Stripe Eyes Another Employee Stock Tender

Hey Payments Fanatic!

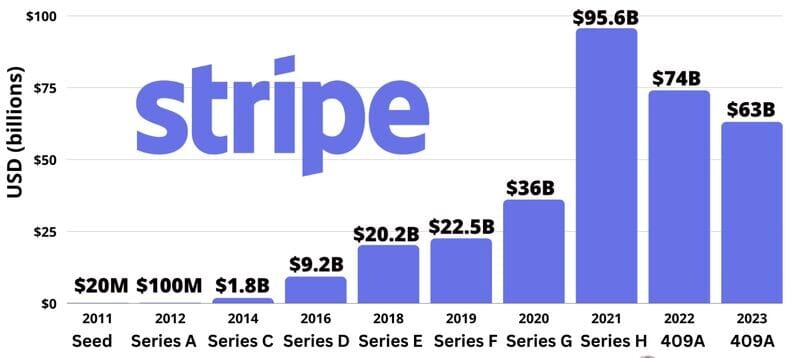

Stripe is likely to offer another employee stock tender soon, according to co-founder John Collison. In a conversation with David Rubenstein for an upcoming episode of Bloomberg Television’s “The David Rubenstein Show: Peer to Peer Conversations,” Collison hinted at another potential tender offer, marking the company’s third such initiative.

“We did that last year, we did that this year, and we’ll probably do it again in the future,” Collison stated, indicating a consistent strategy to allow employees to cash out some of their shares.

The company plans to leverage both investors and its own financial resources for this purpose.

Stripe Eyes Another Employee Stock Tender

Founded in 2009 by John and Patrick Collison, Stripe has seen remarkable growth. In the latest share deal in February, the company was valued at $65 billion. Stripe processed over $1 trillion in payments last year, a testament to its robust expansion, which continued even after the pandemic-induced surge in online shopping.

Enjoy more payments news I listed for you below, and I'll be back tomorrow!

Cheers,

PAYMENTS NEWS

💸 ACI Worldwide and STET: European Instant Cross-Border Transactions Reach New Record High. STET's platform utilizes ACI Low Value Real-Time Payments as a SaaS service, allowing its 20 member banks direct connection to European schemes TIPS and RT1. This ensures full pan-European reachability and interoperability for instant payments.

🇲🇽 Mexico’s payments startup Clip has raised $𝟭𝟬𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻. The investment will be used to continue growing in its home market of Mexico, said Clip Founder and CEO Adolfo Babatz in an interview. More on that here

🇵🇭 Visa expands tokenized payments in Phl. While Visa has distributed 1 billion tokens across the Asia Pacific, Visa head for Product and Solutions for Southeast Asia Poojyata Khattar said the Philippines has yet to catch up on adopting the technology towards safer and more personalized online shopping.

🇬🇧 HSBC UK adds international payments tool to its Kinetic business banking app. HSBC Kinetic current account customers have previously been able to make international payments by phone and in branch, but can now self-serve up to the daily payment limit of £25,000. Doing so from over 200 countries and territories.

🇧🇷 Financial underwriting platform a55 raised an undisclosed amount from payment orchestrator Paysecure. The investment comes after a55’s $16M Series B in January 2022. The firm will use the investment to expand its banking and credit offers, starting with SMEs in Latin America, as well as other initiatives.

🇮🇱 Rapyd lays off dozens of employees, transferring positions from Israel to Eastern Europe, South America. The FinTech unicorn is cutting 30 positions in Israel and is moving them abroad due to the desire to cut costs. Continue reading

🇺🇸 LatAm FinTech Prometeo enters US. Prometeo, a leading FinTech infrastructure company connecting global corporations with financial institutions in LatAm, announced the launch of its Bank Account Validation (BAV) offering for the US Market.

🇦🇷 FinTech Moonflow raises $1.74M to accelerate product development in Latam and Enhance Payment Platform. Founded in 2023, Moonflow has clients in 22 countries and aims to reach 1,000 corporate clients. Companies in various sectors already use Moonflow to improve their collections.

🇦🇺 BNPL firm Laybuy enters receivership. The New Zealand-based BNPL lender has entered receivership after failing to find a buyer for the ailing business. It listed on the Australian stock exchange in 2020 and shares traded as high as A$2.30. It delisted last year after the share price had plumetted to A0.6 cents.

🇨🇱 Chilean paytech Shinkansen receives new investment from Corporate Venture Capital Krealo. he firm specializes in automating, via APIs, company payments to multiple recipients (payouts) and the automatic reception of payments (pay in). Read on

🇪🇺 Bank-to-bank payment messaging network Swift is working to facilitate interoperability of Verifcation of Payee schemes across Europe as new research shows that 83% of SMEs across France, Germany, Italy and Spain rank upfront beneficiary checks as important to them in trading across borders.

🇺🇸 US-based paytech Payzli has revealed a string of immediate “strategic changes” to its leadership team “to further accelerate revenue growth”. Arash Izadpanah, the firm’s former CEO, will assume the role of chief risk officer (CRO).

GOLDEN NUGGET

🤯 The Payment Orchestration market will be worth over $15 billion by 2026

Let's have a closer look:

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn.

Comments ()