Stablecoins in 2025: The $205B Market Ready to Revolutionize Payments

Happy New Year, Payments Fanatic!

2025 kicks off with stablecoins taking center stage in the $205 billion crypto market. While Bitcoin's 2024 surge grabbed headlines, the real buzz is around these price-stable tokens, pegged to fiat currencies like the US dollar. Giants like Visa, PayPal, and Stripe are diving deeper into this space, leveraging stablecoins for payments, trade finance, and remittances.

Why the hype? Stablecoins now back their reserves with high-yielding US Treasuries, making them a lucrative venture. Unlike volatile cryptocurrencies, they're gaining traction for everyday transactions worldwide.

“We’ve seen significant growth in demand from some of the largest companies in the world that participate in under-served payment verticals like global contractor and employee payouts, trade finance, and remittance,” said Rob Hadick, a general partner at digital-asset venture firm Dragonfly.

Visa launched its Tokenized Asset Platform, enabling banks to issue stablecoins, while PayPal's PYUSD and Revolut's reported stablecoin plans highlight growing interest. Stripe recently acquired Bridge, a stablecoin-focused FinTech, and Robinhood is teaming up with Paxos on the Global Dollar Network.

But it’s not all smooth sailing. In the EU, new MiCA regulations mandate e-money licenses for stablecoins, leading some exchanges to delist Tether's USDT. Meanwhile, regulatory clarity in the US remains elusive.

Despite challenges, stablecoins are reshaping payments. As Anna Yuan, founder of Perena, puts it: "They let companies enter crypto without the risky baggage." Here’s to 2025 – the year stablecoins truly go mainstream.

I am back with all you need to know about the payments industry, more important updates below!👇

Cheers!

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

📊 A look back: Top 10 Cross Border Payment trends that defined 2024. This report by Almond FinTech underscores how efficiency, inclusivity, and innovation are reshaping the industry, offering a glimpse into the future of global finance. Click here to learn more.

PAYMENTS NEWS

🇿🇦 KuCoin launches crypto payment solution. This system allows businesses to accept crypto payments easily, offering contactless, borderless transactions with reduced fees and instant settlements. The platform provides businesses access to KuCoin’s global user base, boosting reach and enhancing customer experience.

🇨🇳 Alipay introduces AI tool for analyzing images in app. The “Tanyixia” feature allows users to analyze images of plants, animals, food, or cartoons to access relevant details like menu translations or medication instructions also allows to gather information from uploaded images.

🇪🇺 MoonPay secures MiCA approval. MiCA aims to create a standardized regulatory environment for digital assets. It sets new rules for consumer protection, market transparency, and financial integrity across Europe. For MoonPay, this approval is a major step forward, allowing the company to continue expanding its services while ensuring compliance with the latest regulations.

🇺🇸 iWallet adds voice AI payments. This new technology aims to revolutionise how payments are processed, combining advanced security features with seamless usability. “Adding the ability for businesses to use AI for payments saves them a lot of time and money,” stated the company’s Founder and CEO.

🇬🇧 Strictly Money launches crowdcube campaign. The primary objective with this campaign is to accelerate its growth, fuel product development, and expand its shareholder base. The company plans to introduce hedge fund returns products, broadening investment options for consumers by the end of 2025.

🇮🇳 India again delays UPI duopoly rules. This provides temporary relief to Google Pay and PhonePe, which together process over 85% of UPI transactions. UPI, handling 13 billion monthly transactions, is crucial to India's digital economy. The regulator faces challenges in enforcing the cap without disrupting services for millions of users. The delay prolongs regulatory uncertainty in the sector.

🇮🇳 India lifts WhatsApp payment curbs, allowing Meta to roll out the service to its entire user base of over 500 million in the country. This removes the previous cap of 100 million users and marks a shift in the regulator's cautious stance. The move strengthens WhatsApp's position in India’s growing digital payments market. Continue reading

GOLDEN NUGGET

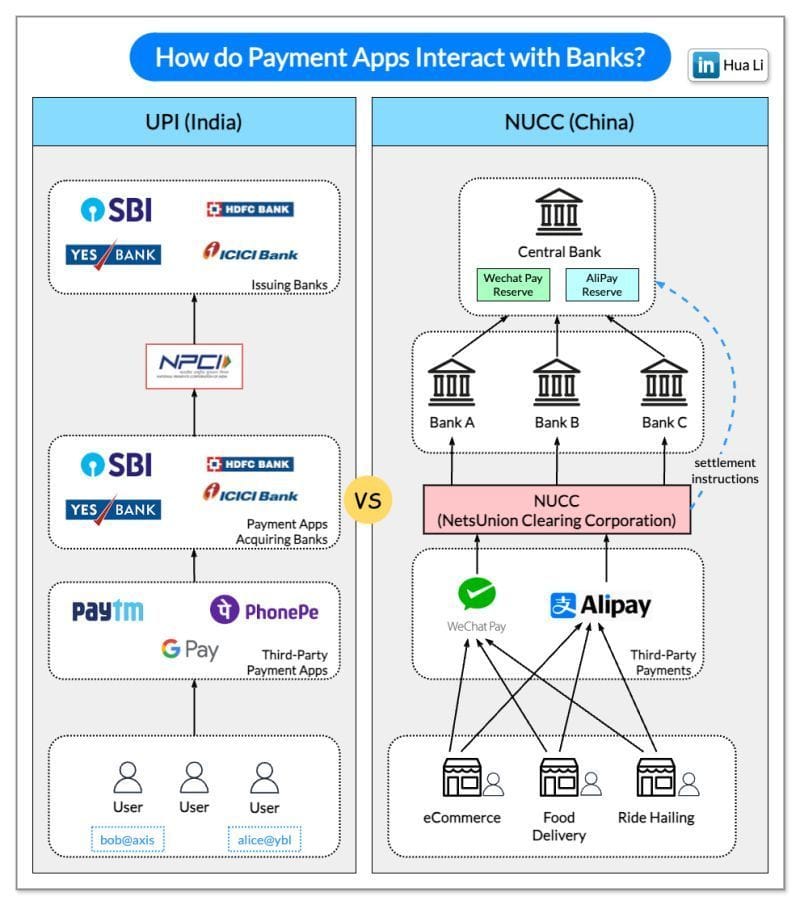

How do Payment Apps interact with Banks in India and China?

🇮🇳 UPI 🆚 NUCC 🇨🇳

The diagram above shows a comparison between UPI (Unified Payments Interface) in India and NUCC (NetsUnion Clearing Corporation) in China.

Both are nationwide efforts to streamline third-party payments, which means payment apps don’t need to handle the complexity of connecting to banks.

Some differences are:

► UPI = payment markup language + standard for interoperable payments, while NUCC (NetsUnion Clearing Corporation) is a clearing system among banks. So UPI covers the whole workflow, but NUCC handles transaction clearing and settlements.

► UPI builds a digital payments ecosystem with payment apps, banks, and NPCI (National Payments Corporation of India). NUCC saves each payment app the effort of connecting to each bank separately.

► UPI adopts a mobile-first design, each account is given a VPA (Virtual Payment Address), while NUCC doesn’t have such a setup.

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()