Trace Finance Joins Borderless.xyz to Strengthen FX Liquidity and Stablecoin Payments in Brazil

Hey Payments Fanatic!

Trace Finance, a Brazilian FinTech focused on cross-border transactions, has officially joined the BorderlessXYZ network, in an attempt to boost foreign exchange liquidity and stablecoin payment solutions throughout Brazil.

This partnership is expected to benefit businesses and individuals engaged in international trade and remittances, providing them with improved access to FX markets and stablecoin-based payment options.

“Brazil remains a key market for stablecoin adoption due to its high remittance volume and appetite for lower-cost, faster settlement options,” said Kevin Lehtiniitty, CEO of Borderless.xyz. “Trace Finance's capabilities align perfectly with our mission, and we're excited to embed their infrastructure into our global network.”

Bernardo Brites, CEO of Trace Finance, added, "Trace Finance already moves hundreds of millions of USD every month, and by joining Borderless, we'll further enhance our payment capabilities, unlock new corridors, and offer instant settlement with industry-leading pricing."

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

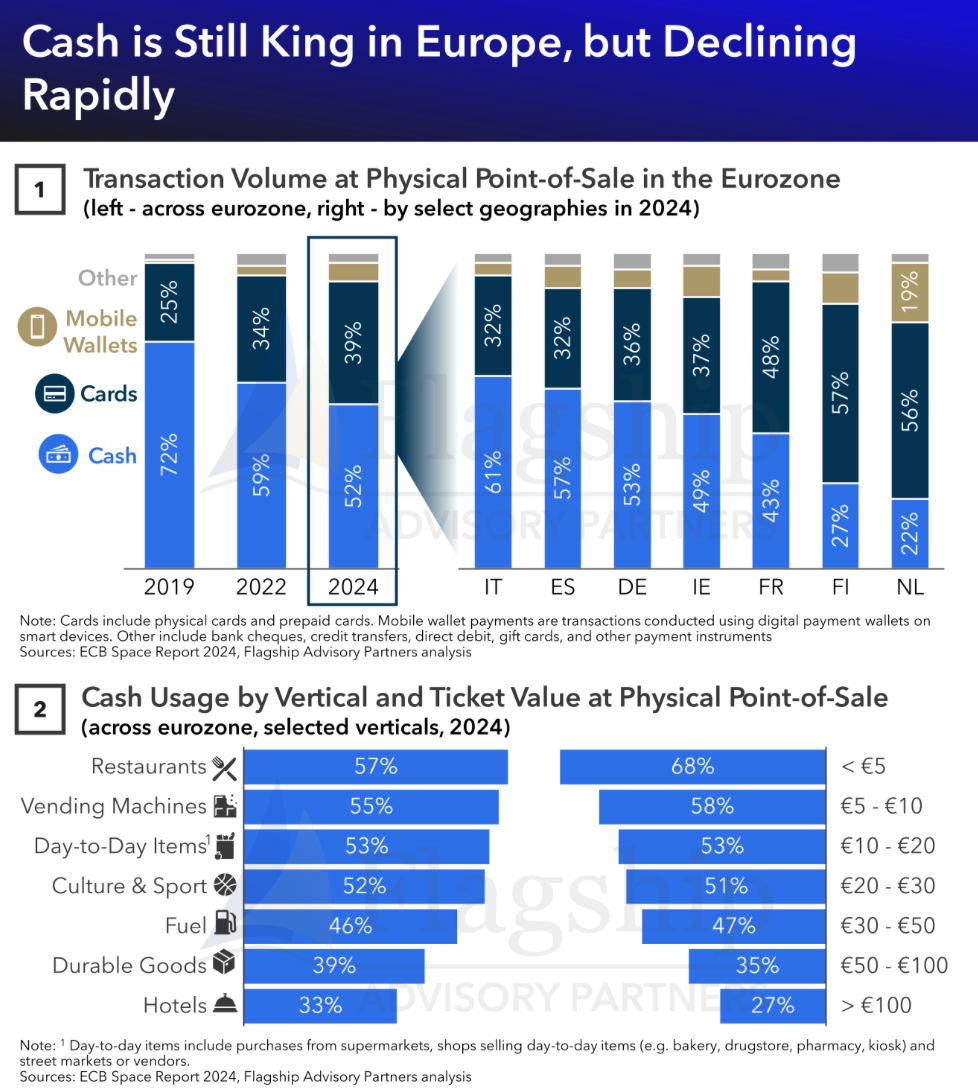

🇪🇺 Cash is still King in Europe, but its declining rapidly. While industry narratives often downplay the role of cash, cash remains a significant payment method at the European point-of-sale (POS).

PAYMENTS NEWS

🇧🇷 Digital scams are likely to increase in the coming years. Digital fraud is set to rise in 2025, with mobile devices as the main target, says Kaspersky. In Brazil, Pix scams remain the most common and could cost the country R$12 billion by 2028, warns ACI Worldwide. The Central Bank offers guidance as 76.4% of the population uses the service.

🇺🇸 Credit Builders Alliance and VantageScore expand nonprofit lenders pilot program. The platform developed in collaboration with data firm Pentadata provides lenders with a comprehensive view of consumers' financial behavior by combining traditional credit data with real-time, consumer-permissioned cash flow insights from bank accounts.

🇮🇹 Bancomat lands on Google Pay: Intesa Sanpaolo opens up to digital payments via smartphone. For the first time in Italy, the banking group’s customers can now add their card to Google Wallet and make payments directly with an Android smartphone.

🇶🇦 QNB joins hands with Harrods and Visa to provide ‘unrivalled’ payment experience. This collaboration will see the launch of the QNB Harrods co-branded Visa credit cards exclusively in Qatar, offering customers an unprecedented blend of superior, convenient, and secure payment methods.

🇵🇰 SBP launches 'Go Cashless' campaign to promote digital economy. This move is part of the central bank’s broader push to enhance financial inclusion and increase documentation of the economy through digital transactions. Keep reading

🇿🇦 Virtual cards surge in South Africa: safety, convenience drive adoption. According to the Visa and Discovery Bank SpendTrend25 South African Consumer Survey, 45% of respondents now use virtual cards, citing benefits such as reduced fraud risk and seamless digital transactions.

🇺🇸 Shift4 extends previously announced tender offer to acquire Global Blue. The offer is subject to certain conditions, including satisfaction of a minimum tender condition, for which the 90% threshold has been met, the receipt of regulatory approvals in certain jurisdictions, and other customary closing conditions.

🇯🇵 Square has appointed Stephen Adams as the Head of Japan. Adams previously served as Vice President at Visa Japan and was responsible for merchant sales and acquiring business. In his new role as Head of Japan, Adams will be responsible for accelerating business growth.

🇻🇳 FOMO Pay extends its payment solutions with the launch of VND accounts. The new feature enables simplified cross-border collections and payouts in the Vietnamese market and expands FOMO Pay digital payment solutions. Clients can now send and receive VND through locally established payment channels using their names.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()