UPI Payments Now Accepted Across UAE

Hey Payments Fanatic!

Network International (Network), a key enabler of digital commerce in the Middle East and Africa, has partnered with NPCI International Payments Ltd. (NIPL) to introduce QR code-based Unified Payments Interface (UPI) payments across Network’s point-of-sale (POS) terminals in the UAE.

The announcement, made in Dubai with dignitaries such as Satish Kumar Sivan, Consul General of India to the UAE, aims to streamline transactions for Indian tourists within Network’s extensive merchant network. Network supports over 200,000 POS terminals across 60,000+ merchants, including retail, hospitality, transport, and supermarkets. UPI will be gradually implemented in various establishments, including major malls like Dubai Mall and Mall of the Emirates.

This collaboration aligns with the UAE’s goal to enhance its status as a global tourist and commerce hub. Indian tourist arrivals to the GCC are expected to hit 9.8 million in 2024, with the UAE anticipating 5.29 million visitors from India. UPI, India’s largest instant payments system, processed 14.04 billion transactions in May 2024. Network’s integration of UPI offers a secure method for cross-border payments, allowing Indian tourists and NRIs to use UPI at Network’s POS terminals in the UAE.

Cheers,

Join my Telegram channel for instant access to daily updates and exclusive breaking news from the Payments industry. Connect with fellow Payments Fanatics and stay ahead with the latest trends and insights.

PAYMENTS NEWS

🇦🇪 UPI QR payment acceptance comes to UAE. Network International, the leading enabler of digital commerce across the Middle East and Africa (MEA) region, in partnership with NPCI International Payments Ltd., has enabled the acceptance of QR code-based UPI payments across Network’s POS terminals in the UAE.

🇨🇳 Chinese FinTech giant Ant Group spins off database firm OceanBase, giving Alibaba affiliates a stake. A shareholder restructuring for OceanBase, which develops the database tech behind Alipay, gives 35 companies a stake, paving the way to a possible public listing.

🇨🇴 Clinng arrives in Colombia. Leveraging the booming payment industry in the region, Eduardo Luna (CEO) and Franco Zurita (CCO), founders of Monnet Payments Solutions—a Peruvian payment gateway celebrating its 4th anniversary—announce the launch of their new brand, CLINNG.

🇬🇧 Stephen Bowe joins Paymentology as Chief Product Officer. Stephen will expand Paymentology’s next-generation payments infrastructure, focusing on seamless API integrations to simplify complex payment solutions.

🇨🇦 Helcim launches Integrated Payments for Developers and Platforms. The program allows third-party developers, software platforms and integration partners to participate in the revenue generated by the transactions that flow through those integrations.

🇳🇱 Mollie connects Riverty for postpay. Mollie teamed up with Riverty, offering a 30 day invoicing solution in The Netherlands, Belgium, Austria and Germany. Continue reading

🇨🇴 Pronus launches "Pronus Payments" to provide Instant Payment Technology in Colombia. This launch is thanks to the partnership between the investment bank Pronus and the Brazilian payment developer C&M, which helped build the Pix system.

🇬🇧 Lenovo launches Trustly’s Open Banking at checkout in the UK and Europe. The service will provide customers with an alternative payment method that is less vulnerable to fraud, compared to other forms of payment such as credit or debit cards.

🇺🇸 New York BNPL bill is dead, for now. Hopes for passing a 2024 buy now, pay later bill in New York state to regulate the nascent industry expired with the end of the legislative session last month. But next year could be a different story.

GOLDEN NUGGET

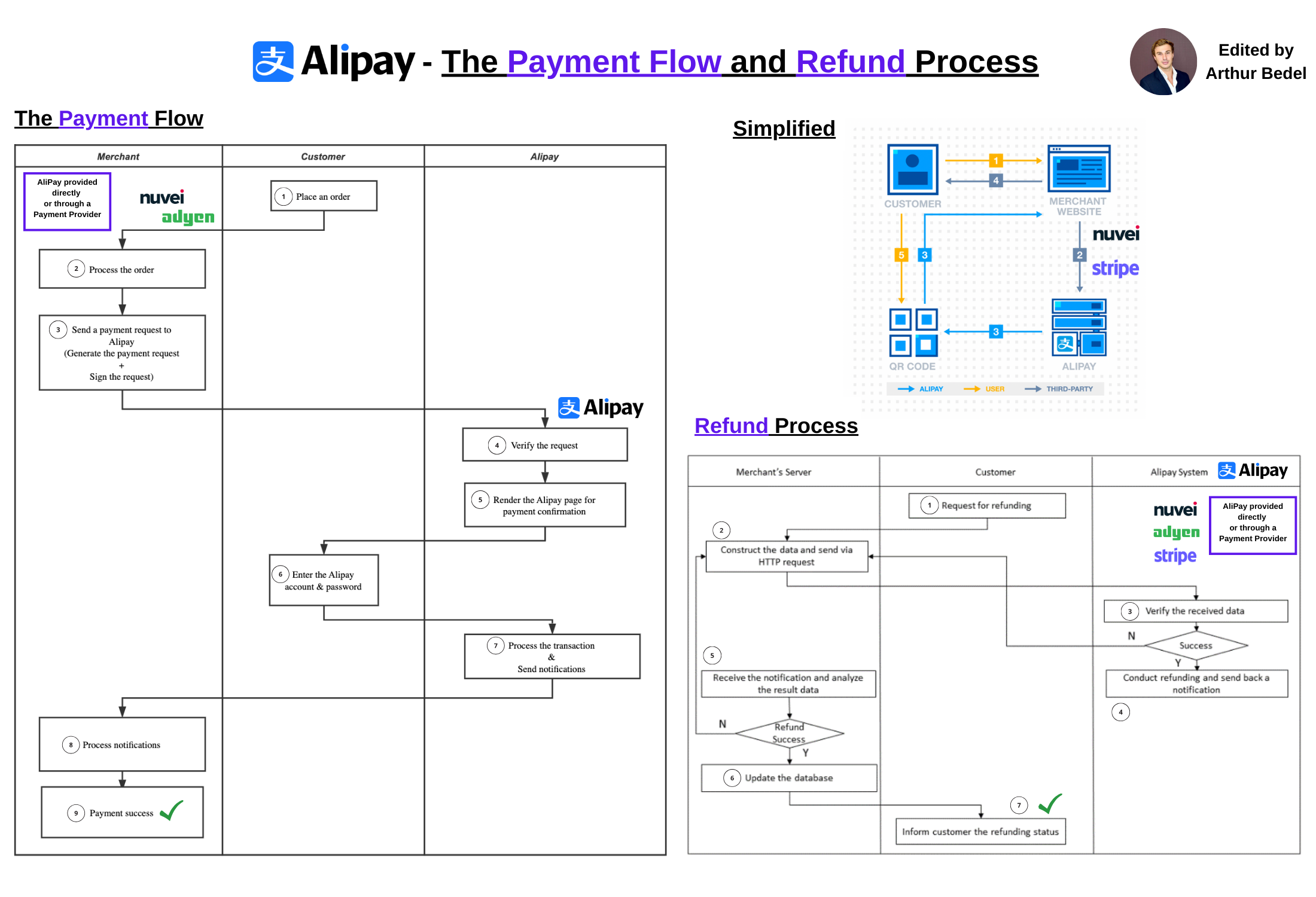

Alipay - The Payment Flow and Refund Process.

Alipay with 1B+ users, is one of the most secured and easy-to-use payment methods out there!

The payment app and eWallet allows users to send and receive money easily internationally, both in-store and online 👇

Just as apps like Venmo, PayPal and ApplePay are popular in the US , Alipay and WeChat Pay enjoy a similar level of popularity in China. Over a billion users downloaded the superapp containing countless other features that allow users to hail a taxi, get a credit card and even buy insurance.

How does it work and where:

🔸Alipay maintains a digital wallet linked to your customer, enabling peer-to-peer P2P and B2C transactions. They can use this wallet for all their transactions, whether using their wallet balance to make purchases from your company or receive payments from others.

🔸Alipay uses a QR code (Quick Response Code) system so you can present a barcode for your customer to scan, or you can scan their mobile QR code to receive payment - both online and instore - shown below 👇

In terms of Security, Alipay is not FDIC insured, that all funds added to an account are lost if the company goes out of business (unlikely right now...). Aside from this, it possesses:

👉 Advanced Encryption - protecting data and securing payments

👉 Risk Management - preventing money laundering and fraud attempts

👉 Real-Time Monitoring - detecting risk level 24/7

How long does it take to get paid with Alipay:

🔸Alipay works using the principle of escrow, holding funds until both sides of the transaction are confirmed – rather than sending payment directly into an account when you hit send. It typically takes between an hour and four business days for a recipient to receive payment.

🔸 This approach to user security and transaction confirmation has made users far more likely to use Alipay since nobody gets paid unless all parties are happy with the transaction = Trust. Once both parties have confirmed, money is deposited in the receiver's account.

Note —— Users can use Alipay even without a Chinese Bank account! It is available to tourists for short-term use of 90 days!

The Chinese super app is gaining traction in Hong Kong, Malaysia, Singapore and across the world!

Brands and Merchants can gain access to this incredible Alternative Payment Method directly through the Alipay platform or through Payment Service Providers - i.e. Nuvei

Alibaba Group & Tencent created two incredible payment methods adopted by entire regions, that today are crucial to connect consumer from APAC anywhere around the world. If you do not offer Alipay or WeChat Pay in the EU, North America or LATAM, you're Customer checkout can be improved.

Source: Alipay

And I highly recommend following my partner at Connecting the Dots in Payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn.

Comments ()