Stripe Expands Access to Japan’s 68 Million PayPay Users

Hey Payments Fanatic!

Stripe introduced a series of updates designed to support businesses operating in Japan—or planning to enter the market. These changes focus on smoother customer experiences, faster payouts, and compliance with evolving regulation.

For Japanese businesses, Stripe now supports PayPay, a QR-based payment method used by over 68 million people. The integration allows for quicker payouts—within just 4 business days. Stripe also added installment card payments, helping consumers spread the cost of larger purchases.

Stripe is also helping merchants adapt to Japan’s new 3D Secure requirements. The changes, which became mandatory in March, can often interrupt the checkout experience. Stripe’s approach aims to reduce friction through smart exemptions, balancing security and usability.

Finally, Stripe will expand the support of network tokens in the country. These credentials replace sensitive card data with merchant-specific tokens, making transactions safer and potentially more cost-effective.

“I firmly believe that Stripe’s vision of expanding the GDP of the internet will not only bolster businesses worldwide, but also enhance the quality of life for individuals,” said Toshifumi Kasakawa, CEO of PayPay.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

🇬🇧 Airline Retailing: The Case for Fraud Prevention. In an industry facing tight margins and rising expectations, fraud is still draining profits. This eBook, by CellPoint Digital, explores how smart payment routing, modern fraud detection, and orchestration can transform airline retailing from reactive to proactive. Download and read here

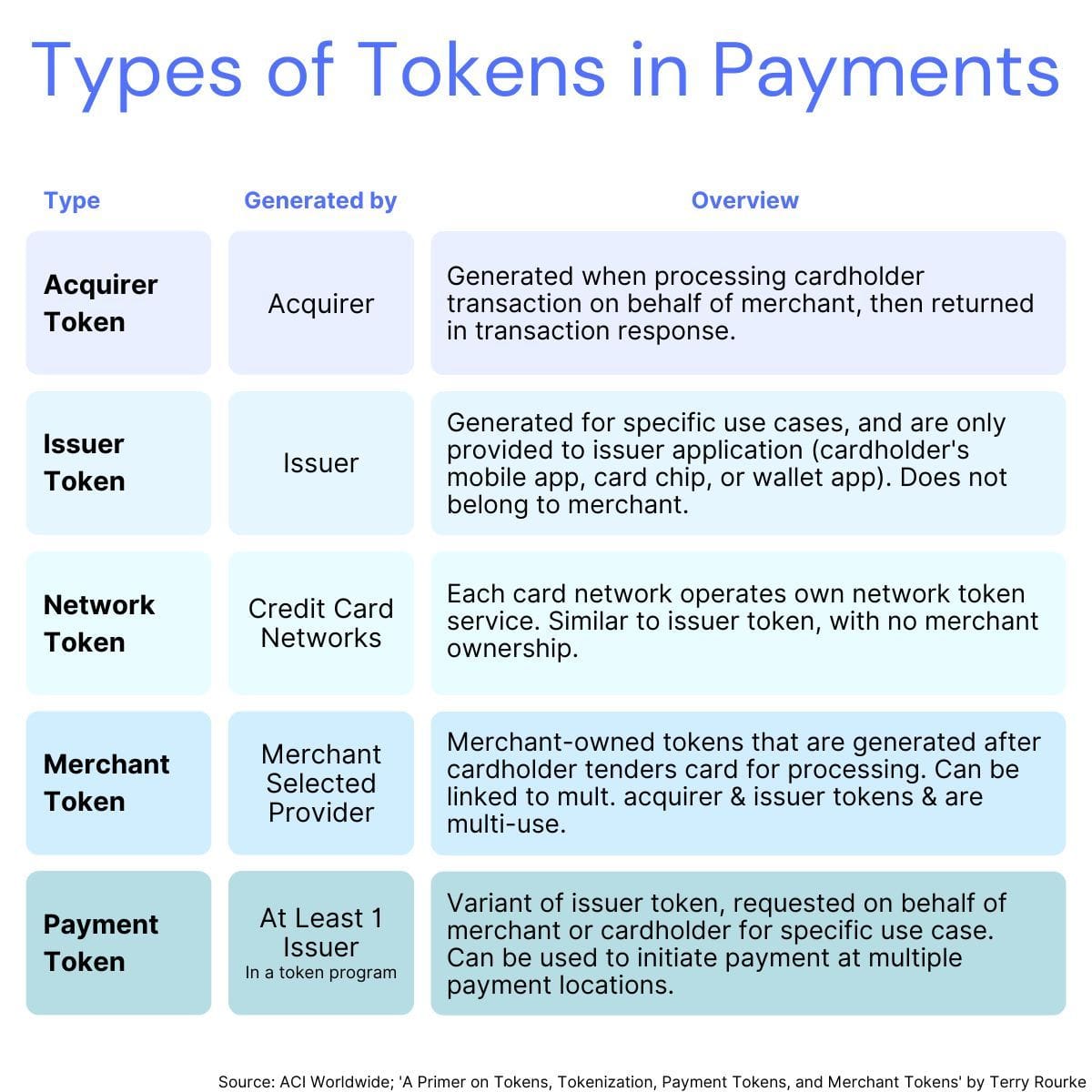

💳 Navigating the Complex World of Tokenization in Retail Payments, by Terry Rourke from ACI Worldwide.

PAYMENTS NEWS

🇬🇧 Ecommpay strengthens leadership team for European growth with appointment of Roy Blokker. Roy will be particularly focused on engaging with large, complex, and globally focused merchants to build strategic partnerships. He will also lead the development of tailored solutions that deliver optimal payment performance.

🌍 Adyen was hit by multiple DDoS attacks. The first attack occurred on Monday 21 around 7.00 pm, and affected customers in Europe. The issues were initially resolved, but a second DDoS attack was reported by the company at 8:35 p.m. Most functionalities were restored.

🇧🇷 Adyen bets on AI and new Pix features to boost online sales. It launched a frictionless payment solution via Open Finance, letting users pay without redirection. It will also pilot "Pix Automático" for recurring payments. These innovations aim to boost conversion rates, lower costs, and offer more payment options, especially for those without credit cards.

🇧🇪 Swift launches Case Management for cross-border payment investigations. The solution aims to help the community improve efficiency, time, and costs, offering a better experience for the customers. Case Management delivers data quality and accuracy through orchestration capabilities.

🇺🇸 Affirm expands credit reporting with TransUnion to all pay-over-time products. New reporting will not impact scores in the near term, but it advances efforts to help consumers build credit histories and support positive credit outcomes. Keep reading

🇬🇧 Paydify launches to enable businesses worldwide to accept crypto payments. Built to simplify fragmented blockchain infrastructure, Paydify turns complex crypto payments into a smooth checkout experience, with real-time stablecoin settlement and zero transaction fees.

🇨🇱 Klap launches Visa and Mastercard acquiring services in collaboration with BPC. The move marks a step in Klap’s technological evolution, enabling it to offer modernised and secure payment processing services while improving operational scalability.

🇬🇧 Fiserv supports Vanquis Banking Group's digital transformation. Vanquis will become the first bank to select Fiserv’s next-generation processing platform, Vision NextTM, an end-to-end solution that delivers global processing economies of scale plus fully integrated adjacent services that span the issuing lifecycle.

🇮🇹 Sale of Italian payments company PagoPA to mint and Poste hits valuation snag. The prospect of PagoPA changing hands, even though it would remain under state-controlled entities, has alarmed Italy's crowded banking sector, which is grappling with increasing competition in the digital payment business.

🌍 Thunes launches new global business payments service. Thunes Business Payments is a new service aimed at helping enterprises, merchants, banks, and mobile wallet providers streamline international business transactions. The new solution provides access to local Automated Clearing House (ACH) systems in over 50 countries.

GOLDEN NUGGET

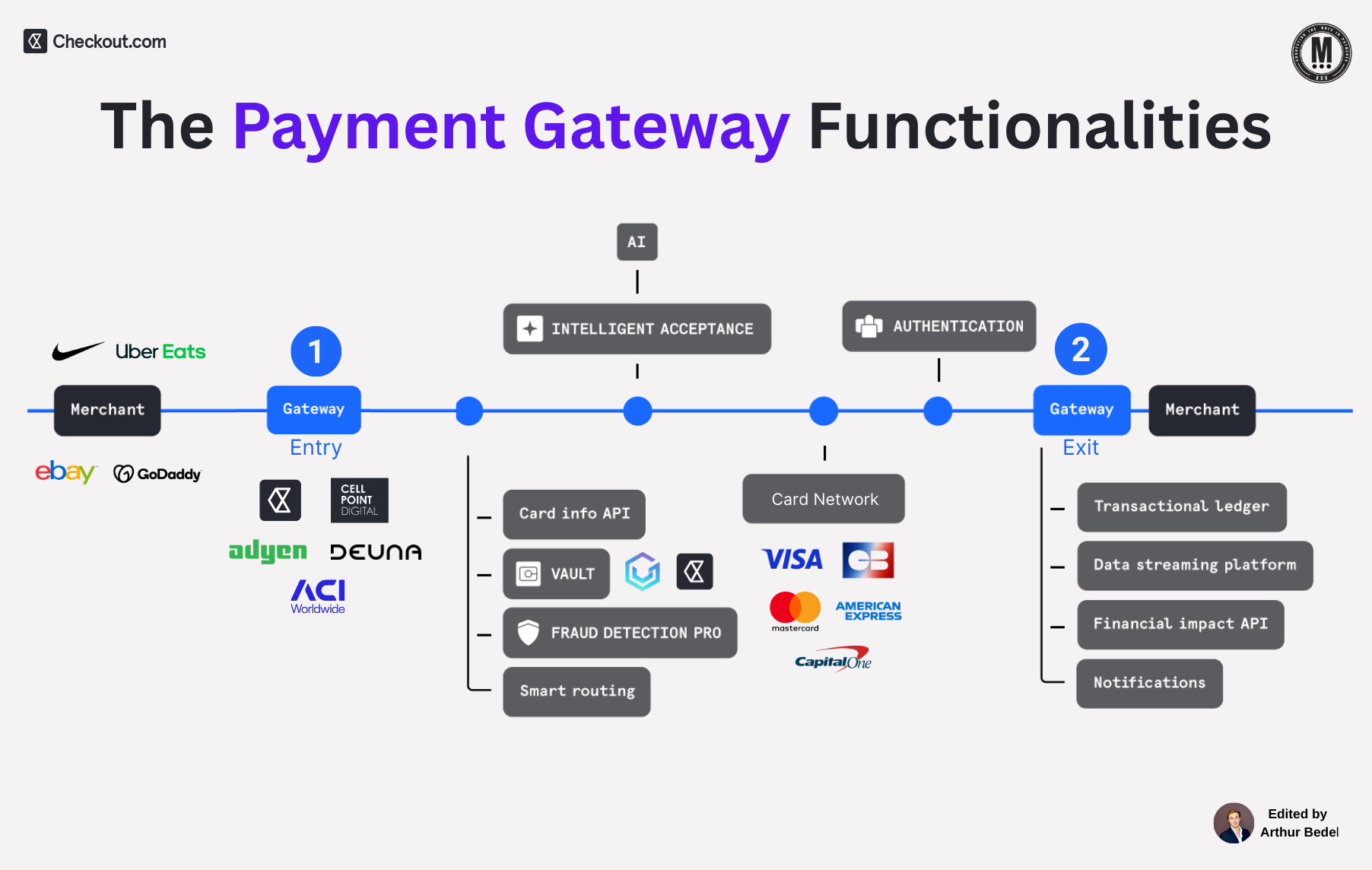

Welcome to 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com — Episode 11 👋

What is a 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲?

► A 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲 is the tech layer that securely transmits cardholder data from the merchant to the acquiring bank, while supporting authentication, fraud detection, smart routing, and response delivery. Think of it as the "digital bridge" between a customer’s intent to pay and the merchant’s ability to get paid.

Gateways are more than pipes — they power security, data intelligence, and performance.

𝐓𝐡𝐞 𝐂𝐨𝐫𝐞 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧𝐬 𝐨𝐟 𝐚 𝐌𝐨𝐝𝐞𝐫𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲

► 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐭 𝐀𝐜𝐜𝐞𝐩𝐭𝐚𝐧𝐜𝐞 — AI-driven optimization to improve approval rates

► 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲 & 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 — Includes fraud engines, 3DS orchestration, smart routing... (Checkout.com, DEUNA, CellPoint Digital, ACI Worldwide)

► 𝐂𝐚𝐫𝐝 𝐈𝐧𝐟𝐨 𝐀𝐏𝐈 & 𝐕𝐚𝐮𝐥𝐭𝐢𝐧𝐠 — Tokenized storage via vaults - Checkout.com & VGS

► 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐂𝐨𝐧𝐧𝐞𝐜𝐭𝐢𝐯𝐢𝐭𝐲 — Interfaces with schemes like Visa, Mastercard, American Express, and GIE Cartes Bancaires

► 𝐄𝐱𝐢𝐭 𝐃𝐚𝐭𝐚 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 — Real-time notifications, financial impact APIs, data streaming & transactional ledgers

𝐀𝐈 𝐱 𝐆𝐚𝐭𝐞𝐰𝐚𝐲: The Rise of Intelligent Acceptance

► As card networks and issuers grow more selective in approving transactions, merchants need AI tools that can adapt in real-time.

► Intelligent Acceptance uses adaptive messaging, routing logic, and retry strategies to optimize for issuer behavior and turn declines into approvals.

It’s the brain behind the gateway.

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐕𝐚𝐮𝐥𝐭 — 𝐀 𝐂𝐫𝐢𝐭𝐢𝐜𝐚𝐥 𝐂𝐨𝐦𝐩𝐨𝐧𝐞𝐧𝐭

Gateways must pair with secure vaults to store and manage tokenized credentials.

Whether it's Checkout.com’s PCI-compliant vault or third-party providers like VGS, the token vault acts as the core memory of the payments stack — enabling recurring billing, one-click checkout, and multi-PSP support.

𝐖𝐡𝐲 𝐆𝐚𝐭𝐞𝐰𝐚𝐲 𝐏𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 𝐌𝐚𝐭𝐭𝐞𝐫𝐬

A performant gateway isn't just fast — it’s adaptive, intelligent, and compliant.

It impacts:

✅ Approval rates

✅ Fraud rates

✅ Customer experience

✅ Infrastructure costs

And in a global payments ecosystem, latency or failure isn’t just technical — it’s commercial.

Source: Checkout.com x Connecting the dots in payments...

I highly recommend following my partner Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()