Facebook, Microsoft, Tesla, Lidl, Uber, Netflix

𝗦𝘁𝗿𝗶𝗽𝗲

• Founded: 2010

• Valuation: $91.5B

• Countries Operated In: 50

• Employees: 8,550

• Revenue: $5.1B (+28% YoY)

• Processed Volume: $1.4T (+38% YoY)

• Profit: Profitable

• Free Cash Flow: $2.2B (+100% YoY)

• Market Share: 17%

• Clients: 50% of Fortune 100 (Nvidia, PepsiCo, NewsCorp, Comcast)

Read my complete comparison article for more info.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()