Triple-Digit Growth & A New Leader for Mollie in the UK

Hey Payments Fanatic!

Mollie, a rapidly expanding financial services provider in Europe (founded in Amsterdam 😉), has appointed Dave Smallwood as the UK managing director.

This strategic move aligns with Mollie’s plans to scale its UK operations, following impressive triple-digit year-on-year growth in the first quarter of 2024 🤯

With over 20 years of experience in the FinTech industry, including roles at major companies like American Express, PayPal, and Super Payments, Smallwood is well-positioned to lead Mollie’s efforts to become the top financial service provider for small and medium-sized businesses in the UK.

The company has also made substantial investments in its UK operations, increasing its team size by more than 60%—from 16 to 26 members across London and other parts of the UK since 2023.

Mollie partners with prominent UK brands such as Gymshark, Soak&Sleep, Mazda, and Wild Cosmetics, offering payment solutions, money management, and accessible financing through its platform.

Globally, Mollie supports over 250,000 (!) businesses.

Enjoy more Payments Industry news I listed for you below and I'll be back in your inbox tomorrow!

Cheers,

Stay Ahead in FinTech! Subscribe to my FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

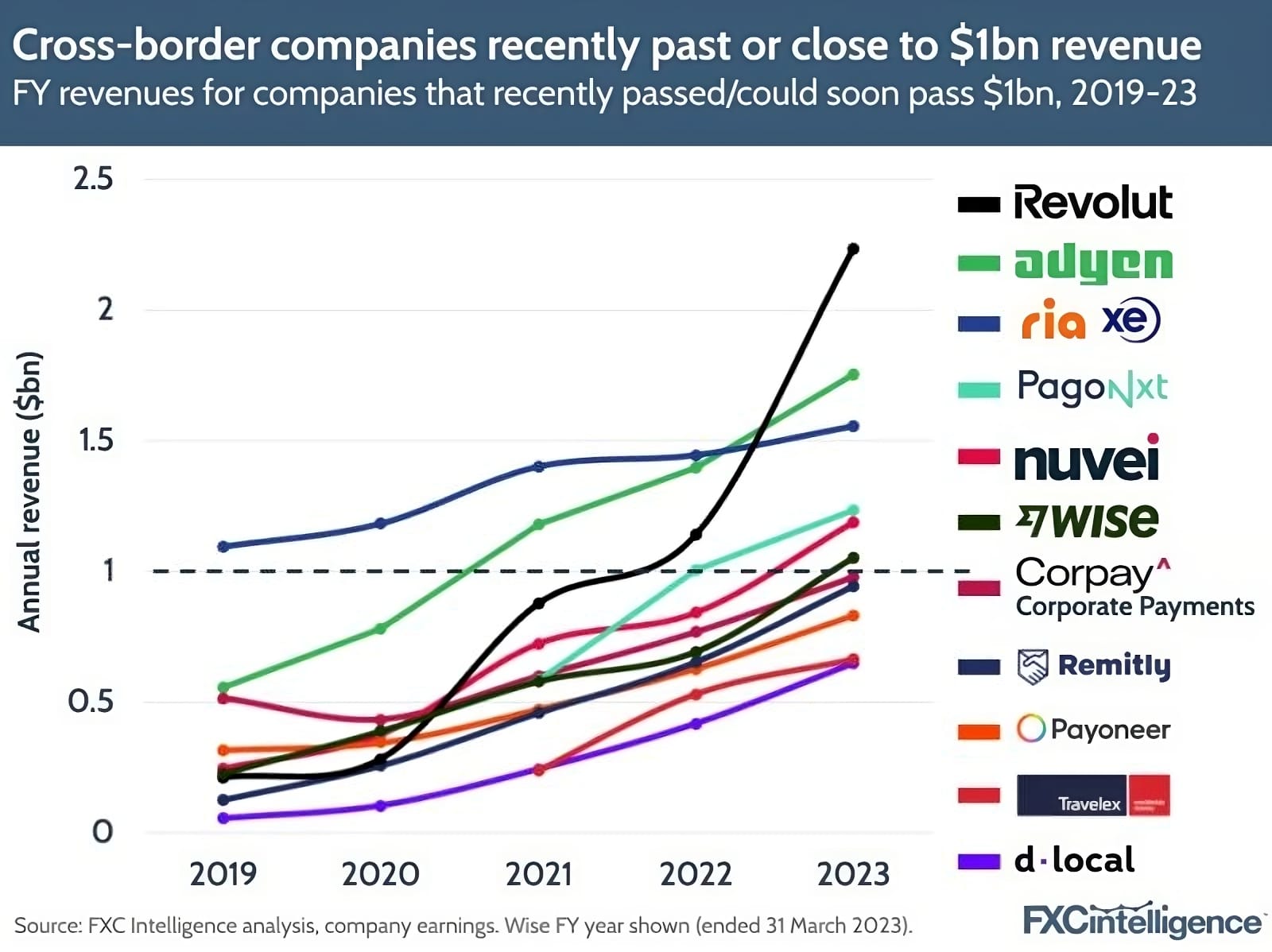

🌐 Which cross-border payments companies have hit $1bn in revenue?

Here is an overview by FXC Intelligence:

PAYMENTS NEWS

🇮🇹 Ecommpay to boost Italian e-Commerce with three new local payment options. The addition of BANCOMAT Pay, MyBank, and Satispay is set to enhance the performance of e-commerce merchants in Italy by offering more tailored payment options that improve conversion rates.

🇦🇿 Epoint, online payments platform in Azerbaijan receives FinTech license. This recognition – which is the first for any startup in the country – is a testament to the high quality of the services provided by the company and their compliance with the most stringent security and reliability standards.

🇬🇧 GoCardless closes deal to acquire Nuapay. Bank payment company GoCardless has closed its acquisition of Nuapay in order to scale its indirect channel proposition and fast-track the launch of new capabilities. More on that here

🇺🇸 Amazon’s checkout reportedly suffered a technical issue as its Labor Day sale began. The glitch in the eCommerce site happened Friday (Aug. 30), preventing users from completing their purchases, CNBC reported, citing reports from customers on social media.

🇩🇪 Computop appoints Kenneth M. Overgaard-Nielsen as COO. His areas of responsibility include the Business Solutions department, which covers processes and internal systems, and the Merchant Services department, which supports Computop customers with connections and answers technical questions.

💵 Cautious approach needed for interlinking fast payment systems, warns Fed Governor. In a recent speech, Fed Governor Christopher Waller highlighted the potential risks and practical challenges associated with interlinking fast payment systems, underscoring the Fed’s focus on strengthening its own FedNow network domestically.

🇬🇧 Modulr adds integration to Xero for payroll services. The integration enables Xero Payroll users to leverage the Modulr real-time payments network. The network supports faster payments, with some payments clearing within 90 seconds, even during weekends and holidays.

🇬🇧 Atlantic Money provides low-cost alternative to Swift with app-less money transfers. Money movement firm Atlantic Money is to make it possible for users to forsake its app and instead send and receive currencies directly from within their own bank accounts.

🇱🇺 VNX platform integrates Volt for seamless deposits. Volt, with connections to over 2,500 banks across Europe, offers a smooth and secure way to fund VNX accounts through mobile or desktop, ensuring convenience for all users. More here

GOLDEN NUGGET

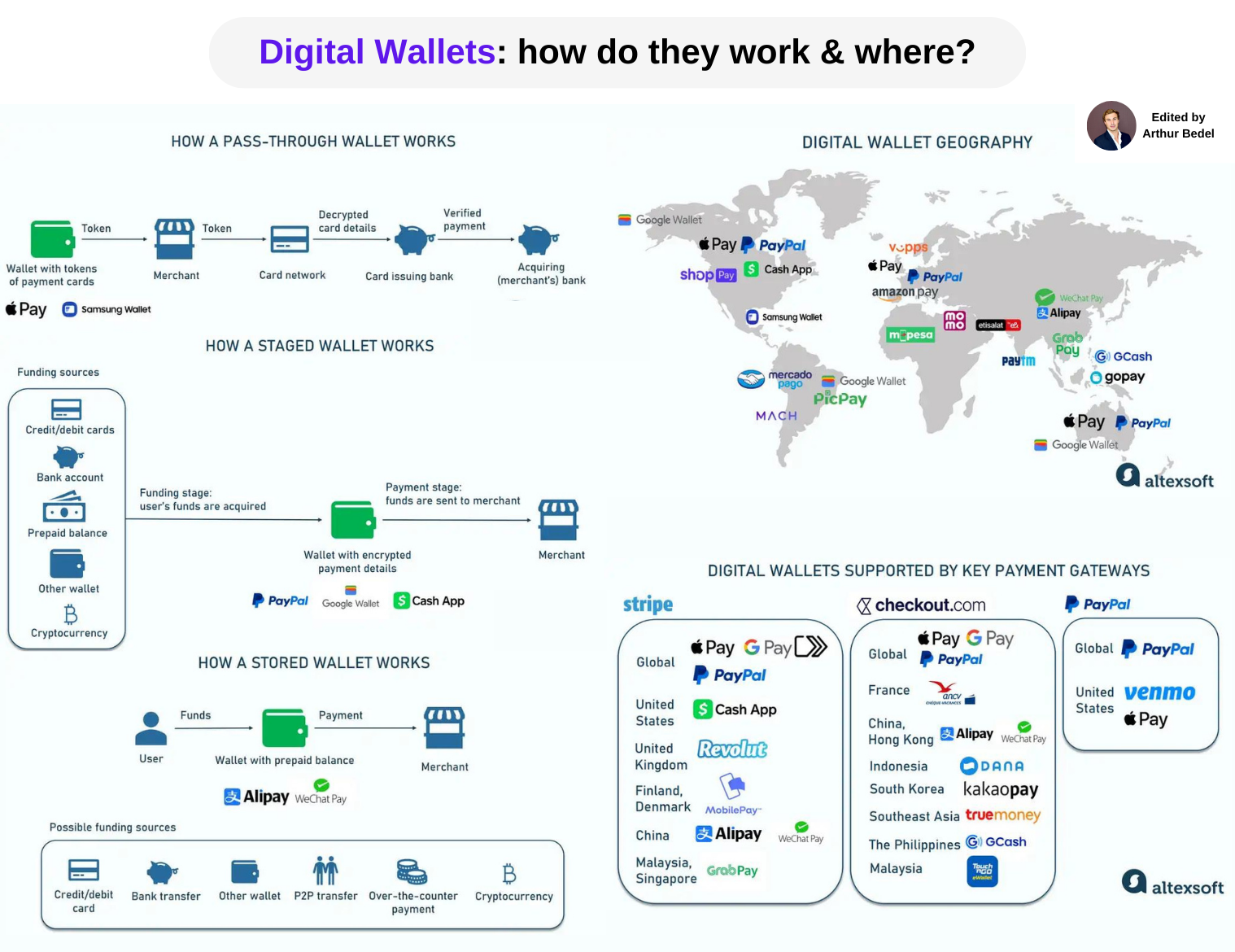

Digital Wallet: how do they work & where?👇

What is a Digital Wallet:

A digital wallet, also known as an electronic or e-wallet, is any application that enables individuals and businesses to make transactions over computer networks using multiple payment options — credit and debit cards, preloaded funds, cryptocurrencies, Buy Now Pay Later (BNPL), etc.

To ensure safety, e-wallets apply several layers of protection, such as data encryption, multi-factor authentication, and tokenization (the app replaces real payment details with a unique token)

Basically, there are 3 distinct groups of B2C wallet apps:

1️⃣ 𝗣𝗮𝘀𝘀-𝘁𝗵𝗿𝗼𝘂𝗴𝗵 𝘄𝗮𝗹𝗹𝗲𝘁𝘀; commonly designed as mobile-first, keep tokens that link to your credit and debit cards instead of storing sensitive data or money directly.

They don't take part in moving funds. Once a transaction is initiated, such apps just pass encrypted information to a merchant — hence, the name.

In the course of further payment processing, the token travels to a payment network to be decrypted and checked against the actual card or account information in the issuing bank. After verification, the payment gets approved and sent to a merchant's acquiring bank.

Known for high security, pass-through wallets act essentially as extensions of credit and debit cards, so they are more widespread in regions with high card adoption, such as Europe and North America.

Major examples: Apple Pay, Samsung Electronics Wallet, Chase Mobile app

2️⃣ 𝗦𝘁𝗮𝗴𝗲𝗱 𝘄𝗮𝗹𝗹𝗲𝘁𝘀; also house tokenized payment details but don't transmit them anywhere. Instead, they perform transactions in two stages.

At the funding stage, the wallet acquires money from a customer's bank account, credit line, or other source. Then, at the payment stage, it sends funds to a merchant.

In this scenario, a wallet provider can make additional fraud assessments. At the same time, a payment network or card issuer may know nothing about details of a particular transaction that are disclosed during operations with pass-through solutions.

Major examples: PayPal, Google Wallet, Cash App (US & UK).

3️⃣ 𝗦𝘁𝗼𝗿𝗲𝗱 𝗱𝗶𝗴𝗶𝘁𝗮𝗹 𝘄𝗮𝗹𝗹𝗲𝘁𝘀; work as prepaid cards. Before making a transaction, a user must load money to a wallet's balance from a bank account, debit or credit card, via peer-to-peer transfer, etc.

The availability of funding sources differs across providers, depending on the location and targeted users. A merchant withdraws money directly from the wallet

Stored wallets are especially popular in unbanked & underbanked countries since they enable people to deposit money without having a bank account

Major examples: Apple Cash (US only), Alipay, WeChat Pay, Paytm Wallet (India's largest platform for instant payments) & work of art merchant wise — Starbucks ☕️

Source: AltexSoft

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()