Uruguayan Payments Firm dLocal Secures UK License for Global Expansion

Hey Payments Fanatic!

DLocal has obtained a U.K. payment institution license from the Financial Conduct Authority, enabling the Uruguayan payments firm to onboard new U.K. merchants through its local entity, dLocal Opco UK.

Pedro Arnt, dLocal's CEO, explains their unique position: "The U.K. has become a hub for many global companies — even the American companies, some Asian companies — for their emerging market expansion, primarily in Africa, and in some cases LatAm." The company now holds over 30 licenses and registrations worldwide.

Established in 2016, dLocal specializes in cross-border payments for emerging markets including Brazil, Mexico, Colombia, and Uruguay. The company plans to expand its U.K. presence, with key executives already based in London and a global workforce exceeding 1,000 employees.

Let's see how this plays out.

It's a jam-packed newsletter full of interesting Payments News updates today, so you better get to it👇

Cheers,

Stay Ahead in FinTech! Subscribe to my Daily FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

12 Ways Instant Payments Delivers Value Across the Financial Ecosystem. Instant payments are rapidly becoming a preferred method for disbursements, revolutionizing how consumers, SMBs and enterprise senders manage their finances. Click here to get the complete ebook by Ingo Payments.

PAYMENTS NEWS

🇬🇧 Zilch announces Joe Zender as its new Chief Product Officer (CPO). Joe has been with Zilch since 2021, and his collaborative leadership and innovative mindset have been instrumental in the company’s success, driving its customer base from fewer than 500,000 to over 4.5 million in just four years. Read on

🇬🇧 Payarc teams with Allpack Fulfillment to bolster payments processing. “Through this collaboration, Allpack is actively referring clients to Payarc, enabling seamless financial transactions that complement Allpack’s comprehensive logistics solutions,” a news release said. Continue reading

🇸🇬 Singapore will not include credit card fraud in Shared Responsibility Framework, citing existing robust protections for consumers. This clarification came in response to a parliamentary question on the prevalence of credit card fraud in the country. Continue reading

💰 Stablecoin payments are catching on in the ‘Real World’. The total market capitalization of all stablecoins in circulation has ballooned from less than $140 billion at the end of 2023 to more than $200 billion today. They are a kind of crypto token designed to mimic the price of a fiat currency, usually the US dollar.

🇨🇦 Nuvei partnership with Gaming Innovation Group (GiG). This collaboration enables iGaming operators to optimize their payments functionality through their existing integration with GiG's CoreX solution. Also, they can leverage Nuvei's payments expertise across global iGaming markets to maximize their revenues and accelerate their growth.

🇸🇬 XTransfer gets green light for Singapore Payment License. The license, issued on 1 January 2025, allows XTransfer to offer services such as account issuance, domestic and cross-border money transfers, flexible top-up options, and e-money issuance in Singapore. Continue reading

🇺🇸 Verifone and FreedomPay announce global partnership, championing a full commerce ecosystem for merchants. The partnership gives merchants the ability to utilize Verifone’s portfolio of industry-leading payment devices with FreedomPay’s commerce platform.

🇮🇹 BALTINI partners with Triple-A to introduce crypto payments for luxury fashion shoppers. This collaboration allows Baltini customers to pay with cryptocurrency, marking a significant step forward in luxury fashion retail and embracing the growing demand for alternative payment methods.

🇦🇪 Network International partners with Money Fellows. Under the partnership, Network will provide Money Fellows with its ‘Digital Payments as a Service’ platform with value added services including advanced fraud prevention, fully secure payment functionality, as well as a full suite of back office managed services.

🇺🇸 Business Payments push The Clearing House and RTP® to faster payments tipping point. Monthly usage by 285,000 businesses for B2B transactions highlights its growing adoption. Feedback from users shows a strong preference for RTP after experiencing its speed and convenience.

PXP appoints Alex Apergis as CRO in brand transformation. Apergis is a prominent business leader in the payments industry and comes with a wealth of experience forming and scaling global distribution channels. He has previously held leadership roles across in the payments space.

🇦🇪 Visa partners with Qashio. The partnership aims to address the needs of the travel and tourism industry in the UAE and beyond by introducing the Visa Commercial Choice Travel programme. The initiative will simplify corporate travel payments, with global issuance capabilities covering the UAE, Mena, Europe, and the UK.

🌏 Nomupay secures $37M to expand Asian payments. The company, now valued at around $200 million, has doubled its revenue annually for two years and is projected to reach profitability in 2025. The new investment will support NomuPay’s M&A strategy.

🇳🇱 Disrupting payments in NL. Robert Vis, Bird founder and CEO says: "Your margin is my opportunity." Today, Bird is slashing processing fees by more than 50%. Just €0.15 for iDEAL, 1% + €0.10 for all European credit cards. Explore the full story here

GOLDEN NUGGET

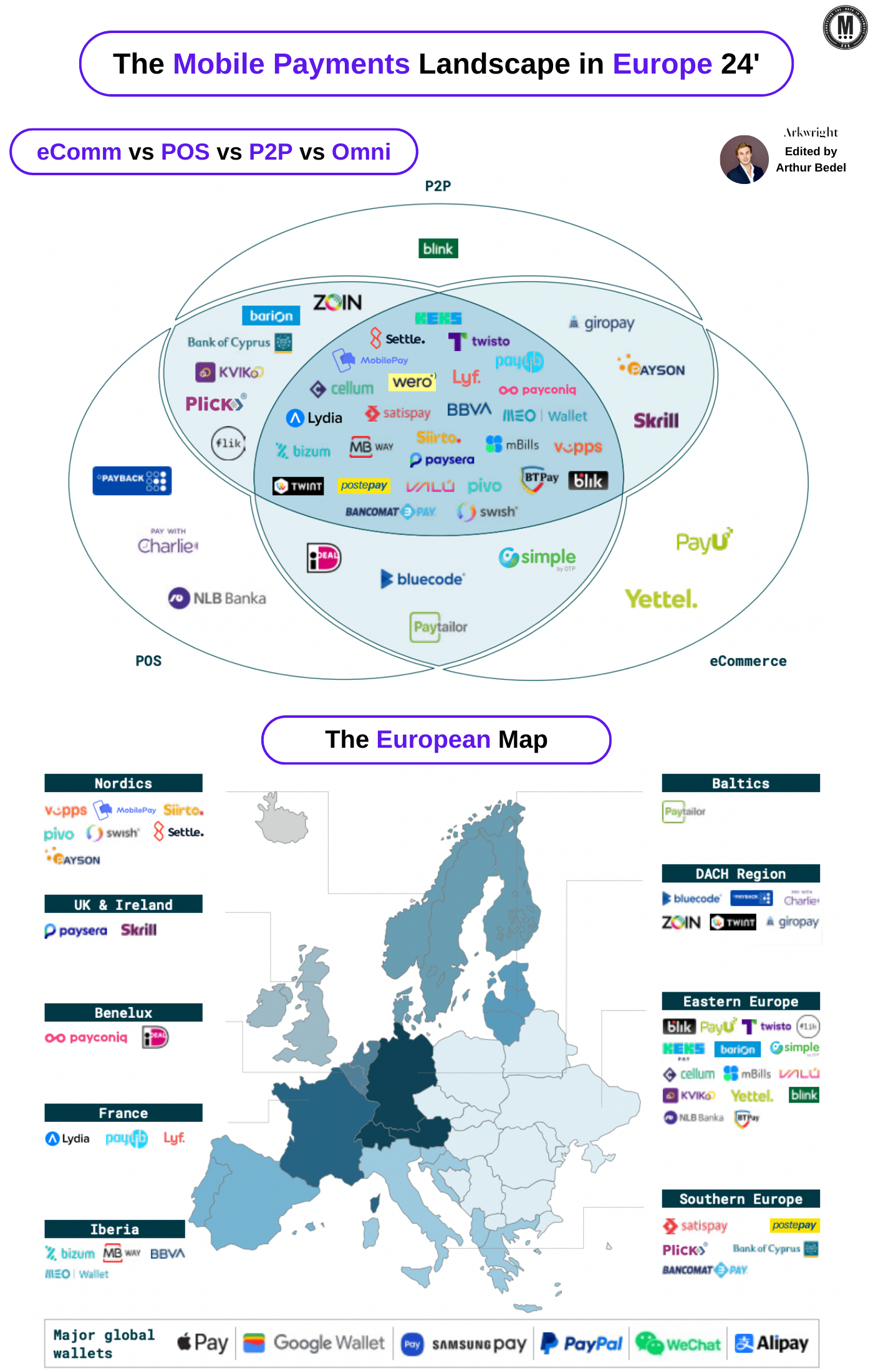

𝐓𝐡𝐞 𝐄𝐮𝐫𝐨𝐩𝐞𝐚𝐧 𝐌𝐨𝐛𝐢𝐥𝐞-𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐋𝐚𝐧𝐝𝐬𝐜𝐚𝐩𝐞 𝐢𝐧 2024👇

The mobile payments landscape in Europe exhibits significant fragmentation, driven by rivalry among international digital wallets (PayPal, ApplePay...) local mobile payments (Bizum, TWINT, VIPPS...) and overarching initiatives: European Payments Initiative (EPI).

𝐍𝐨𝐭𝐞 — PSPs have also specialized in aggregating local payment methods to fulfill this need to offer a localized checkout experience:

I.e. PPRO, CITCON, Checkout.com, Rapyd etc...

Over the past 2 decades, for 𝐁𝐚𝐧𝐤𝐬 and 𝐑𝐞𝐭𝐚𝐢𝐥𝐞𝐫𝐬, mobile interfaces have become critically important, facilitating customer interactions, enhancing the CX and fostering loyalty. It created a highly competitive payments market driven by 3 main categories of local payments (#APMs):

► 𝐌𝐚𝐣𝐨𝐫 𝐆𝐥𝐨𝐛𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬: ApplePay, Google Wallet, WeChat Pay, and PayPal

► 𝐃𝐨𝐦𝐞𝐬𝐭𝐢𝐜 𝐌𝐨𝐛𝐢𝐥𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Over 45 distinct solutions (shown above), each with its own regional footprint, functional set-up, and owners impact the market, i.e.:

👉 Vipps — 78% in Norway 🇳🇴

👉 Swish — 78% in Sweden 🇸🇪

👉 MobilePay — 62% in Denmark 🇩🇰 & Finland 🇫🇮

👉 TWINT — 57% in Switzerland🇨🇭

👉 Payconiq International — 57% in Belgium 🇧🇪

👉 Bizum — 48% in Spain 🇪🇸

► 𝐑𝐞𝐠𝐢𝐨𝐧-𝐰𝐢𝐝𝐞 𝐄𝐮𝐫𝐨𝐩𝐞𝐚𝐧 𝐈𝐧𝐢𝐭𝐢𝐚𝐭𝐢𝐯𝐞𝐬: EPI, #digitaleuro, Wero & EMPSA European Mobile Payment Systems Association — aim to become viable competitors to payment schemes

Most of those local payment methods (60%) are usable across multiple channels (P2P, eCommerce and PoS), making them attractive and competitive against traditional card payments

𝐓𝐡𝐞 𝐑𝐢𝐬𝐞 𝐨𝐟 𝐀𝐏𝐌𝐬 — Reasons:

► 𝐅𝐚𝐯𝐨𝐫𝐚𝐛𝐥𝐞 𝐄𝐧𝐯𝐢𝐫𝐨𝐧𝐦𝐞𝐧𝐭 — cashless payments are booming, supported by the EU regulatory environment

► 𝐀𝐛𝐬𝐞𝐧𝐜𝐞 𝐨𝐟 𝐀𝐏𝐌𝐬 — lack of competition

► 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐒𝐞𝐜𝐭𝐨𝐫 𝐂𝐨𝐥𝐥𝐚𝐛𝐨𝐫𝐚𝐭𝐢𝐨𝐧 — bank endorsement ensuring a widespread market coverage and interoperability

► 𝐒𝐭𝐚𝐫𝐭𝐢𝐧𝐠 𝐰𝐢𝐭𝐡 𝐏2𝐏 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — free P2P payments between users

► 𝐓𝐚𝐫𝐠𝐞𝐭𝐞𝐝 𝐌𝐚𝐫𝐤𝐞𝐭𝐢𝐧𝐠 — promotional activities featuring brands and personalities coupled with special offers

► 𝐕𝐚𝐥𝐮𝐞-𝐀𝐝𝐝𝐞𝐝 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 — discounts, coupons, loyalty programs, FinTech services

Ultimately, the market will have 3 potential outcomes: a 𝐬𝐢𝐧𝐠𝐥𝐞 𝐄𝐮𝐫𝐨𝐩𝐞𝐚𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐞𝐭𝐡𝐨𝐝 (i.e. Wero), 𝐦𝐮𝐥𝐭𝐢-𝐜𝐨𝐮𝐧𝐭𝐫𝐲 𝐜𝐥𝐮𝐬𝐭𝐞𝐫 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐦𝐞𝐭𝐡𝐨𝐝𝐬 or a 𝐜𝐨𝐧𝐭𝐢𝐧𝐮𝐞𝐝 𝐟𝐫𝐚𝐠𝐦𝐞𝐧𝐭𝐞𝐝 𝐦𝐚𝐫𝐤𝐞𝐭. It will be really interesting to see what happens 🚀

Source: Arkwright Consulting & Francesco Burelli

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()