Recharge Launches Pay by Bank in Germany with Tink and Adyen

Hey Payments Fanatic!

Recharge has launched Pay by Bank in Germany through a partnership with Tink, a Visa solution, and Adyen, introducing direct account-to-account transfers as a payment option.

The Open Banking-powered solution will first roll out on Guthaben.de, one of Recharge's main German platforms, allowing customers to make direct bank transfers during checkout without credit cards or third-party services.

The implementation combines Tink's Open Banking integration capabilities with Adyen's payment processing infrastructure to create a streamlined payment experience.

This expansion reflects the growing adoption of innovative payment solutions, with Tink reporting that over 10,000 merchants have already implemented Pay by Bank through payment service provider partnerships.

This new payment method aims to enhance the checkout experience by prioritizing security, speed, and simplicity, enabling customers to transfer money directly from their bank accounts when purchasing vouchers.

Read more global Payments industry updates below 👇 and I'll be back tomorrow!

Cheers,

Explore Latin America’s FinTech growth. Join my weekly newsletter to stay informed—don’t miss a beat!

INSIGHTS

In the world of Digital Wallets, ApplePay and GooglePay are two of the most dominant forces, but how do they compare? Check out Jason Heister’s guide to see how they stack up in a head-to-head comparison. Learn more

PAYMENTS NEWS

🇨🇱 MACHBANK and Pomelo: new credit card in Chile. ¨The partnership with Pomelo represents a significant step for MACHBANK, as it allows us to continue expanding the range of digital products that simplify and improve the financial experience for our users. We are confident that together, we will take innovation and financial inclusion to new levels¨, said CTO of MACHBANK.

🇮🇳 JUSPAY is set to become the first unicorn 🦄 of 2025. The company is in the process of raising $𝟭𝟱𝟬 𝗺𝗶𝗹𝗹𝗶𝗼𝗻. It has been instrumental in defining India's digital payment ecosystem. The National Payments Corporation of India (NPCI) called in Juspay's expertise to build its Unified Payments Interface (UPI) app, BHIM.

🇿🇦 Stitch expands to in-person payments with ExiPay. This acquisition enhances Stitch's enterprise payments offering by integrating both online and in-person payments into a single, unified platform. With this Stitch can support multi-lane retail and omnichannel commerce businesses.

🇻🇳 Visa and DealMe partner on cross-border installment payments. This move will bring cross-border card installment payment services to Vietnamese and other global users. It will enable Vietnamese travelers to use their Visa credit cards for installment payments at duty-free shops, department stores, and medical institutions in South Korea.

🇬🇧 Visa and Mastercard face multi-billion pound lawsuit. Harcus Parker is reaching the final stages of preparation for the commencement of a multi-billion pound class action lawsuit. They allege that businesses overpay interchange fees when customers pay them by commercial card - causing an estimated $4 billion in collective losses.

🇰🇪 KCB and Mastercard unveil Kenya’s first platinum multi- currency card. It offers a cost-effective method for managing international transactions by reducing high transaction fees and enhancing convenience for frequent travelers and global spenders. Continue reading

🇺🇸 Priority Technology buys payroll platform Rollfi. With the backing of Priority, Rollfi partners can now tap into financial infrastructure, including money movement rails that power over $1tn in commerce, connections with over 20 Tier 1 and regional processing banks, and nationwide money transmitter licences.

🇨🇳 Alipay Tap! expands to Macao, now accepted at over 1,000 merchants. Macau Pass, as a partner in the Alipay Tap! rollout, supports the service’s integration into Macao’s digital payment landscape, contributing to greater convenience for merchants and tourists alike.

GOLDEN NUGGET

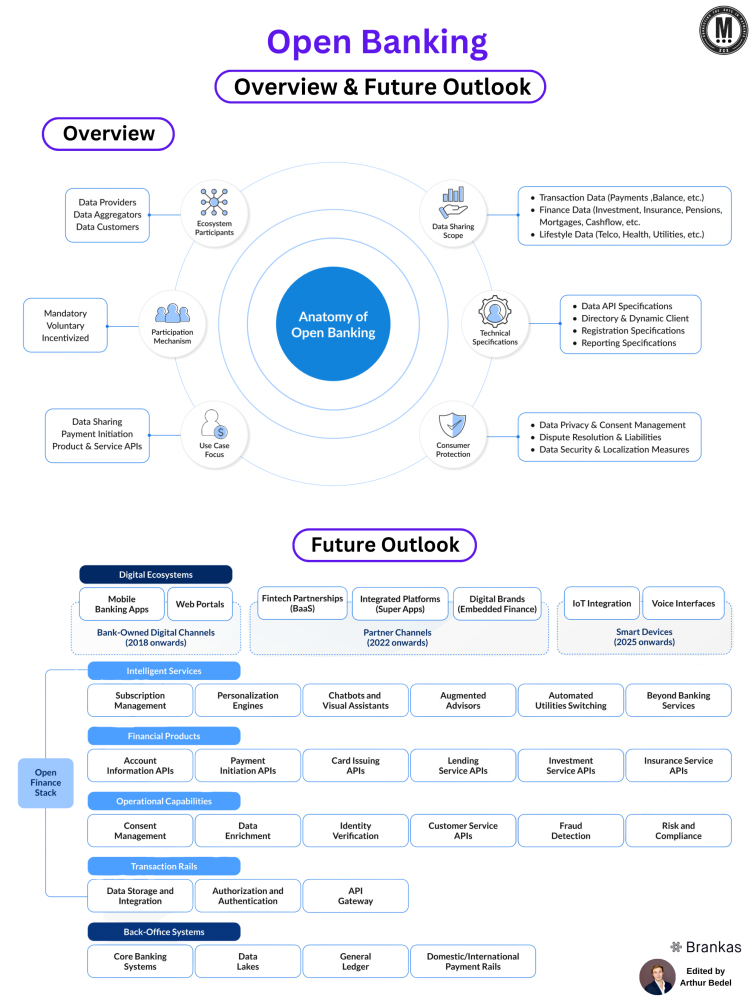

𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 - a reality or not?

The rapid evolution of 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 is reshaping the financial services landscape globally. Leveraging the source, a bank account or a wallet, directly to enable a payment is gaining momentum (finally...).

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠?

Open Banking allows 3-party developers to build applications and services around financial institutions. It enables secure access to customer banking data (with permission) to improve services such as payment initiation, financial management tools, and data aggregation. It relies on several key foundations:

► 𝐀𝐏𝐈𝐬 — Facilitate seamless communication between banks and third-party services.

► 𝐃𝐚𝐭𝐚 𝐏𝐫𝐢𝐯𝐚𝐜𝐲 & 𝐂𝐨𝐧𝐬𝐞𝐧𝐭 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 — Ensures secure data sharing while safeguarding customer consent and privacy.

► 𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫 𝐏𝐫𝐨𝐭𝐞𝐜𝐭𝐢𝐨𝐧 — Involves measures such as fraud detection and dispute resolution, ensuring customers are protected at all times.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐎𝐩𝐞𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐞?

𝐎𝐩𝐞𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐞𝐱𝐩𝐚𝐧𝐝𝐬 𝐨𝐧 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 by incorporating a wider range of financial services, including investments, pensions, insurance, and mortgages. It aims to create a comprehensive financial ecosystem by connecting various financial products to deliver a holistic view and personalized experiences for consumers.

𝐓𝐡𝐞 𝐅𝐮𝐭𝐮𝐫𝐞 𝐨𝐟 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 & 𝐎𝐩𝐞𝐧 𝐅𝐢𝐧𝐚𝐧𝐜𝐞

► 𝐒𝐦𝐚𝐫𝐭 𝐃𝐞𝐯𝐢𝐜𝐞𝐬 & 𝐈𝐨𝐓 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧 (2025 onwards) — Imagine accessing your financial services directly through wearable technology or smart home devices.

► 𝐁𝐞𝐲𝐨𝐧𝐝 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 — Open Finance will push the boundaries of banking, offering more services such as automated utilities switching, lending, insurance, and more.

► 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐭 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 — Personalization engines, chatbots, and augmented advisors will enhance customer engagement.

► 𝐆𝐥𝐨𝐛𝐚𝐥 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦𝐬 — Open Banking will continue to expand through fintech partnerships, embedded finance, and digital brands.

► 𝐓𝐡𝐞 𝐑𝐢𝐬𝐞 𝐨𝐟 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — With the increasing adoption of digital wallets, Open Banking will seamlessly integrate wallets as a core element of financial transactions. Digital Wallets will be the portal to access bank transfers as a form of payment globally.

𝐓𝐡𝐞 𝐁𝐨𝐭𝐭𝐨𝐦 𝐋𝐢𝐧𝐞

Open Banking and Open Finance are not just the future — they are the now. With increasing digitalization, financial institutions, fintech companies, and wallets are adapting rapidly, creating a seamless and personalized financial experience for customers globally.

Source: Brankas

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()