Revolut Rivals Square, SumUp with New Terminal

Hey Payments Fanatic!

Revolut is ramping up its competition against Square and SumUp with the launch of a new payment terminal designed for larger businesses and retailers.

The London-based banking firm will debut the device, known as Revolut Terminal, in the UK and Ireland just in time for the busy holiday season as part of its strategy to expand its business-to-business offerings.

Since 2021, Revolut’s merchant acquiring division has been rolling out both online and offline payment solutions under its Revolut Business brand.

These new terminals will enable merchants to offer Revolut Pay, a checkout option that allows the FinTech’s 45 million+ global users to pay directly from the Revolut app.

Over the past year, Revolut has processed payments for more than 65,000 merchants, with the volume of in-person transactions growing fourfold.

“This is one of our big new bets as a company,” said Alex Codina, Revolut’s general manager for merchant acquiring, to City AM. Codina emphasized that Revolut Terminal is aimed at capturing a new segment of the market, promising streamlined operations and analytics tools that cater to businesses with multiple locations.

Let's see how this plays out…

Enjoy more Payments industry updates I listed for you below and I'll be back in you inbox tomorrow!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

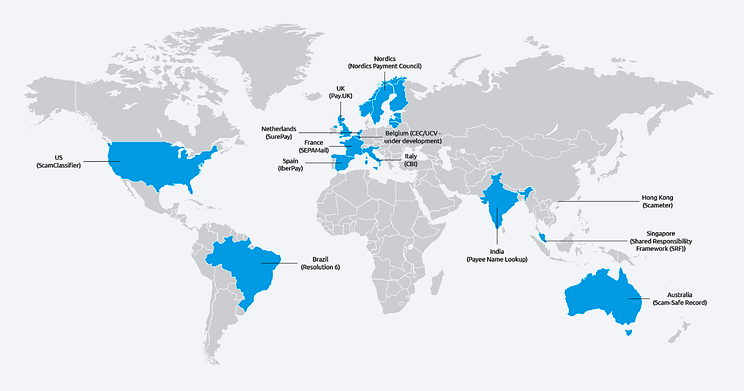

📊 Secure and simple instant payments. As instant payments rise, so does the need for a unified global Confirmation of Payee solution to protect consumers, banks, and reduce fraud. Read this insightful report by Capgemini to get all the details.

PAYMENTS NEWS

🇺🇸 PayQuicker has been recognized as the Best Cross-Border Payments Solution at the 2024 PayTech Awards USA, hosted by FinTech Futures. The company is proud to continue driving innovation in the FinTech space with the smartest, fastest, and easiest way to send payouts to recipients globally.

🇸🇪 Swedish open banking FinTech Trustly to expand DACH region operations. The goal is to boost the FinTech firm’s overall presence in the region and to “precisely” meet local needs and expectations of customers on the product side. Read on

🇦🇪 Mansa surpasses $3 million in transaction volume one month after launch, providing liquidity to payment companies. Launched in September 2024, Mansa leverages decentralized finance to tackle the liquidity shortfall limiting cross-border payment companies.

🇬🇧 Wirex Pay innovates DeFi Space with launch of Node Rewards in WPAY. The introduction of the Wirex Pay Node Rewards Center marks a major leap forward in simplifying the earning process within the decentralized finance ecosystem.

🇩🇰 Cryptomathic unveils Obsidian: The Next-Generation payment platform for the cloud era. The platform provides a cloud-based solution for payment card issuers and FinTechs, enabling rapid card issuance and transaction authorization while offering flexibility and cost savings.

🇫🇷 G7 integrates Alipay+ with PayXpert. This partnership aims to enhance the travel experience for global visitors to France, while continuing to meet client needs and comply with local regulations in an evolving market. Click here to learn more

🇸🇬 Helicap bags US$3 million investment from GMO Payment Gateway for credit fund. The fund offers debt financing to FinTech companies across Southeast Asia, supporting their growth in a rapidly expanding market. Keep reading

🇪🇺 Stripe, Wise founders want a ‘tech renaissance’ in Europe to help the region rival Silicon Valley. Founders of some of Europe’s largest technology unicorns on Monday backed an open letter calling for a “tech renaissance” fueled by the creation of a single pan-European entity to promote startups and innovation in the bloc.

🇪🇺 Mastercard to pilot enhanced ID verification service in Europe. The new service gives issuers the ability to verify more detailed personal information about cardholders, eliminating the need to upload documents like photo ID, proof of residency or passport.

🇷🇴 TOKEN secures authorisation from NBR and becomes a payment institution. Aligning with PSD2 regulation, TOKEN can now accept online payment operations and transactions at physical Point-of-Sale (POS), as well as to conduct money remittance procedures, which facilitates the activities of online marketplace stores.

GOLDEN NUGGET

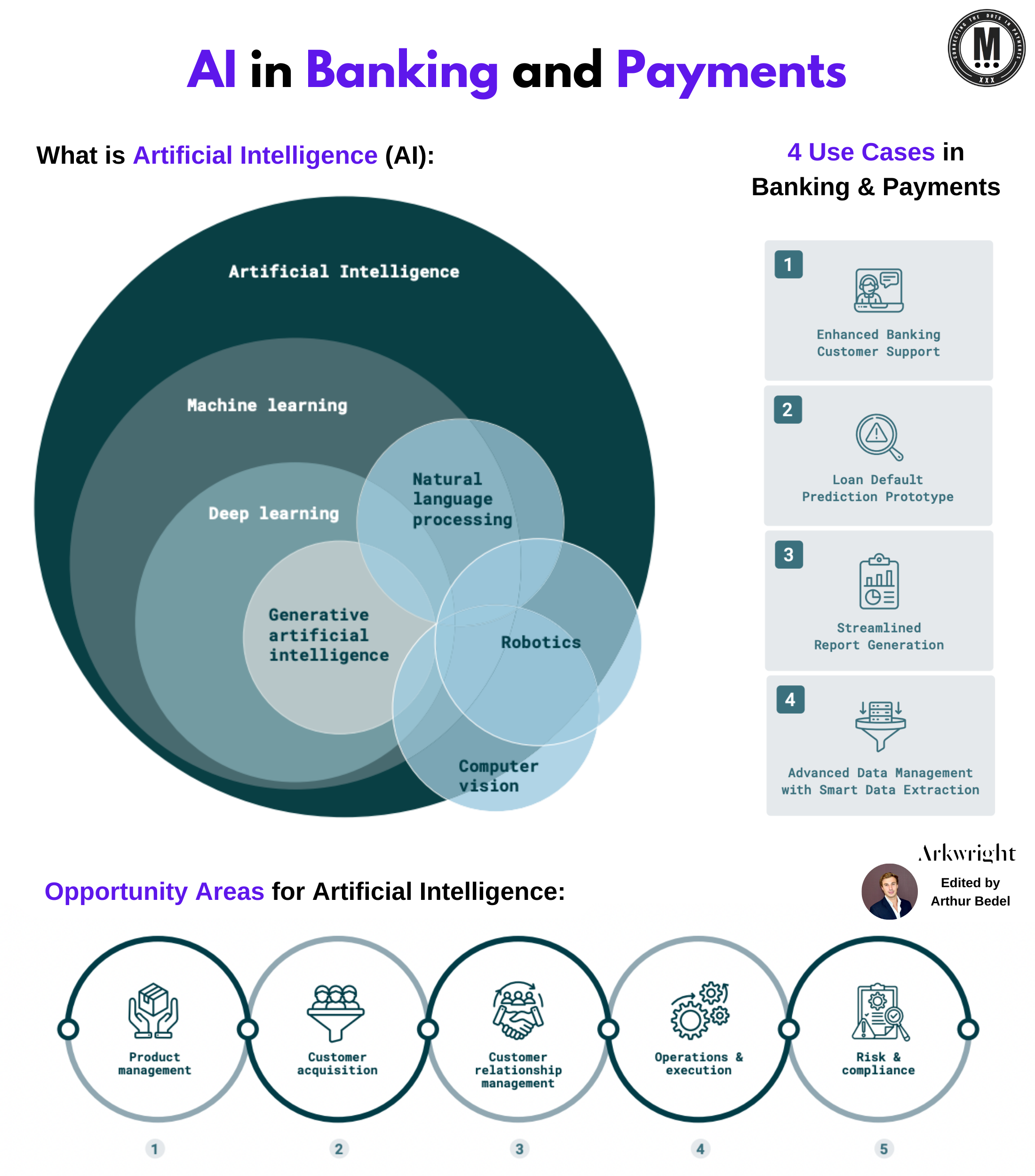

𝐀𝐫𝐭𝐢𝐟𝐢𝐜𝐢𝐚𝐥 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 is revolutionizing 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 and 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬, driving revenue, enhancing fraud detection, slashing costs & more👇

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐀𝐫𝐭𝐢𝐟𝐢𝐜𝐢𝐚𝐥 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞:

Artificial Intelligence (AI) is a field within computer science that focuses on creating systems capable of performing tasks that typically require human intelligence. This includes subfields:

► Machine Learning

► Deep Learning

► Generative AI

There are a multitude of different application fields for AI leveraging the subfields above:

► Natural Language Processing

► Robotics

► Computer vision

AI can be categorized into hashtag#NarrowAI, which targets specific tasks, and hashtag#GeneralAI, which aims for broader, human-like cognitive abilities. Currently, Narrow AI is more prevalent and applied in various industries, including banking and payments.

𝐇𝐨𝐰 𝐀𝐈 𝐢𝐬 𝐈𝐦𝐩𝐚𝐜𝐭𝐢𝐧𝐠 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 & 𝐁𝐚𝐧𝐤𝐢𝐧𝐠:

► 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐄𝐧𝐠𝐚𝐠𝐞𝐦𝐞𝐧𝐭 — AI-driven personalized solutions and customer support enhance customer satisfaction and loyalty.

► 𝐎𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲 — AI automates routine tasks, reduces errors, and streamlines processes, leading to significant cost savings.

► 𝐑𝐢𝐬𝐤 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 — AI provides sophisticated tools for real-time risk detection, compliance, and fraud prevention.

𝐑𝐞𝐚𝐥-𝐥𝐢𝐟𝐞 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬 of hashtag#AI:

👉 Enhancement of customer support

👉 Predictive capabilities of AI in forecasting consumer finance credit defaults

👉Automation of annual report generation utilizing AI technologies

👉 Improvement of organizational data management speed and reliability with AI integration

𝐂𝐮𝐫𝐫𝐞𝐧𝐭 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬 & 𝐏𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥 𝐟𝐨𝐫 𝐃𝐢𝐬𝐫𝐮𝐩𝐭𝐢𝐨𝐧 👇

1️⃣ Revenue Growth and Cost Reduction — AI adoption in banking could lead to a 30% increase in revenue and a 25% decrease in costs

2️⃣ Practical Use Cases:

► Enhancing Customer Support — AI-powered virtual assistants manage 70-80% of incoming calls.

► Loan Default Prediction — Machine learning models predict loan defaults by analyzing diverse data sources, reducing credit risk.

► Streamlining Report Generation — Gen AI automates the creation of financial reports.

► Advanced Data Management — AI enhances data extraction and processing, improving the reliability and usability of data.

3️⃣ Organizational Transformation — Systematic approach is crucial to the implementation of an AI strategy.

By embracing AI, #Banks and #FinTech companies can not only streamline their operations and reduce costs but also create more personalized and efficient services for their customers. This is a competitive advantage 🚀

Source: Arkwright Consulting & DataArt

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great updates like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()