sAxess Card: Biometric Self-Custody for Digital Assets

Hey Payments Fanatic!

Serenity, in collaboration with IDEMIA, has introduced the sAxess Biometric Card, a blockchain-secured biometric card designed to enhance the protection of digital assets. By integrating fingerprint authentication with cold storage security, it eliminates the risks of PINs, passwords, and centralized custody.

Unlike conventional cards, sAxess relies on IST’s B.CHAIN hardware wallet, combining biometric authentication with encrypted storage. This self-custody solution allows users to securely manage their digital assets without relying on third-party intermediaries, giving them full control over their funds. It also simplifies access to blockchain-secured data, making it more accessible to non-crypto users and businesses.

Serenity’s Co-Founder & CPO, Robert Boris Mofrad stated, “sAxess is more than a product, it’s a revolution in digital asset security. By combining biometrics with blockchain, we’ve created a solution that enhances both accessibility and protection for users worldwide.”

Serenity specializes in blockchain infrastructure, integrating DeDaSP, DePIN, and RWA into real-world applications. With sAxess, the company is bridging the gap between security and usability in the digital economy.

If you’re interested in reading a bit about what’s been happening in Payments, keep scrolling!

Cheers,

INSIGHTS

🇨🇴 Digital payments grow about 67% and stimulate the economy for Colombia. This growth has been driven primarily by small and medium-sized businesses, which see digital payments as an important tool for expansion. By December 2024, more than seven million transactions were made in businesses across the country.

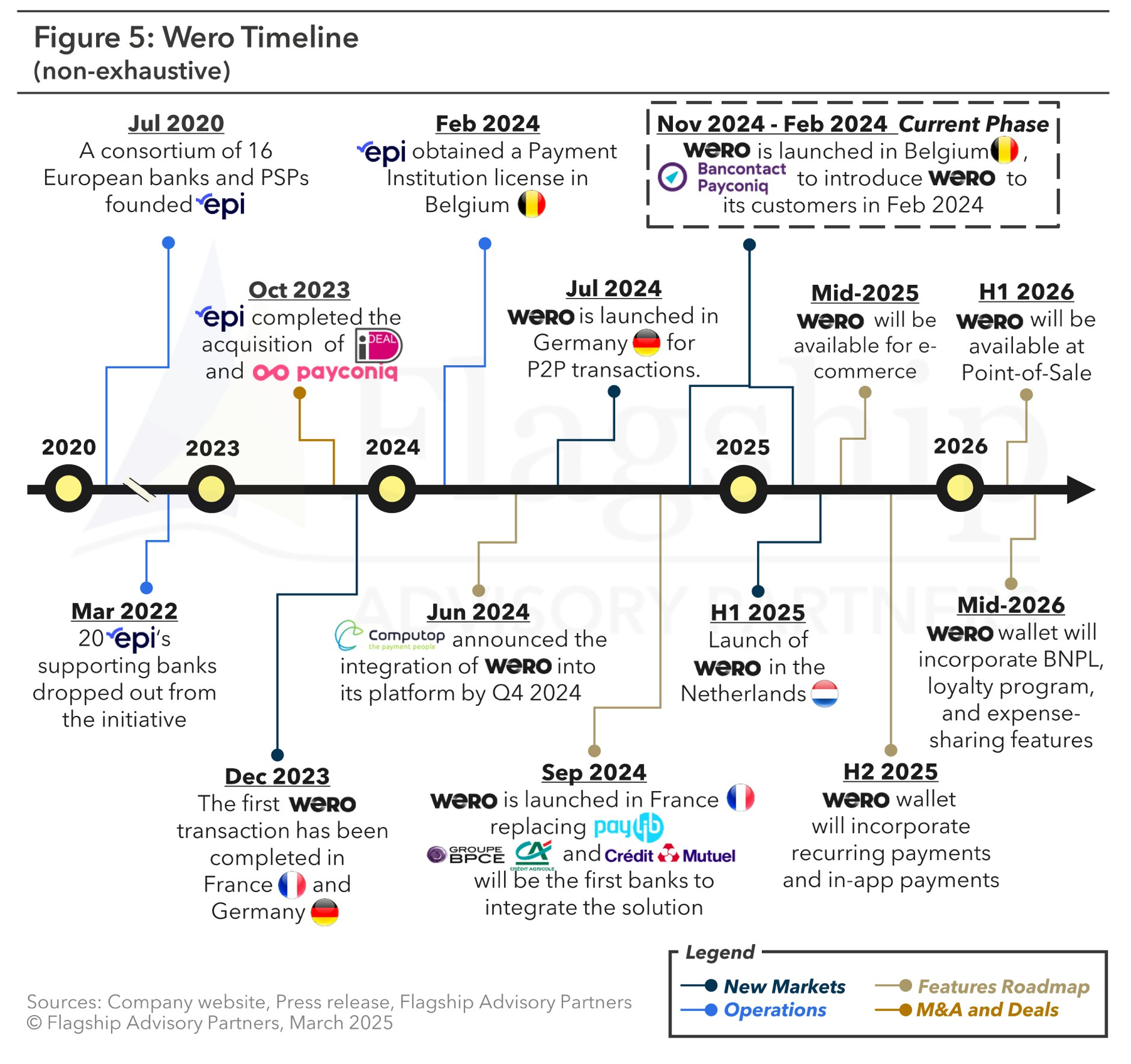

➡️ Here is how Wero, an A2A digital wallet from the European Payment Initiative (EPI), aims to (eventually) provide a pan-European instant payment solution as an alternative to foreign-owned schemes👇

PAYMENTS NEWS

🇺🇸 Sen. Blumenthal asks Visa for records of its payments deal with Elon Musk’s X. Blumenthal asked for a detailed description of Visa’s plans to enable payments on X, including the business model of the service and Visa’s role in compliance with regulatory requirements around money laundering and illicit remittances.

🇪🇺 European Commission welcomes inclusion of Moldova and North Macedonia in the Single Euro Payments Area following the positive decision by the European Payments Council. As a result, the payment service providers of the two countries will have the possibility to adhere to the various SEPA schemes.

🇺🇸 American Express to acquire expense management software Center. The company’s software aims to create a seamless expense management platform that delivers more value across the commercial card payments process – from choice in premium card offerings and rewards to automated accounting and reconciliation.

🇶🇦 Ooredoo upgrades mobile payment security; partners with Evina. Through this partnership, digital service merchants using Ooredoo’s carrier billing will have access to Evina’s advanced fraud detection and prevention system, allowing them to proactively detect and block fraudulent transactions in real time.

🇯🇵 Smartpay announces Japan's first "Embedded Insurance Service" in BNPL in partnership with Chubb. Through its partnership, The company is bringing innovation to the insurance industry. By providing solutions at the moment of need, it is also transforming the nature of insurance.

🇬🇧 FinTech iBanFirst secures UK EMI License to expand market operations. The license highlights the company’s commitment to SME security, ensuring seamless transactions, while keeping payments and funds fully protected. With comprehensive risk protection, including AML and financial crime frameworks.

🇦🇪 Al Etihad Payments and UnionPay International launch co-badge card. The cards will operate on Jaywan’s domestic payment network within the UAE, ensuring seamless local transactions. Internationally, the cardholders will benefit from the extensive UnionPay network, enabling effortless transactions across more than 180 countries and regions.

🇨🇭 Swiss FinTech Centi expands African presence with Yellow Card partnership. This allows Centi’s users in the European country to send money into 20 African countries. Users can transfer funds directly from the wallet to recipients in supported countries, who receive the payment in their preferred local currency.

🇮🇳 Enigmatic Smile acquires majority stake in Spaycial. This strategic acquisition allows Enigmatic Smile to harness Spaycial’s European Account Information Service Provider (AISP) license and open banking expertise to enhance its already extensive payment-card-linking offerings.

🌎 N1U is the first digital wallet to throw in the towel (is it game over for young FinTechs?). The virtual wallet offered a prepaid Visa card, cryptocurrency purchases, and benefits in video games such as Fortnite's V-Bucks and Free Fire's diamonds. However, it has announced that it will cease operations on March 14, 2025.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()