The Latest on Bolt’s Controversial Funding Strategy

TGIF! 😉

Bolt’s latest move to raise $450 million at a potential $14 billion valuation is stirring controversy.

The one-click checkout startup, led by founder Ryan Breslow, has proposed a deal that pressures existing shareholders to either buy more shares at higher prices or risk having their shares bought back for just 1 cent each. This bold move comes as Breslow, who stepped down in 2022 amid legal and investor controversies, returns as CEO.

The deal, which aims to infuse significant capital, is facing resistance from some investors, especially concerning Breslow’s potential $2 million bonus for resuming leadership. Legal experts suggest that while the deal may be possible, it will require approval from a majority of preferred shareholders, making it a tough sell.

Despite the contentious nature of this proposal, the reality of the situation may push investors to agree, especially if the alternative is financial instability for the company.

The high stakes and legal complexities of this "pay-to-play" strategy have created a tense atmosphere, but the outcome remains uncertain as negotiations continue.

I highly recommend reading this interesting interview from Mary Ann Azevedo with teh VC leading this proposal.

To be continued after the weekend!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

🎙️ This month, Ingopay CEO Drew Edwards sat down with Nik Milanović for This Week in FinTech’s monthly podcast. Drew discussed his 25+ years of experience in the FinTech industry, where Ingo Payments has been and where it’s going, and more.

PAYMENTS NEWS

🇺🇸 Checkout 's Chief Operating Officer, Jenny Hadlow is now at the helm of key operational areas supporting the company’s customer journey, including Revenue Operations, Merchant Operations, and Risk Operations. Find out more about her career path, her advocacy for DEIB, and her vision for the future.

🇨🇦 Transact365 achieves Canadian licence. The UK-based global payments platform, powering merchants across the globe, has expanded further by growing its offering of solutions with its new Canadian FINTRAC MSB license.

🇺🇸 InvoiceASAP selects Adyen to offer instant payouts, leveraging FedNow certification. The partnership focuses on providing instant access to deposited funds and capital for InvoiceASAP users. Adyen’s certification with the FedNow™ Service will support instant access to funds.

🇺🇸 Convera, a FinTech in commercial payments, introduced its embedded payments solution for the education industry through its new partnership with Ascent One, an ecosystem purposely built for the education sector. The solution aims to simplify cross-border payments for education agents and international students.

🇺🇸 Ex-Checkout.com duo raise $4.5m to help platform companies streamline their payments. Fika Ventures led the round for Revenew, which aims to help platform businesses like Uber or Spotify to streamline their payments operations. Dash Fund and TTV Capital also participated in the fundraise.

🇰🇼 Tether invests $3 million in Kuwaiti P2P payments app Kem. This landmark deal is set to improve regional adoption of USD₮, combining Tether’s commitment to expanding access to digital finance systems with Kem’s position as an emerging real-time payments leader in the Gulf region.

🇲🇾 India’s UPI and Malaysia’s PayNet to connect for Instant Cross-Border Payments. The move aims to further India’s ongoing efforts to expand its instant payment network globally. PayNet reaffirmed that it is dedicated to enhancing Malaysia’s financial infrastructure through continuous innovation and strategic partnerships.

🇮🇳 Banking Circle and Skydo join forces to streamline cross-border collections for Indian businesses. The collaboration aims to support Indian businesses operating globally by providing them with seamless, efficient and cost-effective payment solutions, enabling them to thrive in international markets.

🇬🇧 DNA Payments arrives on Oracle Cloud Marketplace. DNA Payments announced its Pay at Reception, Pay at Counter and Pay at Table solutions are now available on Oracle Cloud Marketplace and can be deployed on Oracle Cloud Infrastructure (OCI).

GOLDEN NUGGET

💵 What are instant payouts, and how do they work?

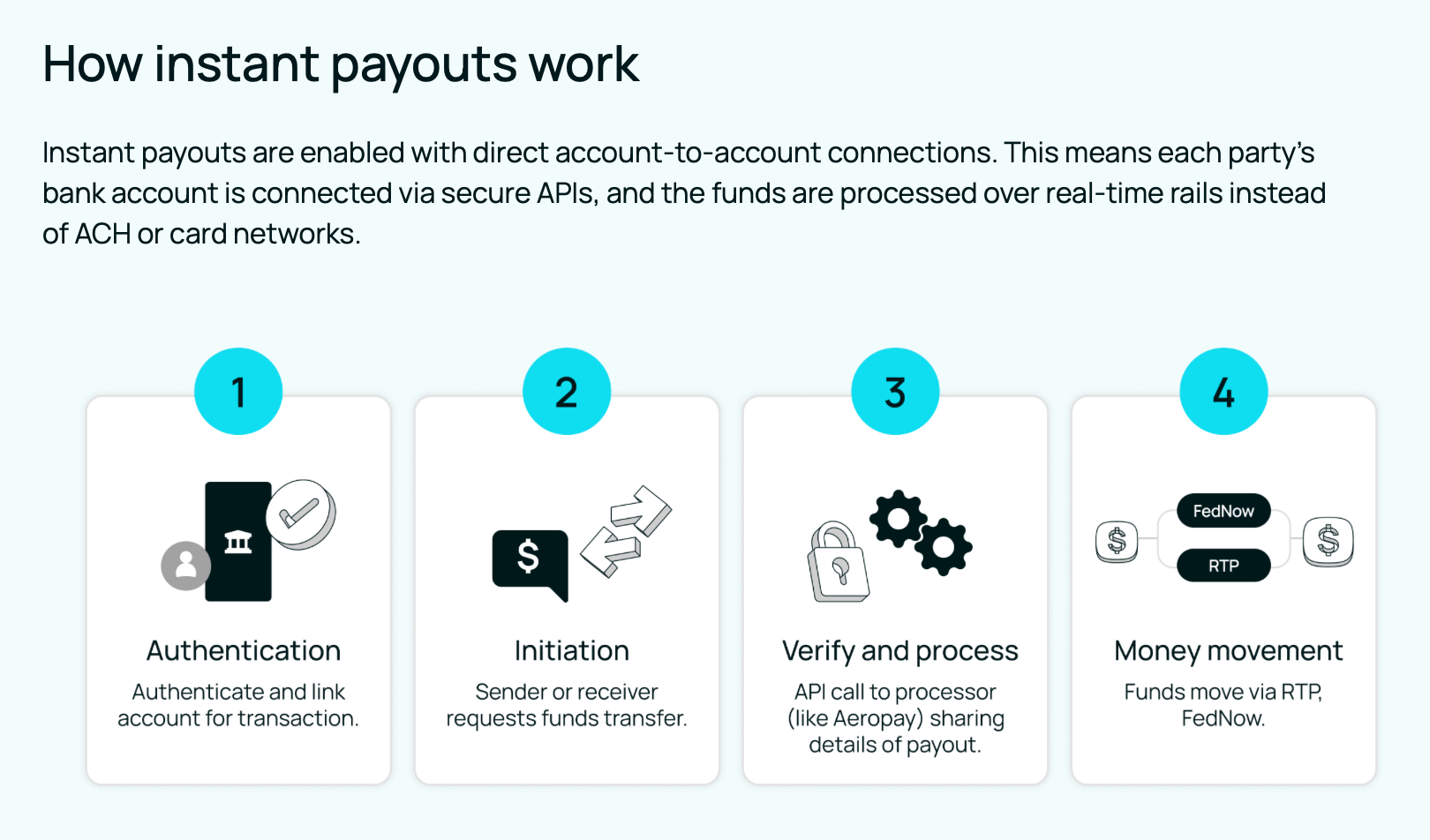

The process involves 4 key steps:

But first: 𝗪𝗵𝗮𝘁 𝗮𝗿𝗲 𝗶𝗻𝘀𝘁𝗮𝗻𝘁 𝗽𝗮𝘆𝗼𝘂𝘁𝘀?

Instant payouts transfer funds from businesses to consumers in real-time, even during holidays, weekends, or after business hours — offering faster settlement than standard ACH payout schedules that take T+3 business days to process.

Instant payouts use application programming interfaces (APIs) to link banks and connect with real-time payment rails like RTP and FedNow, enabling faster payment processing times than standard payouts.

With instant payouts, businesses can send funds, or enable user withdrawals, directly and immediately. The receiver doesn’t wait for their payment and the sender sees funds transfer instantly.

Instant payout providers — like Aeropay (thanks for the great source article 👌) — enable and automate instant settlement payouts, helping reduce the manual time needed to manage payouts and increasing the likelihood the payout will be successful.

𝗛𝗼𝘄 𝗱𝗼 𝗜𝗻𝘀𝘁𝗮𝗻𝘁 𝗣𝗮𝘆𝗼𝘂𝘁𝘀 𝘄𝗼𝗿𝗸?

Instant payouts are enabled with direct account-to-account connections. This means each party’s bank account is connected via secure APIs, and the funds are processed over real-time rails instead of ACH or card networks.

The 4 step process:

1️⃣ Authentication: Before the first instant payout, the receiver’s account must be linked and verified using a bank API like Aerosync.

2️⃣ Initiation: The receiver requests a payout through their chosen method, such as withdrawing funds from an online platform.

3️⃣ Processing: The payment processor verifies the payout details, including the amount and recipient’s info, to ensure security and accuracy.

4️⃣ Money Movement: Once approved, funds are transferred from the merchant to the receiver via RTP, FedNow, or ACH, depending on bank connections.

60% of businesses now prioritize quicker access to funds. They're exploring and adopting emerging open banking money movement methods like pay-by-bank (also known as A2A payments).

Similarly, consumers are growing accustomed to faster payouts for rewards, withdrawals, and payments.

Instant payouts bring immediate settlement to the United States, where funds traditionally take days or even weeks to hit customer accounts.

For businesses in 2024, the reality is your customers want faster payouts — and they are willing to switch platforms to get them.

I highly recommend reading the deep dive article for more interesting info on this topic.

Source: Aeropay

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()