Spendesk Teams Up with Adyen to Revolutionize SMB Finances

Hey Payment Fanatic!

Spendesk and Adyen are joining forces in a strategic partnership aimed at reshaping embedded financial services for small and medium-sized businesses (SMBs). Adyen’s Banking-as-a-Service (BaaS) platform will empower Spendesk to streamline spend management while scaling its offerings globally.

Spendesk, known for helping finance teams automate spending and gain control, now leverages Adyen’s full-stack BaaS solution across key markets. With Adyen’s UK banking license, Spendesk can deliver tailored payment solutions, including virtual cards, digital wallets like Apple Pay, and new procurement tools—all while simplifying workflows for SMBs.

This partnership also enhances security. Adyen’s compliance across the UK, EU, and US ensures Spendesk meets regulatory standards as it scales. “Trust and accountability are key,” says Spendesk’s CEO Stephane Dehaies. “Adyen’s innovation and shared values align perfectly with our mission to deliver top-tier solutions.”

Looking ahead, the duo plans to optimize payment success rates, streamline onboarding, and innovate SMB financial tools. Adyen’s Hemmo Bosscher highlights, “This partnership is all about driving growth and meeting unmet SMB needs.”

Have a great start to the week and I'll be back with more Payments industry updates tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

PAYMENTS NEWS

🇮🇳 Paytm goes global, facilitates UPI payments for Indians abroad. Indian travellers can now use their Paytm UPI app to make seamless, cashless payments at destinations where UPI is accepted, including popular spots in the UAE, Singapore, France, Mauritius, Bhutan, and Nepal.

🇦🇪 Royal Group launches Comera Pay in the UAE. At the forefront of the UAE’s cashless economic vision, Comera Pay provides users with services like digital wallets, P2P transfers, QR payments, remittances, bill payments, mobile top-ups, and virtual accounts.

🇷🇺 HSBC stops processing Russia payments for retail customers. HSBC has ceased processing all payments from Russia and Belarus for personal banking customers, according to a notice on its UK website. The bank advised customers to arrange alternatives for such transactions.

🇬🇧 K3 MStore partners with DNA Payments to deliver unified payment solutions for visitor attractions. This collaboration will offer a seamless and unified payment solution for visitor attractions, enabling organisations to integrate their onsite and online payment systems effortlessly.

🇦🇪 Mastercard partners with Fundbot to accelerate payments between buyers and suppliers across multiple markets. The two companies will introduce a payments platform linking buyers and suppliers, initially focusing on early claim settlements in healthcare to resolve significant payment delays.

🇲🇪 Montenegro and Albania join the Single Euro Payments Area (SEPA). The inclusion of these nations in SEPA aligns with the EU’s Growth Plan, which seeks to enhance socio-economic integration of the Western Balkans through phased access to elements of the EU single market.

🇸🇻 Nayax self-service payments will launch its payment solution across to El Salvador. Nayax is partnering locally to bring Salvadoran operators into its global network of 90,000+ customers, enhancing customer experiences with cashless payments and loyalty programs.

🇺🇸 Finix unveiled Advanced Fraud Monitoring in partnership with Sift. The new service uses AI and machine learning to analyze transactions, offering backtesting, rule simulations, and customizable rulesets. It is designed to combat the creation of fake accounts and unauthorized financial movements.

🇺🇸 One Inc and U.S. Bank partner to modernize payment solutions for insurance carriers and policyholders. In the future, the partnership will help accelerate the use of instant payments within the insurance industry. U.S. Bank was part of the first payment on the RTP Network® and a launch partner of the FedNow® Service.

🇺🇸 Stripe is once again buying back shares, valuing the company at approximately $𝟳𝟬 𝗯𝗶𝗹𝗹𝗶𝗼𝗻. According to documents seen by Bloomberg, the share price is set at $27.51, reflecting the same valuation Stripe reached in a previous share sale earlier this year.

🇺🇸 PayPal resolves 2-hour global outage affecting multiple products. The incident lasted from 10:53 UTC to 12:59 UTC Thursday and affected account withdrawals, express checkout, cryptocurrency, the receive money function of Xoom and several functions of Venmo, according to a status page.

🇬🇧 Wirex Pay announces public access to its payment API. This will enable wallets, dApps, and FinTech platforms to integrate with its infrastructure. It allows non-custodial card issuance and real-time stablecoin payments, leveraging blockchain technology and Visa's global network.

GOLDEN NUGGET

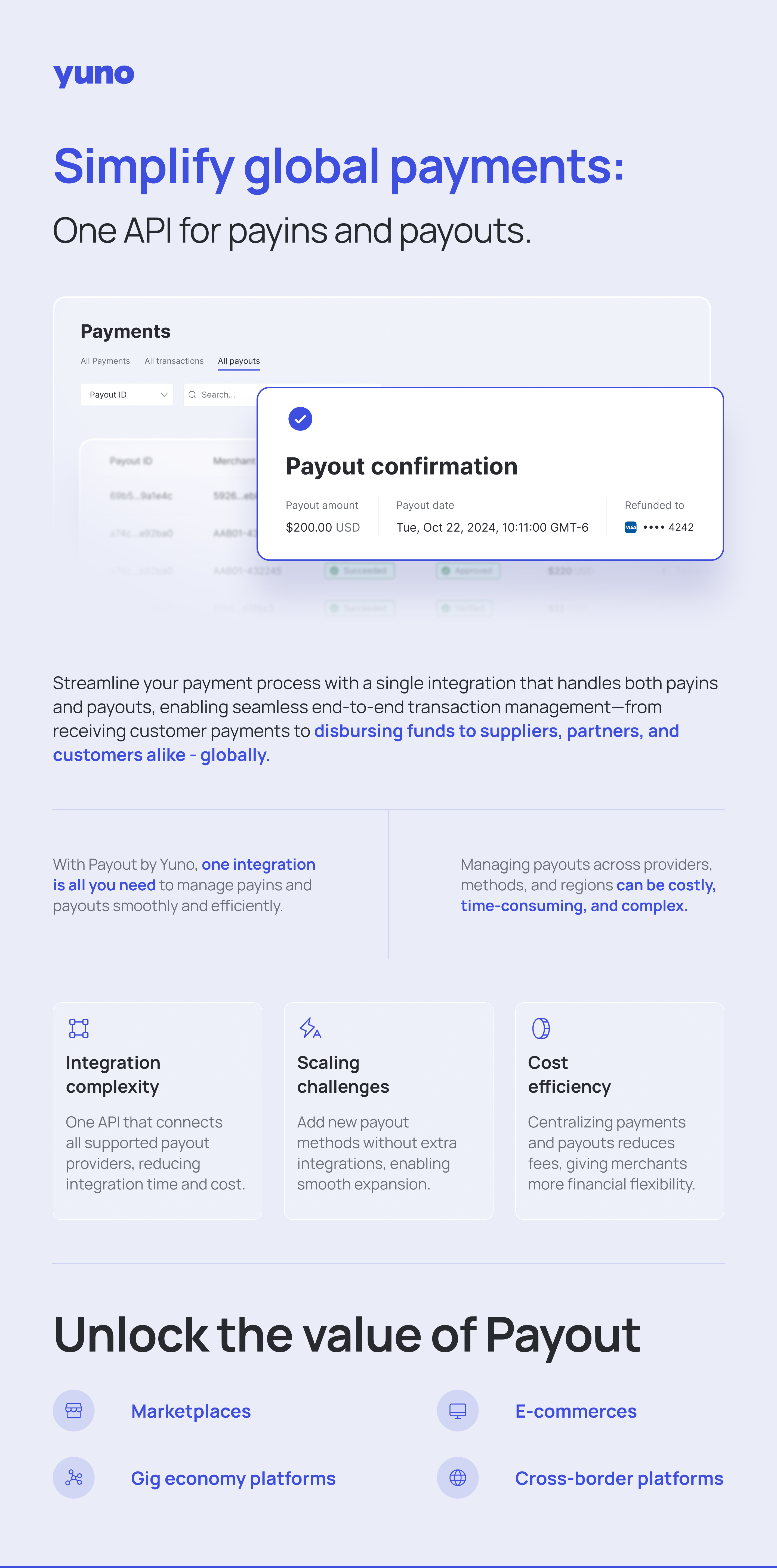

💵 How does Payout work?

Payout simplifies your payment operations by providing a centralized platform for managing all your payment activities.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()