UK Banks to Hold Suspicious Payments for 72 Hours

Hey Payment Fanatic!

The UK Government just introduced legislation that lets banks put a three-day hold on suspicious payments. With fraud losses hitting a staggering £460 million last year, this move aims to give banks more time to investigate potential scams before they wreak havoc on innocent people’s finances.

But not everyone’s convinced. Tulip Siddiq, Economic Secretary to the Treasury, says it’s about giving people better protection against scammers. Yet critics like Jack Kerr from Appdome argue it could disrupt essential payments—think mortgage deadlines. He suggests that automated fraud detection systems might be a better way forward, reducing the impact on everyday users while tightening security.

As mobile banking grows, this legislation raises big questions. With 33% of Brits using their mobile apps daily, it’s clear that robust app security is non-negotiable.

Meanwhile, Mark Munson from Moneyhub points out that delaying payments alone won’t stop fraud at its core. He’s calling for stronger KYC measures and a more united front across industries to truly make a dent in this ongoing battle.

More payment updates coming your way! Stay tuned.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

PAYMENTS NEWS

🇳🇱 Intersolve announces a new partnership with Visa. The partnership has already been implemented in projects such as a prepaid card programme for low-income families, created in cooperation with the Red Cross. Both companies aim to continue collaborating to deliver effective financial solutions and broaden their impact.

🇬🇧 BKN301 launches payment solution for MENA FinTechs. This payment solution is designed to address the evolving needs of the MENA region’s financial sector, with a focus on supporting traditional banks, FinTech companies, and neobanks.

🇫🇷 Paul Marriott-Clarke joins Worldline to drive Merchant Services business. Paul brings a wealth of expertise and a proven track record of success. He will be based at Worldline Headquarters in Paris La Défense, France. As a member of the Group’s Executive Committee, he will report directly to the CEO.

🇯🇵 JCB to offer Google Pay in Japan. Android smartphone users can now use Google Pay in stores where JCB Contactless is accepted, by adding their credit/debit cards issued by the JCB Group in Japan to Google Pay.

🇸🇪 Klarna is about to oust another board member. According to the FT, seven directors just agreed to oust investor Mikael Walther from Klarna’s eight-person board, nearly eight years after he joined it. It’s the second time Klarna’s board has changed in dramatic fashion this year.

🇬🇧 The Payments Association shares comments after UK’s payment systems regulator updates APP rules. Riccardo Tordera, director of policy and government relations at The Payments Association said that they will be monitoring the overall / anticipated impact of the latest APP fraud rules closely in the UK. Read more

🇧🇷 Brazilian FinTech Barte secures $8m Series A to advance modular payments across Brazil. The company primarily operates by offering robust and flexible payment solutions and plans to use the newly acquired funds to expand its payment and cash flow solutions throughout the countryl. Continue reading

🇮🇳 Paytm focusing on consumer payments business: CEO Vijay Shekhar Sharma. The firm's immediate priority is to invest in its consumer payments business to recover its lost user base after the RBI restricted Paytm Payments Bank from accepting deposits and facilitating credit transactions, a top official stated on Sunday.

🇲🇻 Rupay card in Maldives, Hanimaadhu Airport and more. On Monday, Prime Minister Narendra Modi and Maldives President Mohamed Muizzu held talks on repairing and strengthening India-Maldives relations. The leaders witnessed the first transaction using RuPay cards in the Maldives, signaling strengthened digital ties between the two countries.

🇬🇧 Paysafe launches strategic partnership with GiG. Under the agreement, Paysafe becomes the GiG-endorsed payments platform for all UK, continental European, North American and Latin American operators integrating its market-leading CoreX solution.

🇭🇰 Ben Wong to lead Adyen’s Southeast Asia and Hong Kong commercial operations. In his new role, Wong will manage the company’s commercial operations across the region, focusing on growth strategies and strengthening partnerships in key markets, including Singapore, Malaysia, and Hong Kong.

GOLDEN NUGGET

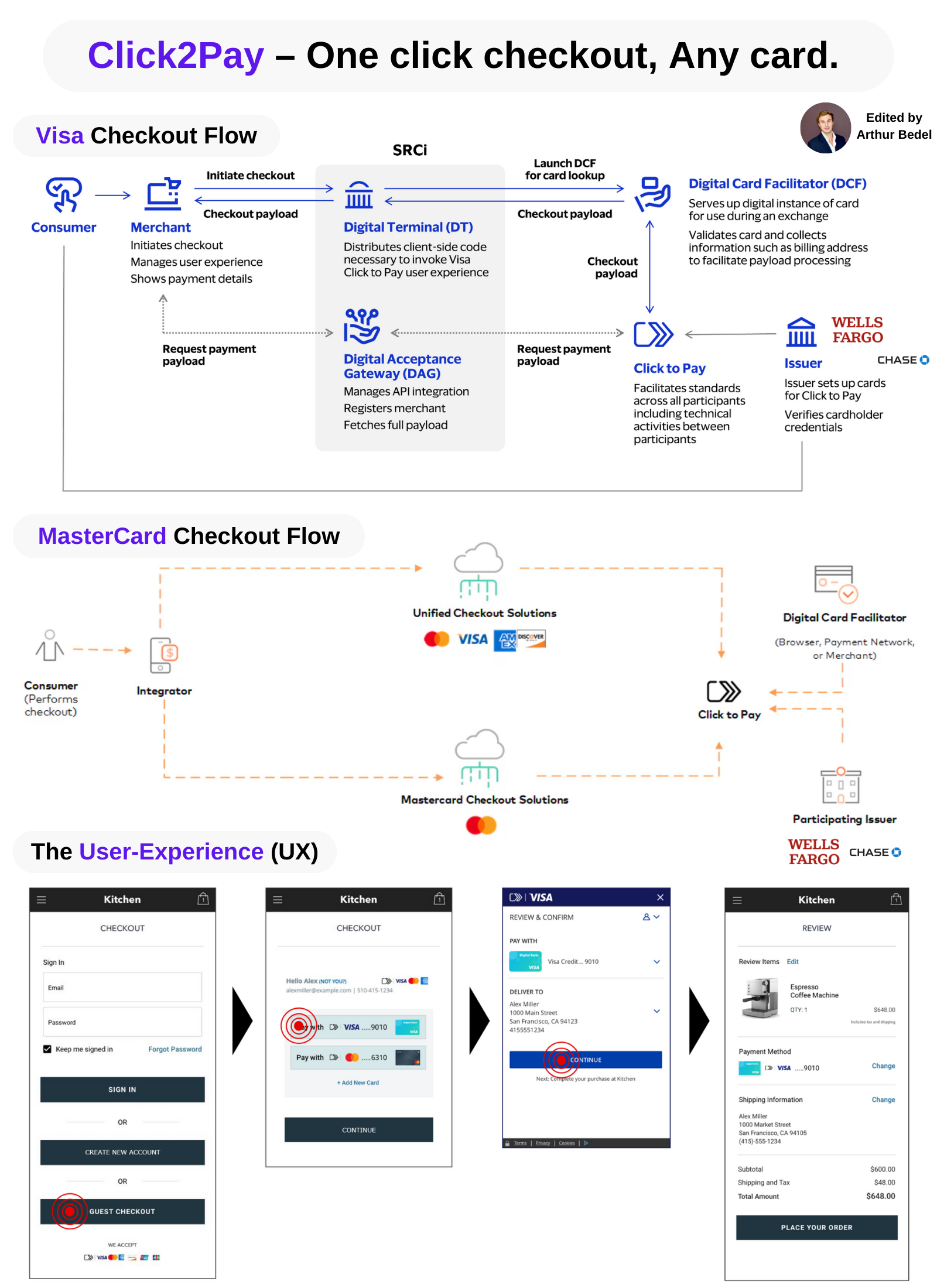

𝐂𝐥𝐢𝐜𝐤2𝐏𝐚𝐲 — the *One-Click Checkout* experience by Visa & Mastercard (card networks) to challenge ApplePay, Google Pay (wallets)👇

🔸 A significant showdown is occurring in the payments industry to dominate at checkout — 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐬 vs 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬:

► The success of platforms like ApplePay, PayPal, Amazon Pay, and Google Pay can largely be attributed to the simplicity, ease-of-use, fast, and user-friendly checkout processes.

► In response, the 4 primary card schemes (Visa, Mastercard, American Express, Discover Financial Services) are introducing 𝐂𝐥𝐢𝐜𝐤-𝐭𝐨-𝐏𝐚𝐲, a streamlined one-click payment solution.

🔸 𝐂𝐥𝐢𝐜𝐤2𝐏𝐚𝐲 — 𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧 & 𝐊𝐞𝐲 𝐀𝐭𝐭𝐫𝐢𝐛𝐮𝐭𝐞𝐬

► Click2Pay is a streamlined payment method designed to simplify the online checkout process for card payments. It aggregates all of one customer's cards into a single payment method, enabling them to complete transactions with just one click. It eliminates the need for manual entry of card credentials by converting consumer data into Tokens.

► The solution adheres to the EMV® Secure Remote Commerce (SRC), the global association representing the 6 major credit card networks.

► In the event of a data breach, the actual card number remains protected due tokenization, ensuring transactions remain secure & it includes built-in measures for verification and fraud prevention.

► Automatic recognition of customers' devices (smartphones, tablets, PCs, laptops) enhances the user experience.

► The fee and cost structure for credit and debit cards remains unchanged.

𝐍𝐨𝐭𝐞: ApplePay, and Google Pay are charging a fee to merchants. Click2Pay is looking to challenge that.

In essence, Click2Pay provides a card-based alternative to digital wallets. It was initially launched in the U.S. in 2019 and is now expanding globally (gaining popularity in Europe).

🔸 𝐇𝐨𝐰 𝐜𝐚𝐧 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐬 𝐛𝐞 𝐬𝐮𝐜𝐜𝐞𝐬𝐬𝐟𝐮𝐥?

► 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧, a simple & rewarding UX will be crucial. A strong collaboration with Issuers could create valuable incentives (rewards etc...) for customers, needed to disrupt their payments preference

► 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧, a straightforward implementation process with good documentation will be needed. Digital Wallets today are expensive, pricing will be crucial and issuer adoption

► 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐯𝐢𝐝𝐞𝐫𝐬 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧, a program to reward enablers/gateways for providing this payment method over others

Noticing a trend? The majority of all new payment initiatives from the Card Networks are based on Tokenization. Other non-card initiatives are gaining momentum, for which data will be required to be shared across industry players securely.

𝐓𝐡𝐨𝐮𝐠𝐡𝐭𝐬 𝐨𝐧 𝐰𝐡𝐚𝐭'𝐬 𝐧𝐞𝐱𝐭? 🚀

Source: Visa, Mastercard

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()