TrueLayer Faces Rising Losses Despite Revenue Surge

Hey Payments Fanatic!

TrueLayer, the UK-based payments company backed by Stripe, is seeing pre-tax losses soar nearly 40% to £55.6 million, up from £40.3 million last year. This comes despite the company tripling its revenue year-on-year.

According to recent filings, TrueLayer has cut costs through restructuring, laying off 10% of its workforce last year. The team has shrunk from 434 to about 346 employees.

Yet, 2023 marked TrueLayer’s “strongest year-on-year growth,” with gross profit more than doubling from £2.96 million to £7.78 million, and revenue jumping from £4.1 million to £12.4 million. A company spokesperson said, “2023 was a year of remarkable growth, consolidating our position as the European market leader.”

Operational losses decreased from £61 million in 2022 to £54 million in 2023, reflecting strong performance in markets beyond the UK. The number of transactions on its Payout product skyrocketed over 20 times in 2023.

TrueLayer is a key player in the open banking space, enabling direct account-to-account payments. However, A2A payments currently only capture 7% of global e-commerce transaction volume, compared to digital wallets at 50% and credit cards at 22%.

While TrueLayer’s growth story is compelling, it’s not alone in the payments sector facing profit challenges. Other FinTechs like GoCardless have also reported rising net losses recently.

What are your thoughts on TrueLayer’s journey? Let me know in the comments!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

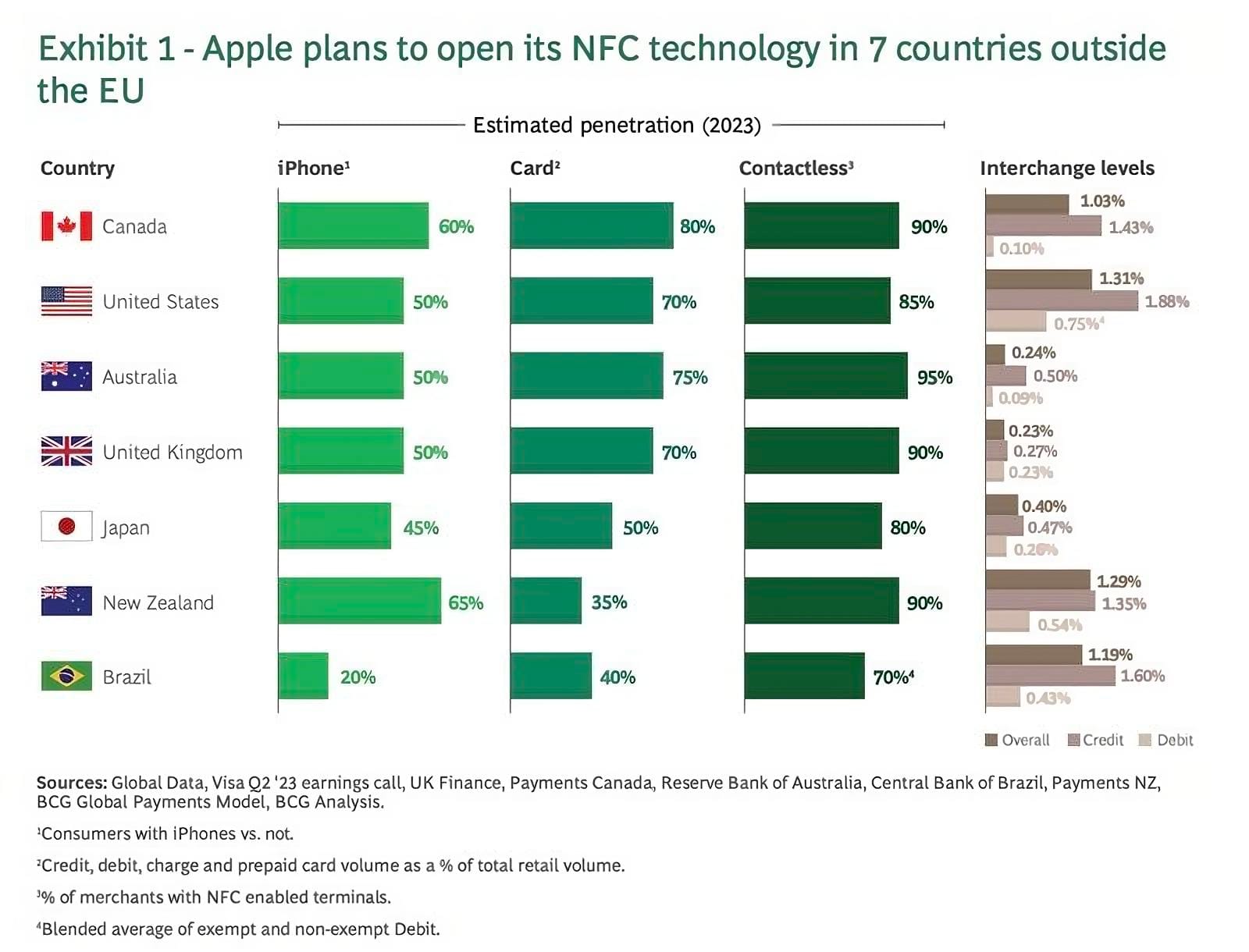

📊 Apple in Payments. Over the past few months, Apple has made three significant announcements that shed new light on its payments strategy. But they also raise questions for other payments players that they must speedily resolve.

PAYMENTS NEWS

🇪🇺 EU Banks launch Wero Payments to dislodge Visa, Mastercard. EU’s biggest banks have spent years quietly creating a new way to pay that could finally allow customers to ditch their Visa and Mastercard cards — the latest sign that the region is looking to dislodge two of the most valuable financial firms on the planet.

🇨🇳 WeChat Pay now available on Taobao. This integration comes after Taobao and its Tmall’s user feedback solicitation was announced in early September, reflecting the growing competition in China’s digital payments sector. Find out more

🇺🇸 Paymentus to bring advanced billing and payments capabilities to Altera digital health solutions. Altera serve physician practices, hospitals, and health networks globally. Integrating Paymentus' billing platform will enhance revenue cycle management by optimizing billing and payments.

🇺🇸 Airbase demonstrates the transformational power of AI with the launch of touchless accounts payable. Airbase’s AI-powered touchless AP system is built to handle every step of the accounts payable process with minimal human intervention.

🇹🇹 NPCI Intl. to develop UPI-like real-time payments platform in Trinidad and Tobago. The partnership aims to help Trinidad and Tobago build a reliable real-time payments platform for person-to-person (P2P) and person-to-merchant (P2M) transactions, boosting digital payments and financial inclusion.

🇵🇦Paymentology and ViaCarte join forces to expand card issuance across Latin America and the Caribbean. Together, Paymentology and ViaCarte will significantly increase card issuance in the LAC region, with ViaCarte acting as the BIN sponsoring institution.

🇨🇦 Stripe opens new flagship office in Toronto. The expansion reflects Toronto’s growth as the fourth-largest market for tech talent in North America and reinforces Stripe’s commitment to Canada. Continue reading

🇲🇽 Due Network, a global FinTech for international payments, announces the start of operations in Mexico. Due Network enables businesses and individuals to transfer funds to and from over 60 countries, including Mexico, at a fraction of the cost and significantly faster than traditional bank transfers.

GOLDEN NUGGET

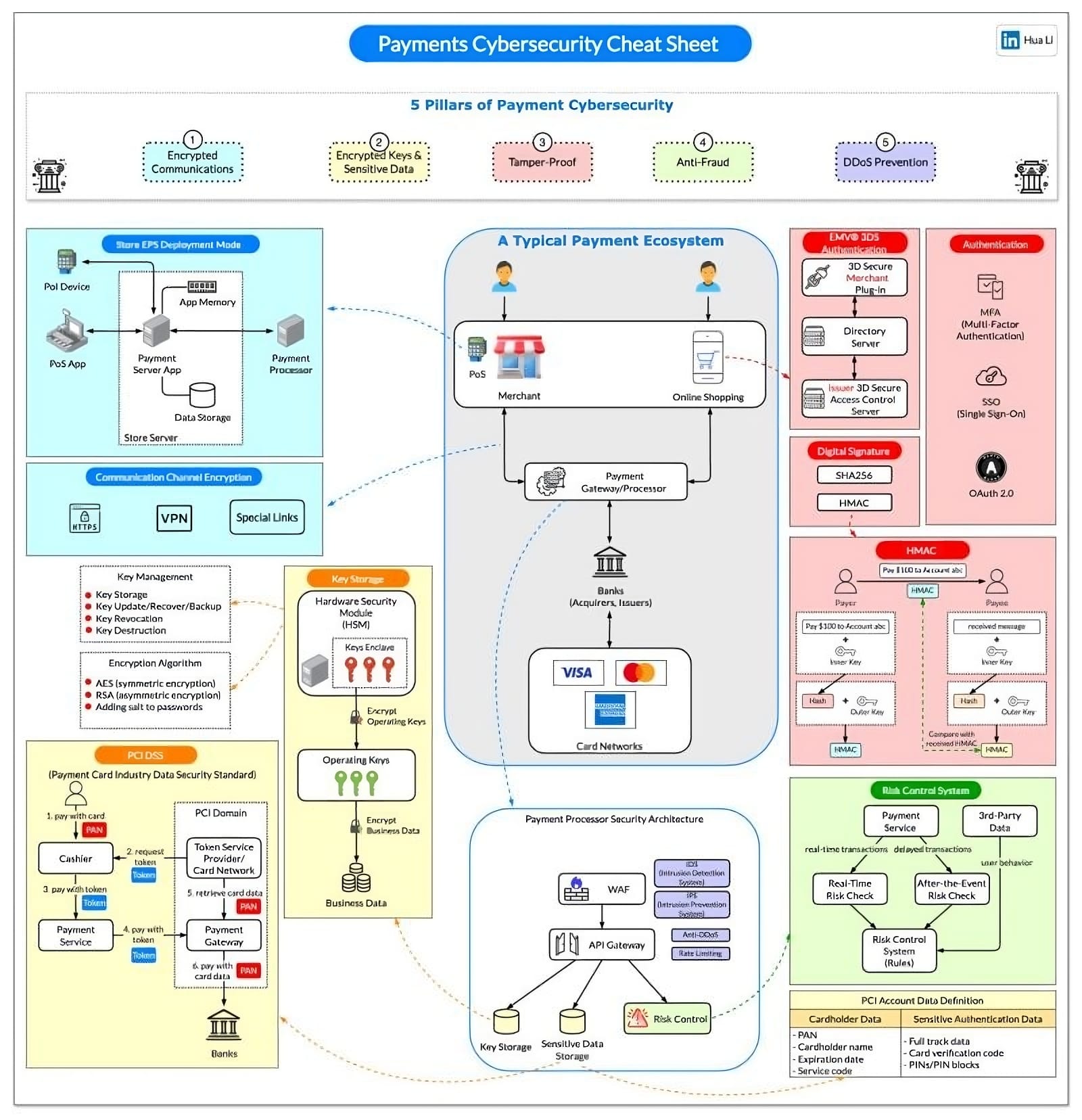

The cheat sheet below outlines 5️⃣ pillars of secure payment systems:

Payment cybersecurity is a crucial aspect of the modern financial ecosystem.

The cheat sheet below outlines 5 pillars of secure payment systems with a typical payment data flow.

1️⃣ 𝗘𝗻𝗰𝗿𝘆𝗽𝘁𝗲𝗱 𝗖𝗼𝗺𝗺𝘂𝗻𝗶𝗰𝗮𝘁𝗶𝗼𝗻 𝗖𝗵𝗮𝗻𝗻𝗲𝗹𝘀

Unencrypted data transmitted over the internet can be intercepted, leading to data breaches or theft. Using protocols like HTTPS for web transactions or VPNs for internal corporate communication further reduces vulnerabilities.

2️⃣ 𝗘𝗻𝗰𝗿𝘆𝗽𝘁𝗲𝗱 𝗞𝗲𝘆𝘀 𝗮𝗻𝗱 𝗦𝗲𝗻𝘀𝗶𝘁𝗶𝘃𝗲 𝗗𝗮𝘁𝗮

Use Advanced Encryption Standard (AES) for data encryption and RSA or Elliptic Curve Cryptography (ECC) for securing key exchanges. Implement Hardware Security Modules (HSMs) to securely manage and store cryptographic keys.

Data masking and Tokenization can further enhance the protection of sensitive payment information by replacing real data with dummy values.

3️⃣ 𝗧𝗮𝗺𝗽𝗲𝗿-𝗣𝗿𝗼𝗼𝗳

Payment systems must be resistant to tampering, both physically and digitally, to prevent fraud, data theft, or unauthorized access.

3D Secure (3DS): This is an authentication protocol designed to provide an additional layer of security in online credit card transactions, helping to prevent fraud.

MFA is a key component in making systems tamper-proof by requiring more than one authentication method.

OAuth 2.0 is an open standard for access delegation, commonly used to grant websites or applications limited access to user information without exposing passwords.

HMAC is crucial for ensuring that messages or data within a system are not tampered with. Any attempt to modify the message without knowing the secret key will result in an invalid HMAC.

4️⃣ 𝗔𝗻𝘁𝗶-𝗙𝗿𝗮𝘂𝗱 & 𝗥𝗶𝘀𝗸 𝗖𝗼𝗻𝘁𝗿𝗼𝗹

Use a combination of Multi-Factor Authentication (MFA), biometrics, and tokenization to secure user authentication.

Implement real-time monitoring and machine learning-based anomaly detection systems that track transaction patterns and flag unusual activity.

5️⃣ 𝗗𝗗𝗼𝗦 𝗣𝗿𝗲𝘃𝗲𝗻𝘁𝗶𝗼𝗻

Distributed Denial of Service (DDoS) attacks aim to overwhelm payment systems with massive traffic, rendering them inoperable.

Employ Web Application Firewalls (WAFs) and Intrusion Detection Systems (IDS) to detect and mitigate DDoS attacks. Cloud-based DDoS protection services, such as CDNs or services like AWS Shield, can absorb and filter malicious traffic. Rate limiting and geo-blocking are also effective strategies to prevent large volumes of unwanted traffic from overwhelming systems.

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()