Vipps MobilePay Launches World’s First Apple Pay Alternative for iPhone

Hey Payments Fanatic!

A significant shift is occurring in the mobile payments landscape as Norwegian payment service Vipps becomes the world's first company to launch a competing tap-to-pay solution for iPhone.

This development follows the European Commission's July 2024 acceptance of Apple's legally binding commitments to open its mobile payments system to competitors.

Rune Garborg, CEO of Vipps MobilePay stated: "We have fought for years to be able to compete on equal footing with Apple, and it feels almost surreal to finally be able to launch our very own solution." The service currently supports customers of SpareBank 1, DNB, and over 40 other Norwegian banks, representing approximately 70% of Norwegian bank customers.

The 'tap with Vipps' solution works with BankAxept terminals, covering more than 90% of payment terminals in Norway, with plans to expand Visa and Mastercard support before summer 2025. The company has also announced plans to extend this contactless payment solution to Denmark, Finland, and Sweden in 2025.

Now, let's not waste any more of your time and dive straight into today's Payments news I listed for you below👇

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

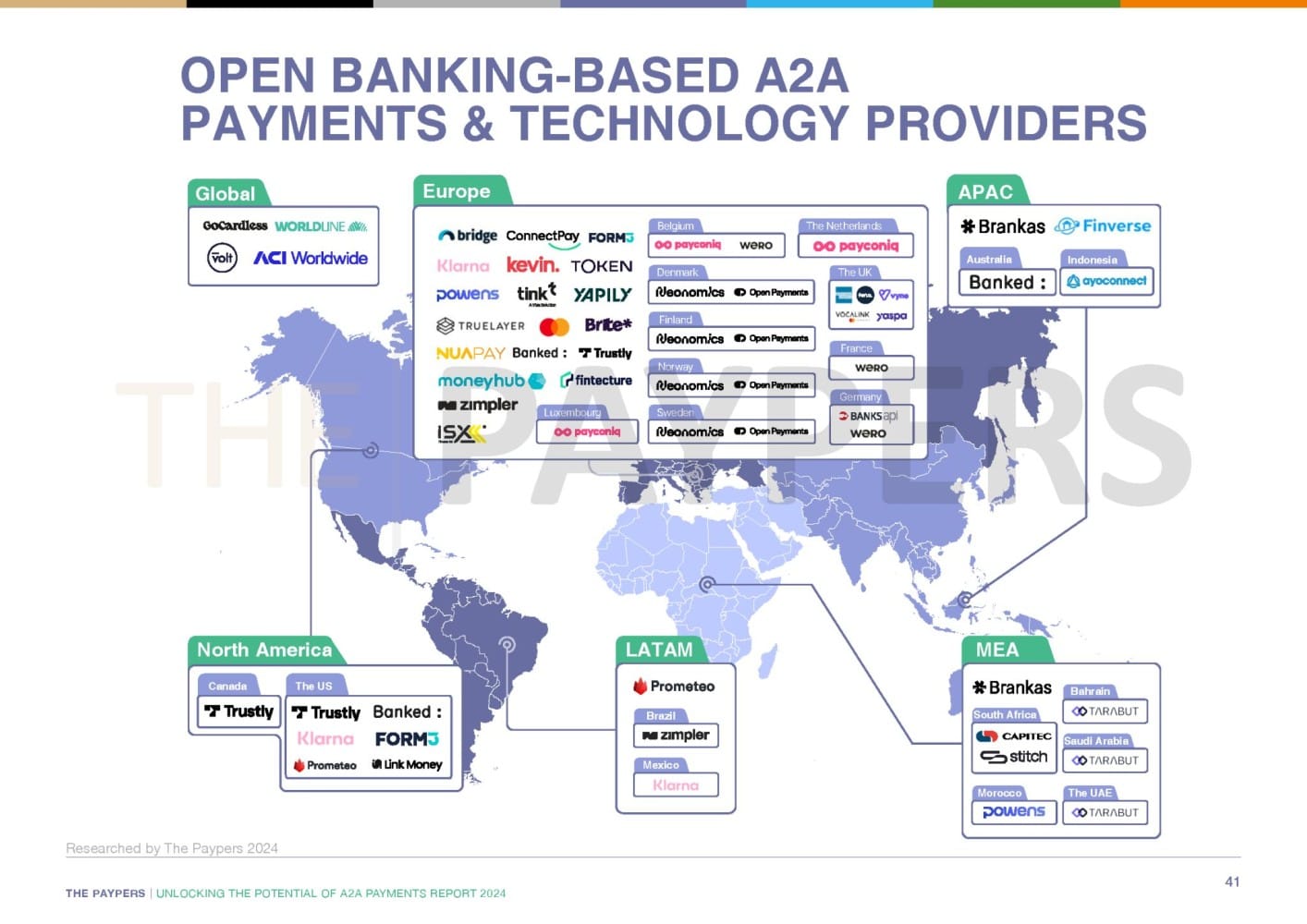

📊 The Paypers' global overview of A2A Payment Providers 👇

Any missing in this overview?

PAYMENTS NEWS

🇬🇧 Airwallex celebrates end of Formula 1 season with ‘podium finish’ for brand and partnership metrics. The leading global payments and financial platform for modern businesses, recently announced the impact of its first year of partnership with the McLaren Racing Formula 1 team, to demonstrate that winning off-track is a prerequisite for winning on-track. Discover more

🇦🇪 Apple's Tap to Pay on iPhone is now live in the UAE. Retailers in the UAE can now accept these contactless payments using an iPhone after Adyen, and the UAE payment platforms Magnati and Network International brought out the Tap to Pay feature. Merchants can process payments from cards, Apple Pay, and digital wallets.

🇺🇸 Ibanera leverages FIS Innovation to launch comprehensive prepaid card program, supported by Visa’s global network, offering users the flexibility to make payments wherever Visa is accepted, ensuring both convenience and security. Keep reading

🇺🇸 Lithic announces Commercial Revolving Credit API, bringing enhanced flexibility to business credit card programs. The new offering enables card programs to quickly launch and scale commercial credit card programs with unmatched flexibility and control.

🇬🇧 SumUp to offer cash advance product, available in several European countries including Germany, France, Ireland, and the Netherlands. The service allows merchants to tap into funding of up to £20,000. Typically, the funds are available in just two days.

🇮🇱 Nayax enables Discover® Global Network cardholders to use their preferred payment method across EMEA. This collaboration boosts growth for Nayax and Discover Global Network, enabling Nayax customers to serve 345 million Discover Global Network cardholders and access automated payment devices worldwide.

🇦🇪 Worldline empowers global online businesses to succeed in the strategically important United Arab Emirates. Worldline has joined forces with Telr to launch an advanced e-commerce payment solution aimed to simplify online transactions and enable global businesses to access the dynamic market, reinforcing the UAE's role as a strategic hub for commerce in the Middle East and Africa.

🇪🇺 Scalapay boosts BNPL fraud prevention with Trustfull. The collaboration will strengthen fraud prevention operations across Scalapay’s extensive network of European markets, leveraging Trustfull’s platform to proactively identify fraudsters and prevent first payment defaults.

🇲🇽 Kueski welcomes Andreas Waldmann as Chief Marketing Officer. In this role, Waldmann will lead strategic marketing initiatives, reinforcing market leadership, unifying brand identity, and leveraging his expertise in the Mexican market to drive product adoption.

🇬🇧 PPRO names Nicole Asling as new SVP of Commercial Europe. Nicole joins PPRO to lead the European Commercial team, where she will focus on forging partnerships that fuel growth and innovation across the region.🇬🇧 PPRO names Nicole Asling as new SVP of Commercial Europe. Nicole joins PPRO to lead the European Commercial team, where she will focus on forging partnerships that fuel growth and innovation across the region.

Asian cross-border payment framework to launch in '2 or 3 years.' A payment framework that enables immediate money transfer between five Asian nations is expected to launch in two to three years, according to a senior official at the central bank in Thailand, one of the participating countries.

GOLDEN NUGGET

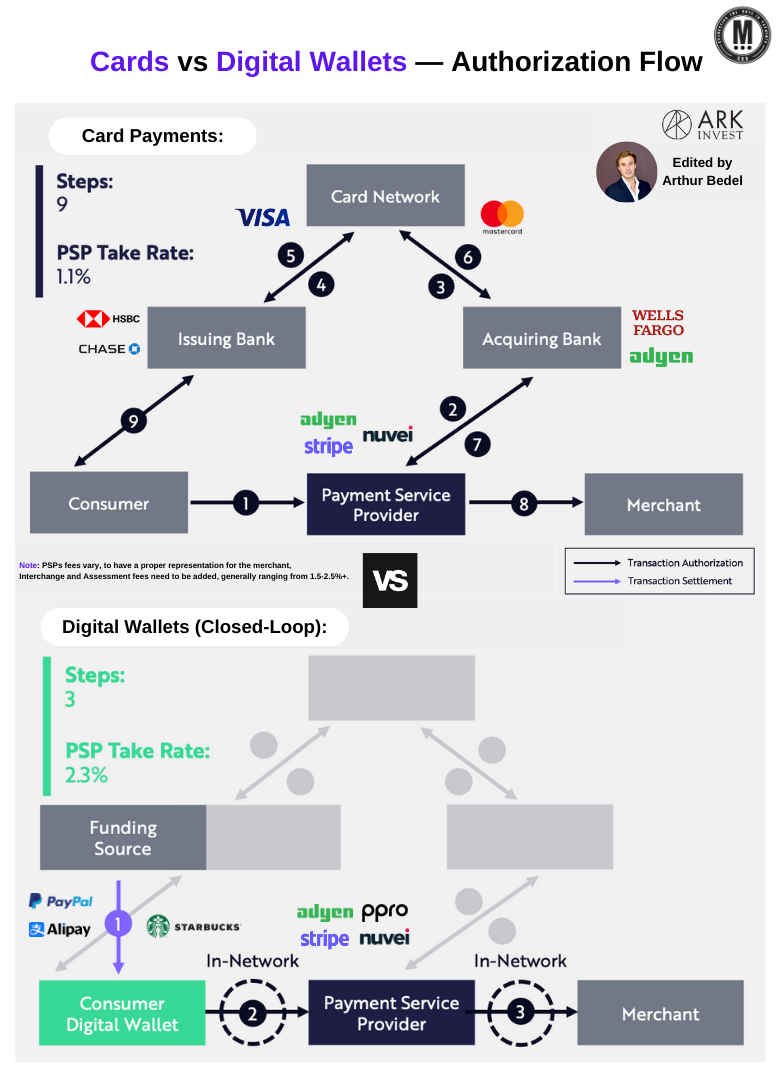

Digital Wallets are challenging the Consumer-To-Business (C2B) payment ecosystems, including cards with their on-us approach.

There are 3 main types of digital wallets:

► 𝐏𝐚𝐬𝐬 𝐓𝐡𝐫𝐨𝐮𝐠𝐡 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — (ApplePay, Google Pay) — commonly mobile device-oriented solutions that enable customers to make payments both in physical stores, using tap-to-pay functionality, and online. These wallets typically use tokenization to create a secure, digital representation of the customer's physical Visa card.

► 𝐒𝐭𝐨𝐫𝐞𝐝 𝐕𝐚𝐥𝐮𝐞 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — (Cash App, Venmo) — similar to prepaid cards, as they allocate a separate "account" to each customer. Users can load funds onto this account, then, once the account is funded, customers can engage in transactions with sellers who are part of the digital wallet's platform. It operates as the Merchant Of Record (MOR) in its own ecosystem.

► 𝐒𝐭𝐚𝐠𝐞𝐝 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — (PayPal, Alipay, Amazon Pay) — operates by using multiple "stages" to complete a transaction, consisting of a "funding" stage and a "payment" stage. Essentially, the wallet acts like an intermediary in the transaction process. With a staged wallet, the card issuer or card network may not have access to specific card details or other pertinent information. It is the MOR in all transactions.

𝐂𝐥𝐨𝐬𝐞𝐝-𝐋𝐨𝐨𝐩 𝐖𝐚𝐥𝐥𝐞𝐭𝐬

► Definition: Digital payment systems restricted to a specific network of merchants or services.

► Usage: Only usable within a specific ecosystem (e.g., Starbucks app).

► Benefits: Enhances customer loyalty, integrates rewards and promotions.

► i.e.: Starbucks Mobile App, Walmart Pay

𝐎𝐩𝐞𝐧-𝐋𝐨𝐨𝐩 𝐖𝐚𝐥𝐥𝐞𝐭𝐬:

► Definition: Digital payment systems usable across a wide range of merchants and platforms.

► Usage: Can be used at any merchant that supports the payment method (e.g., Apple Pay).

► Benefits: Broad acceptance, versatile, links various credit/debit cards.

► i.e: ApplePay, Google Pay

Note: A closed-loop wallet can become open and vice versa, an open-loop wallet can also adopt a closed-loop model.

The card payment authorization flow involves a minimum of 9 steps, at times more & is subject to interchange, assessment & PSP fees. A closed-loop wallet bypasses the issuer (interchange) and card networks (assessment) fees, making this an attractive solution for merchants and giving them more bandwidth to create advantageous loyalty programs.

If you could move forward with 1 initiative, create a digital wallet, or launch a co-branded card, what would you choose & why?

Source: ARK Investment Management LLC, Checkout.com

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()