Stripe Begins Testing New Stablecoin

Hey Payments Fanatic!

Stripe has opened testing for its new stablecoin product, built on the foundation of Bridge, the payments network it recently acquired for $1.1 billion. CEO Patrick Collison announced the launch on X, describing it as “something we’ve wanted to build for around a decade,” marking a new chapter in Stripe’s evolving relationship with crypto.

The product, aimed at businesses outside the United States, United Kingdom, and Europe, could further change how dollars move across borders. Bridge’s technology, originally developed as an alternative to the SWIFT network, now becomes part of Stripe’s growing financial infrastructure.

Stripe’s first steps into crypto came in 2014 with Bitcoin integration, a venture that ended due to high fees and long transaction times. Since 2021, the company has quietly rebuilt its crypto efforts, leading to services like stablecoin payments across more than 70 countries and partnerships with firms such as Coinbase.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Transform Your Banking Experience! Subscribe to my Daily Banking Newsletter for the latest trends and updates delivered daily to your inbox. Embrace the Future of Banking—Never miss an update!

INSIGHTS

🇦🇿 Azerbaijan sees surge in cashless payments as card usage hits record high. As of the end of March, the number of payment cards in circulation across banks and “Azərpoçt” (Azerpost) LLC systems increased by 221,000 compared to the previous month, reaching a total of 20.46 million cards.

PAYMENTS NEWS

🇺🇸 ACI Worldwide Revolutionises Payments at Pay360. ACI Worldwide's Andrew Moseley shares insights on the transformation of payments infrastructure, regulatory challenges, and the rising importance of AI in fraud prevention, as the industry shifts towards instant processing. Read on

🇺🇸 Airwallex and Panax partner to transform the way companies manage cash globally. The partnership enables finance teams to gain full visibility and control over their cash while reducing operational complexity and enhancing liquidity management.

🇧🇷 Automatic Pix enters the Central Bank's testing phase. This phase, known as "homologatory testing," began on April 28, 2025, and involves all service providers within the Instant Payment System (SPI) to ensure the system functions correctly before its official release.

🇦🇪 UAE set to launch its first regulated national stablecoin. This initiative is part of the country’s broader Digital Dirham strategy, which aims to establish a framework for stablecoin operations. AE Coin is expected to streamline remittances for UAE residents, with the country ranking among the top ten global sources of remittances.

🇲🇽 Bitso Card will cease operations in Mexico. The decision aligns with Bitso's strategic shift toward developing financial solutions focusing on savings, investment, and long-term wealth management. Keep reading

🇦🇺 PAX Technology appoints Michael Johnson as new CEO as it scales up Australian operations. PAX Vice-President Heidi Hoo expressed enthusiasm about the recent appointment, stating that the company is "delighted to welcome Michael," highlighting his corporate experience as a key asset in scaling PAX Technology to become the leading vendor across Australia and New Zealand.

🇺🇸 New MetaMask Metal Payment Card: self-custody crypto card with direct payments unveiled by CompoSecure, Baanx, and MetaMask. This metal card enables users to securely pay directly from their self-custody MetaMask wallets, eliminating the need for traditional banking intermediaries.

🇺🇸 Thunes raises USD 150 million in series D, led by Apis Partners and Vitruvian Partners. Thunes plans to leverage this capital to supercharge its expansion in the United States, supported by the recent acquisition of licenses across 50 U.S. States, subject to regulatory approval.

GOLDEN NUGGET

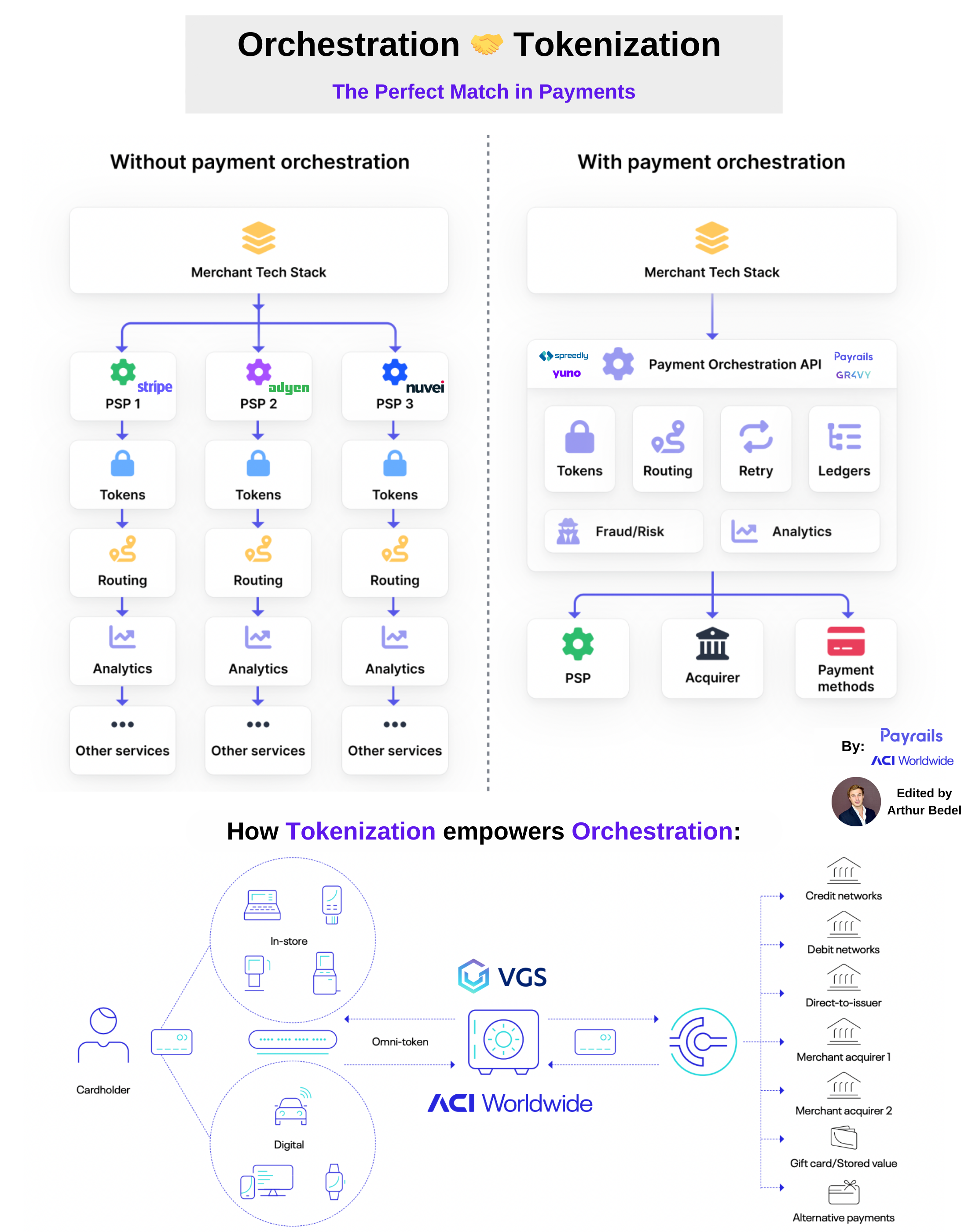

Orchestration 🤝 Tokenization — the perfect date(a) does exist in payments:

What is a PaymentOrchestration:

Payment orchestration is a software solution that connects merchants to multiple PSPs, acquirers, payment partners. It unites most aspects of the online payment process in one place, including payment authorization, transaction routing, reconciliation, payouts, ledgers, analytics and payment settlement details.

The purpose is to remove complexity for merchants by enabling them to take advantage of working with multiple PSPs and route payments based on a variety of factors, including:

► Payment processor availability

► Best fee conditions

► Highest authorization rates

► Locality / Currencies

► Local Payment Methods

► etc...

Connecting to multiple providers can help protect against failed payments and reduce costs BUT an Orchestrator remains the potential point of failure.

Though a Payment Orchestrator is a crucial part of any good payment infrastructure, not all solutions on the market include important features like:

👉 Native Token Vault Storage

👉 Payment analytics

👉 etc…

Businesses, especially enterprise merchants with high transaction volumes, should both look:

1️⃣ All-in-one: Beyond payment orchestration for providers that cover the entire spectrum of payment

2️⃣ Mitigate Risk by storing their Payments Data (the most crucial component of any transaction) in a specialized external Token Vault - VGS - (personal opinion). Worst comes to worst, if an Orchestrator or PSP fails, your payments data is available and ready to be used by alternative providers

What is Tokenization in Payments:

Tokenization is the process of replacing your personal payments information (not only) with a token stored in a PCI-Compliant token vault owned by the token creator, which can be an acquirer, issuer, 3rd party token vault & network or payment processor.

In simple terms, it’s taking consumers & merchants payments DATA, placing that into a token and storing that in a secure and accessible location.

Benefits of Tokenization:

► Ensure PCI DSS compliance

► Control costs

► Increase payments efficiency

► Reduce the risk of data breaches

► Improve the customer experience

Orchestration 🤝 Tokenization Providers:

Ultimately, everything is about data. You need your payments data to be securely stored and accessible at will.

It is the foundation of all transactions globally. While Payment Orchestrators route payments to multiple PSPs, Tokenization providers’ route your payments data to Orchestrators, PSP and any company in payments.

Hot Take 🚨 — an Orchestrator is a great-to-have solution, bringing flexibility and speed to market. A Tokenization Provider, is a must. Both together, that’s flexibility, cost efficiency, redundancy and a scalable payment infrastructure 🚀

Source: Payrails & ACI Worldwide & VGS

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()