Unicorn Zilch Achieves First Monthly Profit Ahead of IPO

Hey Payments Fanatic!

Zilch, valued at $2bn (£1.65bn) in October, has reported its first monthly operating profit, four years after its 2020 launch.

In July, the London-based payments firm also surpassed a revenue run rate of $130m (£100m) but did not disclose the exact profit. Over the year to March 2024, Zilch nearly doubled its revenue, previously reporting £30m for the year ending March 2023.

Zilch's rapid profitability places it among Europe’s top FinTechs like Revolut and Monzo. The focus on profitability has intensified for UK FinTechs as investment has slowed since 2021.

Zilch’s CEO, Philip Belamant, highlighted the significance of this milestone, noting the firm's success in doubling revenue, expanding its team, and saving customers over half a billion dollars in fees.

As one of the UK’s leading BNPL providers, Zilch competes with Klarna and Clearpay, offering a card for interest-free payments over time. The company is planning a stock market listing, with potential locations including London, Nasdaq, and NYSE. Also, Mark Wilson, former Aviva CEO, joined Zilch's board as a non-executive director.

Enjoy more Payments industry updates I listed for you below and I'll be back in your inbox tomorrow!

Cheers,

Stay Ahead in FinTech! Subscribe to my FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

📊 8 ways to optimize interchange and scheme fees 👉 This guide by checkout.com offers a quick overview of strategies to reduce overspending. Learn more

PAYMENTS NEWS

🇧🇷 Airwallex is in the "early stages" of securing a license to operate in Brazil and hopes to be operating in the Latin American country by 2025 "at the earliest," said Ravi Adusumilli, executive general manager of the Americas for Airwallex.

🇺🇸 PayQuicker has been named a finalist in the Best Cross-Border Payments Solution category by FinTech Futures Paytech Awards USA. Its Earned Income Access feature, Insta-Pay, has also been named a finalist in the Best Real-Time Payments Solution category.

🇦🇷 Payments service processor Open Payment Technologies Ltd has announced the expansion of its digital wallet services, Kuady, into Argentina. It brings an advanced, user-friendly experience that ensures secure and efficient money management through an e-wallet app.

💳 Mastercard wants to get rid of card numbers for online shopping. Mastercard is expanding its efforts to eliminate the use of credit card numbers when customers make purchases online in a bid to fight fraud.

🇦🇺 Square unveiled Square Kiosk, a fully integrated software, hardware, and payments solution that enables self-serve ordering for hospitality businesses. This is the latest technology from Square as it continues to invest in its hardware and software offerings for Australian hospo businesses.

🇲🇾 Fingular launches buy now, pay later business in Malaysia under the Ahapay brand. AhaPay is set to revolutionize the way Malaysians shop. It enables consumers to purchase a wide range of products from home appliances to fashion items while easing their monthly cash flow.

🇬🇧 McLear shuts down pre-paid payment ring programme. The payments vendor is closing down its flagship Ring pre-paid programme, blaming the increasing complexity and cost of maintaining the product.

🇬🇧 DNA Payments launched its new Merchant Portal App for iOS and Android, bringing the full functionality of DNA Payments’ Merchant Portal to any smartphone. The app lets merchants accept online payments, manage their finances, and oversee transactional data, all from their mobile device.

🇮🇳 Visa has unveiled an array of innovative payment products and solutions during the Global FinTech Fest 2024. These advancements, developed in collaboration with a range of partners, are set to drive digital payment adoption across India by streamlining payment processes and enhancing transaction security and customer experience.

GOLDEN NUGGET

𝗪𝗵𝗮𝘁 𝗶𝘀 𝗶𝗻𝘁𝗲𝗿𝗰𝗵𝗮𝗻𝗴𝗲, 𝗮𝗻𝗱 𝘄𝗵𝗮𝘁 𝗳𝗮𝗰𝘁𝗼𝗿𝘀 𝗶𝗺𝗽𝗮𝗰𝘁 𝘁𝗵𝗲 𝗶𝗻𝘁𝗲𝗿𝗰𝗵𝗮𝗻𝗴𝗲 𝗿𝗮𝘁𝗲?

Let’s dive in:

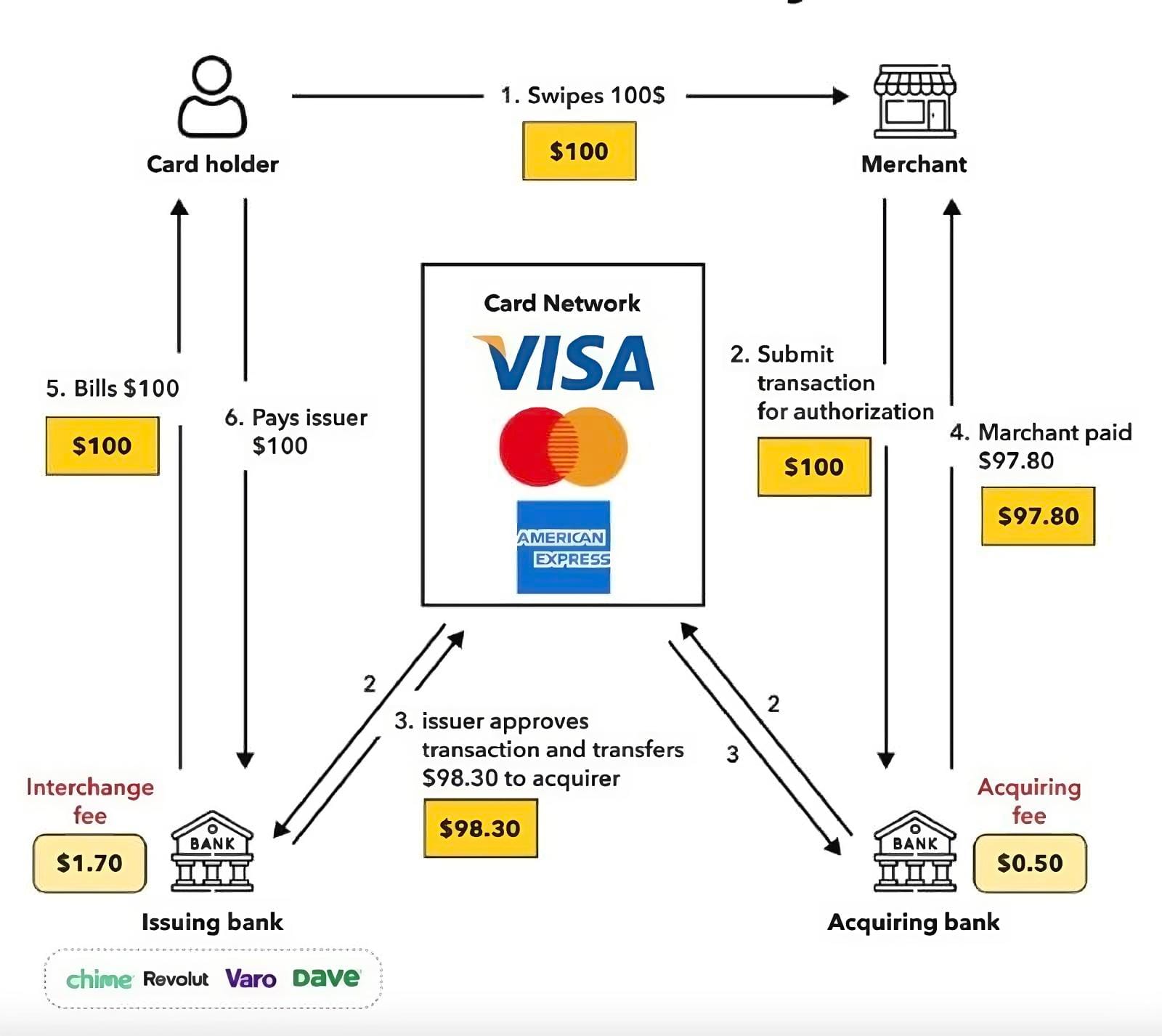

Every time a consumer swipes a card to make a purchase, the merchant pays an interchange fee.

Revenue from the fee gets divided among parties that facilitated the transaction: the banks that send and receive the payment, the card network, the payment processor, and—more recently—fintechs and businesses that embed payments.

When you take the bird-eye view diagram below 👇 as an example:

If a user swipes a card issued by a Neobank, $1.70 (interchange fee) goes to the issuing bank and the card network, $0.50 (acquiring fee) goes to the acquiring bank.

Interchange fees are not always the same though.

𝗪𝗵𝗮𝘁 𝗳𝗮𝗰𝘁𝗼𝗿𝘀 𝗶𝗺𝗽𝗮𝗰𝘁 𝗶𝗻𝘁𝗲𝗿𝗰𝗵𝗮𝗻𝗴𝗲 𝗿𝗮𝘁𝗲?

► Credit vs. Debit

Interchange rates on credit cards are significantly higher than those on debit cards.

► Rewards programs

These benefits are financed through higher interchange rates, and have proven to be very popular with consumers.

► Online vs. Offline

Online purchases are less secure than in-person purchases.

► Consumer vs. Commercial

Cards associated with business or corporate accounts carry higher interchange rates than consumer cards.

► Merchant Category Code (MCC)

Every merchant is categorized by the major card networks according to a Merchant Category Code (MCC). This means that there are different interchange rates depending on whether someone uses a card in a supermarket, a retail store, a gas station, or with some other form of merchant.

► The Card Network

Different card networks charge different rates. Visa and Mastercard are known for charging lower rates. Other networks like AMEX are known for charging higher rates.

► Network partner programs

Visa and Mastercard’s partner programs like VPP (Visa Partner Program) and MPP (Mastercard Partner Program) often give specific retailers interchange rates that are much lower than the networks’ published interchange rates.

► Size of the issuing bank (in the US 🇺🇸)

Larger banks are subject to a regulation called the Durbin Amendment that caps interchange rates on consumer debit transactions. Smaller banks are exempt.

As a result, these smaller banks can earn more revenue from interchange rates—and that benefits the FinTechs and embedded finance businesses that partner with them.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()