Record-Breaking Black Friday Cyber Monday Weekend

Hey Payments Fanatic!

The 2024 Black Friday/Cyber Monday weekend has transformed into a record-breaking global phenomenon! Let me break down the most impressive numbers for you:

Shopify's Record-Breaking Performance:

- Total sales reached $11.5B (up 24% from 2023's $9.3B)

- 76+ million consumers made purchases globally

- Average cart value: $108.56 USD

- 16,500+ entrepreneurs made their first-ever sale

- 67,000+ merchants had their highest-selling day

- 91+ million packages tracked on the Shop app

Stripe's Milestone Achievement:

- Processed $31B+ in total payment volume

- Handled 465M transactions

- Processed 209M unique cards and wallets

- Average spend per wallet: $121 (up 4.3% from 2023)

- Prevented 20.9M fraudulent transactions worth $917M

- 35,000+ businesses had their best day ever

Payment Infrastructure Excellence:

- Processed over $34B in volume

- Handled 670M+ total transactions

- Peak: 163,430 transactions per minute

- 99.9999% uptime

Stripe:

- Peak: 137,000 transactions per minute

- Cross-border: $3.2B across 43M transactions

- Processed 428,000 crypto transactions

- 99.9999% API uptime

Global Highlights:

- Top selling cities: Seattle, New York, Los Angeles, London, and San Francisco

- Shopify EMEA sales: ↑ 39% since last year

- Shopify APAC growth: ↑ 29% since last year

- Top currencies: USD, GBP, EUR, AUD, CAD

What's your take on these impressive numbers? Did you contribute to these record-breaking figures by starting your holiday shopping early? Share your thoughts in the comments below!

Scroll down for more interesting Payments industry news updates and I'll be back in your inbox tomorrow! 👇

Cheers,

Marcel

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

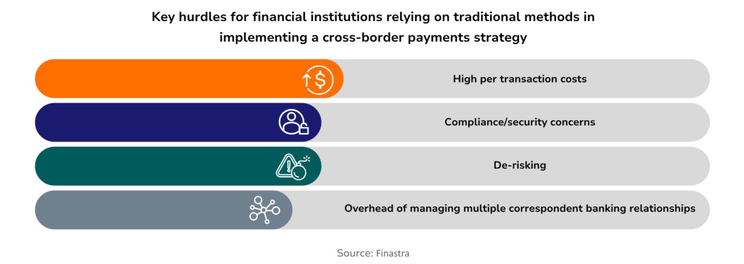

📊 Take a look at “Unlocking instant cross border payments in APAC” report. Global cross-border ecommerce is expected to reach 𝗨𝗦$𝟯.𝟰 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 in 2028, with Asia Pacific emerging as the largest market by accounting for over 40% of global sales. Read the full report

PAYMENTS NEWS

🇬🇧 Ecommpay streamlines payouts where beneficiary details unknown with new Payouts via Hosted Payment Page. The new Payouts via Payment Page solution offers an efficient way to process payouts to payment cards, as well as deposits to Apple Pay and Google Pay. This advanced solution is an industry first and game-changer for businesses where senders don’t have the beneficiary's details.

🇨🇴 Yuno brings smart routing to payments process. Yuno announced the launch of Smart Routing, a revolutionary payment solution leveraging proprietary data and intelligent algorithms, reinforcing its leadership in payment orchestration and commitment to empowering merchants with seamless, intelligent tech.

🇧🇷 Rerserva achieves the perfect balance of efficiency and control with Yuno. The partnership between Reserva and Yuno has delivered exceptional results in a short period. Within three months of launching Yuno’s solutions on the Reserva website, the company achieved a four-percentage-point increase in its purchase conversion rate. Get the full story here

🇺🇸 Banks hit credit card users with higher rates in response to regulation that may never arrive. Banks that issue credit cards used by millions of consumers raised interest rates and introduced new fees over the past year in response to an impending regulation that most experts now believe will never take effect.

🇸🇬 dtcpay announces shift to stablecoin-only payment services by 2025. This move will see the phasing out of support for Bitcoin (BTC) and Ethereum (ETH) by the end of the year, while maintaining support for all other stablecoin and fiat currency services.

🇱🇹 myTU issues business Visa debit card, built to simplify expense management for businesses of all sizes across the EEA. Raman Korneu, CEO said: “We created this new offering to help businesses streamline expenses and scale efficiently.”

🇳🇵 Fonepay introduces Nepal’s first virtual credit card with support of Compass Plus Technologies. The service is designed to provide a secure, flexible, and cost-effective digital credit solution for Nepal’s financial institutions (FIs), offering a strong local alternative to those offered by international card networks

🇫🇷 La Banque Postale launches 'impact' bank card in collaboration with WWF France. The bank's impact card - made from recycled PVC - is available on the Visa Classic and Visa Premier ranges at current rates. An additional €5 annual fee for the card will be donated in full to WWF France.

🇭🇰 KPay, a financial management platform for SMEs, raises $55M Series A. The funds will support product development, accelerate go-to-market efforts, enhance customer experience, expand into new Asian markets, and pursue growth through mergers and acquisitions, according to the company’s CFO.

🇦🇺 Zip Co's pioneering FinTech leader Larry Diamond to step down. Co-Founder Larry Diamond has agreed with the Board that he will step down as a director of Zip and as US Chairman to establish a Family Office and Foundation for his philanthropic endeavours.

GOLDEN NUGGET

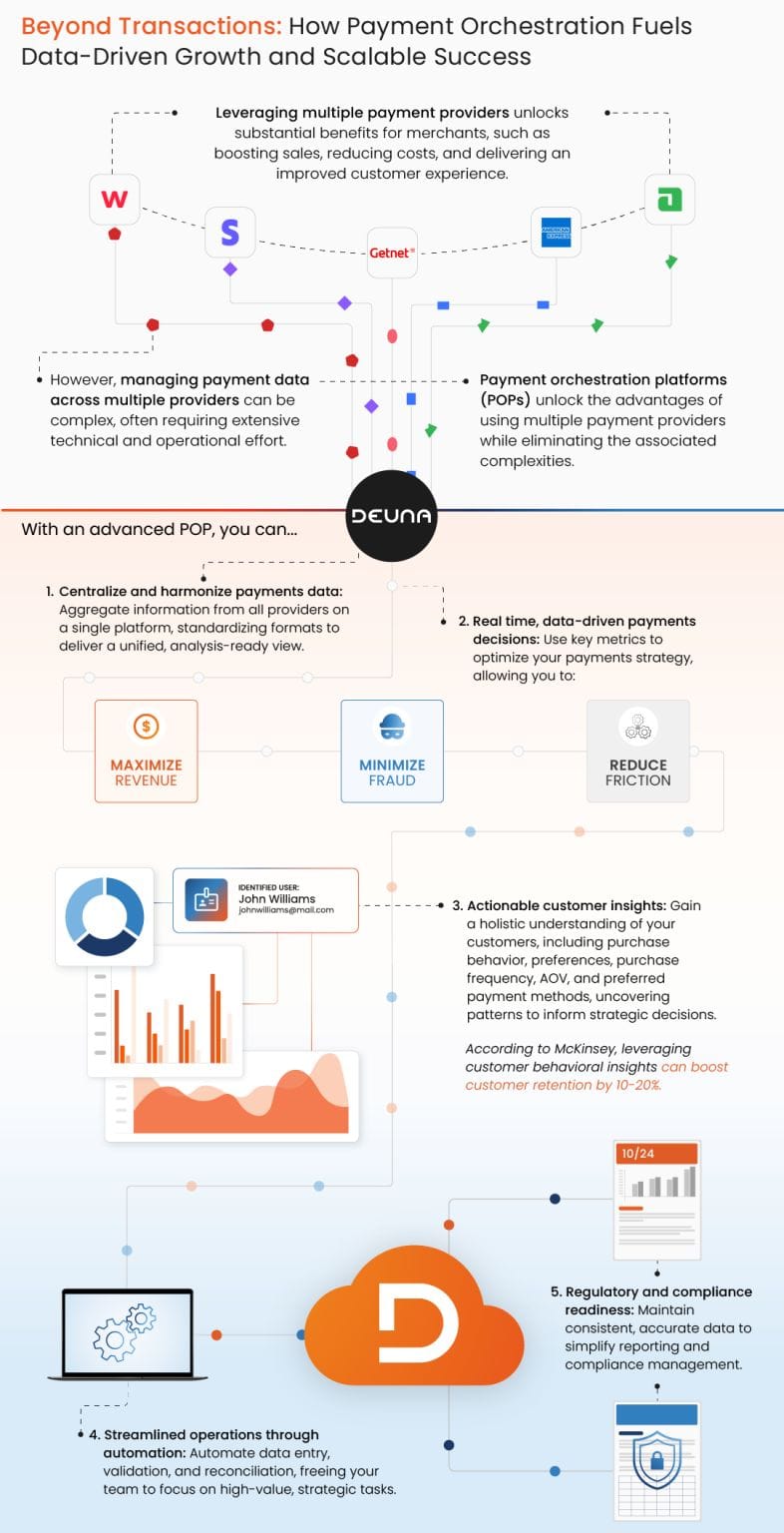

5 ways advanced Payment Orchestration Platforms drive growth & efficiency.

Let's dive in:

1️⃣ 𝗨𝗻𝗶𝗳𝗶𝗲𝗱 𝗗𝗮𝘁𝗮:

Best-in-class POPs centralize and standardize payment data, making it analysis-ready and reducing the burden on internal teams while supporting seamless operations.

2️⃣ 𝗥𝗲𝗮𝗹-𝗧𝗶𝗺𝗲 𝗜𝗻𝘀𝗶𝗴𝗵𝘁𝘀:

POPs enable smarter payment decisions by offering real-time metrics like acceptance rates and fraud patterns, leading to higher success rates and reduced costs.

3️⃣ 𝗖𝘂𝘀𝘁𝗼𝗺𝗲𝗿 𝗜𝗻𝘀𝗶𝗴𝗵𝘁𝘀:

Analyze payment patterns to uncover trends that boost retention and drive strategy—like AOV shifts and preferred payment methods.

4️⃣ 𝗖𝗼𝘀𝘁 𝗦𝗮𝘃𝗶𝗻𝗴𝘀:

Automation cuts manual data tasks, reducing errors and freeing teams to focus on strategic initiatives, enhancing productivity.

5️⃣ 𝗖𝗼𝗺𝗽𝗹𝗶𝗮𝗻𝗰𝗲 𝗠𝗮𝗱𝗲 𝗘𝗮𝘀𝘆:

Simplified data consistency supports accurate reporting, helping businesses stay ahead of growing regulatory demands.

By automating and structuring data, POPs transform raw info into actionable insights, empowering smarter, faster decisions for scalable growth.

I highly recommend reading the complete deep dive source article by DEUNA for more interesting info on this topic.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()