Think You’re the Best in Payments? Prove It with Transacteroids!👾

Happy Black Friday Payments Fanatic!

Peak season is upon us, and for payments professionals, it’s a time of high stakes and endless challenges. But who says we can’t have a little fun along the way? 🎮

Yesterday, I took a break to try out Checkout.com’s Transacteroids game—I managed to score 598, and let me tell you, it was harder than I expected!

Set your sights on the stars and have a blast in Transacteroids 👾

Play now and share your Score in the comments! Let's see who's the best in the Payments Industry!

Let's have fun before the Black Friday rush - I'll catch you all on Monday with more updates! 👇

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

PAYMENTS NEWS

🇵🇭 ADB, Mastercard launch an innovative partnership to finance MSMEs in Asia and the Pacific. The initiative will initially target Georgia, India, Indonesia, Malaysia, the Philippines, Thailand, and Vietnam, using a $5 million Mastercard grant to boost lending to MSMEs, focusing on women-led businesses and climate finance.

🇨🇳 Visa and LianLian Global collaborate to launch Yueda Card. Through the integration of Visa’s global payment infrastructure and LianLian Global’s technological capabilities, the Yueda Card addresses payment needs in various sectors, including ecommerce, foreign trade, travel, and supplier transactions.

🇨🇦 RealDesk and Zum rails enable payment processing for Canadian real estate brokerages. This collaboration integrates Zum Rails’ payment processing with RealDesk’s real estate management platform, providing a solution to the challenges of disconnected, manual payment processes for real estate brokerages.

🇺🇸 Blindpay leverages Bitso Business technology to connect global tech firms with Latin America. Blindpay’s API enables seamless cross-border payments, leveraging Bitso Business infrastructure to link businesses with local payment channels, simplifying access to advanced payment technology.

🇺🇸 TCB Pay launches innovative corporate card program TCB Pay Issuing, to simplify business expenses. This innovative product aims to simplify corporate spending, offering a suite of features tailored to meet the needs of modern enterprises.

🇮🇹 Adyen and Doctolib partner on embedded financial products in healthcare. Doctolib is integrating Adyen's online payment and financial services into its digital healthcare platform, and recently launched in France and Italy with plans to expand to Germany and other European countries, according to a press release.

🇵🇭 GCash said to weigh record Philippine IPO of up to $1.5 billion. GCash has invited banks to pitch for an IPO in Manila aiming to raise $1-1.5 billion in the second half of 2025, according to people familiar with the matter. An IPO of that size would likely make it the biggest ever in the Philippines.

🇬🇧 SumUp surpasses 1 billion transactions per year and accelerates global expansion with record growth. This milestone marks a pivotal point in SumUp’s mission to help merchants start, run, and grow their businesses, highlighting its rapid expansion across multiple markets.

🇬🇧 Ex-Revolut duo raise $2.3 million to build 'blockchain bank account' Bleap. Joao Alves and Guilherme Gomes, former Revolut employees, believe that blockchain technology forms the foundation of the future of finance. The concept for Bleap began to take shape in July 2023. Find out more

GOLDEN NUGGET

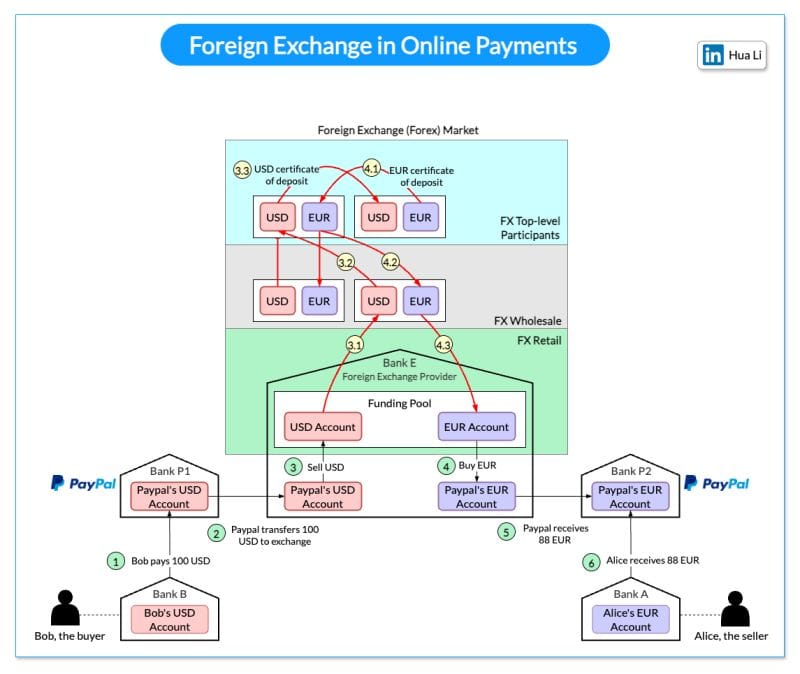

How do we settle foreign exchange in cross-border payments?

The diagram shows the information flow and settlement flow. Bob needs to pay 100 USD to Alice, who can only receive EUR.

Step 1 - Bob sends 100 USD via a third-party payment provider. In our example, it is Paypal. The money is transferred from Bob’s bank account (Bank B) to Paypal’s account in Bank P1.

Step 2 - Paypal needs to convert USD to EUR. It leverages the foreign exchange provider (Bank E). Paypal sends 100 USD to its USD account in Bank E.

Step 3 - 100 USD is sold to Bank E’s funding pool.

Step 4 - Bank E’s funding pool provides 88 EUR in exchange for 100 USD. The money is put into Paypal’s EUR account in Bank E.

Step 5 - Paypal’s EUR account in Bank P2 receives 88 EUR.

Step 6 - 88 EUR is paid to Alice’s EUR account in Bank A.

Now let’s closely examine the foreign exchange (forex) market. There are 3 layers:

🔹 Retail market. Funding pools are parts of the retail market. Paypal usually buys a certain amount of foreign currencies in advance to improve efficiency.

🔹 Wholesale market. The wholesale business is composed of investment banks, commercial banks, and foreign exchange providers. It usually handles accumulated orders from the retail market.

🔹 Top-level participants. They are multinational commercial banks that hold a large number of certificates of deposit from different countries. They exchange these certificates for foreign exchange trading.

When Bank E’s funding pool needs more EUR, it goes upward to the wholesale market to sell USD and buy EUR. When the wholesale market accumulates enough orders, it goes upward to top-level participants. Steps 3.1-3.3 and 4.1-4.3 explain how it works.

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()