Venmo to Launch Scheduled Payments Feature

Hey Payment Fanatic!

Venmo is gearing up to make managing your recurring payments even easier. According to recent reports, users will soon be able to schedule payments and requests directly within the app on a weekly, monthly, or bi-monthly basis.

Whether splitting rent with roommates or setting reminders for recurring bills, Venmo’s latest addition offers more control and flexibility to manage payments.

Venmo’s Teen Account will also support this feature, allowing parents to automate their kids' allowances or birthday money transfers.

Users will receive email, and push notification reminders a day before a scheduled payment goes through. They can also set end dates for payments or cancel recurring transactions anytime through the app’s settings.

The feature is expected to go live in the coming weeks, bringing a new level of convenience to Venmo’s millions of users.

Let's see how this plays out!

Enjoy more FinTech industry updates I listed for you below and I'll be back in your inbox tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

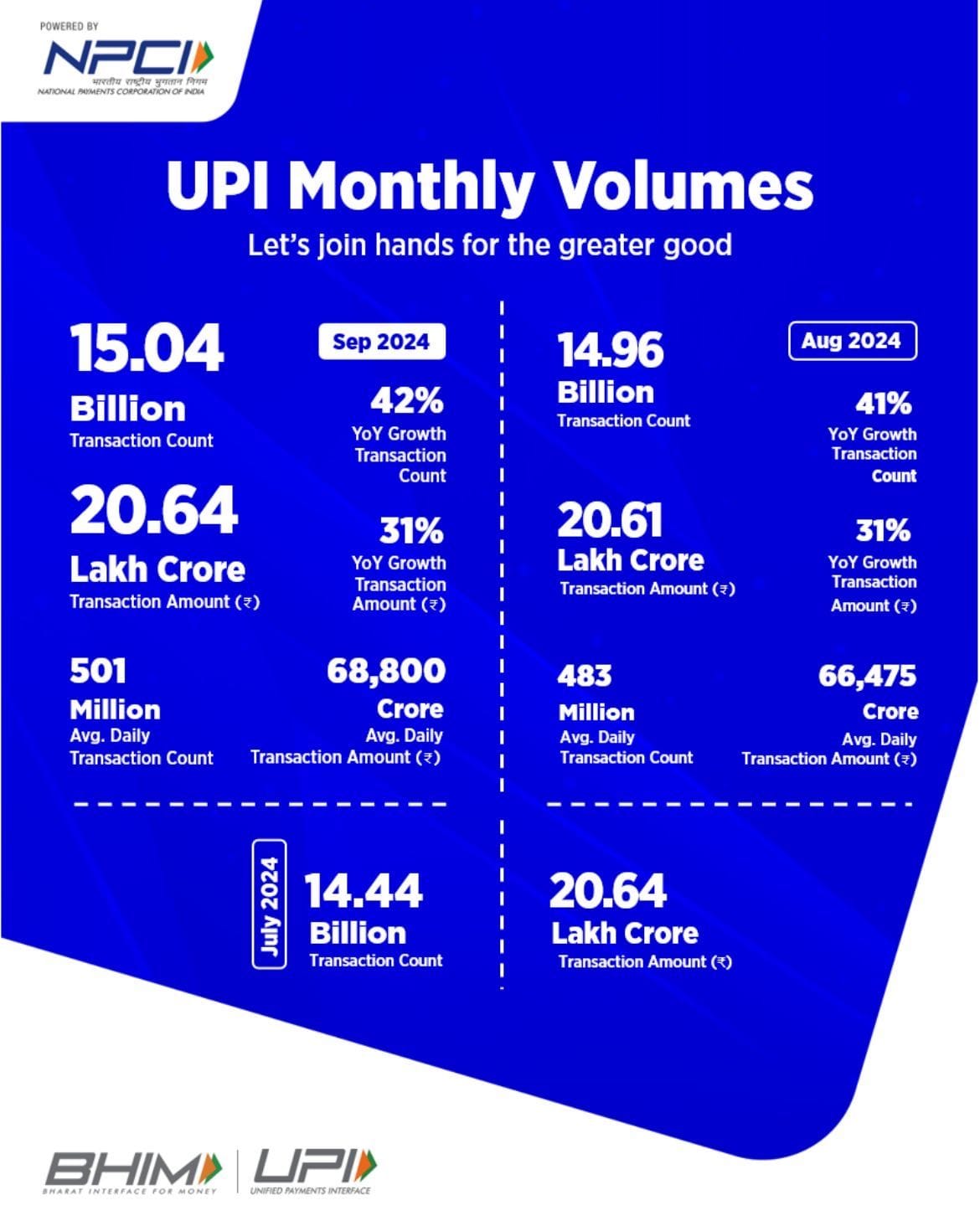

📈 UPI Payments averaged over 𝟱𝟬𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 daily transactions in September 🤯

Other Key Takeaways:

PAYMENTS NEWS

🇬🇧 Crypto "not a focus" for Checkout.com, as it concentrates on e-commerce and FinTech partners. The firm recently launched new products and reported 40% year-on-year revenue growth. As a full-stack payment processor and acquirer, the company reported that crypto represented less than 4% of its payment volume.

🇿🇲 Kazang Pay introduces a card acquiring service in Zambia. According to the company, Kazang Pay makes it 'affordable for merchants to accept card payments' on the same terminal where they sell prepaid items and services. Read on

🇪🇺 Euronext Securities expands services with acquisition of Acupay. The acquisition of Acupay further expands Euronext Securities’ services offering to investors and issuers, the firm says, leveraging Acupay’s presence in Italy and opportunities to scale services through Euronext Securities’ network across Europe.

🇬🇧 UK-based SumUP could reach near $9 bln valuation in new share sale, sources say. It would be the latest European FinTech to pursue a share sale, after UK FinTech Revolut secured a $45 billion valuation in August in a share sale by employees to investors including Coatue, D1 Capital Partners and Tiger Global.

🏛 Bank of America introduces Virtual Payables Direct in the EMEA region. This business-to-business (B2B) payment solution provides buyers with the typical advantages of card transactions, such as extended payment terms, while now offering the option to pay suppliers via direct bank transfer.

🇩🇰 Cardlay announces collaboration with Visa to help revolutionise spend management solutions. Cardlay’s platform will enable Visa’s clients, particularly issuers across multiple segments, to leverage their BINs’ structure with Cardlay’s white label solutions to improve customers’ experience.

🇬🇧 BB Merchant Services and Ordo team up to cut payment processing fees. This partnership offers a compelling alternative with Pay by Bank, which uses real-time bank transfers to bypass intermediaries, cutting fees and ensuring secure, instant fund settlement.

GOLDEN NUGGET

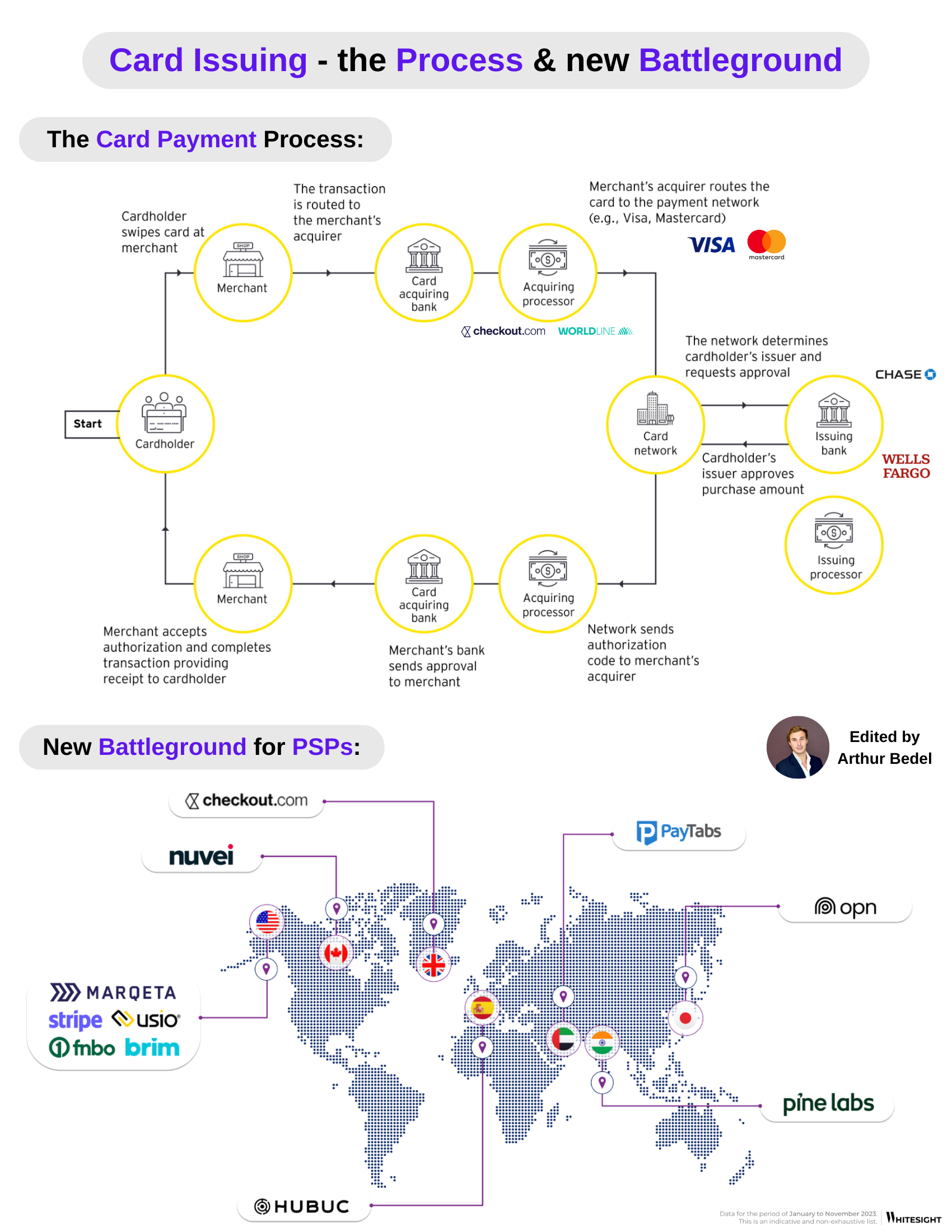

Card Issuing – The Process & New Battle Ground𝐓𝐡𝐞 𝐚𝐫𝐭 𝐨𝐟 𝐂𝐚𝐫𝐝 𝐈𝐬𝐬𝐮𝐢𝐧𝐠, now powered by FinTechs. Payment Providers are reshaping this industry, beyond good old plastic cards👇

The disruption of the COVID-19 pandemic has accelerated the growth of digital payment methods such as contactless and card-not-present transactions, driving card issuers to transform. Card issuing has been a major part of payments for tens of decades, mainly led by banks but Payment Service Providers (psp) are "coming in hot".

A traditional card transaction cycle incorporates an Issuer, an Acquirer and a network. A PSP (most often acquirers or gateways), are now diving into the Issuing portion of the card lifecycle to create more seamlessness. Inflexible legacy technology has meant that various integrations, extensive regulatory compliance demands, and operational inefficiencies have hindered businesses from getting a share of the interchange fees and enabled newcomers to make way.

🔸Marqeta debuted a credit card issuing platform, incorporating user-friendly credit card program management tools and establishing a comprehensive 'one-stop shop' for launching consumer and commercial credit programs.

🔸 Nuvei launched its card issuing solution in 30 markets globally, allowing its clients to provide their customers with both physical and virtual white-labelled cards. Adyen has been doing so for quite some time too.

🔸 Pine Labs launched a new credit issuance platform called Credit+, targeting banks, FinTechs and large merchants.

These solutions are designed to simplify the intricacies and cost barriers associated with card issuance, allowing brand owners the flexibility to concentrate on enhancing core CX & advancing their business expansion initiatives.

𝐌𝐨𝐝𝐞𝐫𝐧 𝐜𝐚𝐫𝐝 𝐢𝐬𝐬𝐮𝐢𝐧𝐠 𝐩𝐥𝐚𝐭𝐟𝐨𝐫𝐦𝐬 also offer customizable branded cards featuring reward programs, such as cashback and loyalty points, to enhance customer retention. With 40% of consumers expressing a desire for cards that are tailored to their specific needs, brands are capitalizing on this opportunity to establish a new benchmark.

These PSPs dedicated themselves to addressing payment card challenges and providing a comprehensive array of features for card issuance, processing, and management. These encompassed:

👉 Underwriting

👉 Customer service

👉 Bank integrations

👉 Functionalities related to personalization, tokenization (VGS), authentication, compliance, risk management, KYC, physical/virtual card issuance and distribution, and membership in card networks like Visa or Mastercard & Capital One coming in hot.

In 2024, the world of financial transactions is witnessing a significant shift. This is a new chapter in the digital payment landscape, ultimately enhancing cash flow flexibility and providing tailored financial products to customers, suppliers and employees 🚀

Source — EY, WhiteSight, Sanjeev Kumar.

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()