Scheduled Pix is now mandatory

Hey Payment Fanatic!

Starting this Monday, October 28th, institutions participating in Pix are required to offer their customers the Scheduled Pix feature for recurring transactions. Until now, offering this feature was optional. These rules were outlined in a Central Bank (BC) resolution published in December 2023 and updated in July this year when the BC decided to postpone the launch of Automatic Pix.

Both options target periodic payments but function differently. With recurring Scheduled Pix, the paying user defines the payment instructions. The transaction recipient can be either an individual or a business.

In the case of Automatic Pix, businesses initiate the payment “command,” provided the paying user has given prior authorization. This feature is set to launch in June 2025.

Also, starting on Friday, November 1st, new security rules for Pix will come into force. Changes include a R$200 limit per transaction and a daily cap of R$1,000 for transactions initiated from unregistered devices.

“This measure reduces the likelihood of fraudsters using devices other than those typically used by clients to manage keys and initiate Pix transactions. It will make it harder for fraudsters to exploit credentials obtained through theft or social engineering, such as login and password details,” stated the BC when it announced the new regulations.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

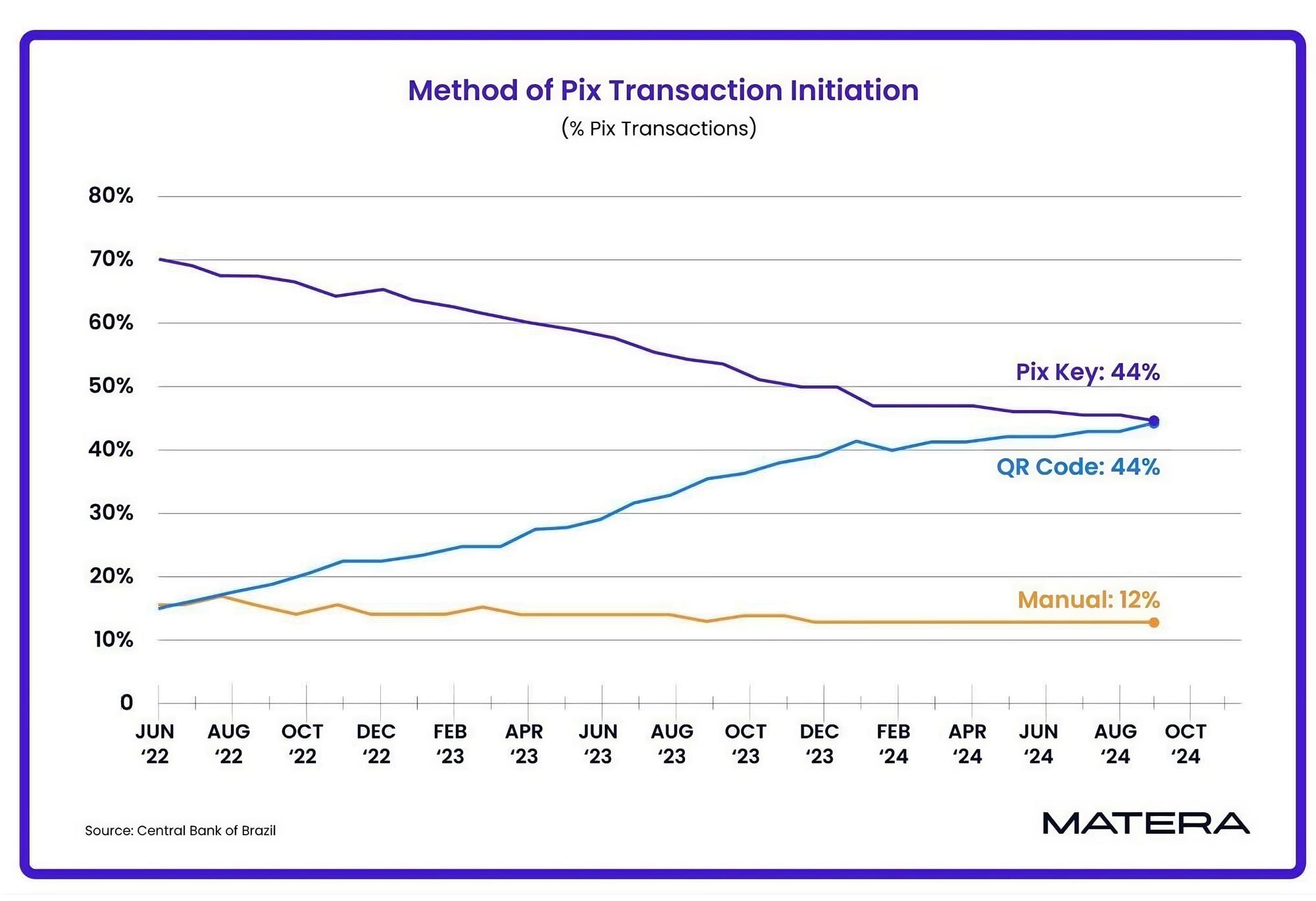

📊 There were an estimated 𝟱.𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 Pix transactions in Sept 2024 - 41% more than Sept 2023 🤯

Let's dive into more mind blowing info & Stats by reading the full report by Matera

PAYMENTS NEWS

🇺🇸 Yuno unveils Payout at Money 20/20, revolutionizing payment orchestration with first of its kind end-to-end solution for merchants. Payout allows businesses to quickly transfer funds globally to suppliers and clients via a single API that connects to multiple payout providers. Yuno Co-founder and CEO Juan Pablo Ortega unveiled Payout at Money 20/20 USA alongside James Stack, Yuno's Head of Product.

🇸🇬 Thunes expands global reach with launch of Pay-to-Card Solution. Thunes now connects Members of its proprietary Network to 15 billion cards globally, including Mastercard, Visa, and UnionPay, making cross-border payments faster, more efficient, and more accessible than ever before.

🇺🇸 Shift4 unveils global crypto payment capabilities. The company announced Pay with Crypto, allowing businesses to accept cryptocurrency with the click of a button for both e-commerce and POS merchants. Read the full piece

🇪🇺 Kia launches CarPay, an in-car payment service that allows drivers to pay for items and services directly from their vehicle, starting with the EV3 electric compact SUV. The first application is with Parkopedia, which helps European drivers find and pay for parking through the vehicle's navigation screen.

Adyen and BCG research finds embedded payments and finance now a $185 billion opportunity -- a 25% Increase in Two Years. BCG's analysis reveals this market growth is driven by a favorable interest rate environment — due to higher bank revenues from accounts — and an overall expansion of banking revenue pools.

🇬🇧 Online Payment Platform (OPP) expands its offering and obtains EMI license in the UK. This license enables OPP to continue its growth journey to become a PSP for marketplaces and platforms with their new product offering in the UK.

🇺🇸 Marqeta announces Marqeta Flex, an industry-leading, BNPL solution that can be embedded into payment apps. This new solution, developed with leading payment providers Klarna and Affirm, along with the payments platform Branch, plans to be integrated into its app for W-2 and 1099 workers.

🇺🇸 Worldpay and Capital One join forces in a new collaboration to optimize payment fraud decisioning and enhance payment security and efficiency with a data sharing agreement. Merchants using Worldpay’s FraudSight™ solution will automatically benefit when accepting payments made with Capital One-issued cards.

🇺🇸 Nium launches Nium Verify for real-time account verification to eliminate misdirected global payments. Nium Verify aims to reduce errors, operational inefficiencies, and compliance risks, increasing the confidence of the finality of real-time payments.

🇺🇸 Mastercard unveils Bill Qkr to streamline and enhance the way bills are paid. The solution will enable merchants, acquirers, payment facilitators and service providers globally by providing them with leading, faster card-based bill payment solutions and tailored expertise to improve the consumer experience.

🇺🇸 Account verification becomes critical factor in cross-border payments. Money movement can accelerate the flow of funds between consumers and corporations, but it faces complexities and fraud risks. According to Nium CPO Alex Johnson, the accuracy of payee information is a significant vulnerability in cross-border payments. More on that here

🇺🇸 PublicSquare formally launches payments platform. The company also announced a capital raise to fund further growth and stated that it is taking significant steps to modify its marketplace strategy and launch a fee-based affiliate offering in 2025.

🇬🇧 Zilch secures £150m Deutsche Bank-led securitisation deal. The expanded facility, which represents a £50m increase from its initial securitisation, will support £10bn in annual commerce through Zilch's payment network. Read on

🇬🇧 Klarna valuation raised by Chrysalis as FinTech preps for IPO. Chrysalis Investments Ltd increased the value of its stake to £120.6 million, up from the £100.3 million it assigned the holding in the second quarter, according to company filings.

🇺🇸 X Payments delayed after Musk’s X weirdly withdrew application for NY license. Approvals in New York stalled after Walden Macht Haran & Williams (WMHW) sent a letter in September 2023 urging that X be deemed "unfit" for a money transmitter license. In April 2024, X withdrew its application and did not resubmit it, according to the NY Department of Financial Services. Discover more

🇺🇸 Osigu’s $25m Series B to help revolutionise healthcare payments in Latin America. This funding aims to transform healthcare payment transactions in the region by improving interactions among providers, payers, and patients through innovative technology and real-time payment solutions.

🇨🇳 Ant CEO Eric Jing touts tokenisation benefits for cross-border transactions at FinTech Week. “If we can really solve … cross-bank, cross-currency [issues], then we are really moving to real-time settlement on a global scale.” said Jing in a panel discussion with Howard Lee, Deputy Chief Executive of the Hong Kong Monetary Authority.

GOLDEN NUGGET

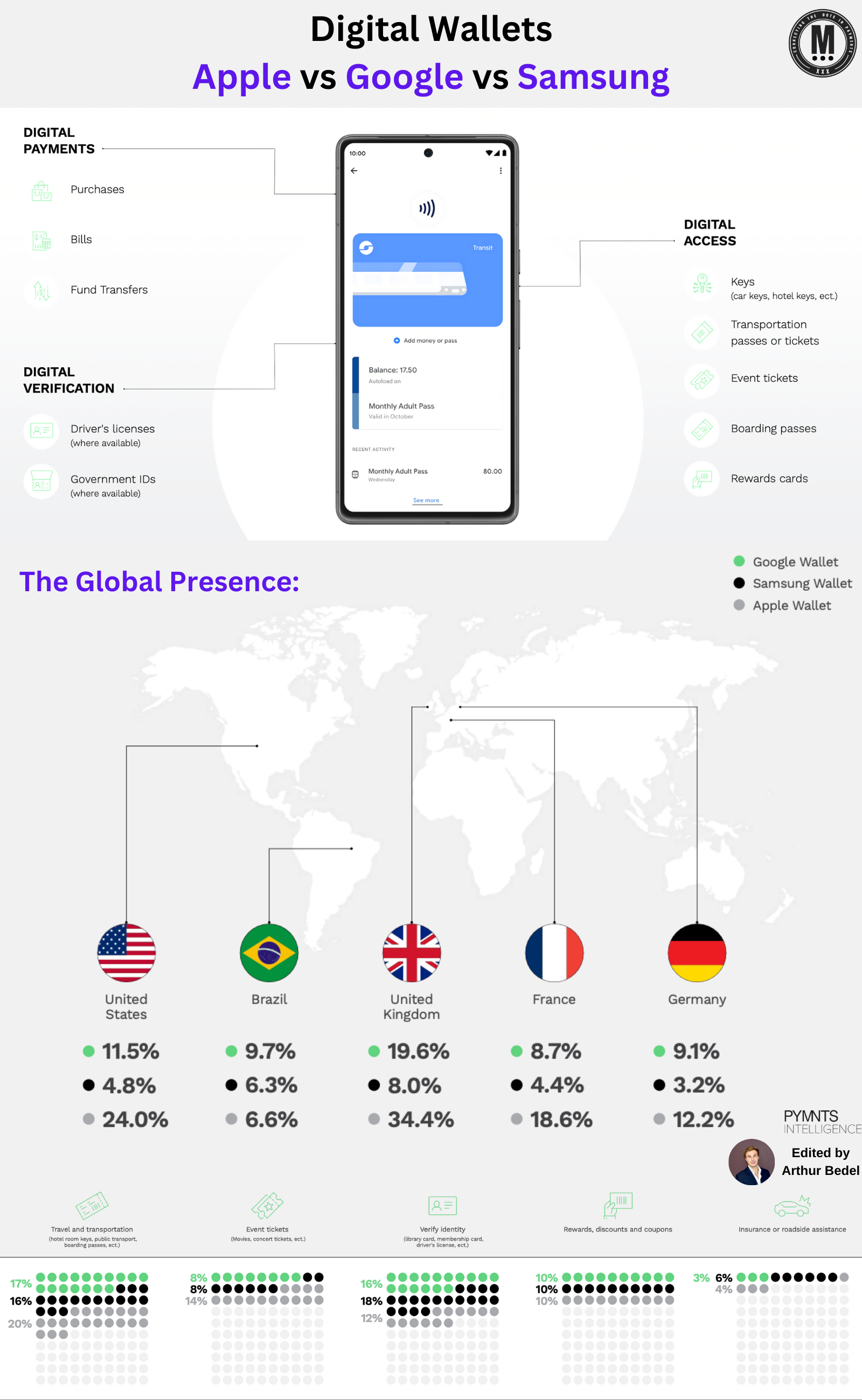

𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬, 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐚𝐧𝐝 𝐀𝐜𝐜𝐞𝐬𝐬 👇

Digital wallets have evolved beyond simple payment tools to become essential companions in our daily lives. Consumers across the globe, especially in major markets like the U.S., Brazil, the U.K., France, and Germany, increasingly rely on digital wallets for more than just transactions. They offer convenience, security, and a streamlined experience, making them indispensable in today's digital economy.

𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 are far more than payment platforms. They are transforming how we interact with financial services and digital credentials as we can leverage them for: ► 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞𝐬: Online and in-store shopping.

► 𝐅𝐮𝐧𝐝 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫𝐬: Sending and receiving payments.

► 𝐁𝐢𝐥𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Managing monthly expenses.

► 𝐕𝐞𝐫𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧: Storing driver's licenses and government IDs.

► 𝐀𝐜𝐜𝐞𝐬𝐬: Digital keys for cars, hotels, and transport passes.

► 𝐓𝐢𝐜𝐤𝐞𝐭𝐬: Boarding passes and event tickets.

► 𝐑𝐞𝐰𝐚𝐫𝐝𝐬: Storing loyalty and membership cards

𝐀𝐩𝐩𝐥𝐞 𝐯𝐬. 𝐆𝐨𝐨𝐠𝐥𝐞 𝐯𝐬. 𝐒𝐚𝐦𝐬𝐮𝐧𝐠 𝐖𝐚𝐥𝐥𝐞𝐭𝐬:

Each wallet platform has unique strengths that appeal to different user segments:

► Apple Wallet:

* High penetration in the U.S. and U.K., especially popular among travelers.

* Widely used for storing boarding passes, event tickets, and transportation passes.

* Known for its seamless integration with the Apple ecosystem, including iCloud syncing for multi-device access.

* Offers Apple Pay for secure online and in-store purchases.

► Google Wallet:

* Higher user satisfaction despite lower adoption.

* Preferred in countries like Brazil for online shopping and peer-to-peer payments.

* Frequently used for bill payments and online purchases, particularly in the U.S.

* Syncs well across all Android devices, making it accessible to a broader user base

► Samsung Wallet:

* Lower adoption compared to Apple and Google, but excels in ID storage such as library and membership cards.

* Primarily used for in-store purchases in markets like the U.K.

* Integrates with Samsung Pay, and supports rewards programs for Samsung users

Digital wallets are still in their early stages of growth, especially when considering their potential beyond transactions. As consumers begin to leverage these platforms for storing digital credentials, rewards, and tickets, the market is poised for expansion. The time is ripe for companies to enhance these functionalities and capitalize on growing consumer familiarity

Source: PYMNTS

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()