Pix Surpasses 6 Billion Monthly Transactions

Hey Payments Fanatic!

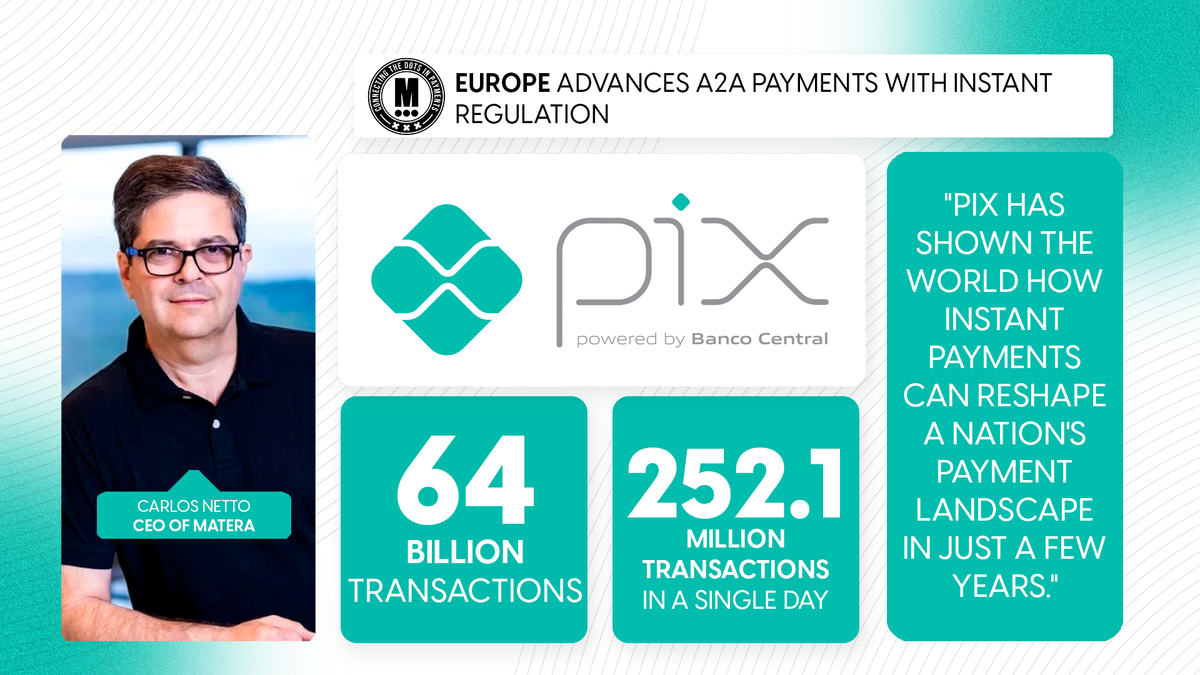

Brazil's Pix payment system processed 64 billion transactions in 2024, marking a 53% year-over-year increase and surpassing combined credit and debit card volumes by 80%. According to Matera's latest Pix by the Numbers report, the system hit a record 252.1 million transactions in a single day on December 20, 2024.

Carlos Netto, CEO of Matera, noted: "Pix has shown the world how instant payments can reshape a nation's payment landscape in just a few years." The report reveals person-to-business (P2B) payments grew 94% in 2024, while B2B payments reached R$1 trillion in December 2024, up 56% from the previous year.

Looking ahead, Pix will introduce NFC tap-to-pay functionality and Pix Automatic for recurring payments in 2025, with the latter launching on June 16th. These innovations aim to further expand the system's capabilities beyond its current 6 billion monthly transactions.

If you’re curious about the latest happenings in Payments, keep reading!

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

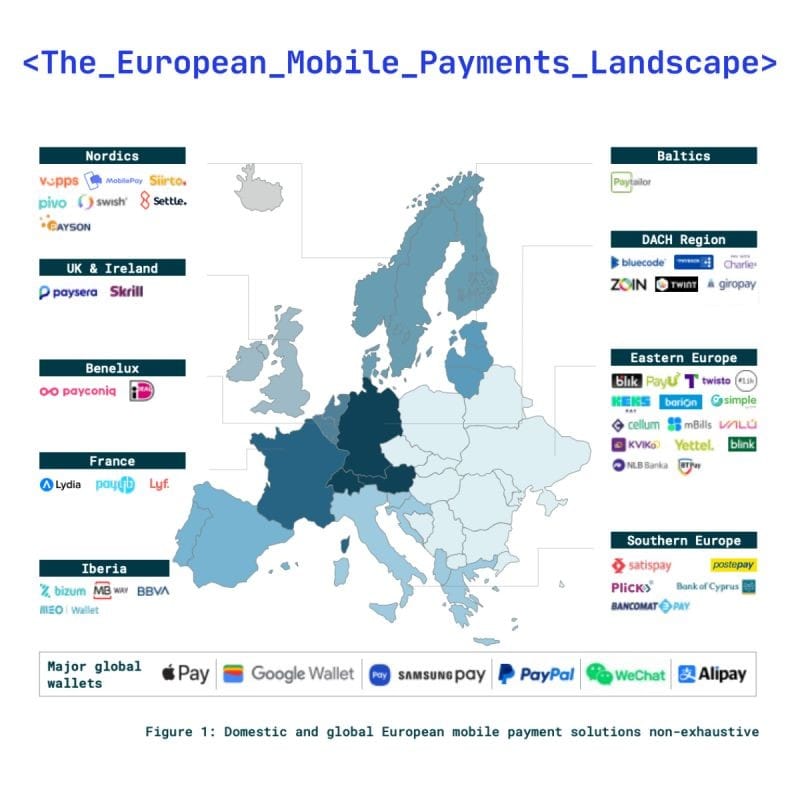

📊 The European Mobile Payments landscape by Arkwright Consulting.

Which players are missing in this overview? Let's dive in👇

PAYMENTS NEWS

🇸🇪 Ecommpay adds Swish to payment platform to improve checkout experience for Swedish customers.“The addition of Swish is an important step in our mission to make payments fully accessible and inclusive to all consumers, regardless of geography”, added Rosanna Helm-Visscher. “Merchants can enable regional payment methods for more than 200 countries across Europe, Asia, Latin America and North America, ensuring every customer sees a familiar payment method when checking out.”

🇪🇪 Wise: FinTech’s customers surge on back of payment deals boom. Wise said it continued to expect underlying income growth of 15-20 per cent in the full financial year on a constant currency basis, but reported growth is expected to be on the lower end of the range thanks to foreign exchange headwinds.

🇬🇧 FCA proposes £100 contactless limit removal and calls for SME support legislation. The decision follows the success of digital wallets with biometric logins, which currently bypass the limit. The FCA plans to prioritize SME lending under new powers expected from the Data (Use and Access) Bill.

🇪🇺 Marqeta powers Trading 212’s expansion into continental Europe. Trading 212 aims to upend the status quo in financial services and democratize access to markets with free and easy to use apps, enabling anyone to start their wealth building journey. Read more

🇳🇱 Klarna ordered to halt In-Store Buy-Now-Pay-Later services. The Dutch government has expressed concerns over increasing consumer debt, especially among vulnerable groups like young people. Controversy arose over Adyen and Klarna’s plan to introduce BNPL services to physical retail stores.

🇺🇸 Highnote clinches $90m in Series B. The new funds will be utilized to expand in the embedded finance market by enhancing its acquiring services aiming to accelerate growth and expand its market presence in the US, offering a holistic approach to embedded payments to both small businesses and large enterprises.

🇬🇧 Aslan roars to life with £4m seed funding. Its new funding will enable Aslan to augment its rewards offering and expand its workforce. Aslan provides reward cards offering tax-efficient cashback on everyday spending for its clients' employees. Continue reading

🇺🇸 One Inc. announces Scott G. Stephenson as New Board Chairman. "Scott’s extensive capabilities coupled with the existing strengths of our distinguished board members will be invaluable as we execute upon the next phase of our growth," has said the company’s CEO.

🇦🇪 Paymob secures UAE Central Bank retail payment services licence. The license authorises Paymob to offer merchant acquisition, payment aggregation services, and domestic fund transfers. This milestone enables the company to provide merchants with its full suite of omni-channel solutions that drive growth and competitiveness.

🇮🇩 Google hit with $12.6M fine in Indonesia for monopolistic practices in payment system. The antitrust watchdog launched an investigation into Google in 2022 for its market dominance. The agency found that the Google Pay Billing System had charged fees up to 30%, higher than other payment systems.

🇺🇸 JetBlue now takes Venmo online bookings, a first for airlines. Venmo payment options are the latest effort from JetBlue to enhance its services and boost profits. The struggling low-cost carrier has searched for new revenue streams as larger airlines introduce their own budget options, increasing competition for those flyers.

🇫🇷 IDEMIA launches smartphone enrolment for biometric payment cards. The company aims to deliver to its customers a reliable and convenient enrolment journey. These cards enhance security in the event of loss or theft, reducing the risk of fraudulent contactless payments.

🇬🇧 BR-DGE partners with Brooklyn Travel to power payments modernisation. BR-DGE will maintain connectivity to its existing payment partners, add new acquiring connections for resilience and transaction routing options and will provide access to new payment methods.

GOLDEN NUGGET

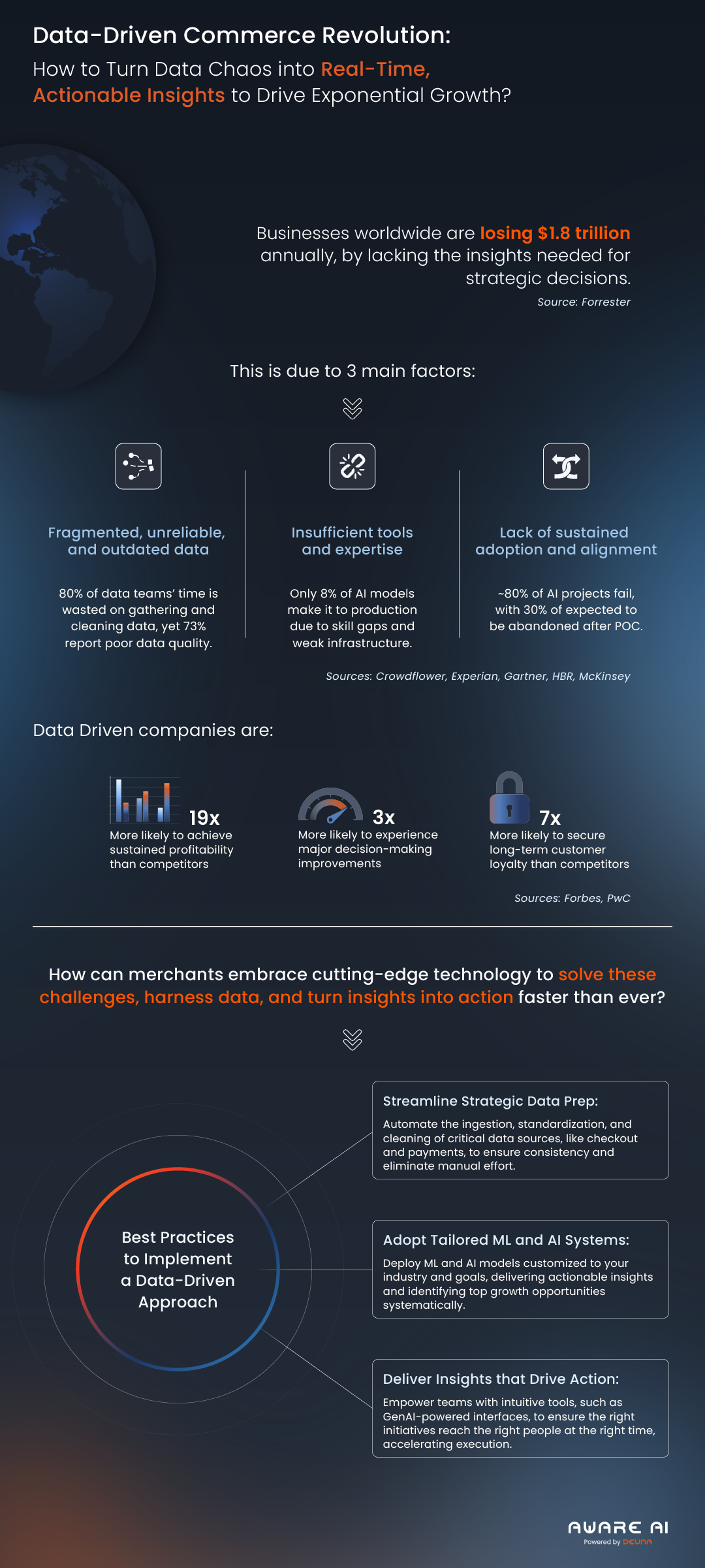

How Can AI Transform Your Business Data into Revenue?

The data challenge in modern business is real. Despite massive investments, companies struggle to harness their data's true potential.

👉 𝐓𝐡𝐞 𝐂𝐮𝐫𝐫𝐞𝐧𝐭 𝐒𝐭𝐚𝐭𝐞:

► 80% of data teams' time spent on cleaning and organizing

► 73% of companies report poor data quality

► 80% of AI projects fail

► 30% of AI initiatives abandoned after pilots

👉 𝐓𝐡𝐞 𝐏𝐨𝐰𝐞𝐫 𝐨𝐟 𝐃𝐚𝐭𝐚-𝐃𝐫𝐢𝐯𝐞𝐧 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬:

Companies leveraging data effectively are:

► 19x more likely to achieve sustained profitability

► 7x more likely to secure long-term customer loyalty

► 3x more likely to make impactful decisions

👉 𝐈𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐄𝐔𝐍𝐀 𝐀𝐰𝐚𝐫𝐞 𝐀𝐈:

The first commerce-aware AI platform that:

► Automates data preparation

► Systematizes insight discovery

► Delivers proactive, actionable strategies

► Optimizes payment performance in real-time

► Enhances customer lifetime value

► Streamlines operations

Source: DEUNA

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()