Primer to Enable dtcpay's Next-Gen Payment Solutions for Fiat and Stablecoins

Hey Payments Fanatic!

Singapore-based dtcpay has formed a partnership with global payment infrastructure provider Primer to enhance its transaction capabilities for both fiat and stablecoin payments. The collaboration aims to expand dtcpay's services in the luxury retail and hospitality sectors, including clients like the Capella Hotel Group.

Alice Liu, CEO and co-founder of dtcpay, highlighted that this partnership will help facilitate seamless transactions for merchants whose customers seek to pay through stablecoins. Kailash Madan, head of global sales at Primer, announced that dtcpay will be available on the Primer platform as a payment method, enabling merchants to collect stablecoin payments.

Dtcpay plans to expand its market presence into Europe, the Middle East, and the US, focusing on meeting the growing demand from high-net-worth individuals seeking diverse payment options through this integration with Primer's payment solutions and global network.

Keep up with the latest updates—staying informed is your greatest asset in the ever-changing world of Payments! 😉

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

PAYMENTS NEWS

🇺🇸 DEUNA Introduces the First Commerce Aware AI. At NRF, DEUNA proudly launched Aware AI, the first commerce-aware AI platform designed to turn data chaos into actionable insights for growth. During the event, DEUNA CEO Roberto Kafati showcased the platform’s unique capabilities: real-time insights, end-to-end data automation, and prioritized growth strategies for profitability. Click here for further details

🇬🇧 Ecommpay appoints Chris Wilson as new CFO. Driven by data and a passion for problem-solving and relationship-building, Chris’ focus on the commercial, strategic, and operational aspects of finance makes him well-equipped to join the Ecommpay leadership team, supporting the company’s growth ambitions in 2025 and beyond.

🌏 Airwallex names new marketing VP for APAC. Andrew Balint will lead marketing efforts in Australia, New Zealand, Singapore, Hong Kong, and Malaysia, effective immediately. In his new role, he will oversee branding, integrated campaigns, growth marketing, content, and partnerships.

🇮🇳 Paytm sales slump after regulator crackdown. India’s banking regulator all but shut down Paytm’s banking affiliate after years of warnings about unregulated data flows. The clampdown forced its Founder to strengthen ties with other Indian lenders to aid its recovery. The company recently announced plans to achieve profitability within one to two quarters, reporting a narrower third-quarter adjusted loss as its payments business rebounded from the closure of its payments bank unit.

🇸🇪 Trustly to roll out enhanced user onboarding technology for gaming operators. The new version of Pay N Play is expected to reduce players’ average login time from 48 seconds to less than 10 seconds, combine logins and deposits into a single flow, and allow customers to start playing in fewer than 20 seconds.

🇲🇾 UnionPay, BSN to launch QR payments in Malaysia. This initiative is set to launch in the first half of 2025 and marks a significant step in expanding digital payment options. Through the collaboration, BSN will join UnionPay’s network as a member, broadening its payment offerings to include UnionPay alongside existing platforms.

🌍 bunq introduces Mastercard benefits to its European SMEs. Through Mastercard's Business Bonus, bunq's users gain access to merchant discounts and offers, including business software, travel, shipping, and freelance contracting. The programme will be available in the Netherlands, Germany, France, Spain, and Italy.

🇬🇧 Nuvei expands Omnichannel capabilities to the UK Gaming industry. This platform unifies all payment channels, delivering unmatched convenience and flexibility for operators and players, including unified integration, enhanced player experiences, global reach, and stronger brand loyalty.

🇪🇸 Air Europa selects Hands In to add split payments to checkout. This enables Air Europa customers to divide ticket costs between multiple travelers or credit cards at checkout. Since launching the feature, Air Europa revealed it has generated over €3.8million in incremental revenue.

🇬🇧 Acquired.com Appoints an Ex-Stripe Senior Leader as COO. Lee Clifton will be responsible for strengthening Acquired. com’s strategic relationships with its key customers, as well as driving operational excellence across the business, will underpin Acquired.com’s continued growth.

GOLDEN NUGGET

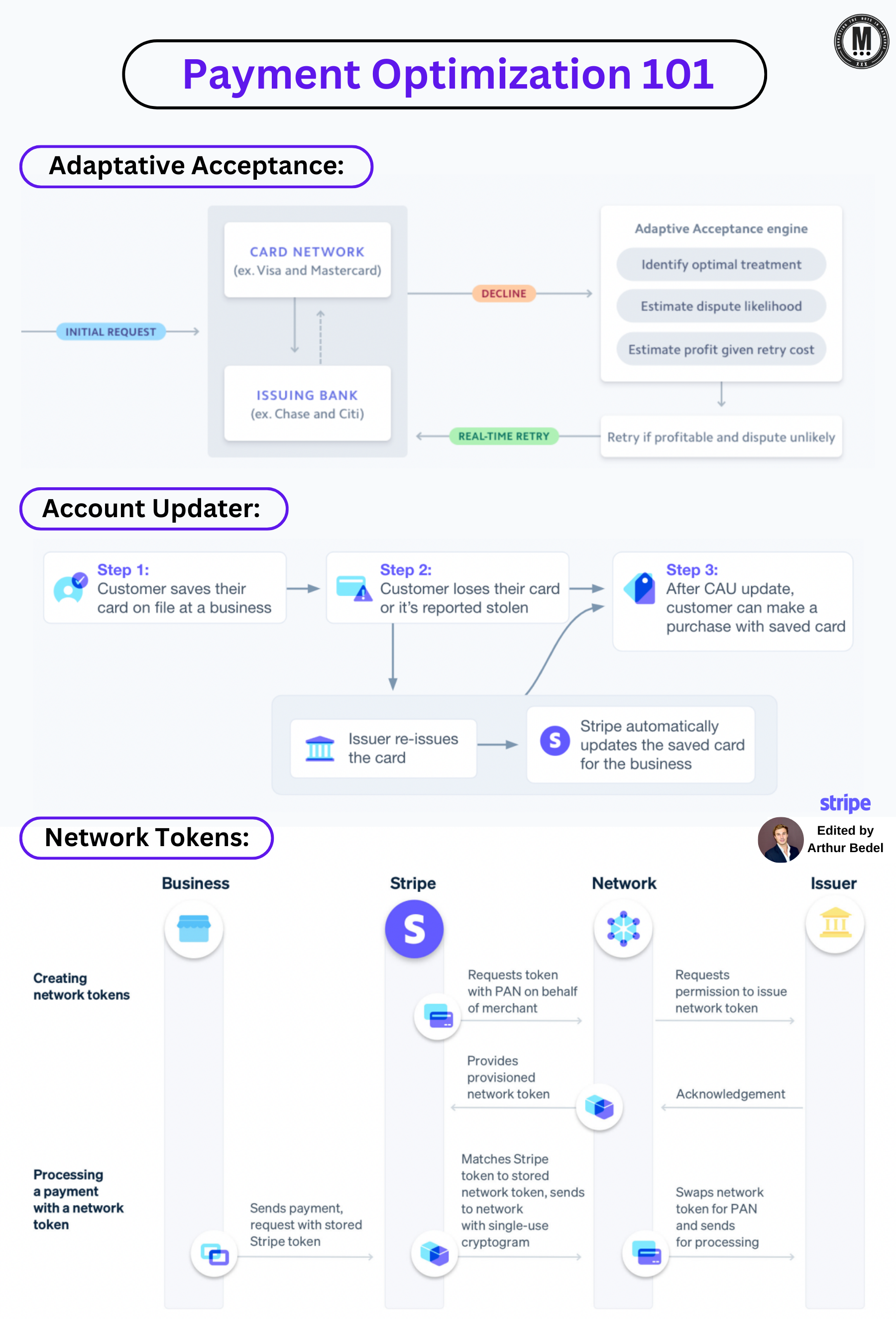

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 101 — the route to higher acceptance 👇

Payment optimization focuses on improving the efficiency and success rate of transactions, reducing declines, and maximizing the chances that legitimate payments go through successfully.

👉 𝐌𝐚𝐢𝐧 𝐓𝐲𝐩𝐞 𝐨𝐟 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐃𝐞𝐜𝐥𝐢𝐧𝐞𝐬:

► 𝐆𝐞𝐧𝐞𝐫𝐢𝐜 (Issuer Declines)

► 𝐈𝐧𝐬𝐮𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐅𝐮𝐧𝐝𝐬

► 𝐎𝐮𝐭𝐝𝐚𝐭𝐞𝐝 𝐂𝐚𝐫𝐝 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧

► 𝐒𝐮𝐬𝐩𝐢𝐜𝐢𝐨𝐧 𝐨𝐟 𝐅𝐫𝐚𝐮𝐝

👉 𝐇𝐨𝐰 𝐭𝐨 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐑𝐚𝐭𝐞𝐬:

► 𝐒𝐮𝐛𝐦𝐢𝐭 𝐀𝐝𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐁𝐢𝐥𝐥𝐢𝐧𝐠 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧: Providing details like postal codes and CVC can help increase success rates.

► 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐅𝐥𝐨𝐰𝐬: Balance customer experience and costs based on your specific business model.

► 𝐔𝐬𝐞 𝐒𝐦𝐚𝐫𝐭 𝐑𝐞𝐭𝐫𝐢𝐞𝐬: Retry declined payments at optimal times using machine learning models.

► 𝐄𝐧𝐚𝐛𝐥𝐞 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐬: Reduce declines due to outdated credentials by using network tokens.

► 𝐄𝐧𝐚𝐛𝐥𝐞 𝐂𝐚𝐫𝐝 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐔𝐩𝐝𝐚𝐭𝐞𝐫: Automatically update card details when customers' cards are renewed or replaced.

👉 𝐂𝐚𝐫𝐝 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐔𝐩𝐝𝐚𝐭𝐞𝐫:

► 𝐀𝐮𝐭𝐨𝐦𝐚𝐭𝐢𝐜 𝐔𝐩𝐝𝐚𝐭𝐞𝐬: When a customer's card is replaced (e.g., lost, stolen, expired), the updater automatically refreshes the saved card details.

► 𝐑𝐞𝐝𝐮𝐜𝐞𝐝 𝐃𝐞𝐜𝐥𝐢𝐧𝐞𝐬: Prevents transaction failures caused by outdated card information, keeping payments smooth and continuous.

► 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐑𝐞𝐭𝐞𝐧𝐭𝐢𝐨𝐧: Helps maintain ongoing service access for customers without requiring them to update their payment information manually.

👉 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐬:

Network tokens replace traditional card details with a unique, secure identifier for each transaction, issued by Card Networks (Visa, Mastercard etc...)

► 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐞𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: Network tokens are tied to a specific merchant and card pair, making them more secure than traditional PANs.

► 𝐏𝐞𝐫𝐬𝐢𝐬𝐭𝐞𝐧𝐭 𝐂𝐫𝐞𝐝𝐞𝐧𝐭𝐢𝐚𝐥𝐬: Even if a customer's card details change (e.g., card lost or expired), the token remains valid, reducing declines due to outdated information.

► 𝐄𝐧𝐡𝐚𝐧𝐜𝐞𝐝 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐑𝐚𝐭𝐞𝐬: By ensuring that the most current credentials are always used, network tokens help boost authorization rates and reduce failed transactions.

👉 In essence, 𝐀𝐝𝐚𝐩𝐭𝐢𝐯𝐞 𝐀𝐜𝐜𝐞𝐩𝐭𝐚𝐧𝐜𝐞 or 𝐒𝐦𝐚𝐫𝐭 𝐑𝐨𝐮𝐭𝐢𝐧𝐠, based on Machine Learning (#ML), leverages these strategies to help businesses avoid lost revenue and enhance customer satisfaction. It is based on Real-Time Optimization, Dynamic Adjustments to maximize the success rates.

Those are key steps to fully optimizing your payment strategy.

Source: Stripe

I highly recommend following my partner at Connecting the dots in payments... Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()