Shaping the Future: UK Unveils National Payments Vision

Hey Payment Fanatic!

The UK Government has launched its National Payments Vision, outlining key objectives to modernize the payments sector. In 2023 alone, 48.1 billion transactions powered the UK’s economy, reflecting a rapid shift from cash to digital payments like contactless and Open Banking.

Contactless payments surged from 3% of all payments in 2015 to 38% in 2023, while 11 million users now embrace Open Banking for account-to-account (A2A) payments.

To drive this transformation, a Payments Vision Delivery Committee will align regulations, refresh the UK’s retail payment infrastructure, and oversee initiatives like the digital pound design. Deliverables include a Payments Forward Plan and reforms to Pay.UK, expected by late 2025.

Industry leaders like TrueLayer and Token.io have praised the Vision’s focus on Open Banking, emphasizing its potential to reduce costs, enhance security, and boost consumer convenience.

What’s your take on the future of UK payments? Let’s chat in the comments!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

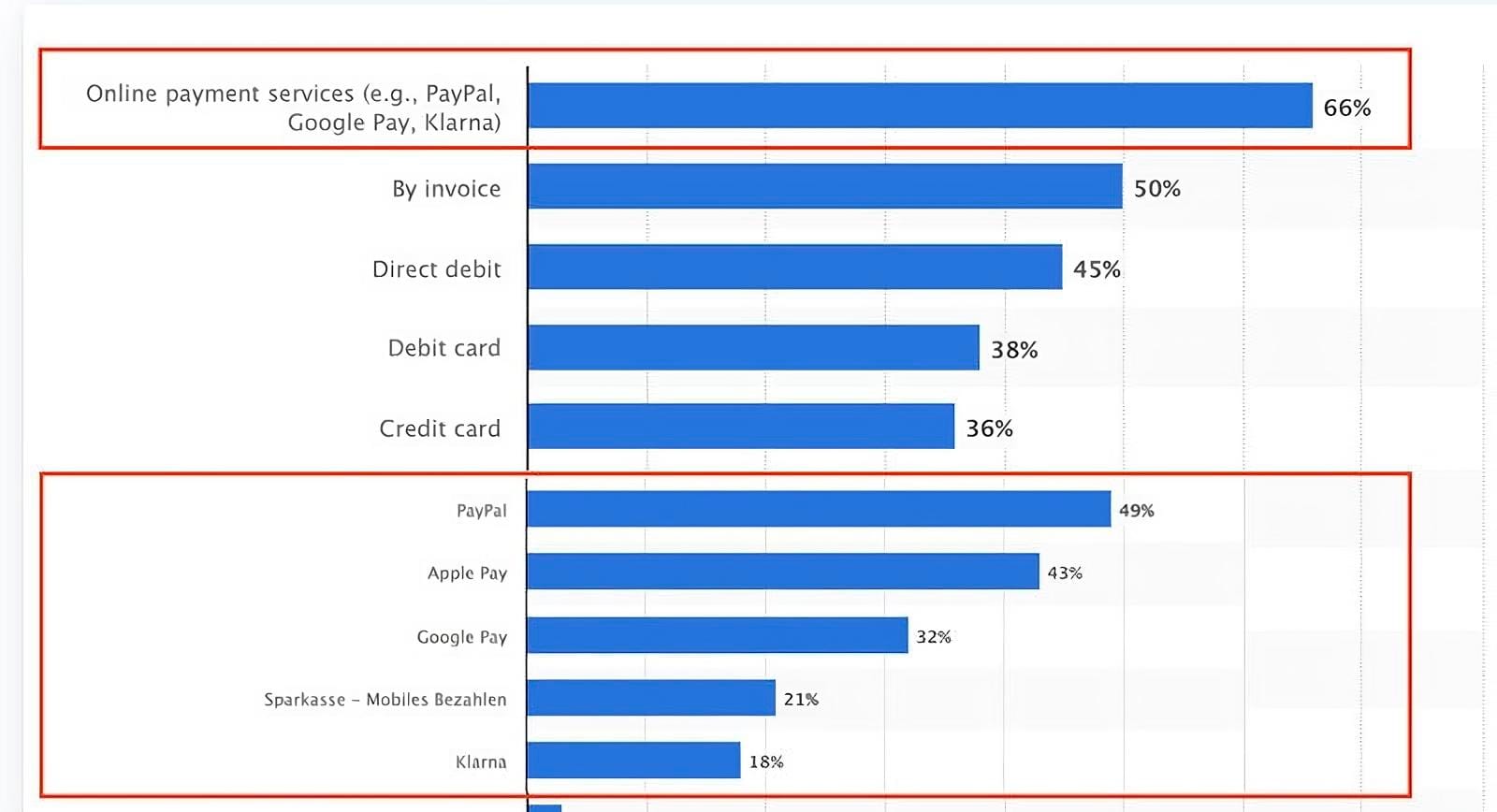

In 2024, the online payment services (e.g., PayPal, Google Pay, Klarna), the "By invoice" and "Direct debit" payments are the top answers among German 🇩🇪 consumers in a mobile payments survey from Statista.

PAYMENTS NEWS

🇺🇸 Mesa debuts homeowners credit card, offering rewards on mortgage and home expenses. The Mesa Homeowners Card, allows customers to earn ‘Mesa Points’ on various purchases, including car fuel, home maintenance and utilities. Continue reading

🇺🇸 Volante Technologies launches real-time payments intelligence solution. The Volante Payments Intelligence feature provides financial institutions with enhanced visibility and control over payment operations, streamlining decision-making and boosting performance.

🇶🇦 Qatar Central Bank clarifies use of Himyan card for payments at government agencies. The bank has stated that this is part of a phased digital transformation initiative, set to launch in February 2025, aiming to enhance transaction security and reduce payment processing costs.

HSBC partners with Dandelion in a move to reshape cross-border payments. This collaboration shifts away from traditional banking intermediaries, and aims to reach over 100 destinations through a direct-to-local network, bypassing the conventional Swift system.

🇺🇸 Blackstone, Warburg weighing $12 Billion sale of IntraFi. The alternative-asset managers have begun talking to investment banks about soliciting interest in IntraFi — which could fetch $12 billion or more in any transaction — in early 2025, according to people familiar with the matter.

🇧🇪 Qover and Mastercard secure return shopping fees in two European markets. Mastercard credit cardholders in Belgium and Luxembourg can access return shipping cost protection via Qover’s platform. Available on mastercard.be and mastercard. lu, it will add an extra layer of shopping protection for the entire retail experience.

🇺🇸 PayJunction appoints Scott Herriman as Vice President of Engineering. As VP of Engineering at PayJunction, Scott will lead the engineering team in advancing the No-code Payments Integration® platform and driving innovations to expand the company's capabilities.

🇨🇦 Trolley raises $23M in series B funding. The company plans to use the funds to accelerate product development, broaden its market presence, and enhance its platform to better serve businesses ranging from startups to Fortune 500 companies.

🇬🇧 Laurence William Booth appointed Trust Payments Group Chief Executive Officer with immediate effect. His appointment has been made following a robust and competitive evaluation process carried out by the board with support from international search advisers.

🇬🇧 Kody raises US$20m in Series A financing. This highlights the company's progress and commitment to expanding internationally, attracting talent in the UK, Europe, Hong Kong, and Singapore, while forging strategic partnerships to enhance its product offerings.

GOLDEN NUGGET

Understanding PSD3:

Let’s dive in👇

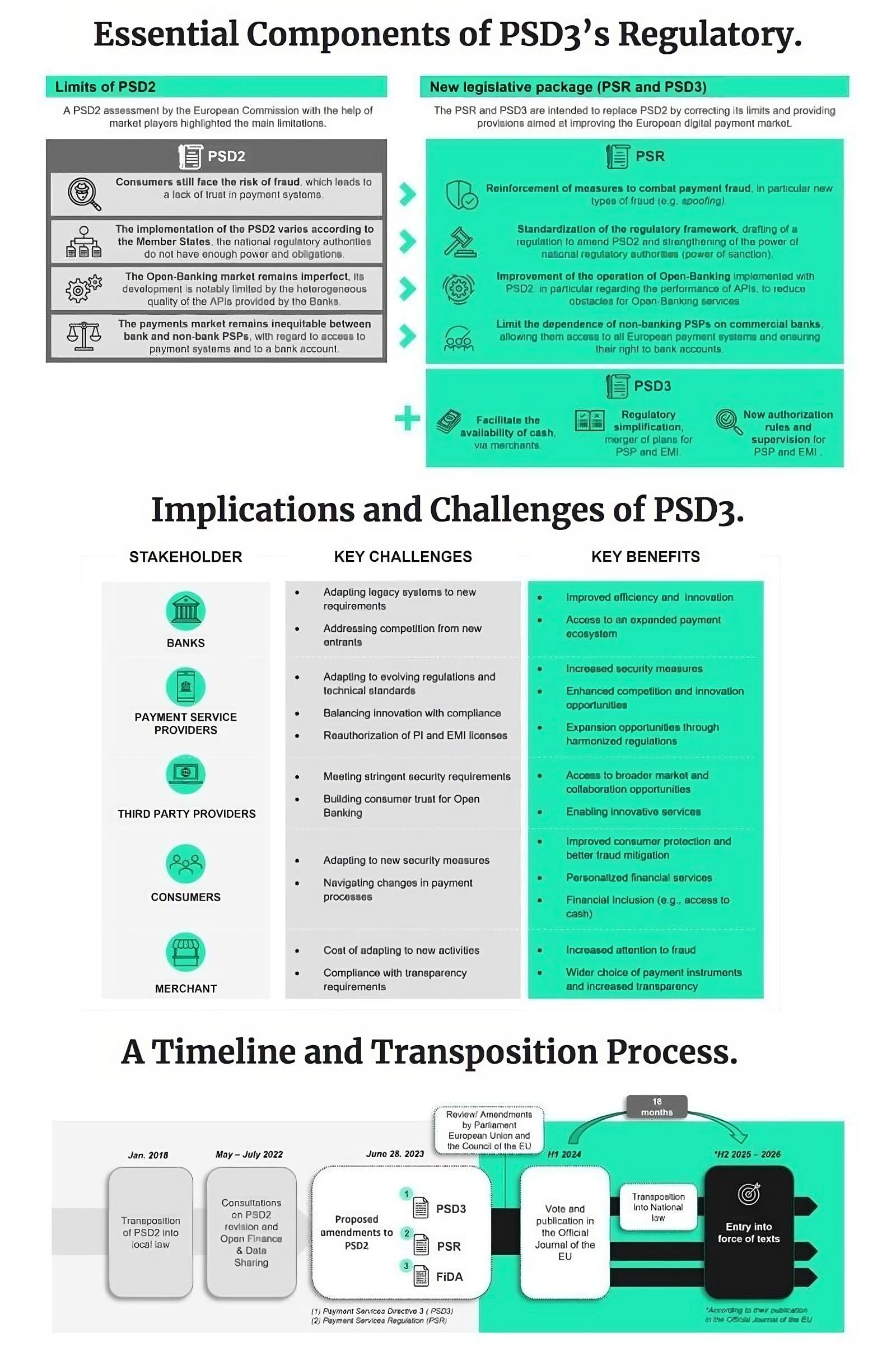

The upcoming PSD3 framework marks a significant evolution in payment services, advancing from PSD2. It aims to foster a secure, transparent, and efficient payment system by integrating innovative entities like FinTech companies and Third-Party Providers (TPPs).

This inclusion boosts competition and innovation while ensuring consumer protection and data security.

PSD3, divided into the Payment Services Regulation (PSR) and the revised PSD3, focuses on several key areas: fraud prevention, regulatory simplification, open banking enhancement, equal opportunities for all payment service providers, and cash availability support.

A crucial emphasis of PSD3 is on cybersecurity, data protection, and operational resilience to adapt to the digital transaction landscape.

This includes establishing strong cybersecurity measures, enhancing data protection laws for consumer trust and privacy, and ensuring continuous operations during disruptions.

Overall, PSD3 signifies a paradigm shift towards a more competitive, secure, and consumer-centric payment environment, balancing innovation with high safety and user experience standards.

I highly recommend the complete deep dive article by Sia Partners for more interesting info on this topic.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()