RTP® Network Boosts Transaction Limit to $10 Million

Hey Payments Fanatic!

The Clearing House is raising its RTP® network transaction limit to $10 million, effective February 9, 2025.

The increased limit enables instant payments for commercial real estate closings after business hours, daily merchant settlements, immediate supplier payments for manufacturers, and efficient cash concentration for business accounts.

"The $10 million transaction limit allows financial institutions and their customers to make larger payments in real time, continually enabling the RTP network to evolve to meet industry needs," said Margaret M Weichert, Chief Product Officer, The Clearing House. "Customers already benefit from the system's around-the-clock availability, with 42% of transactions taking place overnight, on weekends, or holidays. This aligns with how businesses operate in today's 24/7 economy."

The RTP network has processed over $500 billion in instant payments since launch, with more than 285,000 businesses sending payments monthly.

If you’re interested in reading a bit about what’s been happening in Payments, keep scrolling!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

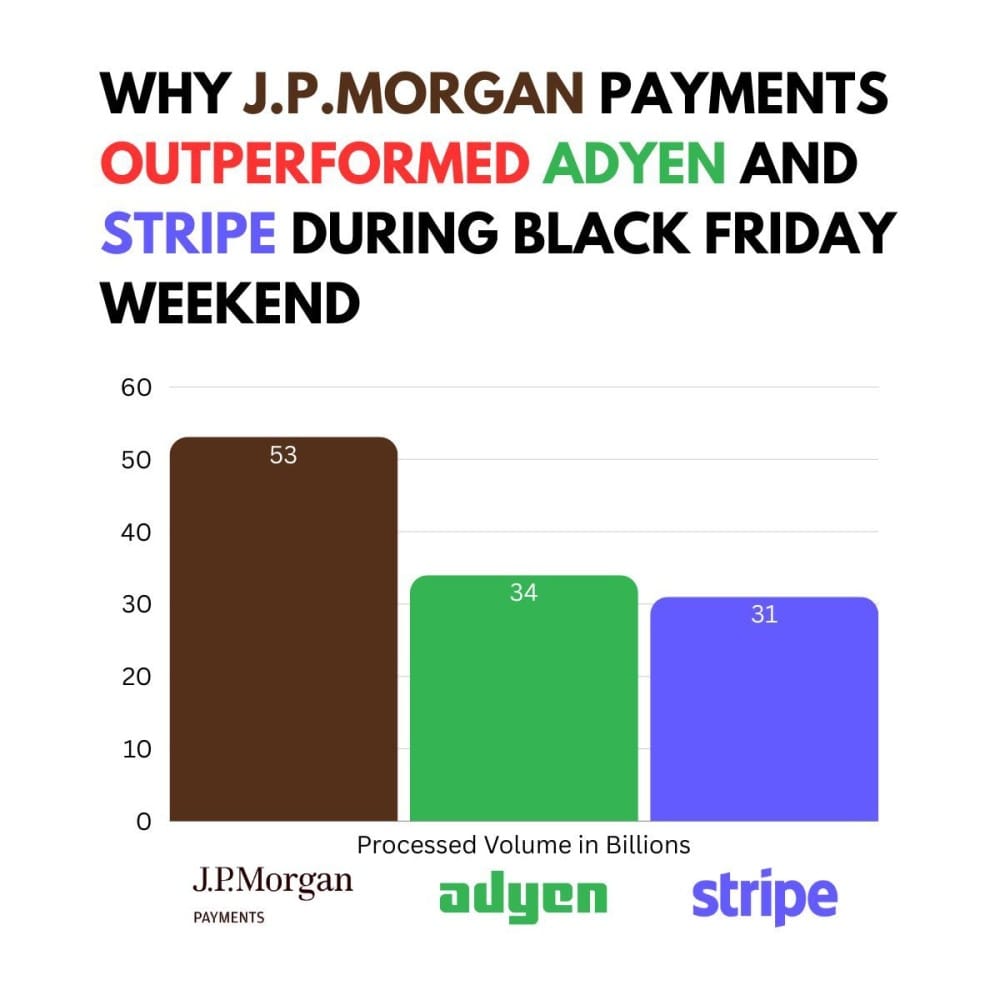

➡️ Why J.P. Morgan Payments Outperformed Adyen and Stripe During Black Friday Weekend.

With $𝟱𝟯.𝟭 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 processed during Thanksgiving week, a 17% YoY growth, and 6,000+ TPS at peak, J.P. Morgan Payments outperformed Adyen and Stripe during Black Friday Weekend 🤯

PAYMENTS NEWS

🇬🇧 Philip Symes joins Checkout.com as interim Chief Financial Officer. Philip brings extensive experience in payments, notably as CFO of Visa Europe for 10 years, and will support Checkout's international expansion into regions such as Brazil and Canada.

🇺🇸 Transform your workforce payroll and payments operations with Papaya Global’s AI solutions.

Papaya Global’s four core new platform technologies bring the payroll industry one step closer to creating a seamless workforce payments experience – regardless of location or employment model.

“After listening to our customers and spending countless hours rigorously planning, developing, and testing, I'm excited to launch the next phase of our platform technology.” Amit Levi, SVP Product.

Papaya Global’s new AI-powered solutions run on four central pillars: AI Data Connectors, Real-Time Workforce Payments, Papaya 360 Support, and AI Cycle Validation Agent.

🇬🇧 2025: Growth of new payment tech critical for merchants. 2024 has seen open banking, Buy Now, Pay Later (BNPL), and marketplaces continue to gain traction, and Moshe Winegarten, CRO at inclusive global payments platform, Ecommpay, believes 2025 will tell a similar story. However, he suggests other changes may evolve, not least within globalisation, as more merchants extend their reach to serve customers in other regions. Click here to learn more

🇪🇬 Contact Pay, eKhales expand partnership to offer PoS payment solutions. This partnership enables Contact customers across the country to conveniently settle their payments via eKhales’ expansive partners network of PoS terminals.

🇬🇧 PayPoint and Lloyds join forces to empower the nation’s 60,000+ SMEs with new payments offering. This collaboration aims to enhance merchant support and accelerate growth, delivering better tools and services to their SME and retailer partners.

🇬🇧 Tribe powers up Ribbon’s issuer processing, enabling its UK launch. Ribbon will leverage Tribe’s Risk Monitor platform to assess card transactions in real-time, ensuring customer protection and compliance with AML requirements for EMI license holders.

🇺🇸 Intuit and Adyen collaborate to help small and mid-market businesses get paid faster. This collaboration aims to accelerate payments and reduce late fees, helping UK SMBs improve cash flow. The two companies will initially integrate Adyen's embedded payment services into Intuit’s business platform through QuickBooks Online (QBO).

🇲🇾 Atome partners with Valiram to expand payment solutions. Valiram partners with Atome to offer embedded financing and flexible payments at over 200 stores in Malaysia, including brands like Victoria’s Secret and Michael Kors. The solution will expand to 40 stores in Singapore soon.

🇫🇷 French FinTech Hero secures payment institution licence from ACPR. Having obtained its ACPR licence, Hero is set to expand its presence across Europe. The company has also launched an all-in-one business account that includes a Visa.

🇬🇧 Mastercard reaches 'agreement in principle' to settle mass UK fees case. Mastercard faced a landmark lawsuit led by consumer advocate Walter Merricks on behalf of 46 million UK adults. After a five-year legal journey, it became the first mass consumer action approved in the UK, reaching the Supreme Court. More on that here

Crypto.com and Mastercard collaborate to scale digital payments in GCC region. This initiative focuses on scaling financial innovation in the region, promoting the adoption of cryptocurrencies, and providing secure, efficient payment infrastructure.

🇺🇸 Buy Now, Pay Later has almost a billion reasons to celebrate the season. BNPL spending reached $991 million on Cyber Monday, setting a record, with total holiday-season BNPL spending projected to hit $18.5 billion. While shares of Affirm, Block, and Klarna rise, BNPL's retail spending share has modestly increased, reaching 7.7%.

🇺🇸 TrueBiz approved by Mastercard as a Merchant Monitoring Service Provider. TrueBiz joins Mastercard’s Merchant Monitoring Program, offering advanced tools to detect merchant risks, such as prohibited content and transaction laundering.

GOLDEN NUGGET

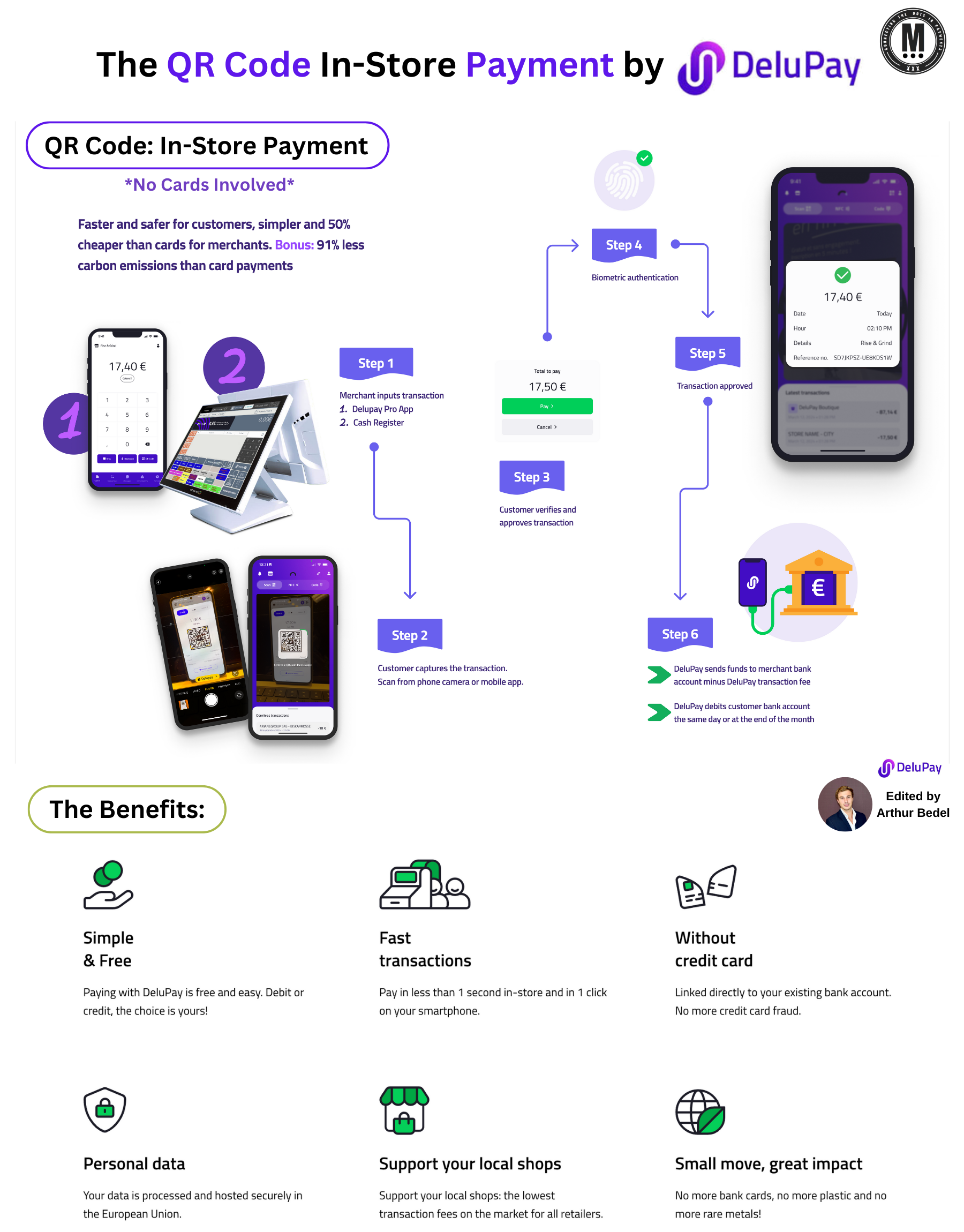

𝐓𝐡𝐞 𝐑𝐢𝐬𝐞 𝐨𝐟 𝐐𝐑 𝐂𝐨𝐝𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐢𝐧 𝐒𝐭𝐨𝐫𝐞𝐬 👇

QR code payments are digitalizing the retail payment experience, offering a faster, more secure, and cost-efficient way to pay and get paid.

► 𝐖𝐡𝐚𝐭 𝐀𝐫𝐞 𝐐𝐑 𝐂𝐨𝐝𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬?

🔸 𝐐𝐑 𝐜𝐨𝐝𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 allow customers to complete transactions by scanning a Quick Response (QR) code generated by the merchant. These payments are processed digitally, eliminate the need for cash & physical cards, making for a better contactless experience directly from a customer's bank account or mobile wallet.

► 𝐐𝐑 𝐂𝐨𝐝𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐩𝐨𝐰𝐞𝐫𝐞𝐝 𝐛𝐲 𝐁𝐚𝐧𝐤 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫𝐬, 𝐧𝐨𝐭 𝐂𝐚𝐫𝐝𝐬

Linking directly to a bank account offers several advantages:

🔸 𝐋𝐨𝐰𝐞𝐫 𝐂𝐨𝐬𝐭𝐬: By bypassing traditional card networks, transaction fees for merchants are significantly reduced.

🔸 𝐈𝐦𝐩𝐫𝐨𝐯𝐞𝐝 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲: Without storing or sharing card credentials, the risk of fraud is minimized.

🔸 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲: Payments are processed through instant bank transfers, such as SEPA (direct & fast).

🔸 𝐄𝐧𝐯𝐢𝐫𝐨𝐧𝐦𝐞𝐧𝐭𝐚𝐥 𝐈𝐦𝐩𝐚𝐜𝐭: Eliminating plastic cards and intermediaries reduces the carbon footprint of transactions.

► 𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐢𝐭 𝐰𝐨𝐫𝐤?

- 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐈𝐧𝐩𝐮𝐭𝐬 𝐀𝐦𝐨𝐮𝐧𝐭: The total transaction amount is entered into the POS system or a payment app (DeluPay).

- 𝐐𝐑 𝐂𝐨𝐝𝐞 𝐆𝐞𝐧𝐞𝐫𝐚𝐭𝐢𝐨𝐧: A unique QR code is generated for the payment.

- 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐒𝐜𝐚𝐧𝐬 𝐭𝐡𝐞 𝐂𝐨𝐝𝐞: The customer uses their smartphone to scan the QR code.

- 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧: Biometric verification or PIN approval ensures a secure transaction.

- 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐀𝐩𝐩𝐫𝐨𝐯𝐚𝐥: The payment is confirmed, and both parties receive a notification.

- 𝐅𝐮𝐧𝐝𝐬 𝐓𝐫𝐚𝐧𝐬𝐟𝐞𝐫

► 𝐎𝐯𝐞𝐫𝐚𝐥𝐥 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬

a. 𝐅𝐨𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬𝐞𝐬:

🔸 Cost Savings

🔸 Faster Access to Funds

🔸 No Hardware Requirements

🔸 Flexibility

b. 𝐅𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫𝐬:

🔸 Convenience

🔸 Free to Use

🔸 Security

🔸 Privacy

🔸 Eco-Friendly

QR code payments are redefining how we think about financial transactions in-store, prioritizing simplicity, security, and sustainability. Could this be the future of payments? Could the in-store experience become fully digital? 👀

Source: DeluPay & Julian Dufoulon

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()