QNB, the first bank to launch the new Visa Click to Pay service

Hey Payments Fanatic!

QNB, the largest financial institution in the Middle East and Africa, has officially become the first bank in the region to roll out Visa’s upgraded Click to Pay service. This marks a significant step forward in the pursuit of smoother, faster, and more secure online payments.

QNB’s latest version of Visa’s solution, enhanced with the Visa Payment Passkey Service, allows customers to authenticate their purchases with a simple biometric scan – face or fingerprint – making checkouts faster than ever before. This update is based on the cutting-edge FIDO standards, delivering not only convenience but a future-proof approach to digital payments.

Merchants, meanwhile, can look forward to a unified and frictionless checkout process, which means fewer abandoned carts and more satisfied customers. The streamlined experience is set to unlock new opportunities for growth and customer engagement.

With this launch, Qatar continues positioning itself as a hub of innovation in the financial space.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

PAYMENTS NEWS

🇹🇭 SCB taps Thunes to offer instant global money transfers. This collaboration will allow SCB customers to send money instantly to 26 countries in 17 currencies, offering increased transparency and reliability while providing fast, dependable international transfers and reducing costs.

🇬🇧 Ecommpay extends partnership with Token.io to optimize real-time open banking payments in more markets. Ecommpay has added Token.io’s virtual accounts in the Netherlands, Spain, France, and Ireland to its Open Banking Advanced, enhancing cash flow and customer experience for e-commerce businesses.

🇦🇺 Airwallex explores building AI models as it drives towards IPO. Airwallex’s global head of product, Shannon Scott, said in an interview that while excitement over generative artificial intelligence can sometimes be exuberant, the technology holds potential for improving automation, compliance and other aspects of its payments platform.

🇸🇪 Mastercard agrees to buy subscription management startup Minna. The payments giant has struck a deal to acquire Swedish subscription management specialist Minna Technologies. Financial terms were not disclosed. The deal is subject to regulatory approval.

🇺🇸 American Express and Boost Payment Solutions bring optimized virtual card payments to suppliers. This collaboration will enable suppliers to streamline acceptance of American Express virtual Cards and minimize the challenges associated with manual processing of virtual Cards.

🇮🇹 Italy's Banco BPM has finalized a partnership with Gruppo BCC Iccrea and FSI to create Numia, the country’s second-largest e-payments provider, with a domestic market share exceeding 10%. Banco BPM and Iccrea will each hold a 28.6% stake in Numia, while FSI will own approximately 43%.

🇺🇸 Klarna has unveiled “𝗔𝗽𝗽𝗹𝗲 𝗳𝗿𝗼𝗺 𝗞𝗹𝗮𝗿𝗻𝗮”, a storefront in the Klarna app and Klarna website where customers can purchase Apple products using its flexible payment options. Now an official Apple reseller, Klarna also launches a brand new, bespoke payment option for Apple products: Upgrade Financing.

GOLDEN NUGGET

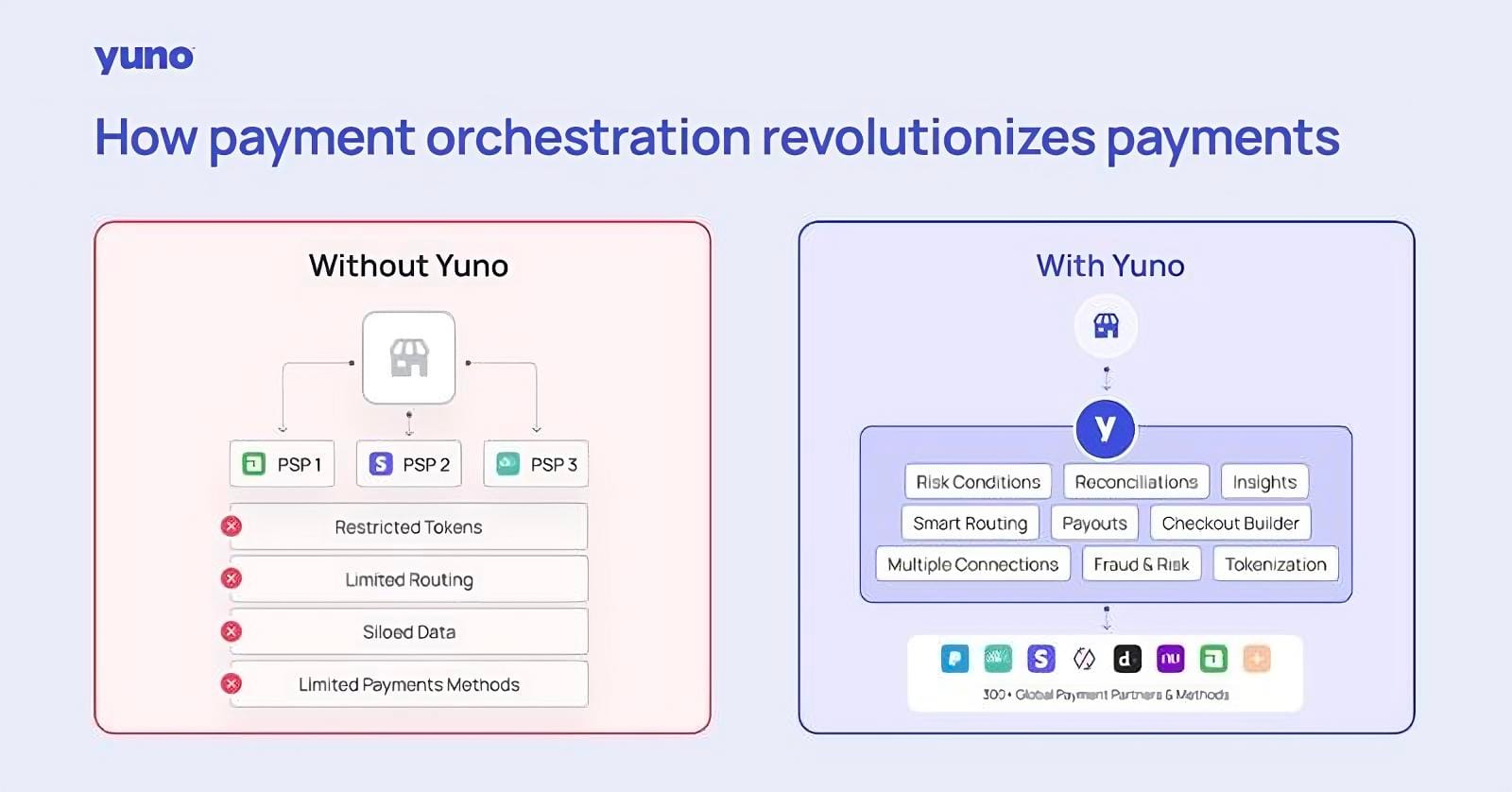

Here is a great example from Yuno:

To understand the benefits of choosing the right payment orchestrator for your business, let's examine what it can offer step by step.

𝗖𝗼𝘀𝘁 𝗿𝗲𝗱𝘂𝗰𝘁𝗶𝗼𝗻

Building technology to integrate global payment services is expensive and time-consuming, requiring ongoing maintenance.

Payment orchestrators provide scalable solutions, allowing businesses to expand without dealing with payment complexities, ultimately reducing development costs.

𝗔𝗰𝗰𝗲𝘀𝘀 𝘁𝗼 𝗴𝗹𝗼𝗯𝗮𝗹 𝗽𝗮𝘆𝗺𝗲𝗻𝘁 𝗺𝗲𝘁𝗵𝗼𝗱𝘀

Navigating the complexities of global payments, like diverse processors and currency fluctuations, is challenging.

Payment orchestrators simplify this by offering businesses access to multiple global payment methods, making international operations smoother.

𝗜𝗻𝗰𝗿𝗲𝗮𝘀𝗲𝗱 𝗮𝗽𝗽𝗿𝗼𝘃𝗮𝗹 𝗿𝗮𝘁𝗲𝘀

Techniques like Dynamic Routing and Smart Routing boost approval rates by switching between providers or directing transactions to the most efficient processor.

This leads to fewer declined payments and higher approval rates.

𝗘𝗻𝗵𝗮𝗻𝗰𝗲𝗱 𝘀𝗲𝗰𝘂𝗿𝗶𝘁𝘆

Payment orchestrators offer strong security features, including anti-fraud tools and encryption, ensuring compliance with regulations like PCI DSS and safeguarding against data breaches.

𝗜𝗺𝗽𝗿𝗼𝘃𝗲𝗱 𝗰𝘂𝘀𝘁𝗼𝗺𝗲𝗿 𝗲𝘅𝗽𝗲𝗿𝗶𝗲𝗻𝗰𝗲

With multiple payment methods and smoother transactions, customers enjoy faster processing times and flexibility, leading to increased satisfaction and repeat business.

I highly recommend reading the deep dive article for more interesting info on this topic.

Source: Yuno

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()