The Rise of Apple Pay: Key Stats and Trends You Need to Know

Hey Payments Fanatic!

Apple Pay continues to dominate the digital wallet landscape, boasting a staggering 500 million global users.

The numbers are nothing short of extraordinary, reflecting Apple Pay's rapid growth and widespread adoption across the globe. In 2022, Apple Pay processed an impressive $6 trillion in payment volume, generating $1.9 billion in revenue.

This places Apple Pay in close competition with payment giants like Mastercard, which processed $8.2 trillion, and Visa, with $14 trillion in payment volume. It's worth noting that many of these transactions leveraged Mastercard and Visa's infrastructure, underscoring Apple's significant stake in the payment ecosystem.

Here's a deeper dive into Apple Pay's impressive stats and market penetration:

Global Reach and Adoption

- Apple Pay is available in 83 countries worldwide, demonstrating its global reach.

- In 2024, an estimated 60.2 million users in the United States will leverage Apple Pay, with projections indicating over 75 million users by 2030.

- By 2023, Apple Pay was responsible for 12.6% of all online consumer payments and 3.1% of all in-store purchases.

- Over 90% of U.S. retailers accept Apple Pay, highlighting its widespread acceptance and convenience.

Consumer Stats and Market Trends

- 21.2% of Americans aged 14 and above are projected to use Apple Pay in 2024.

- 48.7% of Americans owned iPhones in 2022, providing a substantial potential user base for Apple Pay.

- The number of global Apple Pay users has surged by 26.2% since 2020, with an 18.5% increase in the U.S. alone since 2022.

- During the Black Friday/Cyber Monday shopping frenzy in 2022, 12.7% of shoppers used Apple Pay, up from 7.8% in 2021.

Demographics

- 73.1% of Gen Z digital wallet users utilized Apple Pay at least once a week.

- 51.1% of Millennials, 52.4% of Gen X, and 43.9% of Baby Boomers used Apple Pay in the same period.

- High-income users (earning over $100,000 annually) showed a strong preference for Apple Pay, with 57% using it regularly.

Country-Specific Usage

- The United Kingdom leads in Apple Pay penetration, with 67% in-store and 40% online usage.

- Canada follows closely, with 65% in-store and 34% online usage.

- The United States ranks third, with 60% in-store and 38% online usage.

- Australia also shows significant usage, with 52% in-store and 39% online.

- France, the Netherlands, Germany, and Spain show varying degrees of adoption, with France at 59% in-store and 19% online, the Netherlands at 46% in-store and 25% online, Germany at 43% in-store and 17% online, and Spain at 30% in-store and 15% online.

These statistics underscore Apple Pay's phenomenal growth and its increasingly crucial role in the global payments ecosystem. Whether in-store or online, more and more consumers are turning to Apple Pay for its convenience, security, and seamless integration with their Apple devices.

Cheers,

Join my Telegram channel for instant access to daily updates and exclusive breaking news from the Payments industry. Connect with fellow Payments Fanatics and stay ahead with the latest trends and insights.

INSIGHTS

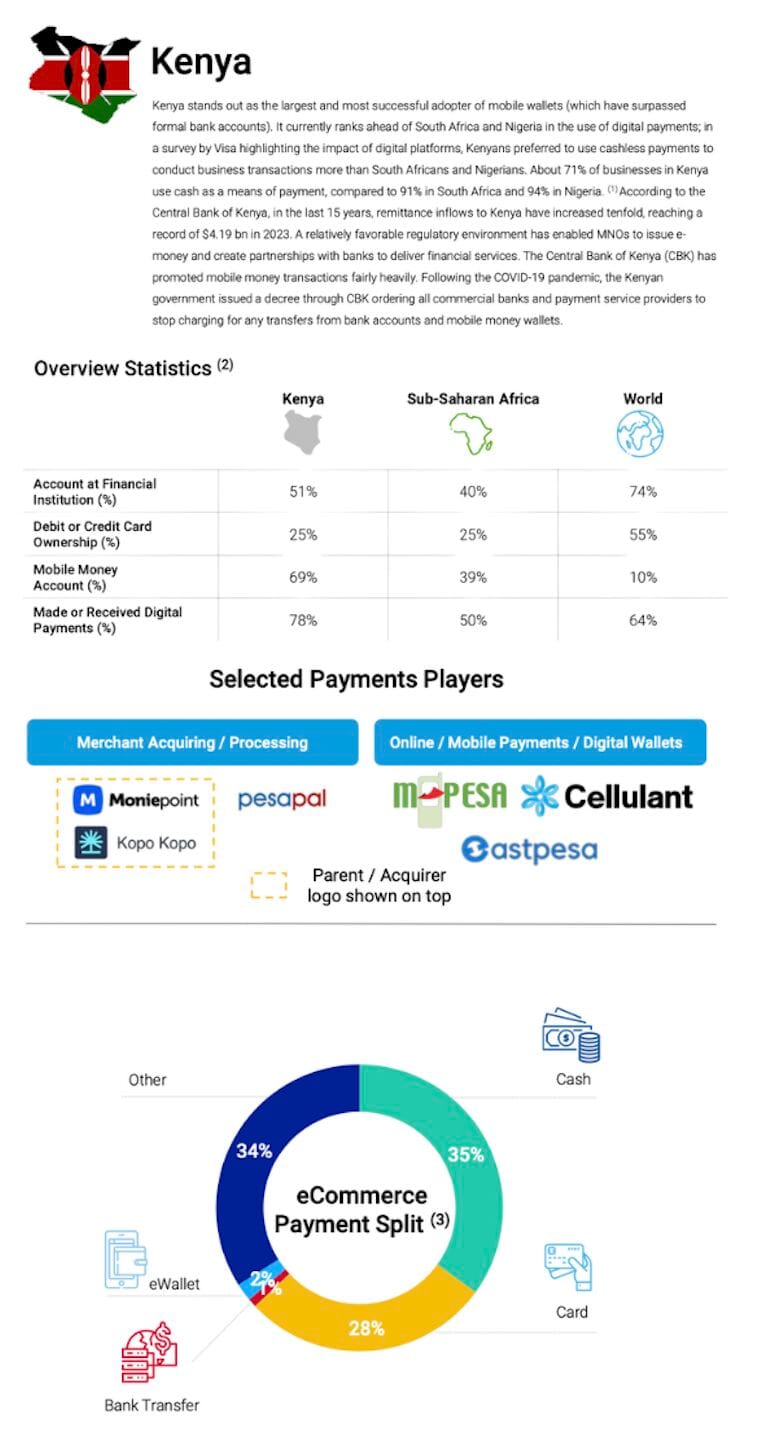

🇰🇪 Kenya: A Pioneer in the Wave of Digital Payments.

Let's dive into Kenya’s Payments Ecosystem:

PAYMENTS NEWS

🇸🇪 Zimpler and Swish partnership boosts merchant payment efficiency and growth. This collaboration will provide Zimpler’s merchants with an optimized payment solution combining the strengths of Zimpler’s account-to-account (A2A) payments and Swish’s seamless transaction capabilities.

🇵🇭 AllBank has announced its partnership with online payment gateway SKYPAY in order to offer customers and clients in the Philippines the possibility to use QR payments. The partnership reflects the shared commitment to offer secure, efficient, and extended services for the convenience of clients and merchants.

🇬🇧 Worldline deepens BKN301 alliance, targets EMEA FinTech growth. Both companies extended their partnership, integrating Worldline's Issuing and Acquiring solutions into BKN301's services. This collaboration aims to enhance digital payment offerings in EMEA markets.

🇩🇪 Security tech company Giesecke+Devrient (G+D) unveiled G+D Filia Unplugged, its offline payment solution. One of the features of the tokenized payment solution is that it works with existing payment systems, mobile money services, and future commercial bank tokenized deposit systems.

🇦🇪 Adyen and noon join forces to transform the UAE e-commerce landscape with advanced payment solutions. Through this partnership, both companies aim to enhance customer experience, streamline payment processes, and drive innovation across the region.

GOLDEN NUGGET

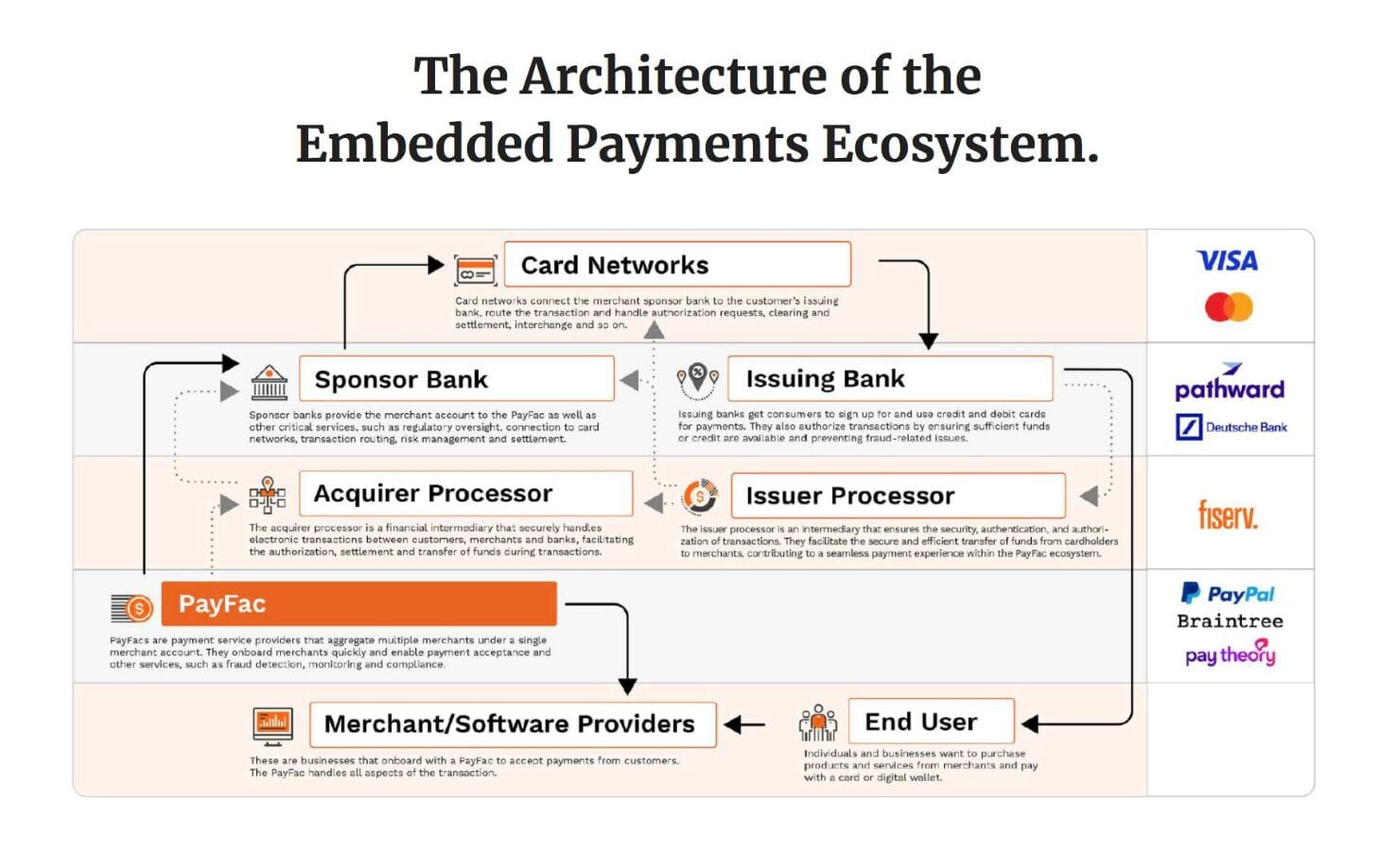

The PayFac Economy and the Embedded Payments Revolution.

The PayFac Ecosystem handles transactional, regulatory, fraud, and risk needs for businesses integrating digital payments without becoming payment providers. It is dynamic, with entities often playing multiple roles:

𝗣𝗹𝗮𝘁𝗳𝗼𝗿𝗺𝘀 𝗮𝗻𝗱 𝗜𝗻𝘁𝗲𝗿𝗺𝗲𝗱𝗶𝗮𝗿𝗶𝗲𝘀

Platforms and intermediaries form the backbone of the digital economy. These are the businesses directly interacting with end users, where the core transactions necessitating embedded digital payments occur. Examples include businesses or marketplaces that connect buyers and sellers of products.

𝗣𝗮𝘆𝗙𝗮𝗰𝘀 (𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗙𝗮𝗰𝗶𝗹𝗶𝘁𝗮𝘁𝗼𝗿𝘀)

PayFacs provide the essential payments infrastructure that enables platforms and intermediaries to incorporate payment services into their offerings. They are crucial for software providers, offering straightforward payment capabilities that are easy to integrate and use.

𝗔𝗰𝗾𝘂𝗶𝗿𝗲𝗿𝘀/𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗣𝗿𝗼𝗰𝗲𝘀𝘀𝗼𝗿𝘀

Payment processors are pivotal in the onboarding and transaction handling of merchants within this ecosystem. These specialized entities connect merchants with card networks, acquiring banks, and issuing banks, utilizing advanced technology infrastructure to manage payment transactions efficiently.

𝗦𝗽𝗼𝗻𝘀𝗼𝗿 𝗕𝗮𝗻𝗸𝘀

Sponsor banks empower non-bank entities to provide financial services by supplying the necessary banking infrastructure, regulatory guidance, and access to payment networks. They ensure compliance with financial regulations and manage associated risks.

𝗜𝘀𝘀𝘂𝗶𝗻𝗴 𝗕𝗮𝗻𝗸𝘀

Issuing banks play a critical role in the ecosystem by issuing payment cards to consumers. They handle the authorization, clearing, and settlement of digital payments for these cards, often partnering with issuing processors to manage these functions on their behalf.

𝗜𝘀𝘀𝘂𝗲𝗿 𝗣𝗿𝗼𝗰𝗲𝘀𝘀𝗼𝗿𝘀

Issuer processors link issuing banks with card networks, facilitating the authorization and settlement of transactions.

𝗖𝗮𝗿𝗱 𝗡𝗲𝘁𝘄𝗼𝗿𝗸𝘀

Card networks are responsible for the clearing and settling of transactions between banks and merchants when customers use their card products. These networks connect banks, ensuring that card credentials are routed correctly from the merchant's bank to the cardholder's bank. They also establish operating rules, maintain security standards, and assist in resolving disputes.

This interconnected web of participants and functions creates a robust and flexible framework for embedded payments, enabling businesses to enhance their digital offerings seamlessly.

Source: "The PayFac Economy and the Embedded Payments Revolution" by PYMNTS.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn.

Comments ()