Venmo Adds Payment Scheduling Feature

Hey Payment Fanatic,

Last week, I mentioned this new feature was coming, and now it's here.

Venmo just rolled out a new feature that lets you schedule one-time or recurring payments or requests with friends and family. Whether it’s rent, utilities, or just regular living expenses, you can now set it and forget it with scheduled payments.

Research shows over 84% of consumers already use peer-to-peer services like Venmo for routine payments, so adding this feature simplifies life even more. Just pick your frequency—monthly, weekly, or bi-weekly—and Venmo takes care of the rest. And, as Venmo’s VP Alexis Sowa put it, this is all about enhancing those essential P2P experiences we’ve come to rely on.

How to do it? Just head to the app, select your recipient, tap “Schedule,” and you’re good to go. You’ll get a reminder a day ahead, and if your Venmo balance isn’t enough, it’ll auto-pull from your backup payment method.

What do you think about this new feature? Tell me more in the comments.

Stay tuned for more, because there’s always something new in the world of payments.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

Three European payment processors IPO'ed in the past decade Worldline, Nexi Group, and Adyen.

PAYMENTS NEWS

🇺🇸 Aeropay and Worldpay partner to advance gaming payments. Aeropay's proprietary account-to-account platform can now be integrated with Worldpay’s extensive merchant network — offering advanced A2A payments and payouts to U.S. gaming operators.

🇿🇦 Mastercard targets real-time card payments in South Africa. The firm says it is rolling out new "standards and solutions" which will accelerate the processing speed for card transactions. ACI Worldwide is onboard to help acquirers adopt the real-time transaction processing standards.

🇭🇰 Checkout.com has partnered with Octopus to make the widely used Hong Kong payment method available for online transactions. Checkout.com is the first global PSP to offer Octopus as an online payment option. This collaboration will simplify online checkout for merchants while addressing the growing demand for digital-first payment solutions.

🇩🇪 FOURSOURCE selects Mangopay to transform textile marketplace experience. The partnership with Mangopay will help to take FOURSOURCE to the next level, by allowing them to offer the security and trust that buyers and sellers are looking for in what is a highly fragmented textile industry.

🇬🇧 Privalgo partners with Experience UK to provide currency exchange solutions. As part of their collaboration, Privalgo is set to offer Experience UK members access to its customised solutions for global payments, currency risk management, and multi-currency accounts.

🇸🇬 WadzChain Network unveils hybrid blockchain to simplify global payments for businesses. The hybrid blockchain is designed to cater to all types of payments needs including micropayments, high-volume payments, disbursements, benefits and many more.

🇮🇹 SEPAmail.eu and CBI joins their IBAN-Name Check expertise at the service of their respective communities in order to offer an interoperable solution to fight against fraud. This partnership enables the Italian and French communities, via their PSP, to secure their cross-border payments.

🇺🇸 Square launches Orders Platform. This new platform fundamentally changes how the company builds products and will provide expanded commerce capabilities like Pre-Auth and Bar Tabs to sellers of all sizes across verticals in the U.S.

🇸🇬 Samsung Pay adds crypto payment option with Alchemy Pay integration. The new partnership allows Alchemy Pay users to pay using their virtual crypto cards both in-store and online at supported retailers. Read more

🇪🇺Worldline moves into embedded payments market via a partnership with Online Payment Platform (OPP), a provider of payment technology for platforms and marketplaces. The collaboration will roll out across Europe, combining OPP's payment technology with Worldline's acquiring, acceptance expertise, and POS capabilities.

🇸🇪 Klarna Director says he was ousted over objection to CEO’s bonus. Board member Mikael Walther claims he was voted out after challenging governance decisions. He has urged investors to vote against his removal at an upcoming meeting.

🇺🇸 Stripe deepens collaboration with NVIDIA to enhance Stripe’s AI-powered capabilities and expand global access to NVIDIA’s AI platform. By giving businesses easier access to NVIDIA's GPUs and AI tools, the partnership enables faster innovation and growth.

🇺🇸 Ansa partners with Plaid to lower payment costs with Pay by Bank. This partnership aims to provide merchants, especially coffee shops and quick-serve spots, with cost-effective payment solutions to boost profitability and improve the overall customer experience.

GOLDEN NUGGET

3D-Secure 2.0 – Everything you need to know about it

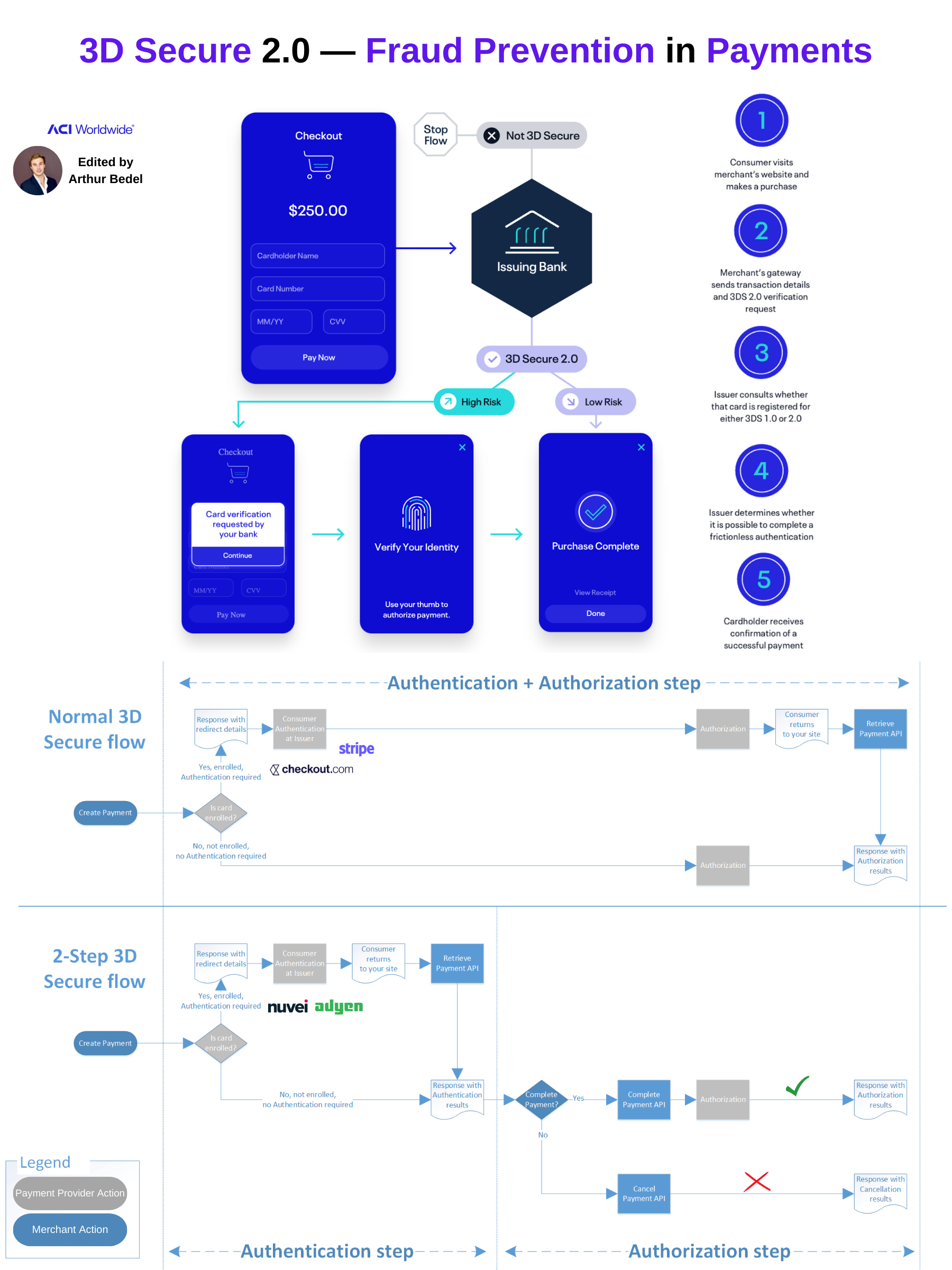

3D-Secure 2.0 (Three-Domain Secure 2.0) is an advanced version of the 3D Secure authentication protocol, designed to enhance the security of online card transactions while improving the customer experience. It enables real-time, data-rich communication between merchants, card issuers, and payment networks to assess the risk of a transaction more accurately.

Unlike its predecessor (3DS 1.0), 3DS 2.0 supports frictionless authentication, allowing low-risk transactions to proceed without additional customer intervention. It also introduces mobile optimization for in-app purchases and modern authentication methods like biometrics (e.g., fingerprint or facial recognition) and one-time passwords (OTP), ensuring a seamless payment experience across devices.

Additionally, 3DS 2.0 is compliant with regulatory requirements like PSD2's Strong Customer Authentication (SCA), offering better fraud prevention while minimizing checkout disruptions.

The Importance of 3DS, especially in Europe:

► Reduce Fraud by verifying cardholder's identity

► Increase Revenue through higher acceptance

► Merchant is covered by Liability Shift (on the card issuer)

Over the years, 3DS became much more thorough, yet frictionless. Payment Providers - i.e. checkout,com, Adyen - supporting that authentication process and tailoring it to the different business models have seen an increase in conversion and a decrease in fraudulent transactions.

What is 3D-Secure exactly:

During the 3DS process, the Issuer or Acquirer directs the customer to an authentication page on their bank's website, Wells Fargo, Bank of America, Citi, and the consumer goes through an ID check:

► Enter a Password sent to their Phone

► Enter a Password sent to their Email

► Verification of ID through Biometrics

► Other processes...

This process is familiar to customers through the card networks' brand names, such as Visa Secure and Mastercard Identity Check. Today, Strong Customer Authentication (SCA) regulations require certain transactions to go through that process.

🔸Normal 3D Secure had the Authentication and Authorization step combined within a single process. This protocol introduced by Visa in 1999 was designed for desktops browsers mainly

🔸2-Step 3D Secure provides the Payment Provider the ability to review the authorization outcome first and later decide to either accept or decline the authorization (not the payment itself!!!) As the liability shifted to the Payment Provider, this is incredibly important as this step weighs heavily on the approval of the transaction later by other parties involved in the transaction.

Only certain card products allow the use of 3D Secure, so 2-Step 3D Secure is only possible for the following card products:

► Visa (including sub-brands)

► Mastercard (including sub-brands)

► Diners Club International

► Discover Financial Services

► American Express

3D-Secure 1.0 vs 3D-Secure 2.0:1. User Experience

3DS 1.0: Often disrupts the user experience by redirecting customers to a separate authentication page where they must enter a static password or code. This could lead to frustration and cart abandonment.

3DS 2.0: Aims to provide a seamless and frictionless experience. It supports frictionless authentication, meaning low-risk transactions may not require any additional steps from the customer. For higher-risk transactions, it can offer more user-friendly methods like biometric authentication (fingerprints, facial recognition) or OTP (one-time password).

2. Mobile and Device Compatibility

3DS 1.0: Was not designed with mobile users in mind, leading to poor user experiences on smartphones and tablets. It often required complex redirects to a browser window, making in-app purchases challenging.

3DS 2.0: Designed to work smoothly across all devices, especially mobile and in-app environments. It supports native app integration and improves the user experience on mobile by avoiding redirects and handling authentication directly within the app or browser.

3. Frictionless Authentication

3DS 1.0: Authentication typically requires user interaction for all transactions, which leads to more disruptions during checkout.

3DS 2.0: Offers frictionless authentication by leveraging more data points to assess transaction risk in real-time. If a transaction is deemed low-risk, the customer can complete the payment without additional authentication steps.

4. Data Transmission

3DS 1.0: Limited data exchange between the merchant and the card issuer, mostly focusing on basic transaction details.

3DS 2.0: Introduces a data-rich environment, allowing merchants to send up to 10 times more data to issuers (e.g., device information, transaction history, customer behavior). This helps issuers make better-informed risk assessments, enabling smoother transactions and stronger security.

5. Security

3DS 1.0: Relied on static passwords or weak OTP systems, which can be vulnerable to phishing and fraud.

3DS 2.0: Stronger authentication with support for biometric methods (fingerprint, facial recognition) and more dynamic forms of authentication. The protocol also adheres to Strong Customer Authentication (SCA) requirements under the PSD2 regulation.

6. Regulatory Compliance

3DS 1.0: Predates many modern regulatory requirements, like the EU's PSD2.

3DS 2.0: Was developed with regulatory compliance in mind, specifically for PSD2's Strong Customer Authentication mandate. This makes it a critical tool for merchants and issuers in regions with such regulations.

7. Checkout Abandonment

3DS 1.0: Higher rates of cart abandonment due to cumbersome authentication steps, especially if the customer forgot their password or encountered technical issues.

3DS 2.0: Reduces cart abandonment by providing a smoother and more integrated user experience, minimizing the need for disruptive authentication steps unless necessary.

Summary:

3DS 1.0: Basic, desktop-focused, with more disruptive user authentication and limited data sharing.

3DS 2.0: Mobile-first, frictionless authentication, richer data for better risk assessments, more flexible authentication methods, and compliance with new regulations like PSD2. It enhances both security and customer convenience, significantly improving the user experience.

Some flexibility exists around the parameters of this authentication process. It is the role of the Payment Provider in collaboration with the merchant to work on tailoring them in order to accept as many valid transactions as possible

Source: Ingenico & ACI Worldwide

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()