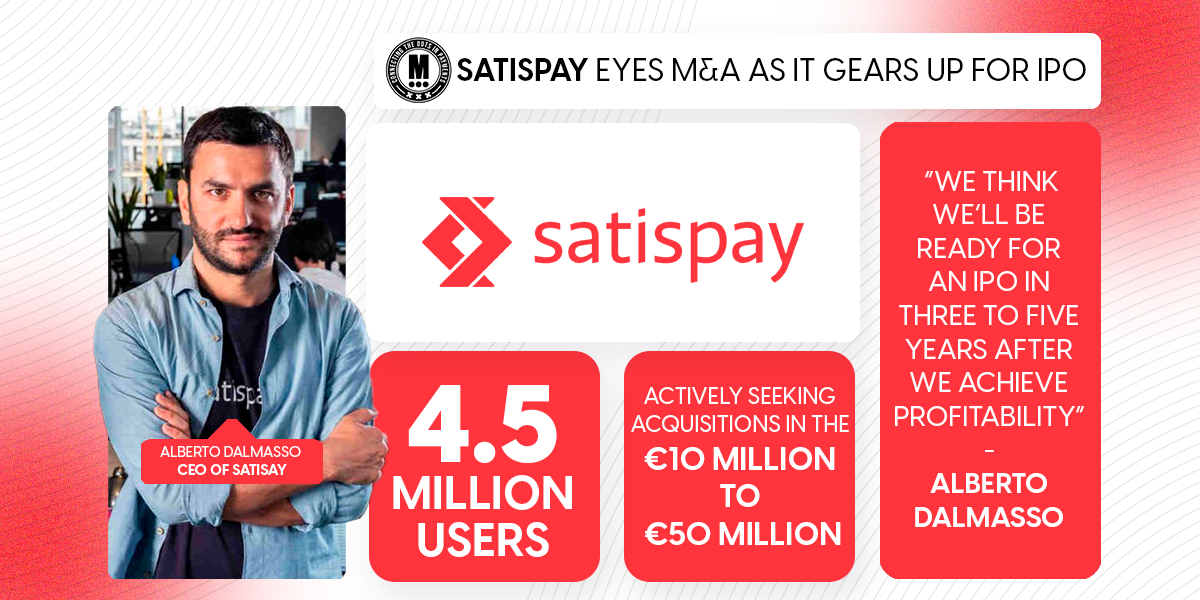

Satispay Eyes M&A as It Gears Up for IPO

Hey Payments Fanatic!

Satispay is mapping out its next move. The Italian payment network, valued at over €1.2 billion, is preparing internally for an IPO while actively seeking acquisitions in the €10 million to €50 million range. Profitability remains the key milestone, with the company expecting to break even by the end of 2026.

“We think we’ll be ready for an IPO in three to five years after we achieve profitability,” CEO Alberto Dalmasso said in an interview.

With 4.5 million users and 300k merchants, Satispay is positioning itself as an alternative to Visa and Paypal. The startup unicorn is not rushing to go public but is keeping its options open, including a potential Nasdaq listing.

Enjoy more Payments industry news below👇 and I'll be back in your inbox on Monday.

Cheers,

Transform Your Banking Experience! Subscribe to my Daily Banking Newsletter for the latest trends and updates delivered daily to your inbox. Embrace the Future of Banking—Never miss an update!

INSIGHTS

🇺🇸 Zelle payments top $𝟭 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 in 2024, as network’s growth outpaces rivals including PayPal. The payments network run by bank-owned Early Warning Services, crossed $1 trillion in total volumes last year, which it said was the most ever for a peer-to-peer platform.

PAYMENTS NEWS

🇬🇧 Wise launches new features. The company has new updates designed to help customers save time and manage international payments more efficiently. The features include: cashback tax statements, account details improved, and managing multiple accounts with ease.

🇩🇰 Ageras acquires Storebuddy. The acquisition would help it expand its reach across e-commerce also it follows Ageras’ purchase of Shine from Société Générale last year. Ageras provides accounting software to over 300,000 European small businesses. Read more

🇺🇸 Corpay Cross-Border launches Multi-Currency Accounts. This enables ever-growing businesses to expand their global footprints while enjoying hassle-free and seamless foreign currency management, in one single point of access. Accounts are designed to provide businesses with flexibility and transparency.

🇩🇪 Commerzbank and Visa agree on strategic partnership in card business. The bank will further develop its payment offerings as an important part of its growth trajectory. Customers can look forward to a strong offering with worldwide acceptance, secure online payments, and easy integration into mobile wallets.

🇺🇸 Canopy Servicing and Moov partner to transform loan repayments for lenders. Combining Moov’s real-time payment capabilities with Canopy’s automated servicing technology, the partnership aims to deliver greater efficiency, reliability, and transparency in loan repayment processing.

🇳🇬 Spayz.io expands operations in Nigeria, Japan, and the Philippines. This is part of SPAZY.io’s strategic commitment to offer its merchants and partners access to high-growth jurisdictions through innovative and reliable financial solutions. In Nigeria, the company provides bank transfer services for both pay-in and payout transactions.

🇺🇸 Spade partners with Stripe to power real-time merchant intelligence. Innovators building with Stripe Issuing can now access Spade’s merchant data to gain enhanced transaction visibility, complete with merchant logos, names, locations, and categories. Read more

🇪🇬 Fawry to launch money transfer service soon. The company aims to promote digital payment acceptance solutions during 2025 after the sector recorded 100% growth, according to the CEO. He also indicated that the company is reevaluating the feasibility of applying for a digital bank license.

🇬🇧 Money Squirrel raises £185,000 to transform business savings in the UK. The funding will be used to develop the platform’s features and expand its offerings to more businesses. The company plans to enhance its savings automation tools, adding further functionality to address the financial needs of small and medium-sized enterprises.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()