UK FinTech Curve Intents to Join Apple’s Newly Opened NFC Ecosystem

Hey Payments Fanatic!

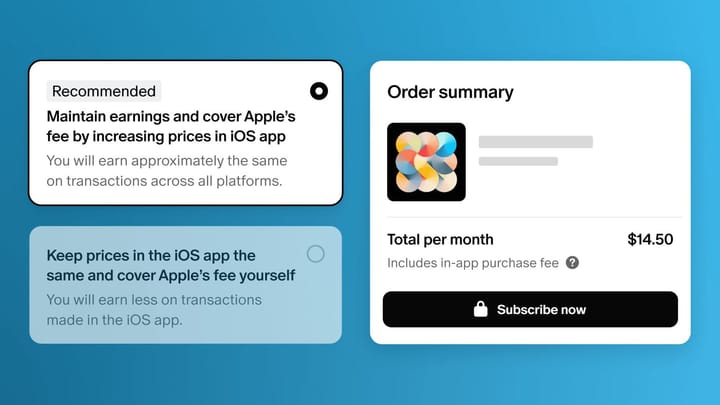

Apple has recently announced plans to open its NFC ecosystem to third-party payment providers, signaling a significant change in its traditionally closed approach. In light of this, UK-based FinTech company Curve has declared its intention to join Apple’s platform.

Curve CEO and founder Shachar Bialick has issued the following statement:

“We welcome Apple’s latest announcement, which will see more consumers around the world gain access to third-party payment wallets and is a positive move for consumers who will benefit from choice and innovation in payments on iOS for the first time. What remains unclear is how onerous Apple’s access fees will be, and whether there is enough profit left for third-party developers to encourage more customer-centric innovation.

“As the leading alternative to Apple Pay, Curve is thrilled to bring unique benefits to customers worldwide. Curve Pay goes beyond traditional wallets by being the only wallet that eliminates foreign transaction fees from linked cards and offers cashback on top of linked cards rewards. This exemplifies the innovation in digital payments, and Curve is committed to staying at the forefront, driving progress and delivering unmatched value to consumers.”

For a long time, Apple has been under pressure, particularly from the European Union, to allow external companies access to its services. Apple has consistently justified its restrictive policies by emphasizing the importance of maintaining high security standards for user data and questioning the need to allow competitors onto its devices.

However, the landscape is shifting as Apple has now confirmed it will permit APIs, developers, and various services to enable in-app payments. Additionally, Apple’s platform will open up to new services, such as digital IDs, keys, tickets, and more.

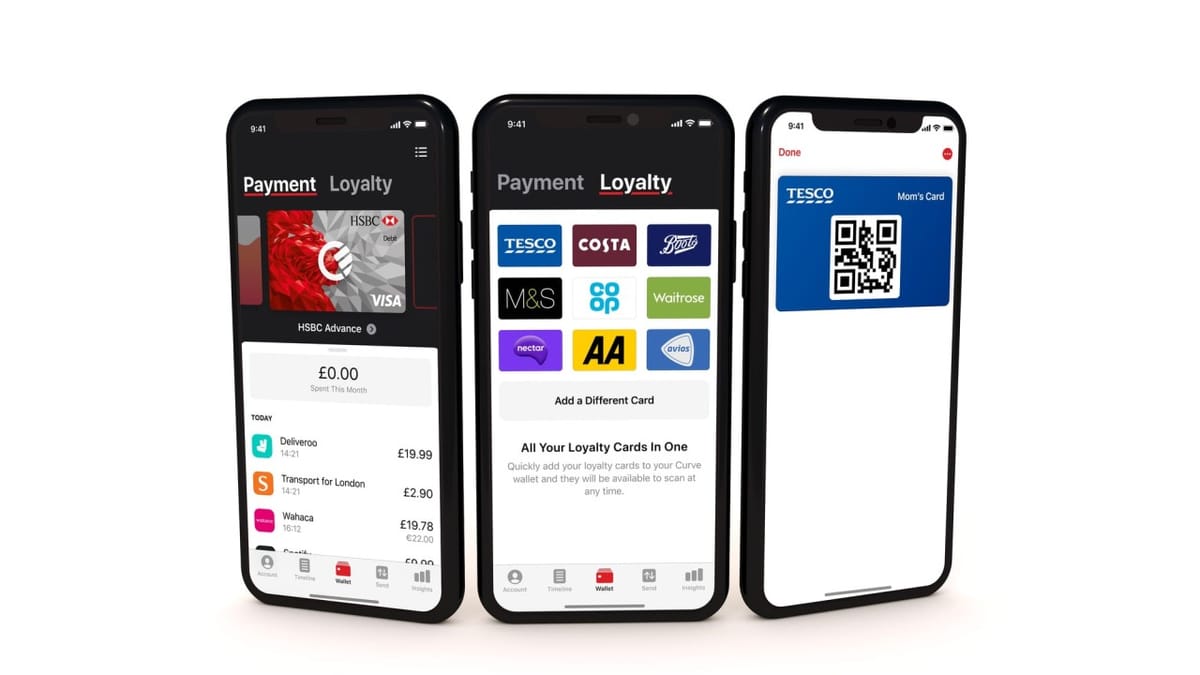

Curve, which is well-known for allowing users to combine multiple payment cards into one while offering advanced tech features, is set to be among the first to leverage this new opportunity on Apple’s platform.

Have a great start to the week!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

💡 How are AI and real-time payments shaping Middle East’s financial future? Damon Madden, Strategic Solution Consultant – Fraud, MEASA, at ACI Worldwide explains: Discover more insights here

PAYMENTS NEWS

🇦🇺 Airwallex, the Tencent-backed digital payments startup, just hit $𝟱𝟬𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 🤯 of annual run rate (ARR) revenue and is seeking to get IPO-ready by 2026, according to CEO Jack Zhang. Read the complete interview by Ryan Browne for more interesting info.

🇺🇸 JPMorgan, Zelle may have upper hand if litigation ensues. With the Consumer Financial Protection Bureau investigating the peer-to-peer payment tool Zelle, its bank owners are on the defensive. However, Zelle’s owners might find a friendly reception in the federal courts if they follow through on threats to litigate, according to lawyers familiar with the industry. Zelle is owned by seven banks through the parent company Early Warning Services.

🇳🇱 The Dutch payment giant Adyen reaffirmed that the FinTech was unlikely to pursue future growth through M&A, saying consolidation can be “very painful”. Ingo Uytdehaage, Adyen co-CEO, was asked by an analyst, given falling FinTech valuations, whether Adyen, which is famous for rejecting acquisitions as a growth strategy, would consider future acquisitions.

🇺🇸 US-based provider of AI-enabled software platforms for real estate RealPage has selected Flex as its preferred technology provider for flexible rent payments. This partnership enhances RealPage’s integration by enabling Flex as a payment option in LOFT, RealPage’s new resident portal and app.

🇬🇧 PSR sets out next steps on expanding VRPs in the UK. On 15 August 2024, the Payment Systems Regulator (PSR) published the response to its December 2023 call for views which set out initial proposals on how to expand variable recurring payments (VRPs) into new use cases, through a Phase 1 roll-out.

🇬🇧 allpay, a payment services provider in the UK, announced the appointment of Matt Marskell as Sales and Marketing Director (Non-Board) to its leadership team. Matt brings a focus on first class account management and optimisation of product for improved customer relationships taking over the commercial function at allpay at a time of exciting growth.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()