Sweden and Denmark to Launch Real-Time Cross-Currency Settlement Via Tips

Hey Payment Fanatic!

The Eurosystem has just announced a major update that will allow instant cross-currency payments in euro, Swedish kronor, and Danish krone through the Tips (Target Instant Payment Settlement) platform.

This means payments made in one currency can now be settled in another, using central bank money—making cross-border payments faster, cheaper, and more secure.

This initiative has been in the works since 2020, with active involvement from the Riksbank and Denmark’s Nationalbank.

Erik Thedéen, Governor of the Riksbank, captured the excitement well: “It is very positive that we have now come so far that we will actually be able to provide a functional infrastructure for cross-currency payments." He further noted that this progress supports the G20’s global goals of making cross-border payments not only more secure but also faster and more affordable.

However, the momentum doesn’t stop at the EU’s borders. The Eurosystem has also announced exploratory work to connect Tips with Project Nexus, a BIS initiative aimed at unifying instant payment networks worldwide.

TGIF! Continue reading for more and I'll be back on Monday.

Cheers,

SPONSOR CONTENT

Check out Mangopay's guide to blocking fraudsters while providing legitimate users with a seamless payments experience.

INSIGHTS

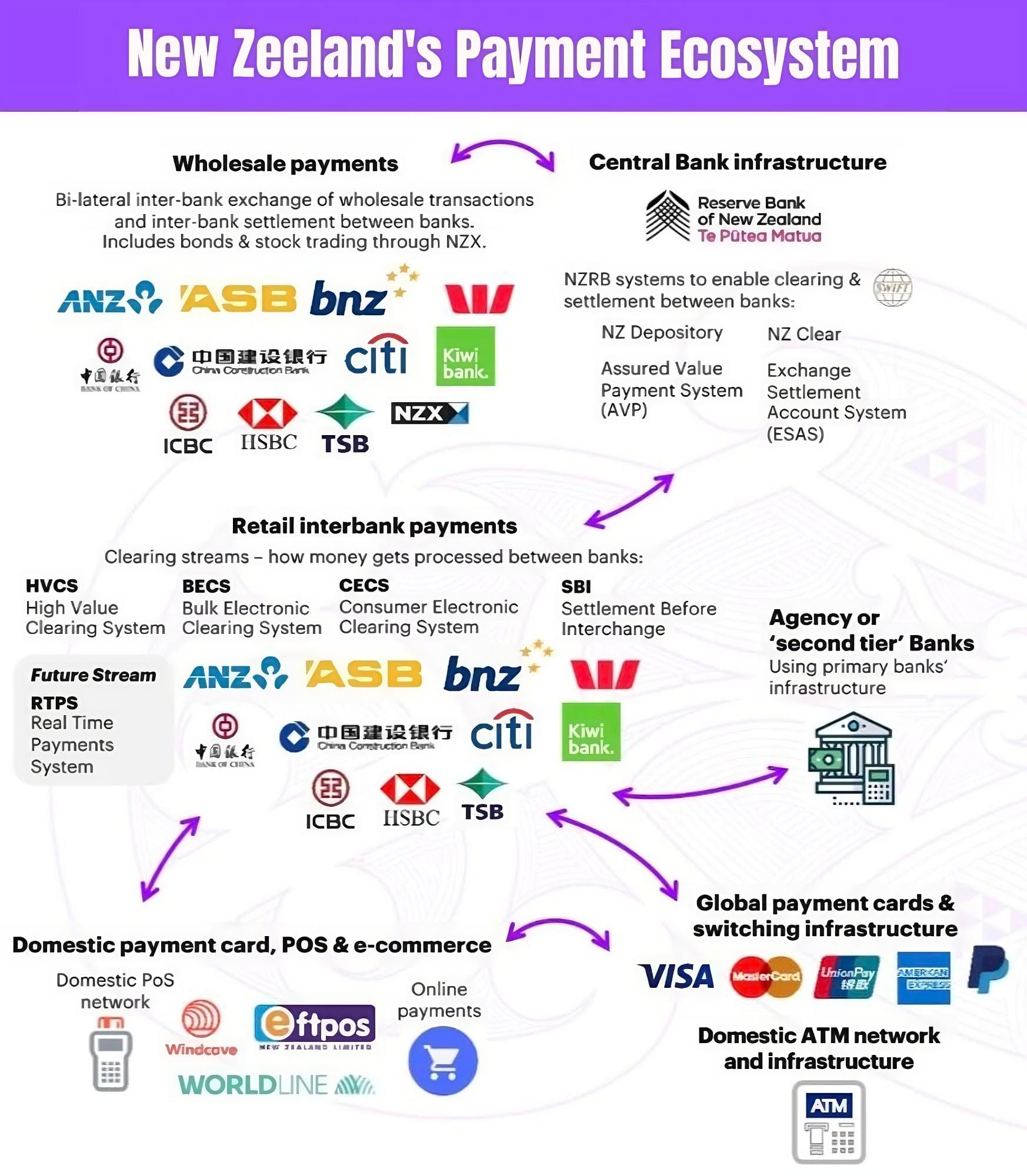

📊 The New Zealand Payments Ecosystem is relatively simple compared to many advanced nations.

PAYMENTS NEWS

🥇 Mangopay wins Fraud & ID Verification at the Global FinTech Awards 2024. Alex Taylor, Head of Sales at Mangopay, explained how "a couple of years ago, we [Mangopay] acquired a fraud prevention business and brought that into the wider Mangopay product stack. So it's fantastic that the progress of our teams and the value that we're delivering to customers has been recognised." Click here to learn more

🇫🇷 Worldline partners with Visa Acceptance Solutions to deliver data-driven fraud management solution. The collaboration combines both companies' transactional data and expertise, enhancing Worldline's payment services with Cybersource Decision Manager for robust fraud detection across industries.

🇬🇧 Klarna enters £7 Billion UK Gift Card market with launch of Gift Card Store in partnership with Blackhawk Network (BHN). This gives customers the ability to buy gift cards from an extensive selection of brands and pay for them using Klarna's range of Buy Now, Pay Later (BNPL) products and instant debit option, Pay Now.

🇸🇪 Klarna shareholders vote to oust Director Mikael Walther amid tension on board. Walther was removed from the board during a meeting of the company’s investors on Thursday, according to a statement on Klarna’s website. The move was approved by 87% of shareholders, the company said.

🇫🇷 Cash collection startup Upflow also wants to handle B2B payments. The French startup has announced a shift in its strategy to become a B2B payment platform with its own payment gateway to complement its accounts receivable automation solution.

🇺🇸 Finix raises $75 Million series C. The firm is evolving into a full-stack acquirer/processor, offering no-code/low-code solutions to provide flexible payment options. Its momentum and Series C milestone reflect the effectiveness of this approach and increasing demand for its services.

GOLDEN NUGGET

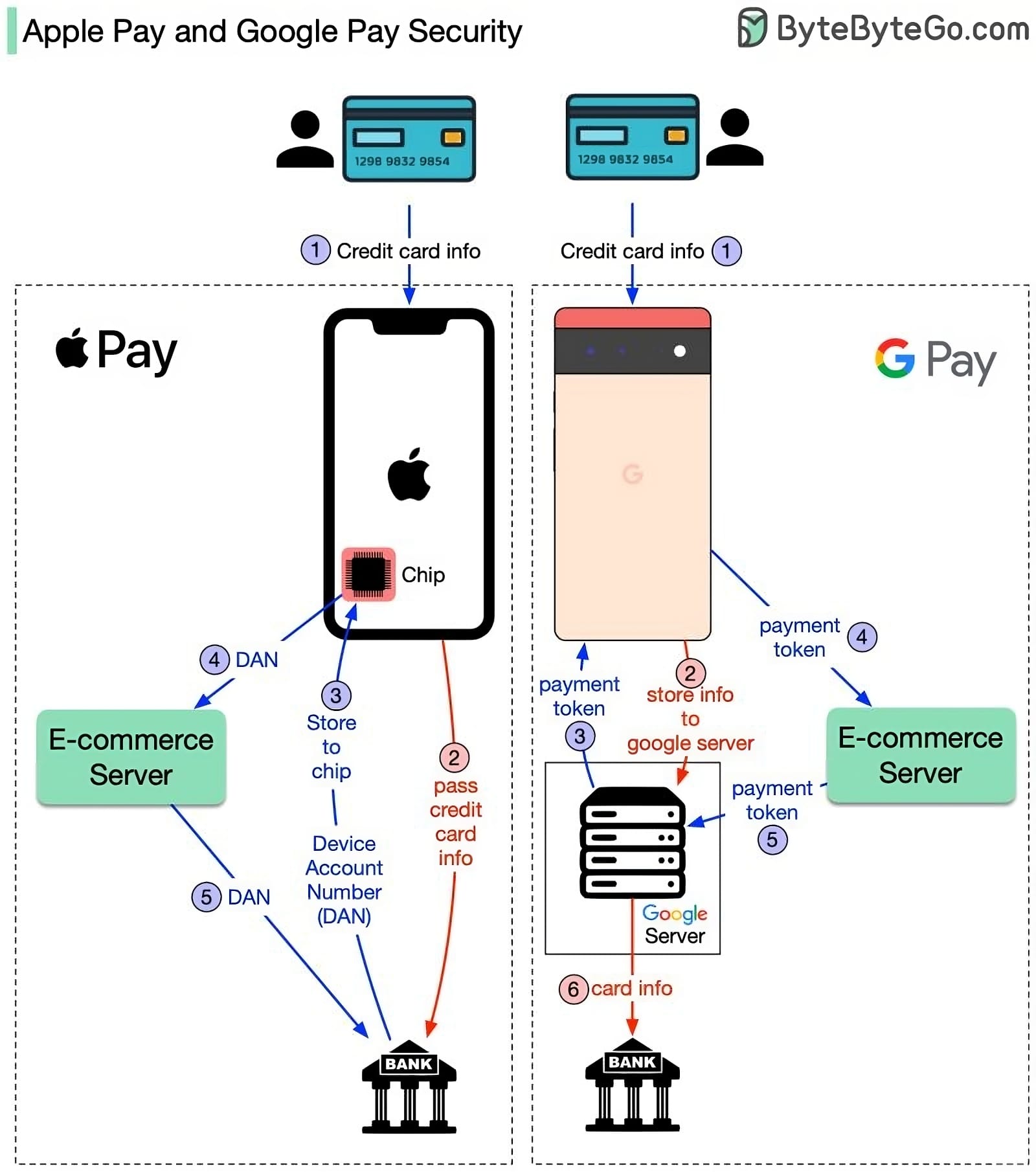

How do Apple Pay and Google Pay handle sensitive card info?

The diagram above shows the differences. Both approaches are very secure, but the implementations are different. To understand the difference, we break down the process into two flows.

1 Registering your credit card flow

2 Basic payment flow

1. The registration flow is represented by steps 1~3 for both cases. The difference is:

Apple Pay: Apple doesn’t store any card info. It passes the card info to the bank. Bank returns a token called DAN (device account number) to the iPhone. iPhone then stores DAN into a special hardware chip.

Google Pay: When you register the credit card with Google Pay, the card info is stored in the Google server. Google returns a payment token to the phone.

2. When you click the “Pay” button on your phone, the basic payment flow starts. Here are the differences:

Apple Pay: For iPhone, the e-commerce server passes the DAN to the bank.

Google Pay: In the Google Pay case, the e-commerce server passes the payment token to the Google server. Google server looks up the credit card info and passes it to the bank.

In the diagram, the red arrow means the credit card info is available on the public network, although it is encrypted.

Source: ByteByteGo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()