Swift Launches AI Fraud Defense for Cross-Border Payments

Hey Payment Fanatic!

Swift is stepping up the game in fraud prevention with its latest AI-enhanced fraud detection service, set to launch in January 2025. After a successful pilot, this new feature promises real-time detection of suspicious transactions by analyzing billions of data points across Swift's vast network.

“Bad actors are using increasingly sophisticated tactics to commit financial crime," notes Jerome Piens, Swift's Chief Product Officer. "The global financial industry needs to raise its defenses higher to ensure customers can continue to transact globally with confidence."

As part of Swift’s strategic initiative to fortify transaction security and streamline cross-border payments, the rollout draws on insights from collaborations with over 11,500 financial institutions worldwide. This collective effort includes industry leaders like BNP Paribas and Standard Bank Group, both recognizing the impact of AI in safeguarding their clients' assets.

With global fraud costing the financial services sector an estimated $485 billion last year, Swift’s innovative approach aims to bolster the industry’s defenses. This enhanced service marks a significant step in Swift's mission to make international transactions not only faster but also more secure and trustworthy.

More updates on the payments industry to follow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

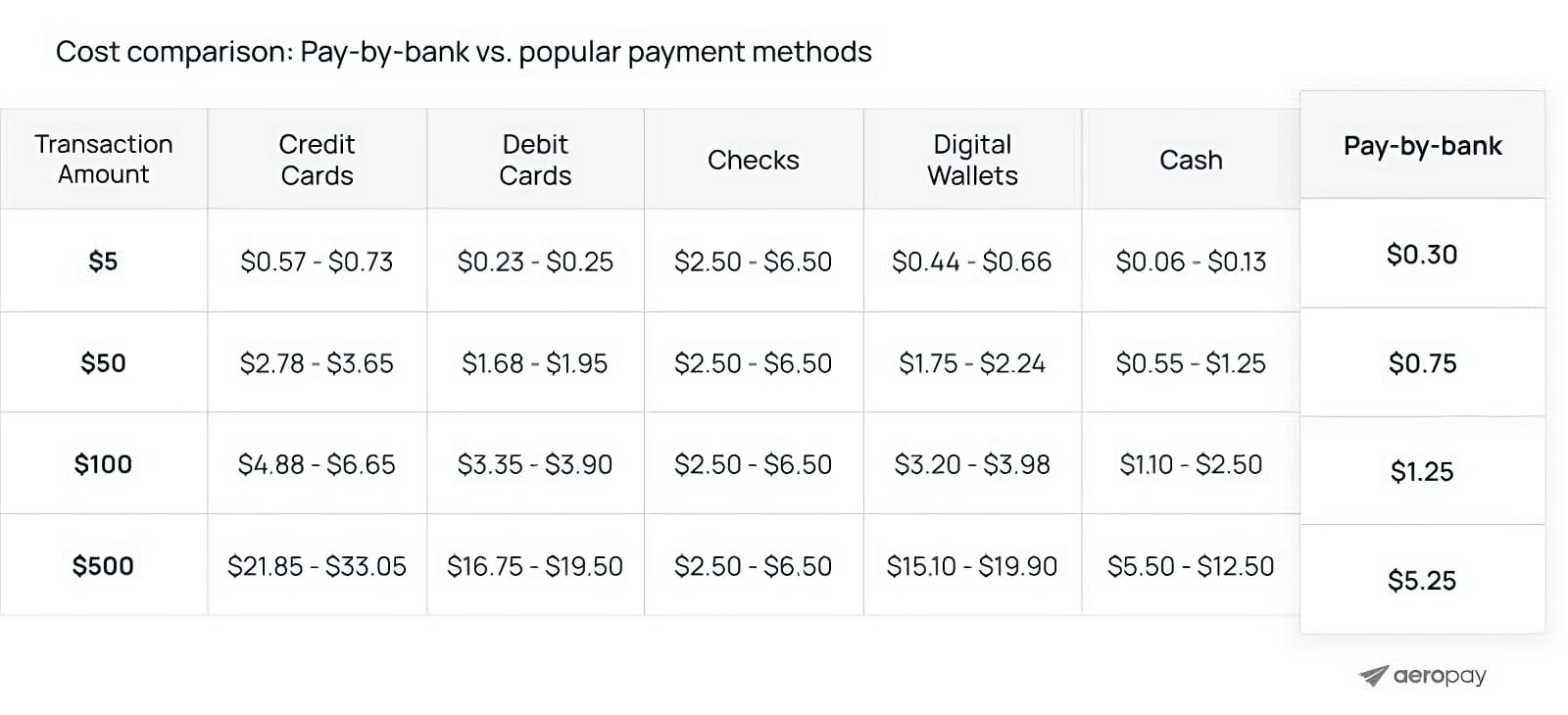

Cost comparison: Pay-by-bank 🆚 popular payment methods.

PAYMENTS NEWS

🇺🇸 ACI Worldwide appoints Erich Litch as Head of Merchant Solutions. In this role, Litch will lead ACI’s merchant strategy and product vision, shaping the go-to-market approach for ACI’s merchant solutions. He brings over 20 years of executive leadership experience in SaaS and tech businesses in payments and contracting.

🇳🇱 Mollie, one of Europe’s fastest-growing financial service providers, announced its integration with HubSpot, the customer platform for scaling businesses. The new integration will enable businesses across The Netherlands, Belgium, Germany, France and the UK to initiate and track payments directly from HubSpot in seconds, making CRM payment processing faster and saving hours of work each month.

🇬🇧 Storfund and Mangopay deepen partnership with embedded wallet solution for marketplace sellers. Through this partnership, Storfund will now leverage Mangopay’s embedded wallet, local accounts, and FX solutions to boost the support it offers on its own platform.

🇺🇸 AI in Payments: Transforming security, speed, and efficiency, by PayQuicker. Artificial intelligence (AI) in payments revolutionizes transaction processing, improving efficiency, security, and personalization. It refers to applying machine learning and natural language processing to streamline various aspects of the payments industry.

🇺🇸 Pivot joins Amex sync to provide better cash flow management. The integration lets Amex business and corporate card members generate virtual cards within PivotLynx, Pivot Payables’ accounting automation application, getting requests to managers for budget approval and cost accounting.

🇺🇸 Tyfone launches Payfinia Inc. to disrupt instant payments digital user experience. This new venture utilizes Tyfone’s expertise in digital banking UX and IP, built through the successful launch of the Instant Payment Xchange (IPX), a scalable gateway to the FedNow Service.

🇺🇸 Brex and Navan join forces to launch business travel and payments solution. The firms have teamed up to launch BrexPay for Navan, a new tool that will allow companies to use their existing payment cards while benefitting from automated receipts and reconciliation.

🇬🇷 Payment Components unveils the next evolution of FINaplo.AI. After the launch of the first Generative AI Assistant for payment transaction analysis, the latest version of FINaplo.AI is set to transform how financial institutions access and manage their internal knowledge.

🇧🇷 EBANX enables merchants to prepare for Pix recurring payments. The company’s partners will be able to start backend development and access a simulated environment that allows them to test their integrations of EBANX’s application programming interface (API) for Pix Automático.

🇬🇧 UK retailer Currys has unveiled Currys Flexpay, a revamped credit product to allow its customers to pay for tech at their pace. It arrives as a credit product that gives customers extra flexibility when purchasing their tech.

🇸🇪 Findity integrates with Mastercard, Visa to simplify business expenses. The firm has launched its innovative real-time Card Functionality which allows users to connect any Mastercard or Visa with their expense management platform to simplify the process of tracking and managing expenses in real-time.

🇷🇴 RoPay: Romania launches instant mobile payment system. TRANSFOND, the Romanian Banking Association, and the broader banking community in Romania announced the launch of the RoPay system, which allows users to conduct instant mobile payments in alignment with the national payment scheme.

🇬🇧 Tide and Adyen unite to enhance small businesses payments with Tap to Pay on iPhone. Merchants of all sizes can now accept all forms of contactless payments. This new ability will help new and existing Tide customers with a smoother checkout experience.

🇺🇸 One Inc and J.P. Morgan Payments collaborate to enhance unified payment platform for insurance. This collaboration integrates J.P. Morgan Payments with One Inc’s PremiumPay® and ClaimsPay® solutions, allowing insurance carriers to access One Inc’s complete suite of digital payment services.

🇺🇸 Klarna is offloading most of its UK “buy now, pay later” portfolio to US hedge fund Elliott for undisclosed terms, in a deal that will free up as much as £𝟑𝟎𝙗𝙣 for new loans, according to people familiar with the matter. Get the full story

GOLDEN NUGGET

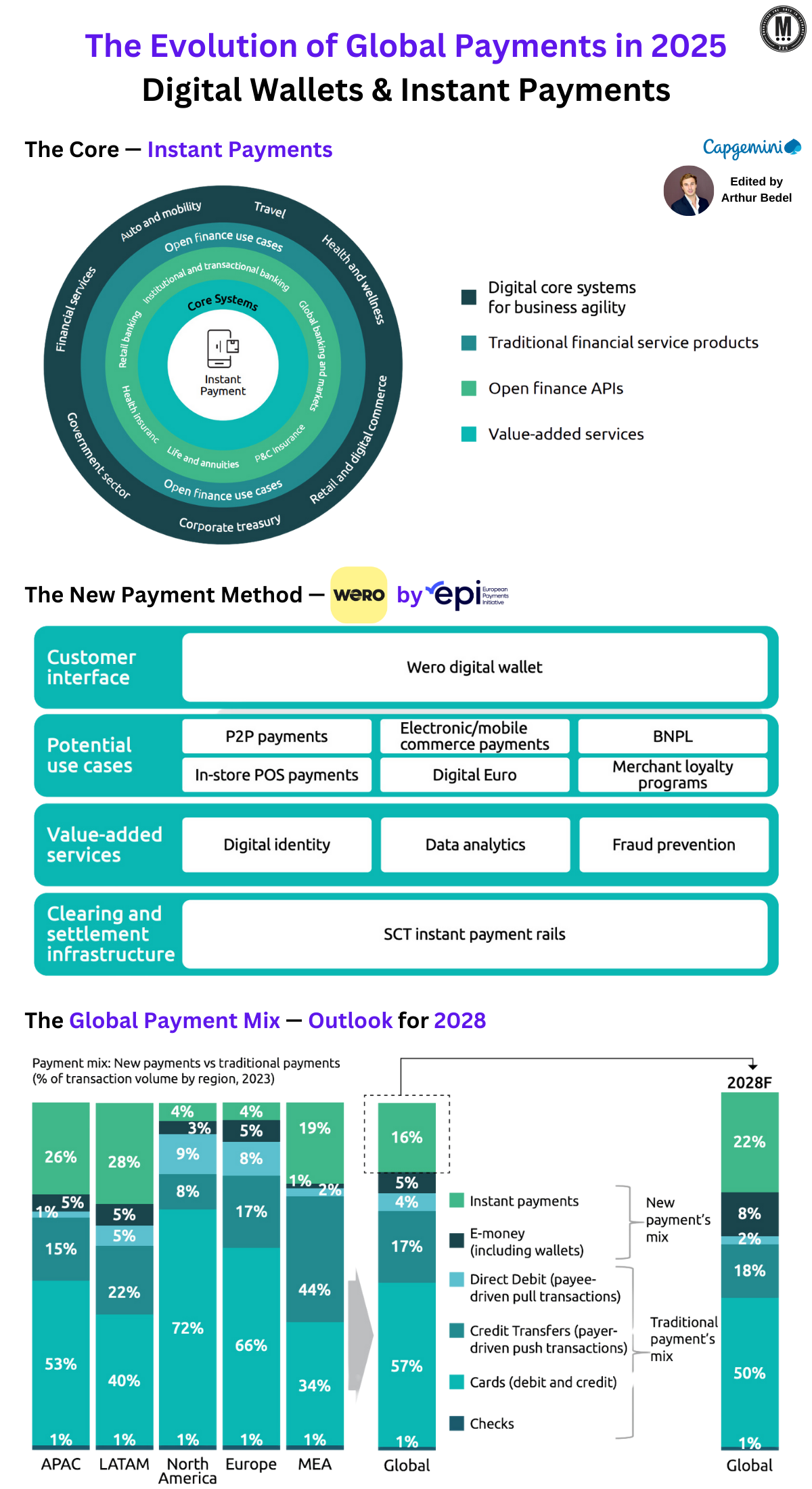

𝐓𝐡𝐞 𝐄𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐨𝐟 𝐆𝐥𝐨𝐛𝐚𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐢𝐧 2025.

The dawn of 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 & 𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬👇

The global payments industry is continuing to undergo a significant shift from traditional methods like cash and checks to digital transactions. By 2025, digital transactions will dominate the landscape reaching 2.8B+ transactions.

𝐖𝐡𝐚𝐭’𝐬 𝐝𝐫𝐢𝐯𝐢𝐧𝐠 𝐭𝐡𝐢𝐬 𝐜𝐡𝐚𝐧𝐠𝐞?

𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫 𝐃𝐞𝐦𝐚𝐧𝐝: consumers are seeking faster, more convenient ways to pay, both online and in-store. This has fueled the rise of:

🔸 digital wallets

🔸 mobile-based payments

🔸 instant transfers

𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐈𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧: Governments worldwide are backing initiatives like open finance and instant payment. This is helping break down the silos between banks, fintechs, and other financial players, creating a more integrated, user-centric financial environment.

𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐢𝐜𝐚𝐥 𝐁𝐫𝐞𝐚𝐤𝐭𝐡𝐫𝐨𝐮𝐠𝐡𝐬: The rise of APIs, AI-driven fraud detection, and cloud-based infrastructure is enabling faster and more secure transactions.

𝐖𝐡𝐢𝐜𝐡 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐞𝐭𝐡𝐨𝐝𝐬 𝐚𝐫𝐞 𝐬𝐞𝐭 𝐭𝐨 𝐝𝐨𝐦𝐢𝐧𝐚𝐭𝐞?

𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬: ApplePay, Google Pay and others… for contactless payments in-store and online

𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Real-time Payments (RTP) using account-to-account (A2A) transfers is becoming a go-to method for retail, P2P, and business payments.

𝐁𝐮𝐲 𝐍𝐨𝐰 𝐏𝐚𝐲 𝐋𝐚𝐭𝐞𝐫 (BNPL): Especially for e-commerce and retail purchases, allowing consumers to pay in installments.

QR Code Payments: Particularly in Asia and Latin America for small value purchases.

𝐂𝐫𝐲𝐩𝐭𝐨𝐜𝐮𝐫𝐫𝐞𝐧𝐜𝐲 & 𝐂𝐁𝐃𝐂𝐬: Early stages, digital currencies are gaining traction, with several central banks piloting CBDCs for domestic and cross-border transactions.

𝐖𝐞𝐫𝐨 — Europe’s New Digital Wallet for Instant Payments

At the forefront of this transformation in Europe is Wero, the digital wallet developed by the European Payments Initiative (EPI) to unify payments across Europe.

Instant, cross-border money transfers: Send & receive money in seconds using just phone numbers, QR codes, or email addresses

Lower fees for merchants

Security and innovation: Fraud detection & Authentication ins included in the technology

Future growth: By 2025, Wero plans to support in-store payments, BNPL, & loyalty programs

𝐖𝐡𝐚𝐭’𝐬 𝐍𝐞𝐱𝐭 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬?

Adopt multi-rail payment strategies

Leverage open finance frameworks

Innovate with Instant Payment Solutions

🚨 Included your thoughts, I'm interesting! 🚨

The future of payments is clear: speed, security, and convenience are the new standard. Those who adapt to these changes will thrive in a digitally-driven financial world.

Source: Capgemini

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()