Tap to Pay on iPhone Expands in Europe

Hey Payment Fanatic!

Tap to Pay on iPhone is expanding across Europe, reaching five new countries and bringing the convenience of contactless payments to even more businesses. Now, merchants in Austria, Czech Republic, Ireland, Romania, and Sweden can transform their iPhones into NFC-powered payment terminals—no extra hardware needed!

For those new to it, Tap to Pay on iPhone lets businesses accept payments by simply holding an iPhone near a customer’s contactless card, iPhone, or Apple Watch. It's powered by the same Secure Element that makes Apple Pay transactions private and secure, so businesses can count on seamless and safe transactions every time.

Major payment players like Adyen, SumUp, and Viva are already on board, supporting the rollout across all five new markets. Plus, Stripe, Global Payments, Nexi, Revolut, and others are stepping in to give businesses a range of payment options.

This will make it easier for small and large businesses alike to go fully contactless, what do you think about this Apple move?

Keep scrolling if you’re interested in reading a bit about what’s been happening in Payments!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

📊 ACI Worldwide study reveals real-time payments to boost global GDP by $285.8 billion, create 167 million new bank account holders by 2028. ACI’s second Real-Time Payments: Economic Impact and Financial Inclusion report leverages data from 40 countries and reveals—for the first time—an empirical link between real-time payments and financial inclusion.

PAYMENTS NEWS

🇺🇸 Viably and Airwallex launch cross-border payment solution for eCommerce businesses. The Viably Global Account, powered by Airwallex, allows sellers to pay vendors and suppliers around the world, collect payouts from marketplaces and manage all financial aspects of their business, the companies said in a recent press release.

🇸🇬 Thunes and Circle to launch stablecoin-powered liquidity management solution. This collaboration enables Thunes’ network members to use USDC for faster, seven-day cross-border transactions, improving liquidity, reducing capital costs, and offering growth opportunities through cost-effective payments.

🇸🇦 Checkout.com pulls in $2 million extra revenue for MENA FinTech unicorn Tamara. Partnering with Checkout.com, Tamara drastically reduced failed transactions and improved payment collection, adding $2 million in revenue during a pilot phase. Learn more

🇺🇸 PayPal's revenue forecast fails to impress as profit push puts growth behind. PayPal raises its annual profit forecast as spending remains strong, but shares fall 5% after a weak Q4 revenue outlook. The company is moderating growth in Braintree and other low-margin businesses, shifting its focus to high-margin opportunities.

🇨🇦 Tappy launches payments and fitness ring. The ring can be tokenized with users' debit, credit, and prepaid cards. It has been designed for fitness enthusiasts and tech-savvy consumers, providing an alternative to traditional trackers.

🇸🇦 Orange Middle East and Africa and Mastercard partner to digitize payments for millions across Africa by 2025. This collaboration, one of the largest in the region, will enable millions of Orange Money users to access digital payments via Mastercard’s global network by 2025, starting in seven countries.

🇨🇦 PSP Services Inc. announces agreement to acquire the NCR Atleos debit card Production and Transaction Processing Business in Canada. The company views this acquisition as strengthening its leadership in the Canadian FinTech industry and enabling credit unions and financial institutions using the acquired assets to access new payment solutions.

🇵🇪 Yape Peru's Supper App and TerraPay join forces to accelerate digital inclusion. The collaboration allows TerraPay Global network partners to send instant international transfers to Yape users, giving them immediate access to funds and financial services within the app.

🇭🇰 Tribe Payments partners with PhotonPay for issuer processing. As a trusted payments solution provider, Tribe meets PhotonPay's needs for flexibility, scalability, and customization. Tribe’s developer-led APIs allowed PhotonPay to launch a pilot in weeks, making Tribe a key partner for global deployment.

🇮🇳 Amazon Pay India loss narrows as sales rise, expenses decline. Amazon Pay India’s loss narrowed almost 40% from the previous year to 9.1 billion rupees ($108 million), according to company filings sourced through Tofler. Keep reading

🇮🇳 Cashfree Payments gains regulatory approval to operate as a PPI provider. This enables the firm to issue prepaid payment instruments, such as cards or digital wallets, and opens up new opportunities for innovation in the payments landscape. Read on

🇬🇧 PayPoint unveils new partnership with Leeds Credit Union. The partnership allows LCU customers to access their cash and savings at any of PayPoint's 29,000 UK retailers, expanding access beyond LCU’s four branches for the first time.

🇿🇦 Standard Bank partners with Volante to revolutionize payment systems across Africa. The partnership, now live in South Africa, uses Volante’s Payments as a Service (PaaS) and Embedded Preprocessing to centralize multiple payment formats and standards into a single system, working alongside existing infrastructure.

🇩🇪 Paysafe partners with Deutsche Bank to provide private customers with easy access to cash services. Paysafecash (branded "viacash" in Germany) will allow banking customers in Germany to deposit and withdraw cash from their accounts. The service starts with Postbank in November with plans to expand to Deutsche Bank in late 2025.

GOLDEN NUGGET

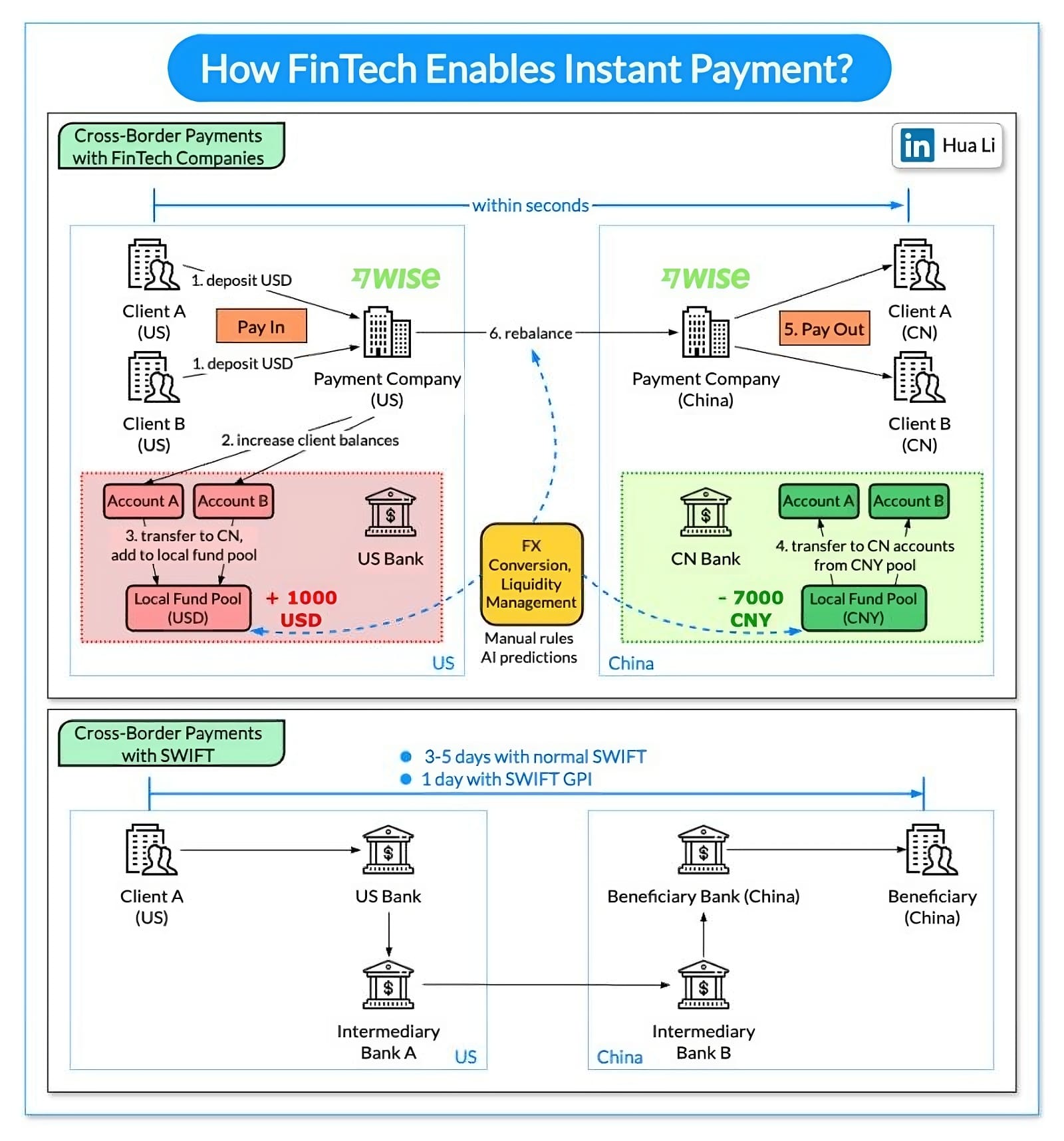

How do FinTech companies enable Instant Payment for cross-border transactions?

👉 The secret is to 𝐛𝐲𝐩𝐚𝐬𝐬 the existing SWIFT-based cross-border payments. FinTech companies maintain their 𝐥𝐨𝐜𝐚𝐥 𝐥𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐩𝐨𝐨𝐥𝐬 and frequently rebalance them. Companies like Wise and Revolut adopt similar approaches.

The diagram above shows a comparison between FinTech and SWIFT implementation.

🔹 FinTech Approach

Steps 1 - 2: The clients deposit money into their US accounts. The FinTech company tops up the accounts in the bank. This is called Pay In.

Step 3: The clients need to transfer 1000 USD to China accounts. The money is deducted from their accounts and added to the local USD pool.

Steps 4 - 5: 7000 CNY is transferred from the local CNY pool to clients’ CNY accounts. This is called Pay Out.

Step 6: Since the dollars are not moved from the US to China, the liquidity pools will be imbalanced over time. We need to constantly rebalance the pools to make sure there is enough liquidity in both countries. We can set up rules or use machine learning algorithms (Long Short-Term Memory) to predict fund movements.

🔹 SWIFT Approach - Separation of Information and Settlement Flows

The sending bank sends the SWIFT message to the recipient bank using the SWIFT network. This message contains instructions for the recipient bank to credit the funds to the designated account.

Often, payments are routed through intermediary banks (correspondent banks) if the sender and recipient banks do not have a direct relationship. The payment flows from the sender's bank to a correspondent bank, which then forwards it to the recipient's bank.

After receiving the SWIFT message, the recipient bank verifies the details and credits the recipient's account. The actual transfer of funds may occur through various settlement systems, depending on the countries and currencies involved.

🔹 Latency Comparison

FinTech companies usually take seconds to minutes to finish the cross-border transfers. SWIFT requires a much longer time (days).

I highly recommend following Hua Li for more interesting insights like this one.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()