Spin by Oxxo and Félix Pago Join Forces to Revolutionize U.S.-Mexico Remittances

Hey Payments Fanatic!

Mexican FinTech Spin by Oxxo has announced a strategic alliance with Félix Pago, the WhatsApp-based digital remittance platform, aiming to streamline how Mexicans receive money from the United States. The integration allows Spin by Oxxo users to instantly receive funds sent via Félix Pago, with recipients paying zero commission—senders cover a flat $2.99 fee. Funds can be used directly in the app for payments or withdrawn at over 23,000 Oxxo stores nationwide.

“This alliance allows us to continue enriching people’s lives with financial services that evolve alongside the needs of Mexicans,” said Ricardo Olmos, CEO of Spin by Oxxo, highlighting the partnership’s focus on innovation, security, and financial inclusion

The service is available to verified Spin Más (N2) account holders, reflecting the growing digitalization of remittances in Mexico, where nearly 60% of recipients now use apps. “At Félix, we believe financial inclusion starts with simplicity and trust,” added Claudia Garavini, Félix’s VP of Strategy & Biz Dev, emphasizing the partnership’s reach to millions of Mexican families.

With remittance flows to Mexico projected to hit $65 billion in 2025, this collaboration sets a new standard for speed, accessibility, and user experience in cross-border payments.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Transform Your Banking Experience! Subscribe to my Daily Banking Newsletter for the latest trends and updates delivered daily to your inbox. Embrace the Future of Banking—Never miss an update!

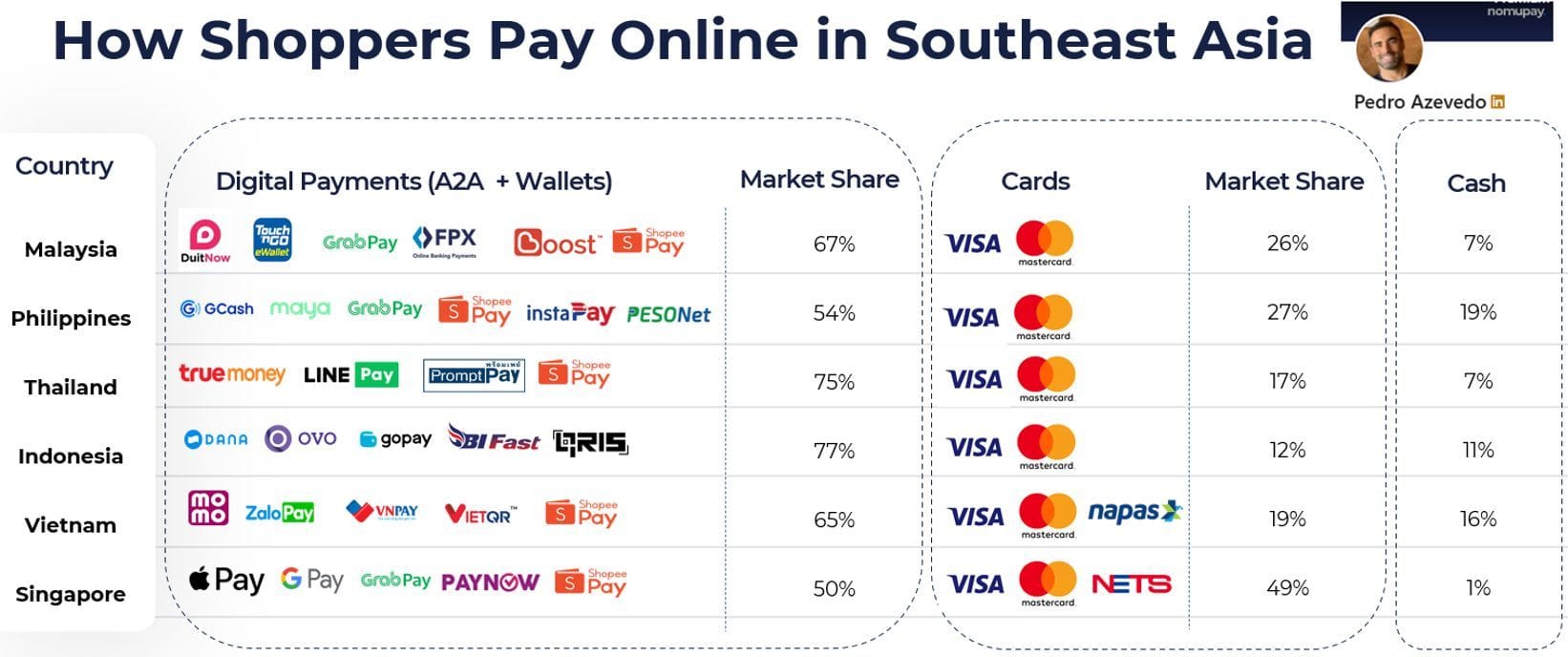

📊 How do shoppers pay online in Southeast Asia?

PAYMENTS NEWS

🇺🇸 ACI Worldwide, Inc. to release financial results for the quarter ending March 31, 2025. The company announced that it will report its financial results for the first quarter of 2025 on Thursday, May 8, 2025. Management will host a conference call at 8:30 a.m. Eastern time to discuss these results. Learn more

🇺🇸 Worldpay has joined Global Dollar Network. As part of this collaboration, Worldpay will use USDG to settle merchant payments, improve cross-border transactions, and develop new stablecoin-based solutions aimed at increasing financial inclusion and driving broader adoption.

🇨🇳 Alipay sees tap! users pass 100 million, accelerating payment and AI innovations. Alipay Tap! further simplifies the payment experience for both consumers and merchants compared to the “scan-and-pay” model ubiquitous in China.

🇺🇸 Circle executive Dante Disparte denies claims of seeking US banking license. Instead, he said that Circle intends to comply with future US regulatory requirements for payment stablecoins, “which may require registering for a federal or state trust charter or other nonbank license.”

🇬🇧 Weavr launches Embedded Payment Run technology on Paperchase. The solution was designed to eliminate the difficulties of AP processes and boost efficiency, while EPR will allow AP and cloud account software to execute payments within a single workflow as well.

🇵🇰 Safepay is now officially a fully licensed Payment Service Provider in Pakistan. Reaching this milestone has been a remarkable journey, made possible by their relentless effort, belief, and dedication. Read more

🇺🇸 US FinTech firm Fiserv reports Q1 revenue drop. The Wisconsin-based payment processing firm’s shares fell approximately 7% in premarket trading. The company recorded adjusted revenue of US$4.79 billion, missing analysts’ expectations of US$4.84 billion.

🇬🇧 DECTA partners with Paysecure to expand payment orchestration capabilities. For DECTA, this collaboration expands its distribution network, allowing more merchants to benefit from its comprehensive payment solutions. Continue reading

🇱🇹 BOBO adds Google Pay and Garmin Pay. The new features allow clients to make fast, secure, and contactless payments via smartphones and smartwatches, further improving BOBO’s digital offering. This feature offers flexibility and convenience, with support for in-store, online, and in-app purchases.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()